Published on January 12th, 2022 by Bob Ciura

Monthly dividend stocks have instant appeal for many income investors. Stocks that pay their dividends each month offer more frequent payouts than traditional quarterly or semi-annual dividend payers.

For this reason, we created a full list of 49 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

In addition, stocks that have high dividend yields are also attractive for income investors.

With the average S&P 500 yield hovering around 1.3%, investors can generate much more income with high-yield stocks.

Screening for monthly dividend stocks that also have high dividend yields makes for an appealing combination.

This article will list the 20 highest-yielding monthly dividend stocks.

Table Of Contents

The following 20 monthly dividend stocks have high dividend yields above 5%. Stocks are listed by their dividend yields, from lowest to highest.

You can instantly jump to an individual section of the article by utilizing the links below:

- High-Yield Monthly Dividend Stock #20: LTC Properties (LTC)

- High-Yield Monthly Dividend Stock #19: Banco Bradesco (BBD)

- High-Yield Monthly Dividend Stock #18: Gladstone Capital (GLAD)

- High-Yield Monthly Dividend Stock #17: Horizon Technology (HRZN)

- High-Yield Monthly Dividend Stock #16: PermRock Royalty Trust (PRT)

- High-Yield Monthly Dividend Stock #15: Eagle Point Income (EIC)

- High-Yield Monthly Dividend Stock #14: Prospect Capital (PSEC)

- High-Yield Monthly Dividend Stock #13: SLR Senior Investment (SUNS)

- High-Yield Monthly Dividend Stock #12: Cross Timbers Royalty Trust (CRT)

- High-Yield Monthly Dividend Stock #11: Stellus Capital Investment (SCM)

- High-Yield Monthly Dividend Stock #10: PennantPark Floating Rate (PFLT)

- High-Yield Monthly Dividend Stock #9: San Juan Basin Royalty Trust (SJT)

- High-Yield Monthly Dividend Stock #8: Broadmark Realty Capital (BRMK)

- High-Yield Monthly Dividend Stock #7: American Finance Trust (AFIN)

- High-Yield Monthly Dividend Stock #6: Dynex Capital (DX)

- High-Yield Monthly Dividend Stock #5: AGNC Investment Corporation (AGNC)

- High-Yield Monthly Dividend Stock #4: Oxford Square Capital (OXSQ)

- High-Yield Monthly Dividend Stock #3: Ellington Financial (EFC)

- High-Yield Monthly Dividend Stock #2: ARMOUR Residential REIT (ARR)

- High-Yield Monthly Dividend Stock #1: Orchid Island Capital (ORC)

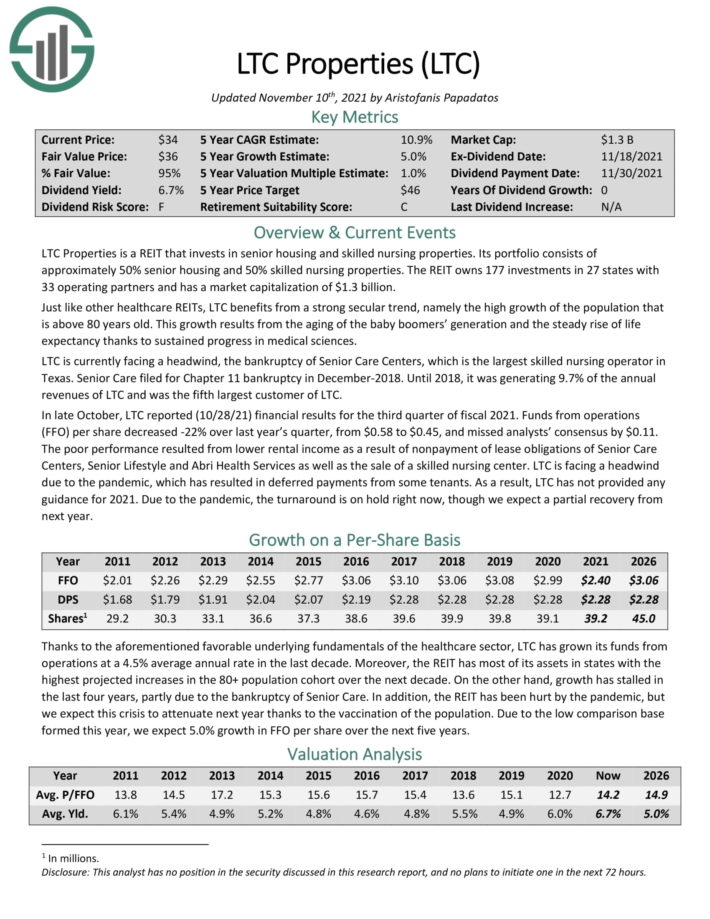

High-Yield Monthly Dividend Stock #20: LTC Properties (LTC)

- Dividend Yield: 6.4%

LTC Properties is a Real Estate Investment Trust, or REIT, that invests in senior housing and skilled nursing properties.

Its portfolio consists of approximately 50% senior housing and 50% skilled nursing properties. The REIT owns 177 investments in 27 states with 33 operating partners.

Source: Investor Presentation

Just like other healthcare REITs, LTC benefits from a strong secular trend, namely the high growth of the population that is above 80 years old.

This growth results from the aging population, and the steady rise of life expectancy thanks to sustained progress in medical sciences.

In late October, LTC reported (10/28/21) financial results for the third quarter of fiscal 2021. Funds from operations (FFO) per share decreased –22% over last year’s quarter, from $0.58 to $0.45, and missed analysts’ consensus by $0.11.

Click here to download our most recent Sure Analysis report on LTC (preview of page 1 of 3 shown below):

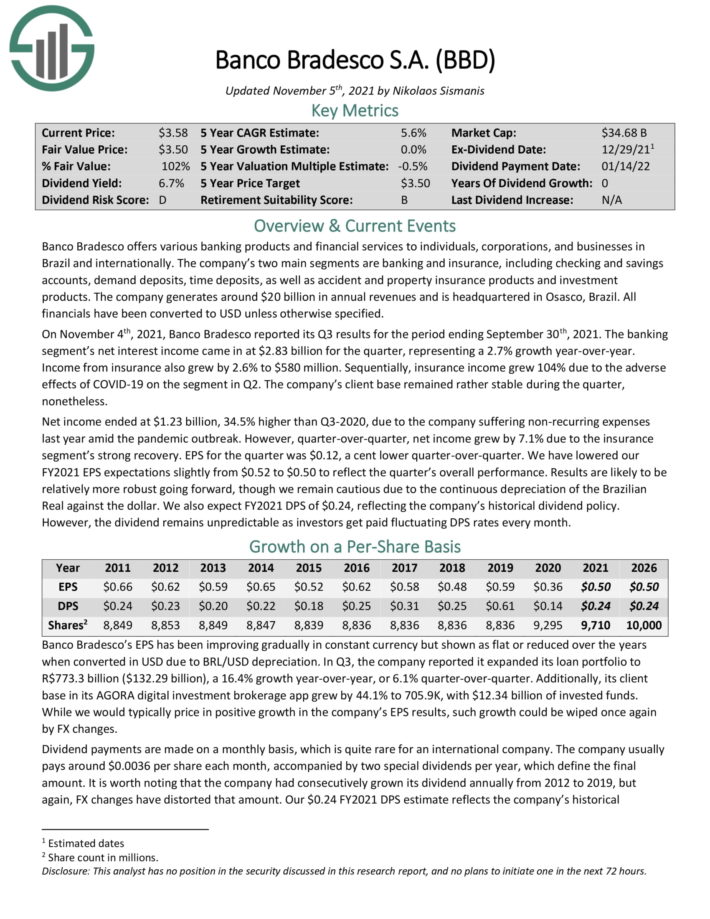

High-Yield Monthly Dividend Stock #19: Banco Bradesco (BBD)

- Dividend Yield: 6.6%

Banco Bradesco offers various banking products and financial services to individuals, corporations, and businesses in Brazil and internationally.

The company’s two main segments are banking and insurance, including checking and savings accounts, demand deposits, time deposits, as well as accident and property insurance products and investment products.

The company generates around $20 billion in annual revenues and is headquartered in Brazil.

On November 4th, 2021, Banco Bradesco reported its Q3 results for the period ending September 30th, 2021. Net interest income came in at $2.83 billion for the quarter, representing a 2.7% growth year–over–year. Income from insurance also grew by 2.6% to $580 million

Click here to download our most recent Sure Analysis report on BBD (preview of page 1 of 3 shown below):

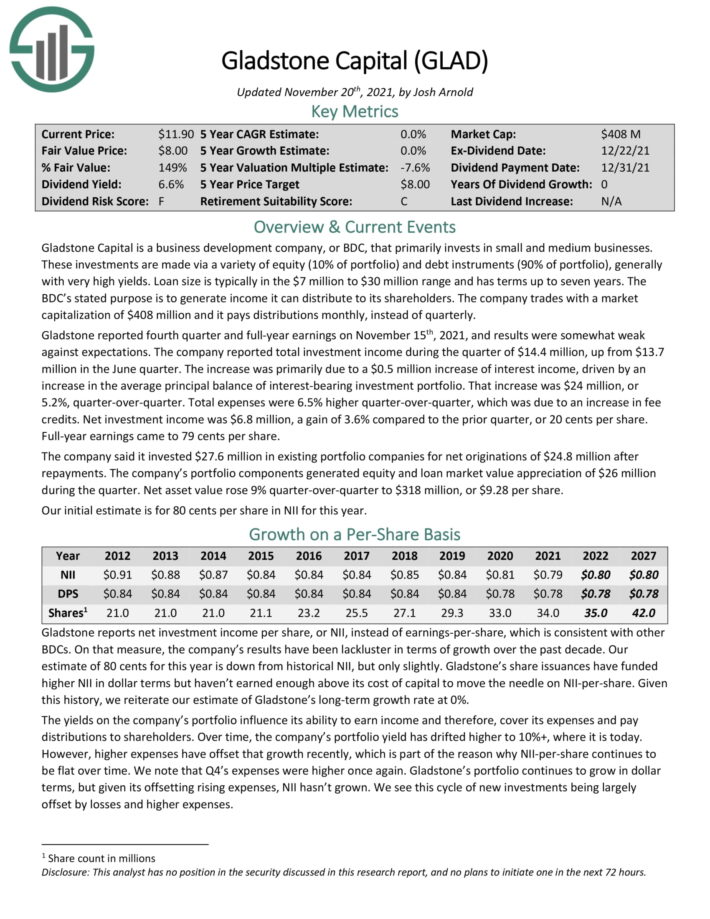

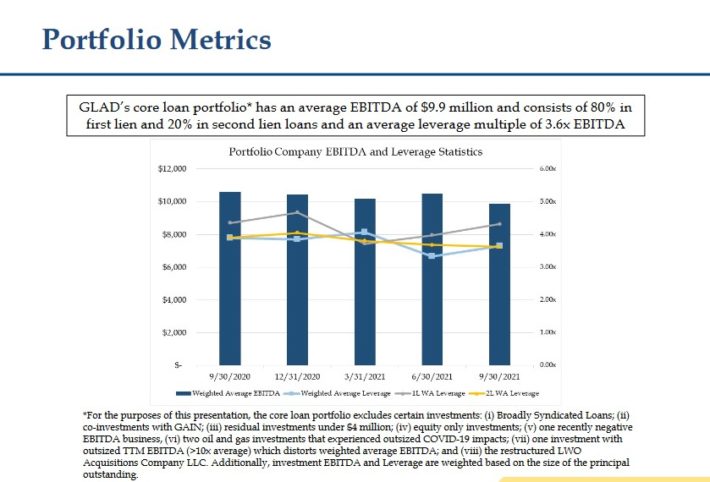

High-Yield Monthly Dividend Stock #18: Gladstone Capital (GLAD)

- Dividend Yield: 6.9%

Gladstone Capital is a Business Development Company, or BDC, that primarily invests in small and medium businesses.

These investments are made via a variety of equity (10% of portfolio) and debt instruments (90% of portfolio), generally with very high yields. Loan size is typically in the $7 million to $30 million range and has terms up to seven years.

Source: Investor Presentation

Gladstone reported fourth quarter and full–year earnings on November 15th, 2021. The company reported total investment income during the quarter of $14.4 million, up from $13.7 million in the June quarter.

The increase was primarily due to a $0.5 million increase of interest income, driven by an increase in the average principal balance of interest–bearing investment portfolio.

Click here to download our most recent Sure Analysis report on GLAD (preview of page 1 of 3 shown below):

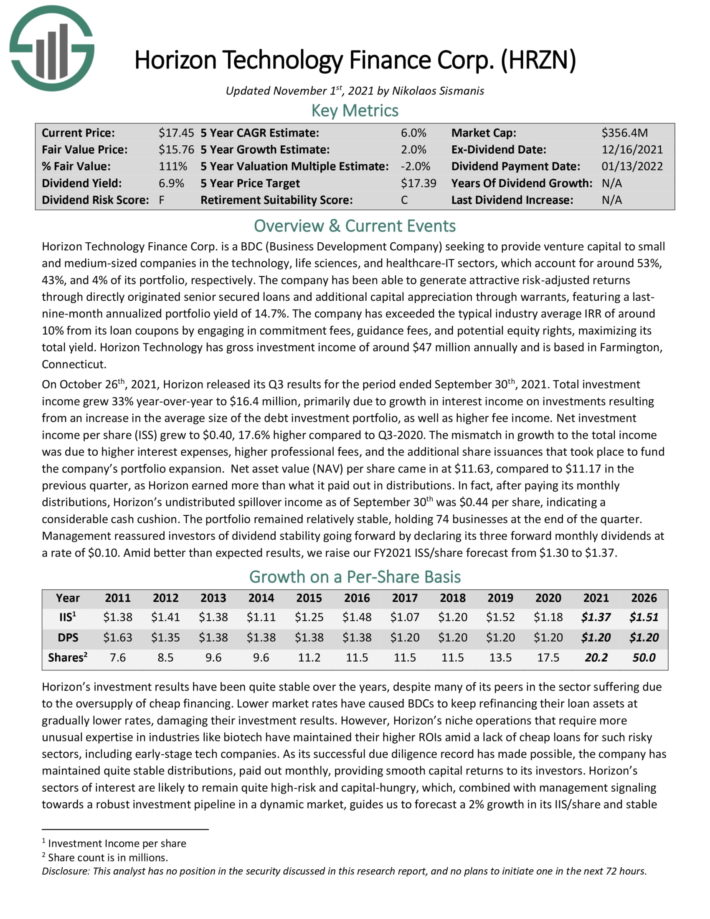

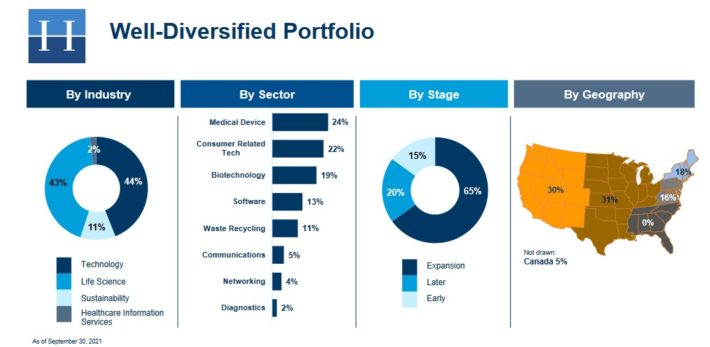

High-Yield Monthly Dividend Stock #17: Horizon Technology (HRZN)

- Dividend Yield: 7.4%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

Source: Investor Presentation

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants, featuring a last–nine–month annualized portfolio yield of 14.7%.

The company has exceeded the typical industry average IRR of around 10% from its loan coupons by engaging in commitment fees, guidance fees, and potential equity rights, maximizing its total yield. Horizon Technology has gross investment income of around $47 million annually.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

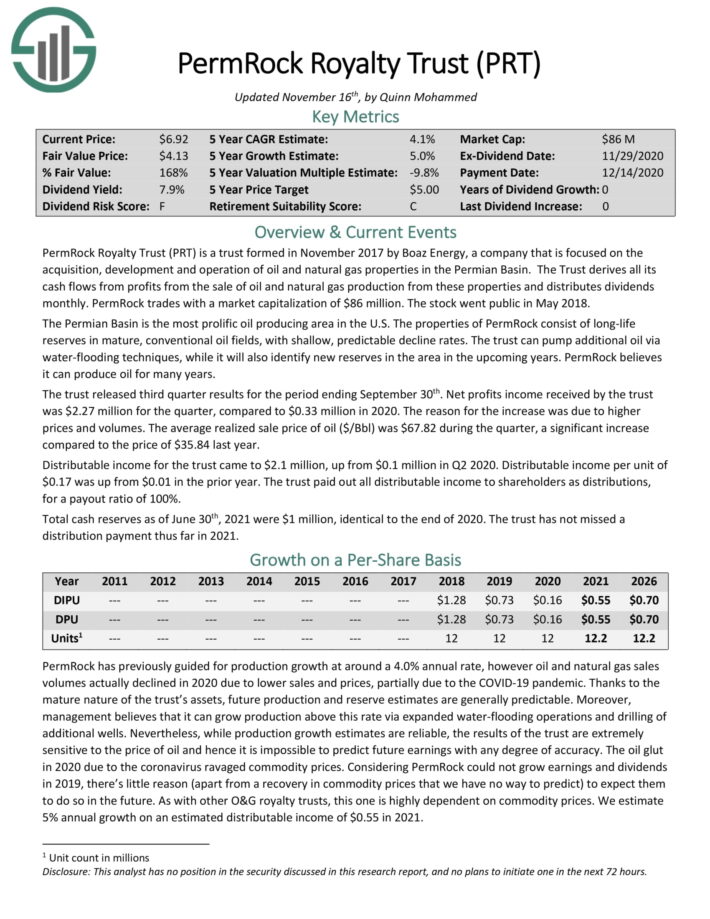

High-Yield Monthly Dividend Stock #16: PermRock Royalty Trust (PRT)

- Dividend Yield: 7.5%

PermRock is an oil and gas royalty trust with properties in the Permian Basin. The Trust derives all its cash flows from profits from the sale of oil and natural gas production from these properties and distributes dividends monthly.

The Permian Basin is the most prolific oil producing area in the United States. The properties of PermRock consist of long–life reserves in mature, conventional oil fields, with shallow, predictable decline rates.

The trust can pump additional oil via water–flooding techniques, while it will also identify new reserves in the area in the upcoming years.

Click here to download our most recent Sure Analysis report on PRT (preview of page 1 of 3 shown below):

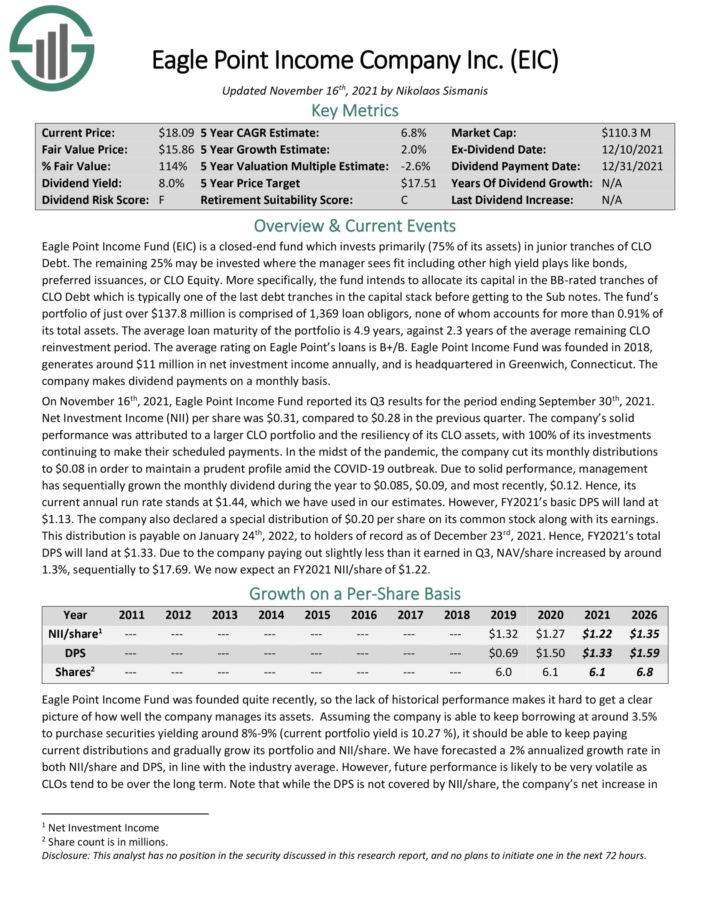

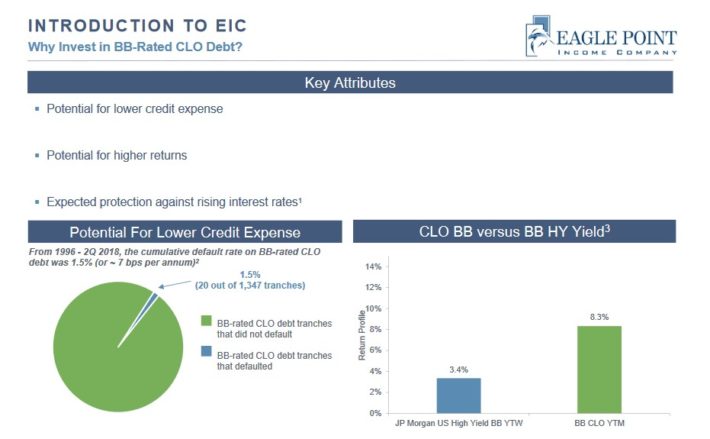

High-Yield Monthly Dividend Stock #15: Eagle Point Income (EIC)

- Dividend Yield: 7.7%

Eagle Point Income Fund (EIC) is a closed–end fund which invests primarily (75% of its assets) in junior tranches of CLO Debt.

The remaining 25% may be invested where the manager sees fit including other high yield plays like bonds, preferred issuances, or CLO Equity.

More specifically, the fund intends to allocate its capital in the BB–rated tranches of CLO Debt which is typically one of the last debt tranches in the capital stack before getting to the Sub notes.

Source: Investor Presentation

The fund’s portfolio of just over $137.8 million is comprised of 1,369 loan obligors, none of whom accounts for more than 0.91% of its total assets.

The average loan maturity of the portfolio is 4.9 years, against 2.3 years of the average remaining CLO reinvestment period. The average rating on Eagle Point’s loans is B+/B.

Eagle Point Income Fund was founded in 2018, and generates around $11 million in net investment income annually.

Click here to download our most recent Sure Analysis report on EIC (preview of page 1 of 3 shown below):

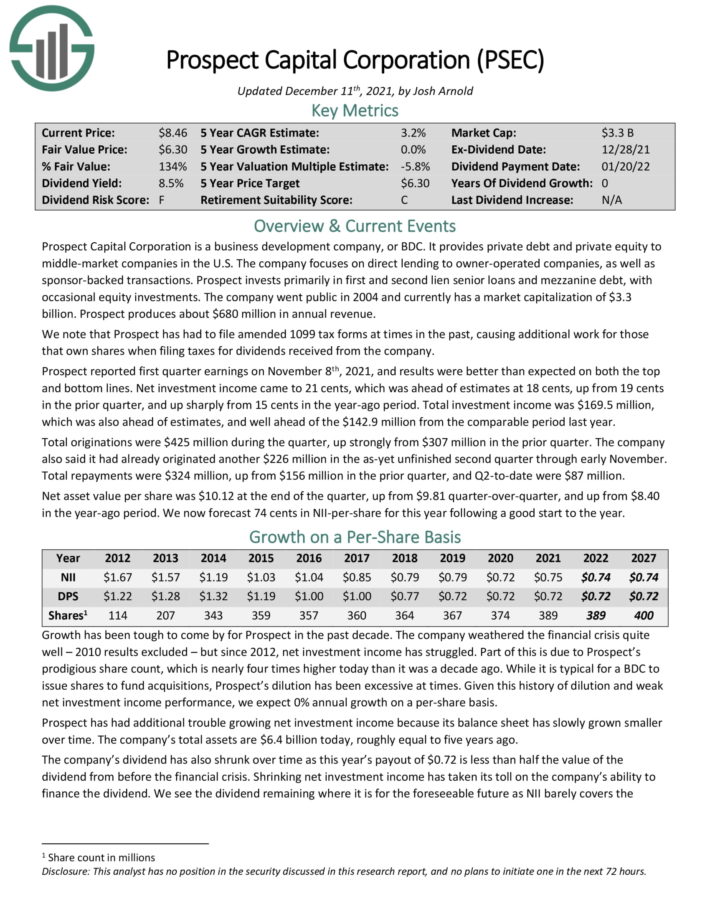

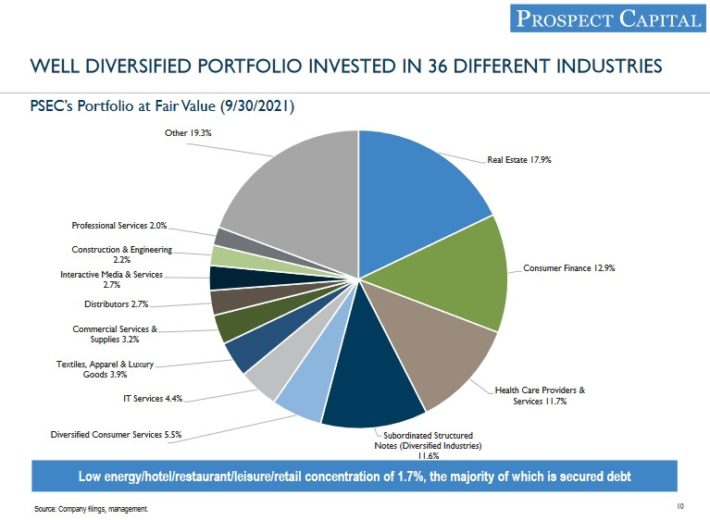

High-Yield Monthly Dividend Stock #14: Prospect Capital (PSEC)

- Dividend Yield: 8.2%

Prospect Capital Corporation is BDC that provides private debt and private equity to middle–market companies in the U.S. The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments. The company produces about $680 million in annual revenue.

Source: Investor Presentation

Prospect reported first quarter earnings on November 8th, 2021, and results were better than expected on both the top and bottom lines.

Net investment income came to $0.21 per share, which beat estimates by $0.03 per share and represented a 40% year-over-year increase.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

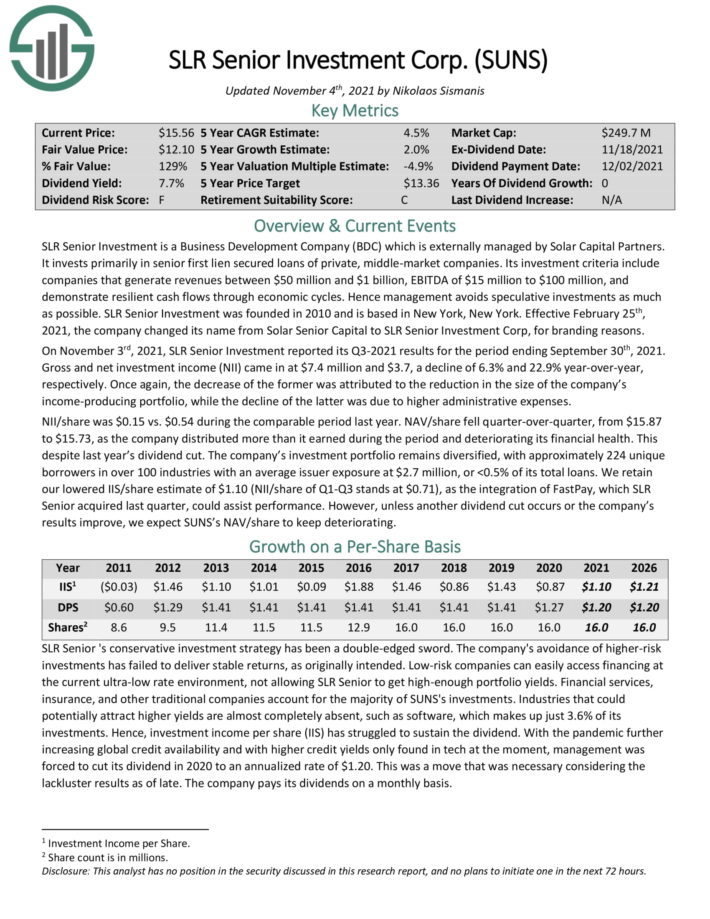

High-Yield Monthly Dividend Stock #13: SLR Senior Investment (SUNS)

- Dividend Yield: 8.2%

SLR Senior Investment is a BDC that is externally managed by Solar Capital Partners. It invests primarily in senior first lien secured loans of private, middle–market companies.

Its investment criteria include companies that generate revenues between $50 million and $1 billion, EBITDA of $15 million to $100 million, and demonstrate resilient cash flows through economic cycles.

On November 3rd, 2021, SLR Senior Investment reported its Q3–2021 results for the period ending September 30th, 2021. Gross and net investment income (NII) came in at $7.4 million and $3.7, a decline of 6.3% and 22.9% year–over–year, respectively. The declines were attributed to the reduction in the size of the company’s income–producing portfolio.

NII/share was $0.15 vs. $0.54 during the comparable period last year. NAV/share fell quarter–over–quarter, from $15.87 to $15.73, as the company distributed more than it earned during the period.

Click here to download our most recent Sure Analysis report on SUNS (preview of page 1 of 3 shown below):

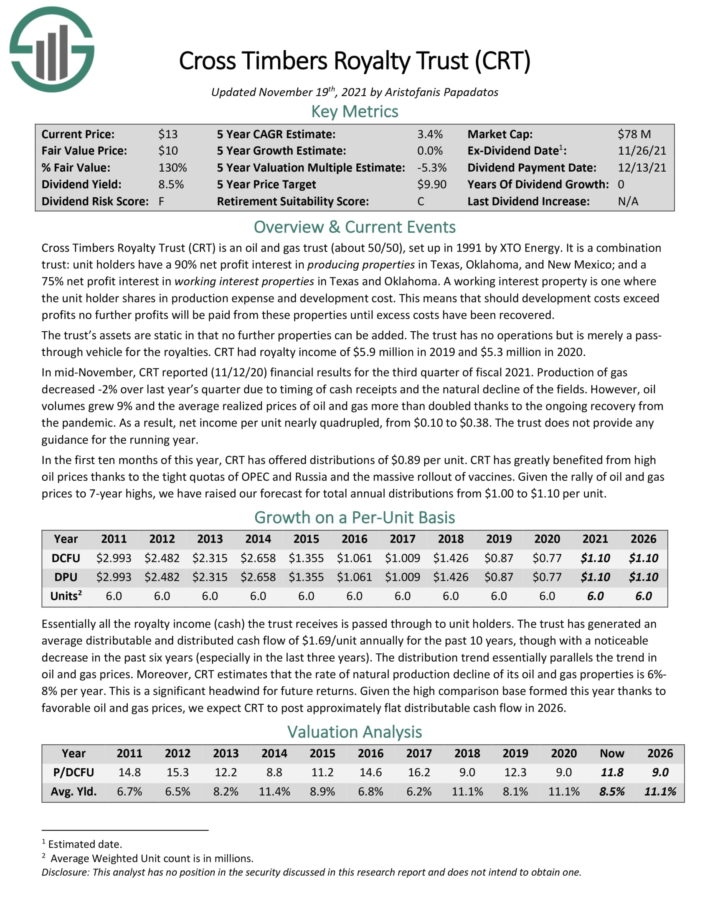

High-Yield Monthly Dividend Stock #12: Cross Timbers Royalty Trust (CRT)

- Dividend Yield: 8.2%

Cross Timbers is an oil and gas trust (about 50/50), set up in 1991 by XTO Energy. Unit holders have a 90% net profit interest in producing properties in Texas, Oklahoma, and New Mexico; and a 75% net profit interest in working interest properties in Texas and Oklahoma.

The trust’s assets are static in that no further properties can be added. The trust has no operations but is merely a pass–through vehicle for the royalties. CRT had royalty income of $5.9 million in 2019 and $5.3 million in 2020.

In mid–November, CRT reported (11/12/20) financial results for the third quarter of fiscal 2021. Production of gas decreased –2% over last year’s quarter due to timing of cash receipts and the natural decline of the fields.

However, oil volumes grew 9% and the average realized prices of oil and gas more than doubled thanks to the ongoing recovery from the pandemic. As a result, net income per unit nearly quadrupled, from $0.10 to $0.38

Click here to download our most recent Sure Analysis report on CRT (preview of page 1 of 3 shown below):

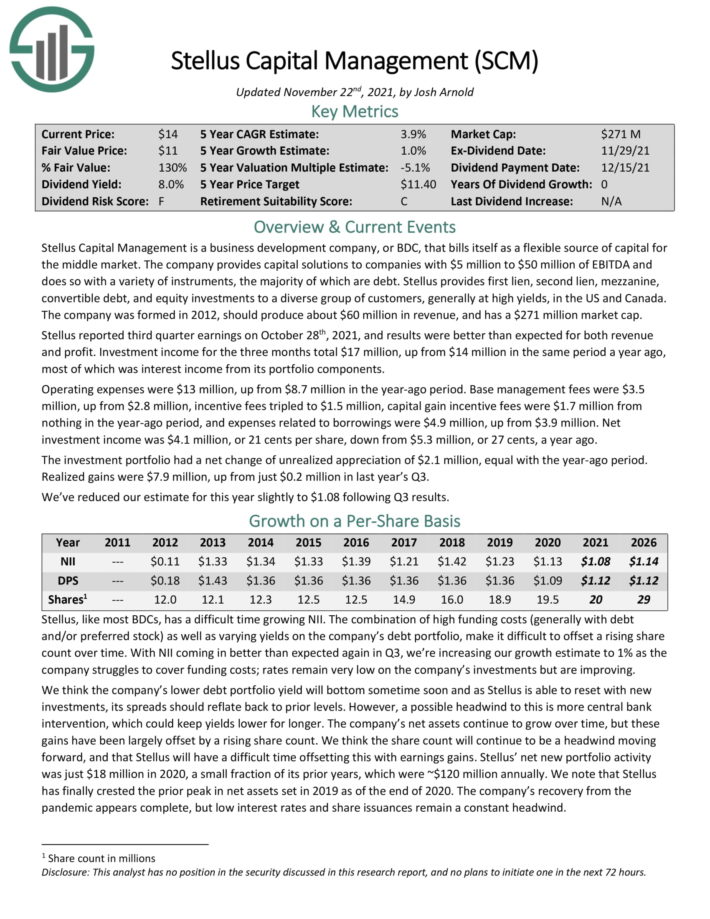

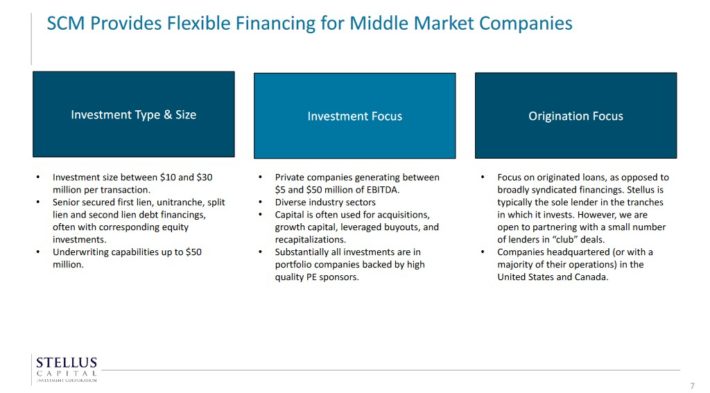

High-Yield Monthly Dividend Stock #11: Stellus Capital (SCM)

- Dividend Yield: 8.3%

Stellus Capital Management is BDC, that provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Source: Investor Presentation

The company was formed in 2012, and should produce about $60 million in revenue. Stellus reported third quarter earnings on October 28th, 2021, and results were better than expected for both revenue and profit.

Investment income for the three months total $17 million, up from $14 million in the same period a year ago, most of which was interest income from its portfolio components.

Click here to download our most recent Sure Analysis report on SCM (preview of page 1 of 3 shown below):

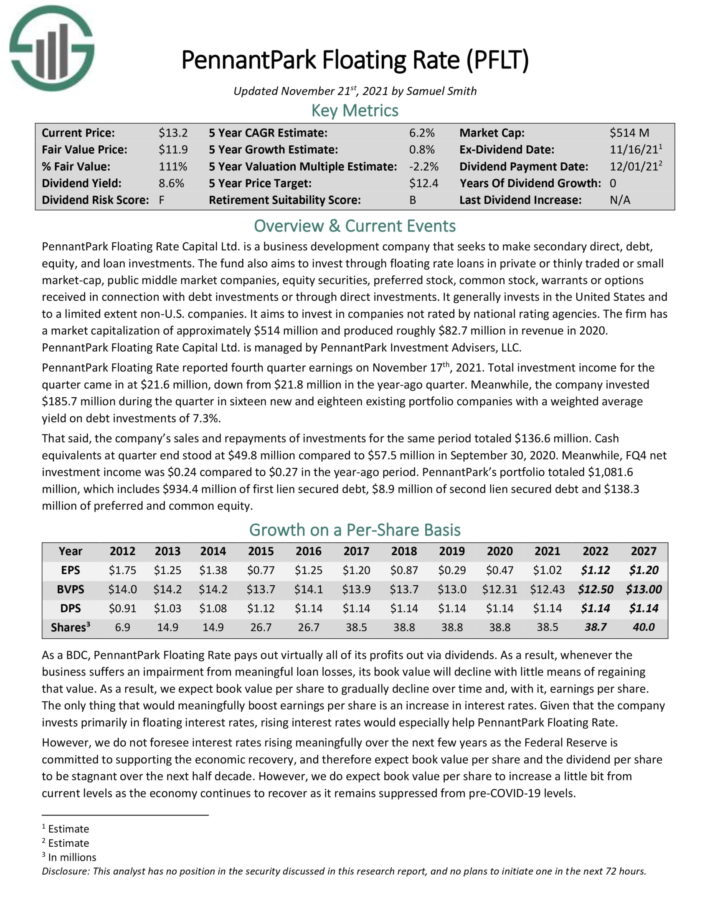

High-Yield Monthly Dividend Stock #10: PennantPark Floating Rate (PFLT)

- Dividend Yield: 8.4%

PennantPark Floating Rate Capital Ltd. is a BDC that makes secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small–cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

It generally invests in the United States and to a limited extent non–U.S. companies. It aims to invest in companies not rated by national rating agencies. The firm produced roughly $82.7 million in revenue in 2020.

PennantPark Floating Rate reported fourth quarter earnings on November 17th, 2021. Total investment income for the quarter came in at $21.6 million, down from $21.8 million in the year–ago quarter.

Meanwhile, the company invested $185.7 million during the quarter in sixteen new and eighteen existing portfolio companies with a weighted average yield on debt investments of 7.3%.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

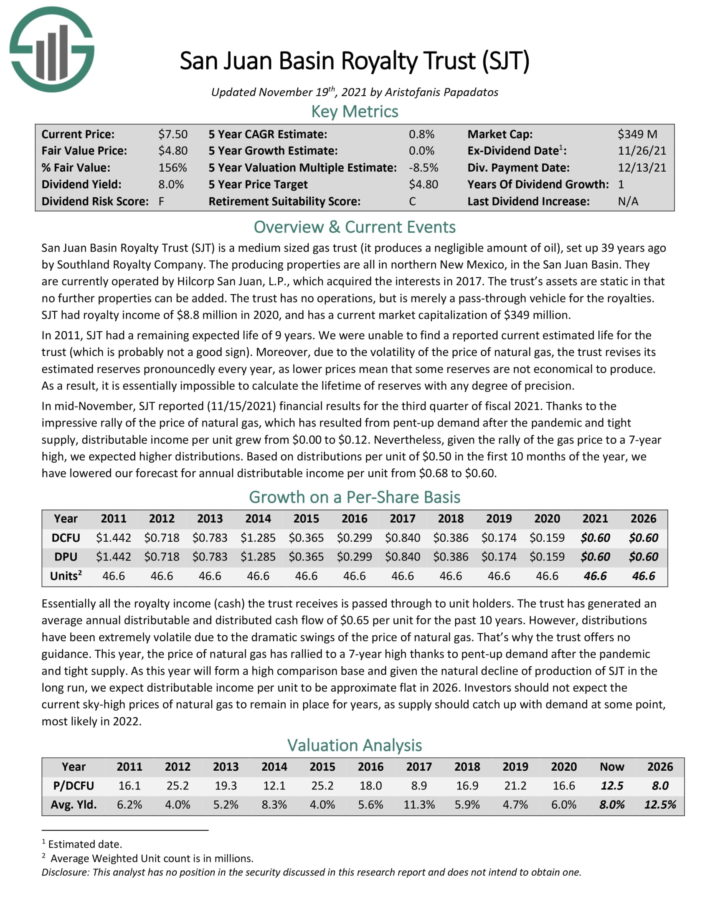

High-Yield Monthly Dividend Stock #9: San Juan Basin Royalty Trust (SJT)

- Dividend Yield: 8.5%

San Juan Basin Royalty Trust is a medium sized gas trust (it produces a negligible amount of oil), set up by Southland Royalty Company. The producing properties are all in northern New Mexico, in the San Juan Basin. They are currently operated by Hilcorp San Juan, L.P., which acquired the interests in 2017.

The trust’s assets are static in that no further properties can be added. The trust has no operations, but is merely a pass–through vehicle for the royalties. SJT had royalty income of $8.8 million in 2020.

Click here to download our most recent Sure Analysis report on SJT (preview of page 1 of 3 shown below):

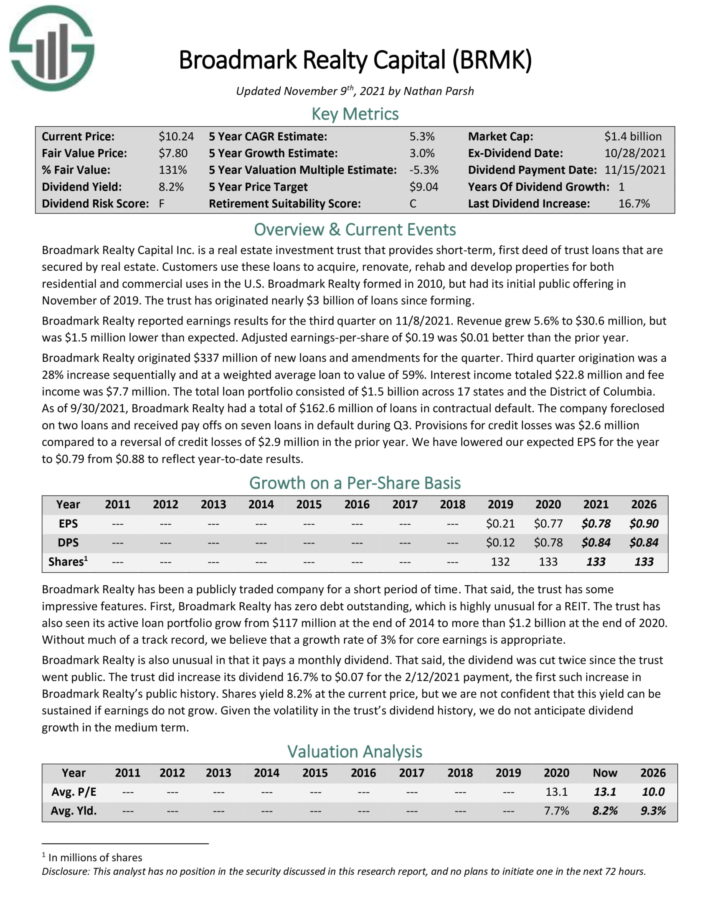

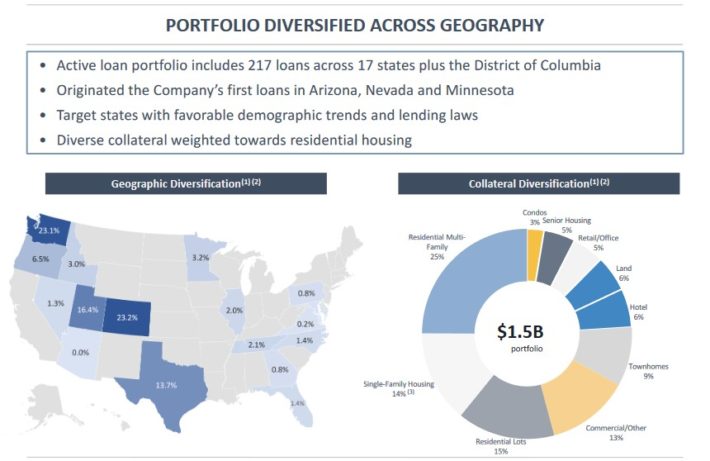

High-Yield Monthly Dividend Stock #8: Broadmark Realty Capital (BRMK)

- Dividend Yield: 8.6%

Broadmark Realty Capital Inc. is a real estate investment trust that provides short–term, first deed of trust loans that are secured by real estate.

Customers use these loans to acquire, renovate, rehab and develop properties for both residential and commercial uses in the United States.

Source: Investor Presentation

Broadmark Realty formed in 2010, but had its initial public offering in November of 2019. The trust has originated nearly $3 billion of loans since forming.

Broadmark Realty reported earnings results for the third quarter on 11/8/2021. Revenue grew 5.6% to $30.6 million, but was $1.5 million lower than expected. Adjusted earnings–per–share of $0.19 was $0.01 better than the prior year.

Click here to download our most recent Sure Analysis report on BRMK (preview of page 1 of 3 shown below):

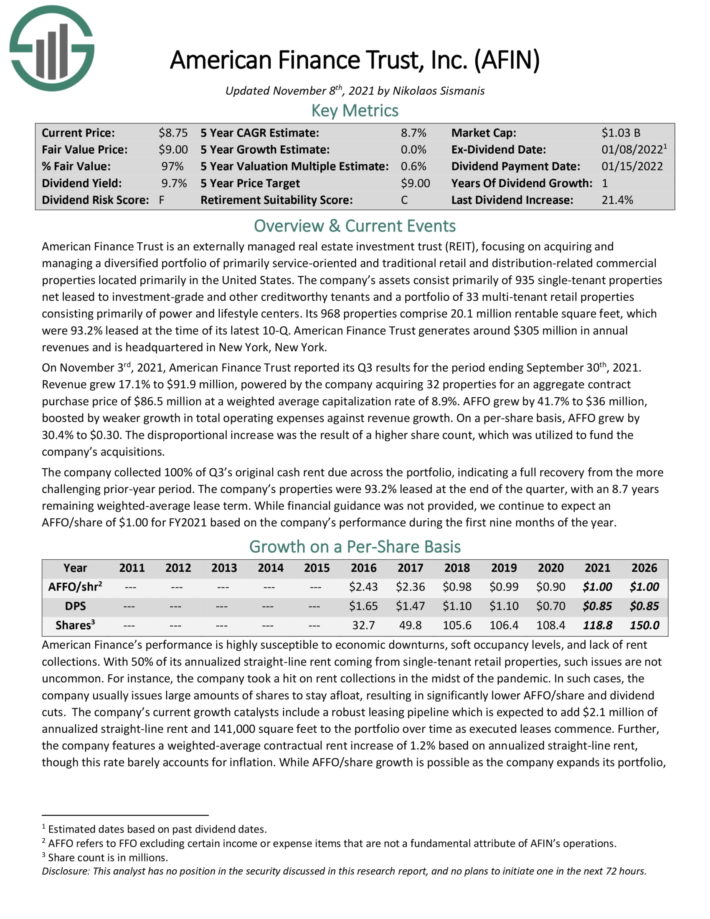

High-Yield Monthly Dividend Stock #7: American Finance Trust (AFIN)

- Dividend Yield: 9.2%

American Finance Trust is an externally managed REIT, focusing on acquiring and managing a diversified portfolio of primarily service–oriented and traditional retail and distribution–related commercial properties.

The company’s assets consist primarily of 935 single–tenant properties net leased to investment–grade and other creditworthy tenants and a portfolio of 33 multi–tenant retail properties consisting primarily of power and lifestyle centers.

Its 968 properties comprise 20.1 million rentable square feet, which were 93.2% leased at the time of its latest 10–Q. American Finance Trust generates around $305 million in annual revenues.

Click here to download our most recent Sure Analysis report on AFIN (preview of page 1 of 3 shown below):

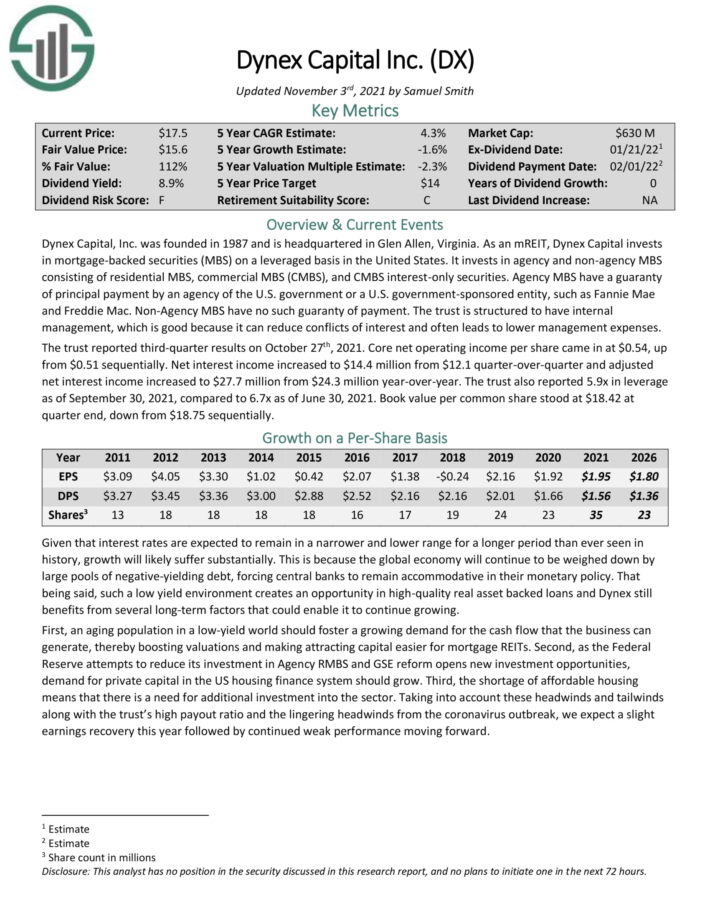

High-Yield Monthly Dividend Stock #6: Dynex Capital (DX)

- Dividend Yield: 9.2%

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Agency MBS have a guaranty of principal payment by an agency of the U.S. government or a U.S. government–sponsored entity, such as Fannie Mae and Freddie Mac. Non–Agency MBS have no such guaranty of payment.

The trust is structured to have internal management, which is good because it can reduce conflicts of interest and often leads to lower management expenses.

The trust reported third–quarter results on October 27th, 2021. Core net operating income per share came in at $0.54, up from $0.51 sequentially. Adjusted net interest income increased to $27.7 million from $24.3 million year–over–year.

The trust also reported 5.9x in leverage as of September 30, 2021, compared to 6.7x as of June 30, 2021. Book value per common share stood at $18.42 at quarter end, down from $18.75 sequentially.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

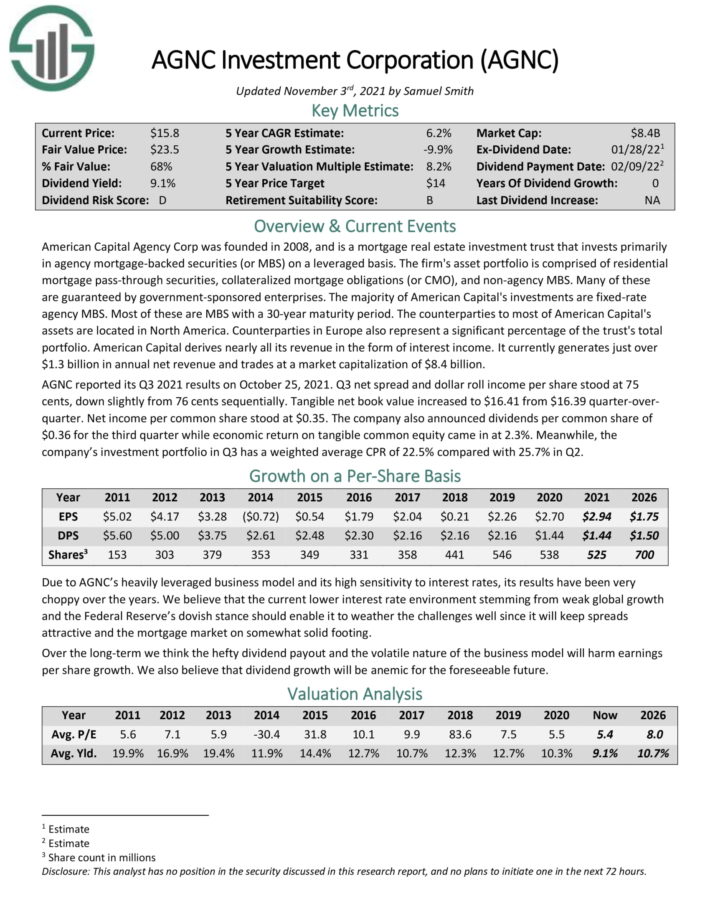

High-Yield Monthly Dividend Stock #5: AGNC Investment Corporation (AGNC)

- Dividend Yield: 8.6%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

The majority of American Capital’s investments are fixed–rate agency MBS. Most of these are MBS with a 30–year maturity period.

American Capital derives nearly all its revenue in the form of interest income. It currently generates just over $1.3 billion in annual net revenue and trades at a market capitalization of $8.4 billion

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

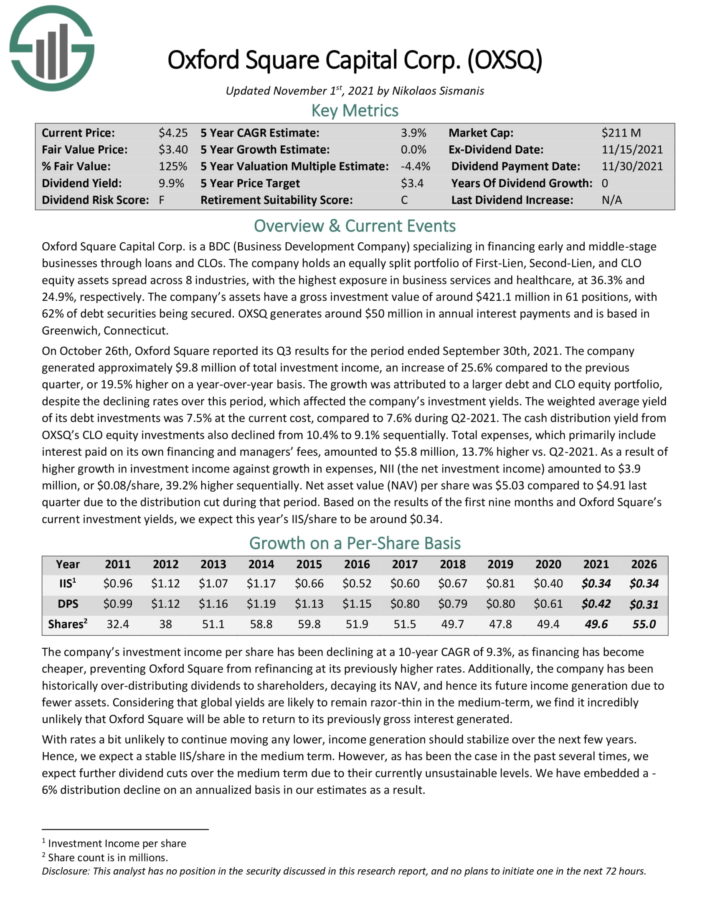

High-Yield Monthly Dividend Stock #4: Oxford Square Capital (OXSQ)

- Dividend Yield:9.7%

Oxford Square Capital Corp. is a BDC specializing in financing early and middle–stage businesses through loans and CLOs.

The company holds an equally split portfolio of First–Lien, Second–Lien, and CLO equity assets spread across 8 industries, with the highest exposure in business services and healthcare, at 36.3% and 24.9%, respectively.

The company’s assets have a gross investment value of around $421.1 million in 61 positions, with62% of debt securities being secured.

On October 26th, Oxford Square reported its Q3 results for the period ended September 30th, 2021. The company generated approximately $9.8 million of total investment income, an increase of 25.6% compared to the previous quarter, or 19.5% higher on a year–over–year basis.

The growth was attributed to a larger debt and CLO equity portfolio, despite the declining rates over this period, which affected the company’s investment yields.

As a result of higher growth in investment income against growth in expenses, NII (the net investment income) amounted to $3.9 million, or $0.08/share, 39.2% higher sequentially.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

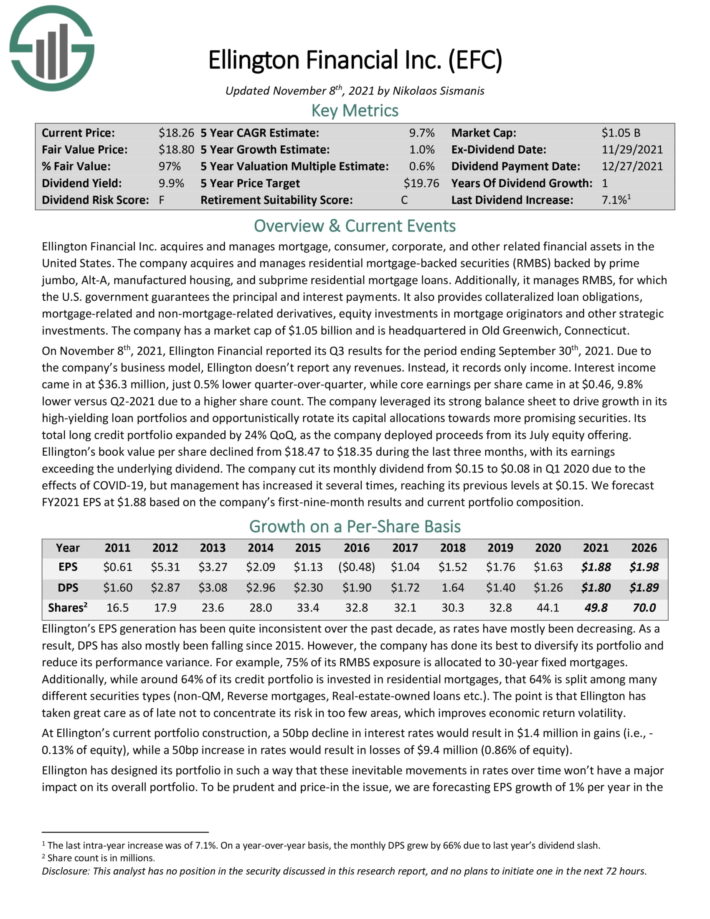

High-Yield Monthly Dividend Stock #3: Ellington Financial (EFC)

- Dividend Yield: 10.2%

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States. The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

On November 8th, 2021, Ellington Financial reported its Q3 results for the period ending September 30th, 2021. Interest income came in at $36.3 million, just 0.5% lower quarter–over–quarter, while core earnings per share came in at $0.46, 9.8% lower versus Q2–2021 due to a higher share count.

Click here to download our most recent Sure Analysis report on EFC (preview of page 1 of 3 shown below):

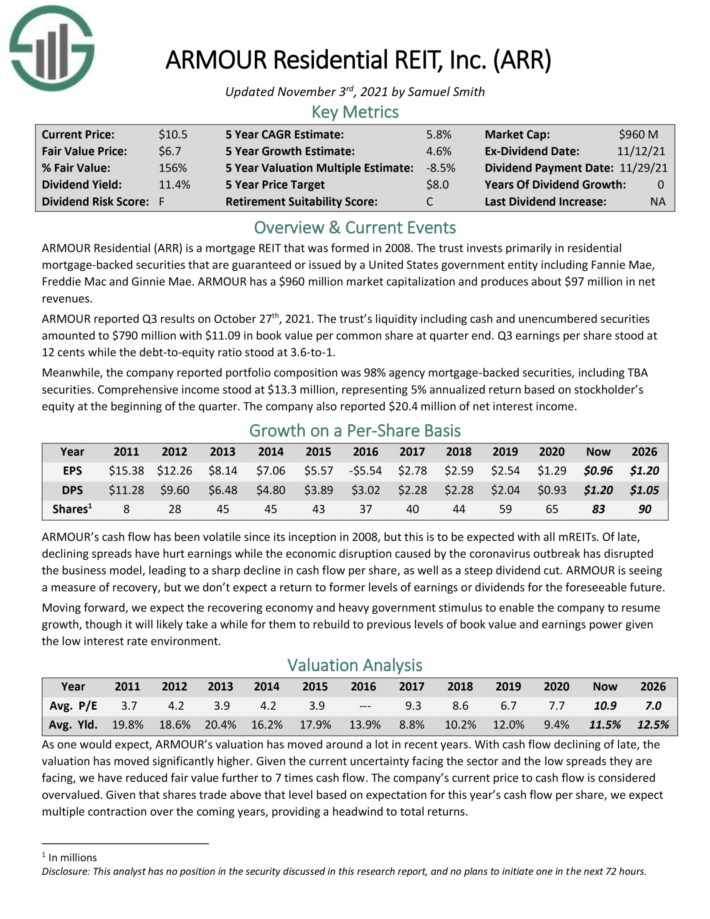

High-Yield Monthly Dividend Stock #2: ARMOUR Residential REIT (ARR)

- Dividend Yield: 11.9%

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are guaranteed or issued by a United States government entity including Fannie Mae, Freddie Mac and Ginnie Mae.

ARMOUR reported Q3 results on October 27th, 2021. The trust’s liquidity including cash and unencumbered securities amounted to $790 million with $11.09 in book value per common share at quarter end. Q3 earnings per share stood at 12 cents while the debt–to–equity ratio stood at 3.6–to–1.

Meanwhile, the company reported portfolio composition was 98% agency mortgage–backed securities, including TBA securities.

Comprehensive income stood at $13.3 million, representing 5% annualized return based on stockholder’s equity at the beginning of the quarter. The company also reported $20.4 million of net interest income.

Click here to download our most recent Sure Analysis report on ARR (preview of page 1 of 3 shown below):

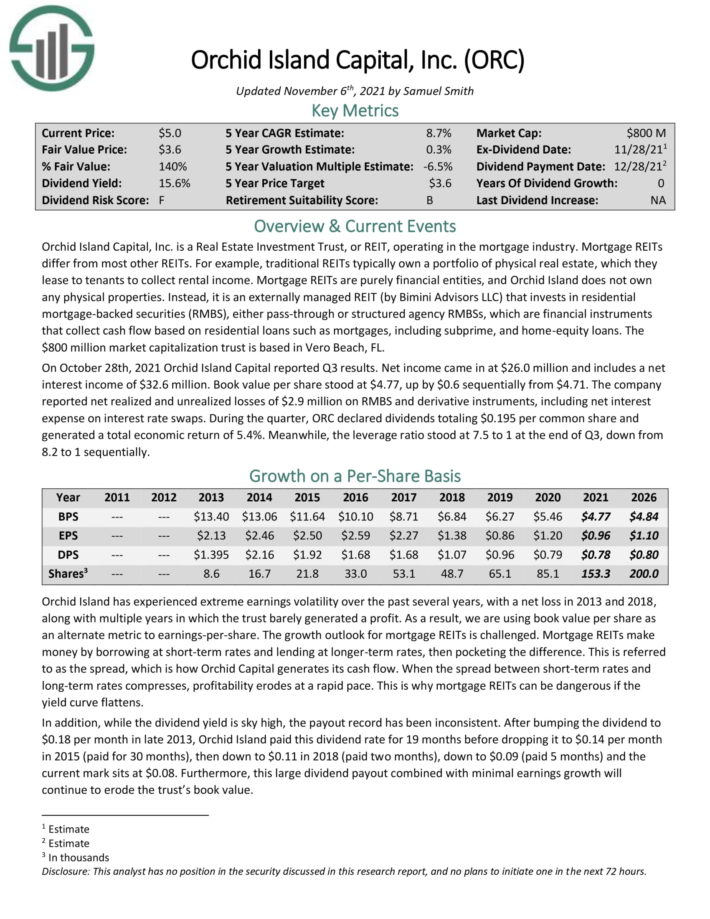

High-Yield Monthly Dividend Stock #1: Orchid Island Capital (ORC)

- Dividend Yield: 16.8%

Orchid Island Capital, Inc. is a mortgage REIT. As such, Orchid Island does not own any physical properties.

Instead, it is an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage–backed securities (RMBS), either pass–through or structured agency RMBSs. These are financial instruments that collect cash flow based on residential loans such as mortgages, including subprime, and home–equity loans.

On October 28th, 2021 Orchid Island Capital reported Q3 results. Net income came in at $26.0 million and includes a net interest income of $32.6 million. Book value per share stood at $4.77, up by $0.6 sequentially from $4.71.

Click here to download our most recent Sure Analysis report on ORC (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks could be more appealing to income investors than quarterly or semi-annual dividend stocks. This is because monthly dividend stocks make 12 dividend payments per year, instead of the usual 4 or 2.

Furthermore, monthly dividend stocks with high yields above 5% are even more attractive for income investors.

The 20 stocks on this list have not been vetted for dividend safety, meaning each investor should understand the unique risk factors of each company.

That said, these 20 dividend stocks make monthly payments to shareholders, and all have high dividend yields.

Further Reading

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Aristocrats List: a group of elite S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Dividend Champions List: a broader group of stocks with 25+ years of consecutive dividend increases, without the S&P 500 Index inclusion requirement.

- The Dividend Challengers List: stocks with 5-9 years of consecutive dividend increases.

- The Dividend Achievers List: a group of stocks with 10-24 years of consecutive dividend increases.

- The Dividend Kings List: considered to be the best-of-the-best among dividend growth stocks, the Dividend Kings are a group of exceptional dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.