Updated on September 21st, 2021 by Bob Ciura

Car part stocks have generated positive returns for shareholders in the last five years. During this period, AutoZone (AZO) and O’Reilly Automotive (ORLY) have delivered over 16% annualized total returns. Meanwhile, Advance Auto Parts (AAP) and Genuine Parts Company (GPC) have returned just over 7% per year in the past five years.

A major reason for their healthy returns is the state of the automotive parts market. As this market is highly fragmented, the four biggest car part stocks have consistently gained market share from the small players thanks to the economies of scale they enjoy, which are impossible for smaller operators.

In addition, consumers are keeping their cars on the road for much longer than before. The average age of vehicles in the U.S. is rising, creating an optimal environment for the car part stocks to thrive.

Two out of the four stocks in this article pay dividends to shareholders. You can find them in our full list of 600+ consumer cyclical stocks.

You can download a full list of all consumer cyclical stocks, along with important financial metrics such as price-to-earnings ratios, dividend yields and more, by clicking on the link below:

While this secular trend has resulted in exceptional returns in the last decade, competition has heated in this business in the last two years. A major turning point was the decision of Amazon (AMZN) to enter this market more aggressively.

However, while competition has heated up, and 2020 was a difficult year due to the coronavirus pandemic, auto parts retailers have returned to growth in 2021.

In this article, we will compare the expected 5-year annualized returns of the four big car part stocks by forecasting their earnings growth, their dividends and their expected valuation expansion or contraction.

Table of Contents

The big 4 car part stocks in North America are ranked below, according to their 5-year expected total annual returns, in order of lowest to highest.

You can jump to any specific section of the article by clicking on the links below:

- Car Part Stock #4: Advance Auto Parts (AAP)

- Car Part Stock #3: Genuine Parts (GPC)

- Car Part Stock #2: AutoZone (AZO)

- Car Part Stock #1: O’Reilly Automotive (ORLY)

Car Part Stock #4: Advance Auto Parts (AAP)

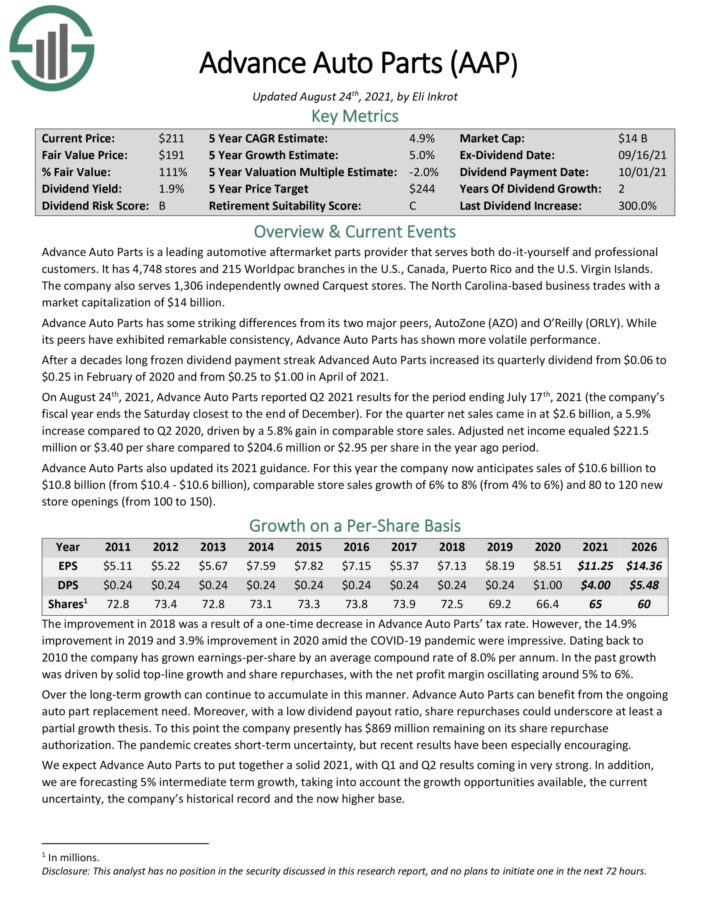

- 5-year expected annual returns: 5.6%

Advance Auto Parts is a leading automotive aftermarket parts provider that serves both do-it-yourself and professional customers. It has ~4,700 stores and 215 Worldpac branches in the U.S., Canada, Puerto Rico and Virgin Islands.

Advance Auto Parts has some striking differences from its above-mentioned peers. First of all, while its peers have exhibited exemplary consistency in their growth record, Advance Auto Parts has exhibited pronounced volatility in its earnings in the last decade.

Still, Advance Auto Parts is in strong position to capitalize on the positive industry fundamentals, just like its peer group.

Source: Investor Presentation

On August 24th, 2021, Advance Auto Parts reported Q2 2021 results for the period ending July 17th, 2021 (the company’s fiscal year ends the Saturday closest to the end of December). For the quarter net sales came in at $2.6 billion, a 5.9% increase compared to Q2 2020, driven by a 5.8% gain in comparable store sales.

Adjusted net income equaled $221.5 million or $3.40 per share compared to $204.6 million or $2.95 per share in the year ago period.

We believe AAP stock will return 5.6% per year over the next five years.

Click here to download our most recent Sure Analysis report on Advanced Auto Parts (preview of page 1 of 3 shown below):

Car Part Stock #3: Genuine Parts (GPC)

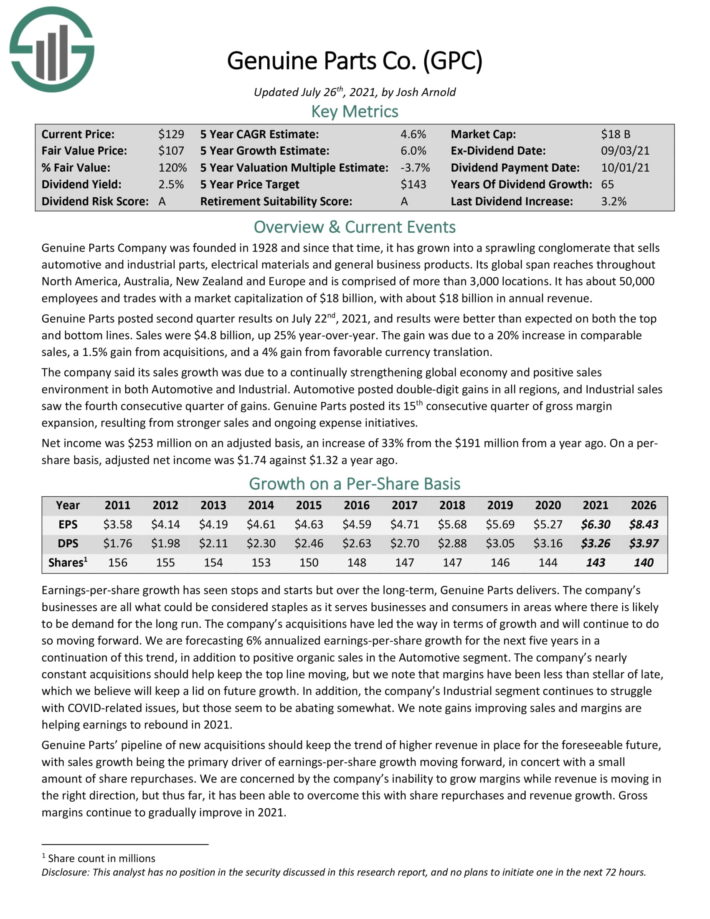

- 5-year expected annual returns: 6.0%

Genuine Parts is a leading distributor of automotive and industrial replacement parts. It has activity in the U.S., Mexico, Canada, Australia, the United Kingdom and other countries. Genuine Parts has increased its dividend for over 60 consecutive years, which makes it a Dividend King.

You can see the entire list of all 30+ Dividend Kings by following the below link:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

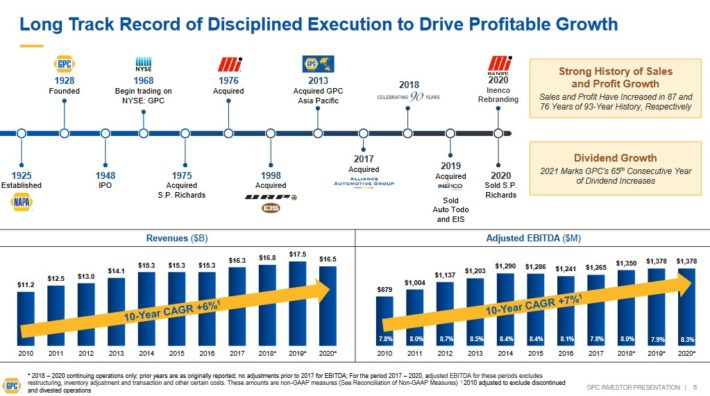

The company has an enviable growth record. The image below shows the impressive performance of the retailer in the last decade.

Source: Investor Presentation

Genuine Parts Company was founded in 1928 and since that time, it has grown into a sprawling conglomerate that sells automotive and industrial parts, electrical materials and general business products.

Genuine Parts posted second quarter results on July 22nd, 2021, and results were better than expected on both the top and bottom lines. Sales were $4.8 billion, up 25% year–over–year. The gain was due to a 20% increase in comparable sales, a 1.5% gain from acquisitions, and a 4% gain from favorable currency translation.

We believe GPC stock is likely to offer a 6% average annual return over the next five years thanks to 6.0% expected annual earnings-per-share growth. Shares appear slightly overvalued here, and we believe negative returns from a declining P/E multiple will essentially offset the 2.7% dividend yield.

Click here to download our most recent Sure Analysis report on Genuine Parts (preview of page 1 of 3 shown below):

Car Part Stock #2: AutoZone (AZO)

- 5-year expected annual returns: 6.1%

AutoZone is the leading retailer of auto parts and accessories in the U.S. It currently has over 6,000 stores in the U.S., Mexico, and Brazil.

AutoZone has an exceptional growth record. To be sure, it grew its earnings-per-share at a double-digit rate for 41 consecutive quarters until early 2017. The company has essentially quintupled its earnings-per-share in the last decade, from $19.47 in fiscal 2011 to $95.19 in the recently-concluded fiscal 2021. We believe the company has ample room for future growth.

While AutoZone has benefited from the fragmentation of its commercial market, its management should be praised for executing its expansion plan in a highly successful way.

AutoZone exhibited remarkable deceleration in 2017, when its multi-year streak of double-digit growth of earnings-per-share ended. Management did not provide specific reasons for the deceleration but it was obvious that competition had intensified.

As the market feared that Amazon was disrupting the business of AutoZone, shares plunged ~40% in just seven months.

However, the company has returned to its solid growth trajectory in the past several years. It is growing its earnings-per-share thanks to the opening of some new stores, low-single digit same-store sales growth, small margin expansion from economies of scale and aggressive share repurchases.

For example, in fiscal 2021 AutoZone grew its sales by 15.8% to $14.6 billion. Earnings-per-share increased 32.3% to $95.19 for the full fiscal year.

Share buybacks were a major reason for AutoZone’s strong EPS growth, as the company repurchased 2.6 million shares of its common stock for $3.4 billion, at an average price of $1,303 per share. At the end of the 2021 fiscal year, AutoZone had $417.6 million remaining under its current share repurchase authorization.

AutoZone has one of the most efficient share buyback programs in the market. Most companies tend to repurchase their shares during boom periods but suspend their buybacks during rough times.

Based on expected EPS of $89.72 for 2022, shares of AZO trade for a forward P/E ratio of 18.3. Our fair value estimate for AZO stock is a P/E of 15, which is roughly equal to the 10-year average. Therefore, a declining P/E could reduce annual returns by -3.9% per year over the next five years.

We expect 10% annual EPS growth over the next five years. The company does not pay a dividend currently, leading to total expected returns of 6.1% per year.

Car Part Stock #1: O’Reilly Automotive (ORLY)

- 5-year expected annual returns: 7.1%

O’Reilly was founded in 1957 by the O’Reilly family and is one of the largest specialty retailers of automotive aftermarket parts and accessories in the U.S., serving both the do-it-yourself and professional service provider markets.

The company has over 5,700 stores in 47 states. Despite its impressive growth record, O’Reilly does not pay a dividend to its shareholders.

O’Reilly has an exceptional growth record. Since its IPO in 1993, it has posted record revenues and earnings every single year. Even better, it has grown its earnings-per-share at a double-digit rate for more than a decade. This rare performance proves the quality of its management and the strength of its business model.

In fact, its IPO is one of the most successful in history, as the stock has rallied from its IPO price of $2.19 in 1993 to the current level of over $600 per share, thus providing huge returns.

The company has greatly benefited from the high fragmentation of its market. There is still ample room for O’Reilly to keep growing.

O’Reilly has grown its earnings-per-share at over 20% annually in the last decade. The company continued to grow even in 2020, when the U.S. economy swung to recession due to the coronavirus pandemic. 2021 has been yet another year of growth for O’Reilly.

In the most recent quarter, comparable store sales increased 9.9% while earnings-per-share grew 17%. Year-to-date EPS rose 39% compared with the same period last year.

Given all the above, we feel it is reasonable to expect O’Reilly to grow its earnings-per-share by about 10.0% per year on average over the next five years. In addition, based on expected EPS of $27.65 for 2021, the stock is now trading at a price-to-earnings ratio of 22. If the stock approaches our assumed fair earnings multiple of 19.0 in the next five years, it will incur a -2.9% annualized valuation contraction.

Overall, the stock is likely to offer a 7.1% average annual return over the next five years thanks to 10% annual earnings-per-share growth, which will be partly offset by a declining P/E multiple.

With expected returns of 7.1% per year, ORLY is our top car part stock right now.

Final Thoughts

The major car part stocks have a solid industry tailwind at their backs, which is the aging vehicle fleet in the United States. As consumers hold onto their cars for longer, aging cars require more frequent (and more expensive) repairs. Therefore, we expect positive total returns for all the major car part stocks.

That said, we believe O’Reilly is likely to continue to offer the highest risk-adjusted returns in the next five years thanks to its high earnings-per-share growth and modest valuation.

At the same time, Genuine Parts might be the most attractive stock for income investors, such as retirees. This is because Genuine Parts has the highest dividend yield of the car part stocks by far, along with one of the longest streaks of annual dividend increases in the entire stock market.