Updated on September 13th, 2019 by Aristofanis Papadatos

Airline stocks used to be avoided by value and income investors, and for good reason. Airlines are highly vulnerable during recessions. Or, an industry downturn brought on by any number of forces was usually sufficient to erase the profits of several years and drive some airlines out of business.

That’s why legendary value investor Warren Buffett had, for many years, avoided airlines and advised investors to do the same.

However, thanks to a series of bankruptcies and mergers, the airline industry has consolidated. As a result, the four major U.S. airlines–American Airlines (AAL), Delta Air Lines (DAL), United Airlines Holdings (UAL) and Southwest Airlines (LUV)–now have an 80% total market share.

Profit margins have also drastically improved across the industry, which is why Buffett changed his stance and purchased significant stakes in the four major U.S. airlines three years ago. All four airlines are among Buffett’s top 20 stock holdings.

You can see the entire list of Buffett’s biggest stock holdings here.

You can download an Excel spreadsheet of all airline stocks (with metrics that matter) by clicking the link below:

You can also see a preview of the retail stocks spreadsheet in the table below:

| DAL | Delta Air Lines, Inc. | 59.44 | 2.4 | 38,647 | 8.8 | 20.8 | 0.98 |

| UAL | United Airlines Holdings, Inc. | 89.38 | 0.0 | 22,963 | 9.0 | 0.0 | 0.99 |

| LUV | Southwest Airlines Co. | 54.98 | 1.2 | 29,552 | 12.7 | 15.3 | 0.91 |

| AAL | American Airlines Group, Inc. | 29.94 | 1.3 | 13,331 | 9.0 | 12.0 | 1.49 |

| ALK | Alaska Air Group, Inc. | 65.68 | 2.0 | 8,096 | 16.0 | 32.7 | 0.97 |

| ALGT | Allegiant Travel Co. | 151.73 | 0.0 | 2,474 | 13.4 | 0.0 | 0.77 |

| SKYW | Sky West, Inc. | 61.37 | 0.7 | 3,069 | 9.7 | 7.1 | 1.22 |

| JBLU | JetBlue Airways Corp. | 17.37 | 0.0 | 5,083 | 12.0 | 0.0 | 0.95 |

| GD | General Dynamics Corporation | 188.60 | 2.2 | 54,710 | 16.8 | 36.0 | 1.49 |

| BA | The Boeing Co. | 375.63 | 2.0 | 211,370 | 43.2 | 86.7 | 1.15 |

| HA | Hawaiian Holdings, Inc. | 28.36 | 1.7 | 1,309 | 6.4 | 11.0 | 1.28 |

| SAVE | Spirit Airlines, Inc. | 39.29 | 0.0 | 2,619 | 7.5 | 0.0 | 1.11 |

| MESA | Mesa Air Group, Inc. | 7.90 | 0.0 | 236 | 3.4 | 0.0 | 1.21 |

| EADSF | Airbus SE | 138.25 | 0.0 | 108,616 | 25.0 | 0.0 | 0.86 |

| CPA | Copa Holdings SA | 100.65 | 3.0 | 4,293 | 101.8 | 304.7 | 1.07 |

| ATSG | Air Transport Services Group, Inc. | 22.64 | 0.0 | 1,311 | 53.5 | 0.0 | 0.93 |

| RYAAY | Ryanair Holdings plc | 61.00 | 0.0 | 12,877 | 9.4 | 0.0 | 1.15 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

This article will discuss our top 6-ranked airline stocks, according to the Sure Analysis Research Database. The stocks are ranked according to expected total returns over the next five years, listed in order of lowest to highest.

Table Of Contents

- Industry Overview

- Delta Airlines

- Hawaiian Holdings

- Alaskan Air Group

- United Airlines Holdings

- Southwest Airlines

- American Airlines

Industry Overview

Due to the industry consolidation, as well as better hedges against rising fuel prices and strict cost controls, many airlines now enjoy strong profit margins.

Airlines also benefit from a secular trend, namely the increasing tendency of people to travel more and more often. According to IATA, the U.S. and the global air traffic are expected to continue to grow by 2.3% and 3.5% per year, respectively, over the next two decades.

Due to their high debt levels and the high cyclicality of their business, airline stocks trade at markedly low, usually single-digit price-to-earnings ratios, which are less than half of the price-to-earnings ratio of the broad market. But this does not automatically make them good investments–investors should check the growth prospects and the risks of each individual airline and then decide whether it is a bargain.

In this article, we will compare the expected 5-year returns of the six major U.S. airlines found in the Sure Analysis Research Database. Stocks are ranked in terms of 5-year expected total returns, from lowest to highest.

Best Airline Stock #6: Delta Air Lines

Delta Air Lines is one of the largest international airlines, serving 304 destinations in 52 countries.

Delta bought a refinery in 2012 in order to limit its risk of high jet fuel prices. However, a single refinery is not sufficient to eliminate this risk, as it limits the effect of an increase in the spread between the prices of jet fuel and crude oil but does not provide any protection against an increase in the price of crude oil.

In addition, the management of Delta has proved incapable of hedging the fuel cost of the airline. It was hedging the fuel cost before the downturn of the oil market began in 2014. Consequently, it incurred heavy losses from those hedges. Then, due to that traumatic experience, it stopped hedging the fuel cost. As a result, the company is now almost fully exposed to an increase in the price of jet fuel.

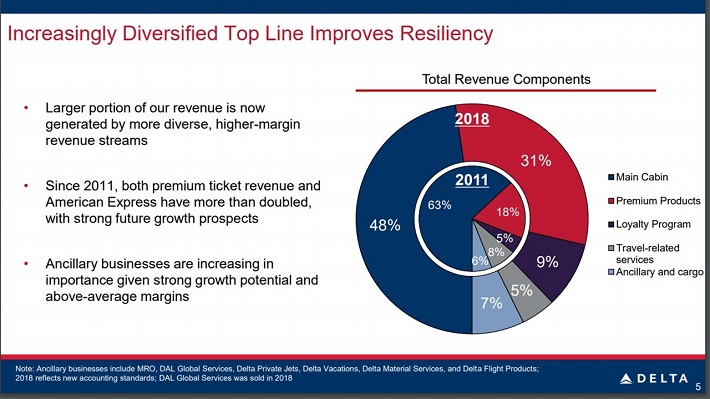

On the other hand, Delta has remarkably increased the portion of its revenues generated by its premium seats, from 18% ($6 billion revenue) in 2011 to 31% ($14 billion revenue) in 2018.

Source: Investor Presentation

As the airline expects its premium seats to comprise more than 30% of its total seats by 2023 (versus 28% in 2018), this strategy is likely to remain a significant growth driver in the upcoming years.

In the most recent quarter, Delta posted record results despite a decline in air fares in two of the three months. The airline grew its adjusted quarterly revenue by 9%, to a quarterly record of $12.5 billion, thanks to its aforementioned initiative on premium tickets and double-digit growth in loyalty and maintenance revenue. Moreover, the company grew its adjusted earnings per share by 32% to a record of $2.35.

Delta has exceeded the analysts’ earnings-per-share estimates for 10 consecutive quarters. Furthermore, the strong business momentum has continued in the running quarter and thus the company expects to grow its earnings per share by 25% this year over last year’s record level of $5.65. It is worth noting that air fares rose 2.3% in July, after a series of months with poor reported figures.

Delta has grown its earnings per share at a 12% average annual rate in the last four years but it will accelerate this year. Due to the high comparison base that will result from this year’s impressive results and an expected rise in fuel costs and wages, most of future growth is likely to come from share repurchases.

In the last four years, Delta has taken advantage of its cheap valuation and has efficiently repurchased its shares. In this period, it has reduced its share count at a 4% average annual rate. Overall, Delta can be reasonably expected to grow its earnings per share at a 4.0% average annual rate over the next five years.

The stock also offers a 2.6% dividend. Moreover, it is trading at a price-to-earnings ratio of 8.2, which is marginally lower than its historical average of 8.3. If the stock reverts to its average valuation level within the next five years, it will enjoy a marginal 0.2% annualized expansion of its price-to-earnings ratio. Therefore, Delta is likely to offer a 6.8% average annual return until 2024.

Best Airline Stock #5: Hawaiian Holdings (HA)

Hawaiian Holdings (HA) is the largest air carrier in Hawaii, transferring about 12 million passengers per year. It has a market capitalization of $1.3 billion, the lowest among the airlines discussed in this article.

Hawaiian hedges its fuel costs but this is much easier said than done. To be sure, in the years 2012-2014, when the price of oil was trading around $100 per barrel, the airline posted poor earnings.

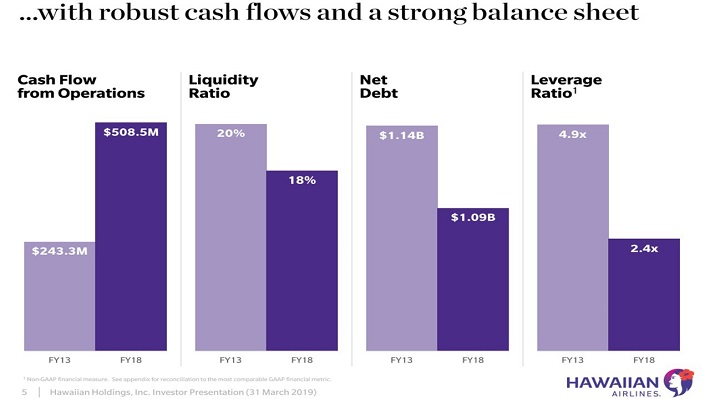

It is undeniable that Hawaiian has improved its performance and its leverage in the last five years.

Source: Investor Presentation

However, Hawaiian is currently facing strong competitive pressure, as Southwest has entered the Hawaiian market. While Hawaiian has a dominant position in this market, the entrance of a strong competitor has exerted pressure on air fares and is likely to increase competitive pressure even further in the upcoming years.

In the most recent quarter, the passenger volume of Hawaiian decreased 2% due to the aforementioned headwind while revenue per mile fell 3.7%. As wages and benefits rose 5%, earnings per share fell 22%, from $1.56 to $1.21. Hawaiian is expected to post earnings per share around $4.00 this year, much lower than last year’s figure of $5.44.

Going forward, we expect Hawaiian to grow its earnings per share by about 3.5% per year over the next five years, primarily thanks to the low comparison base of this year and the contribution of share repurchases. Moreover, the stock is offering a 1.7% dividend and is trading at a price-to-earnings ratio of 7.0, which is lower than our assumed fair earnings multiple of 8.0.

If the stock approaches our fair valuation level over the next five years, it will enjoy a 2.7% annualized boost in its returns. Therefore, Hawaiian is likely to offer a 7.9% average annual return over the next five years.

It is important to note that Hawaiian is more vulnerable to recessions than its peers due to its lack of diversification and its tie to tourist traffic. This is a major risk factor, which should not be underestimated, particularly given the absence of a recession for a whole decade.

Best Airline Stock #4: Alaska Air Group (ALK)

Alaska Air Group transfers 46 million passengers per year to more than 115 destinations in the U.S., Mexico, Costa Rica and Canada.

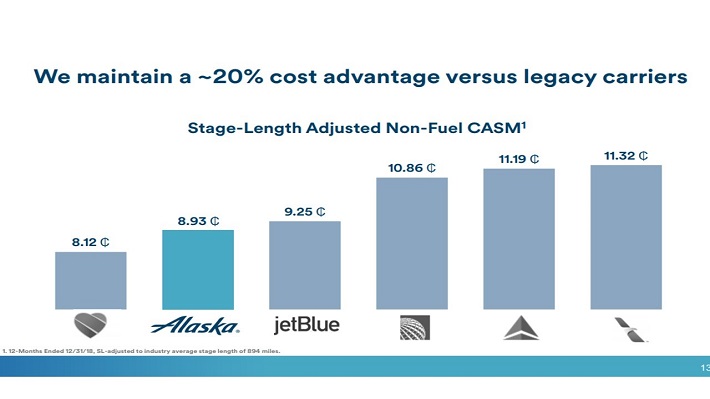

The company operates with a low-cost business model in order to secure a significant competitive advantage over its peers.

Source: Investor Presentation

In the most recent quarter, Alaska Air posted strong results. The company grew its revenue by 6%, primarily thanks to higher pricing, and increased its load factor from 86.0% to 86.2%. As its operating expenses rose much less than its revenue, the airline grew its earnings per share by 31% over last year’s quarter.

We expect Alaska Air to grow its annual earnings per share at a similar rate in the full year, from $4.46 to about $6.00. However, this is partly due to the suppressed earnings that the company reported in 2018.

Beyond this year, we expect Alaska Air to grow its earnings per share by about 6.0% per year over the next five years thanks to new partnerships and the new Saver Fare seats of the company, which will be partly offset by higher expected labor and fuel costs.

Alaska Air is the only airline in this article that does not implement share repurchases. On the other hand, Alaska Air offers a 2.1% dividend. From a valuation point of view, Alaska Air is trading at a price-to-earnings ratio of 11.0, which is equal to our assumed fair valuation of the stock.

As a result, we do not expect the valuation of the stock to affect significantly its future returns. Overall, Alaska is likely to offer an 8.1% average annual return over the next five years.

Best Airline Stock #3: United Airlines Holdings

United Airlines Holdings owns United Airlines and Continental Airlines and operates more than 4,500 daily flights to numerous domestic and international destinations.

United introduced 93 new routes last year, more than any other U.S. airline. This growth strategy has already begun to bear fruit as evidenced by the impressive results of this year.

In the second quarter, United grew its revenue by 5.8% while its total operating expenses rose only 3.1%. As a result, the company reported record second-quarter pre-tax income of $1.4 billion, and grew its adjusted earnings per share by 31%.

Thanks to strong business momentum, management has provided guidance for the earnings per share of this year in the range $10.50-$12.00. At the mid-point, this guidance represents 23% growth over last year.

Source: Investor Presentation

It is also remarkable that the airline has exceeded the analysts’ earnings-per-share estimates in 13 out of the last 14 quarters. It is thus reasonable to expect this year’s earnings to exceed the guidance of management or end up at the high end of the range. Moreover, as the above slide shows, management expects significant earnings-per-share growth in 2020 as well.

A significant portion of future growth will be driven by share repurchases. United takes advantage of its cheap valuation and executes very efficient share repurchases. In the last four years, it has reduced its share count by 8% per year on average. Management recently announced a $3.0 billion share buyback program, which can reduce the share count by 14% at the current stock price.

Thanks to its new routes and its efficient buybacks, United is likely to grow its earnings per share by about 10.0% per year over the next five years. Moreover, the stock is now trading at a price-to-earnings ratio of 7.8, which is lower than its historical average of 8.3. If the stock reverts to its average valuation level within the next five years, it will enjoy a 1.3% annualized expansion of its price-to-earnings ratio.

Therefore, as the stock does not offer a dividend, it is likely to offer an 11.3% average annual return over the next five years.

Best Airline Stock #2: Southwest Airlines

Southwest Airlines is the second-largest U.S. carrier based on market capitalization and carries more than 120 million people annually.

Southwest stands out among its peers for its exceptional consistency. While its peers exhibit highly cyclical performance and tend to post losses during recessions, Southwest has remained profitable for 46 consecutive years.

Source: Investor Presentation

Southwest also stands out in its sector for two more reasons, namely its strong free cash flows and its low debt level. It has posted positive free cash flows in every single year in the last decade and has posted record free cash flows in the last 12 months. It also has by far the lowest debt-to-assets ratio. Its net debt is just $11.7 billion, which is less than five times its annual earnings.

Thanks to the strong balance sheet of the company, Southwest enjoys by far the greatest rating from the three major credit rating firms in its peer group. Its superior balance sheet is of paramount importance, as it renders the company resilient during downturns. This helps explain its above mentioned consistency, which is unique in its sector.

The market obviously appreciates the unique consistency and the superior balance sheet of Southwest. That’s why it has assigned an average price-to-earnings ratio of 16.8 to the stock during the last decade whereas it has assigned single-digit ratios to its peers.

Southwest will pursue growth via new flight routes. For instance, the company has entered the Hawaiian market and sees promising growth prospects in the area in the upcoming years. Moreover, the airline has consistently repurchased its shares in recent years and is likely to continue to do so for the foreseeable future.

In 2018, Southwest achieved all-time high revenues of $22.0 billion and earnings per share of $4.24. This year, the company is poised to achieve new all-time highs even though its performance has been adversely affected by a strong headwind, namely the grounding of the 737 MAX aircraft of Boeing. Due to this issue, we expect Southwest to post earnings per share around $4.40 this year.

However, as this is a non-recurring issue, Southwest can be reasonably expected to accelerate from next year and grow its earnings per share by about 8.0% per year, partly thanks to its share repurchases. In addition, its current price-to-earnings ratio is 12.5, which is lower than its 10-year average of 16.8 and our assumed fair value of 14.0.

If the stock reverts to our assumed fair price-to-earnings ratio of 14.0 over the next five years, it will enjoy a 2.3% annualized expansion of its valuation level. Therefore, given also its 1.3% dividend, the stock is likely to offer an 11.6% average annual return over the next five years.

Best Airline Stock #1: American Airlines

American Airlines is the world’s largest airline in revenue and fleet size, with about 6,800 daily flights to more than 365 destinations in 61 countries. The company emerged from Chapter 11 bankruptcy in December 2013.

American Airlines has a volatile performance record, primarily due to its high sensitivity to fuel costs. Moreover, it is facing some strong headwinds this year, namely disruption from union labor actions and the grounding of the 737 MAX model of Boeing.

Nevertheless, in the second quarter, the company managed to grow its operating revenue and its earnings per share by 2.7% and 9.6%, respectively, thanks to continued strength in passenger demand. The load factor rose to an all-time high of 86.6% while the total revenue per available seat mile grew for an 11th consecutive quarter.

The company has taken advantage of the cheap valuation of its stock and has aggressively repurchased its shares in recent years. In the last four years, it has reduced its share count by 38%. Share buybacks are likely to remain the main growth driver in the upcoming years. The company is also doing its best to improve its efficiency, e.g. close the gap to its peers in the load factor.

Source: Investor Presentation

However, it is prudent to be somewhat conservative in future growth estimates. Overall, we expect American Airlines to grow its earnings per share at a 5.0% average annual rate in the next five years. Moreover, the stock is now trading at a price-to-earnings ratio of 5.7, which is much lower than its historical average of 8.0.

If the stock reverts to its average valuation level within the next five years, it will enjoy a 7.0% annualized gain thanks to the expansion of its price-to-earnings ratio. Therefore, given its 1.3% dividend, the stock is likely to offer a 13.3% average annual return over the next five years.

Investors should note that the stock is highly risky due to its excessive debt load. Its debt-to-assets ratio hovers around 100% lately while its net debt has climbed to $54.5 billion, which is about 27 times its annual earnings. Moreover, its interest expense currently consumes 32% of its operating income.

It is also remarkable that the company has posted negative free cash flows in each of the last three years due to its high capital expenses. Moreover, it is fully exposed to the rising jet fuel price, as it does not hedge its fuel cost.

The excessive debt load renders American Airlines highly vulnerable to a downturn of the sector. Therefore, the stock will offer the above mentioned annual return only in the absence of a recession.

Final Thoughts

Investors should realize that airline stocks are leveraged proxies for the underlying U.S. and global economic growth. As long as the economy keeps growing, the airlines will continue to thrive. Thanks to their always cheap valuation levels, their buybacks will be very efficient and will thus greatly enhance shareholder value.

On the other hand, whenever the next recession shows up, most of the airlines will incur losses and will thus see their stock prices plunge. As a recession has not shown up for an entire decade, investors should keep the high cyclicality of the sector in mind.

American Airlines offers the highest 5-year expected return. However, due to its excessive leverage, it is particularly vulnerable to a downturn of the sector. Given the absence of a recession for a decade, the risk of the stock outweighs its reward potential. Therefore, as the above mentioned return will materialize only in the absence of a recession, investors should probably avoid the stock.

Southwest is likely to offer the highest risk-adjusted annual return over the next five years. It is also the one that stands out in this group of stocks thanks to its unparalleled consistency, as it has posted a profit for 46 consecutive years whereas its peers have incurred heavy losses during recessions. It also has by far the strongest balance sheet in its group.