Updated on September 23rd, 2021 by Bob Ciura

Dividend stocks are a great way to build wealth in the long run, as dividends are one of the key factors for a stock’s total returns over the long run.

This is one of the reasons why the Dividend Aristocrats have performed so well for investors over the past several decades. Dividend stocks also are able to generate a relatively reliable income stream that can help supplement retirement expenses.

Many traditional dividend stocks are from the healthcare and consumer staples industries, which generally aren’t very cyclical and where dividend payouts can thus be very consistent.

There are also attractive dividend stocks in other market sectors, such as the industrial sector. You can see the entire list of 747 dividend-paying industrial stocks here.

You can also access a downloadable spreadsheet below:

In this article we will take a look at the 10 dividend stocks from the industrial sector with the highest expected total returns over the next five years.

Table of Contents

In this article we will take a look at the top 7 industrial stocks in the Sure Analysis Research Database that show the highest expected returns over the coming five years, and that have a Dividend Risk score of C or better.

Our top 7 industrial stocks are ranked below, according to their 5-year expected total annual returns, in order of lowest to highest.

You can jump to any specific section of the article by clicking on the links below:

- Industrial Stock #10: Stanley Black & Decker (SWK)

- Industrial Stock #9: Northrop Grumman (NOC)

- Industrial Stock #8: FedEx Corporation (FDX)

- Industrial Stock #7: C.H. Robinson Worldwide (CHRW)

- Industrial Stock #6: Parker-Hannifin (PH)

- Industrial Stock #5: Donaldson Company (DCI)

- Industrial Stock #4: Tennant Company (TNC)

- Industrial Stock #3: ABM Industries (ABM)

- Industrial Stock #2: Lockheed Martin (LMT)

- Industrial Stock #1: Triton International Limited (TRTN)

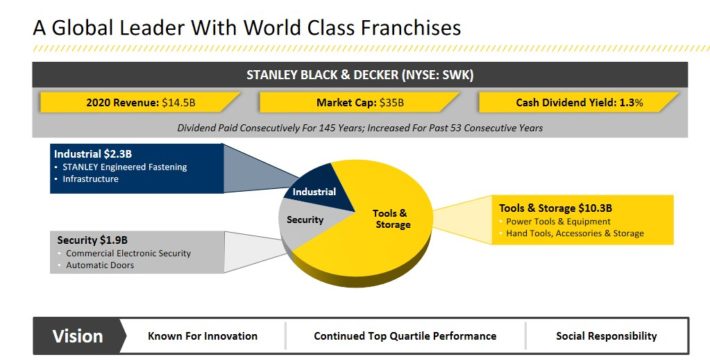

Industrial Stock #10: Stanley Black & Decker (SWK)

- 5-year expected annual returns: 10.2%

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales. Stanley Black & Decker is second in the world in the areas of commercial electronic security and engineered fastening.

With over 50 consecutive years of annual dividend increases, Stanley Black & Decker is on the exclusive list of Dividend Kings. You can see the full Dividend Kings list here.

Source: Investor Presentation

The stock has a 1.7% dividend yield, and we expect 8% annual EPS growth. With a small boost from an expanding P/E multiple, total returns are expected to reach 10.2% per year.

Click here to download our most recent Sure Analysis report on SWK (preview of page 1 of 3 shown below):

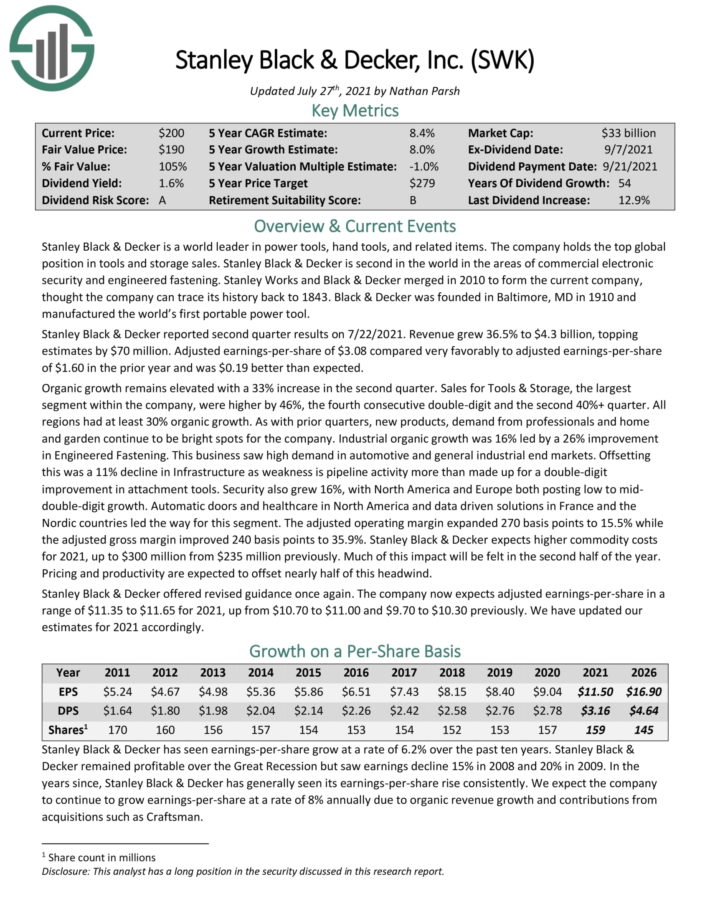

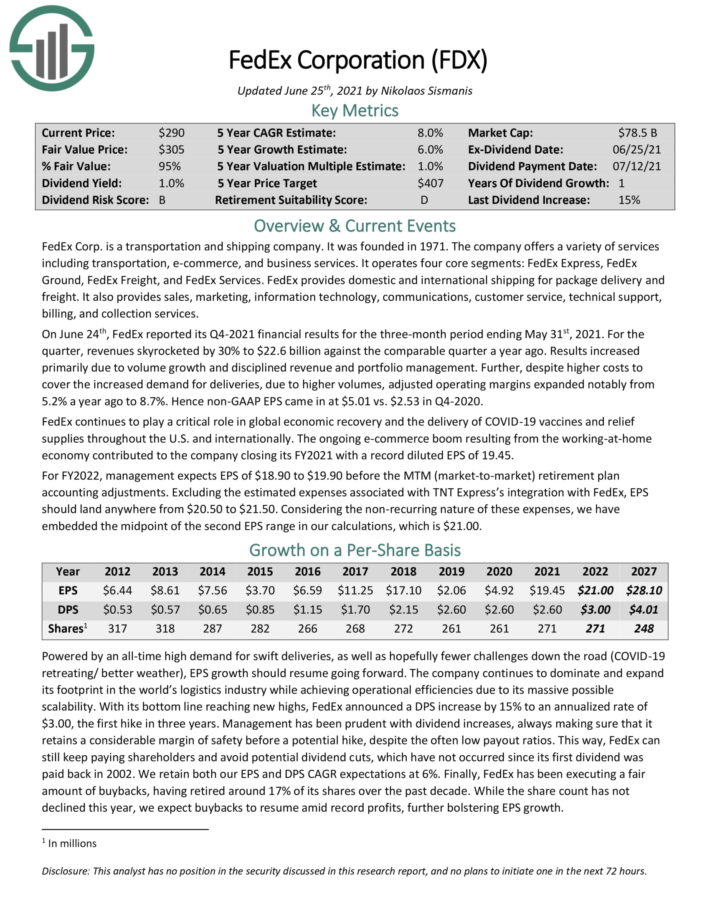

Industrial Stock #9: Northrop Grumman (NOC)

- 5-year expected annual returns: 10.8%

Northrop Grumman is an aerospace and defense company that dates back to 1939. Northrop Grumman was originally a builder of military aircraft, but over the years the company has moved into other segments including ammunition and space systems.

Source: Investor Presentation

Northrop Grumman will, we believe, be able to generate earnings-per-share growth of 8% annually going forward, through a combination of revenue growth, operating leverage, and share repurchases.

Including the 1.8% dividend yield and a 1% annual boost from multiple expansion, total returns could reach 10.8% per year over the next five years.

Click here to download our most recent Sure Analysis report on NOC (preview of page 1 of 3 shown below):

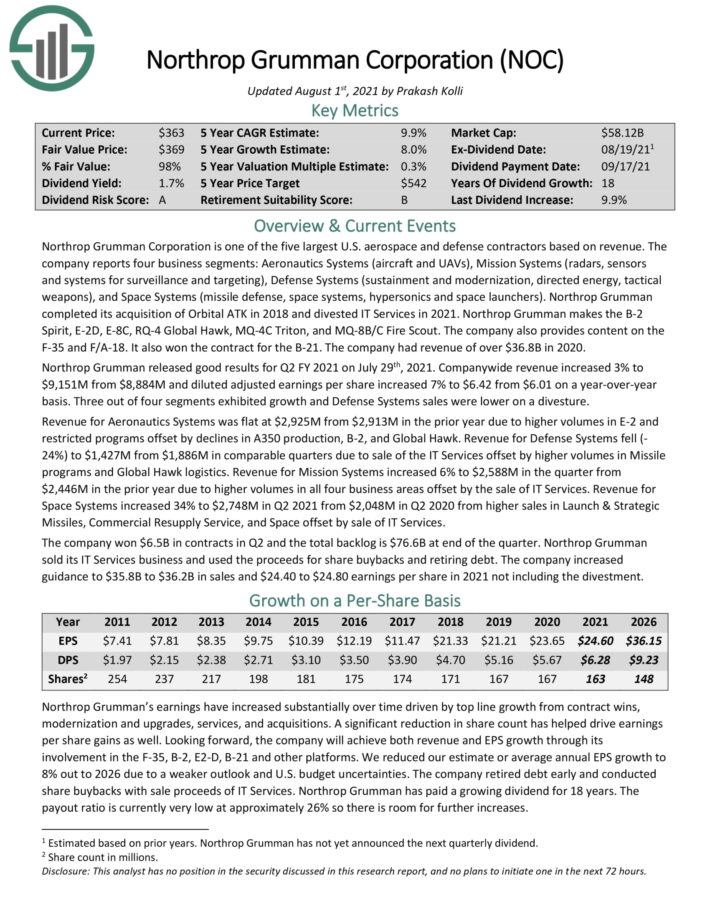

Industrial Stock #8: FedEx Corporation (FDX)

- 5-year expected annual returns: 11.2%

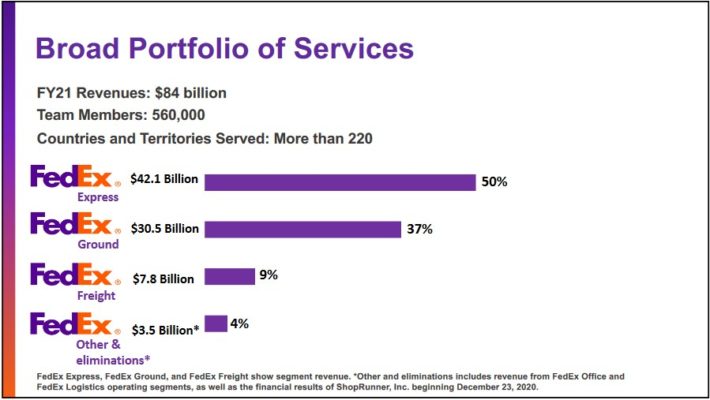

FedEx Corp. is a transportation and shipping company. It was founded in 1971. The company offers a variety of services including transportation, e–commerce, and business services.

It operates four core segments: FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services. FedEx provides domestic and international shipping for package delivery and freight. It also provides sales, marketing, information technology, communications, customer service, technical support, billing, and collection services.

Source: Investor Presentation

We believe that FedEx will grow its earnings-per-share by 6% annually. Combined with a 1.3% dividend yield, with a boost from an expanding P/E multiple, total returns are expected to exceed 11% per year over the next five years.

Click here to download our most recent Sure Analysis report on FDX (preview of page 1 of 3 shown below):

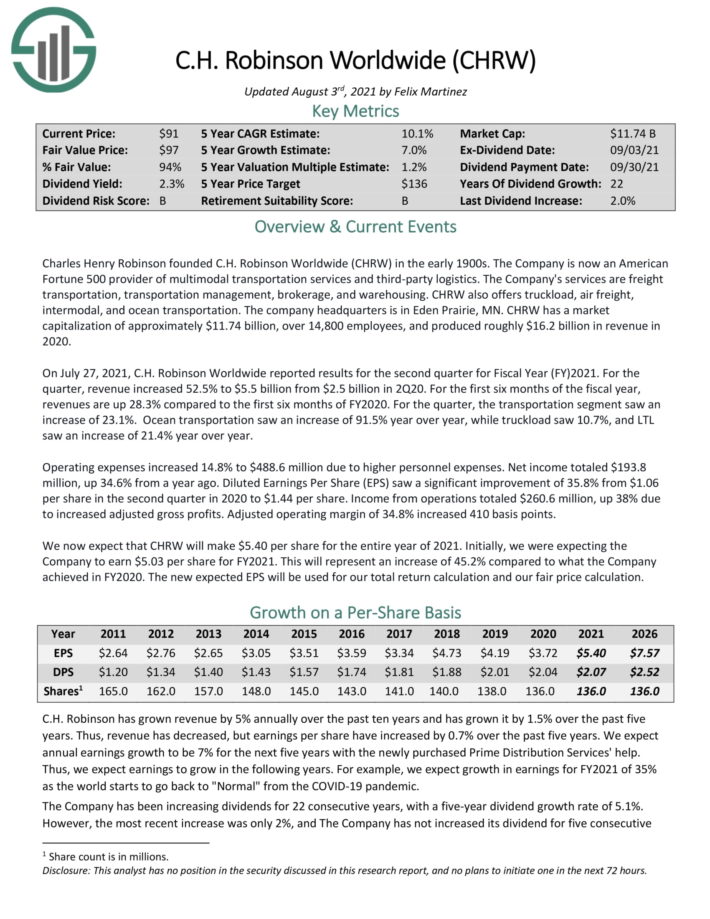

Industrial Stock #7: C.H. Robinson Worldwide (CHRW)

- 5-year expected annual returns: 11.2%

Charles Henry Robinson founded C.H. Robinson Worldwide (CHRW) in the early 1900s. The company is now a provider of multimodal transportation services and third–party logistics.

The company’s services are freight transportation, transportation management, brokerage, and warehousing. CHRW also offers truckload, air freight, intermodal, and ocean transportation. CHRW produced roughly $16.2 billion in revenue in 2020.

Source: Investor Presentation

We expect 7% annual EPS growth over the next five years. Adding in the 2.3% dividend yield and a ~2% annual boost from an expanding P/E multiple, total annual returns could reach 11.2% through 2026.

Click here to download our most recent Sure Analysis report on CHRW (preview of page 1 of 3 shown below):

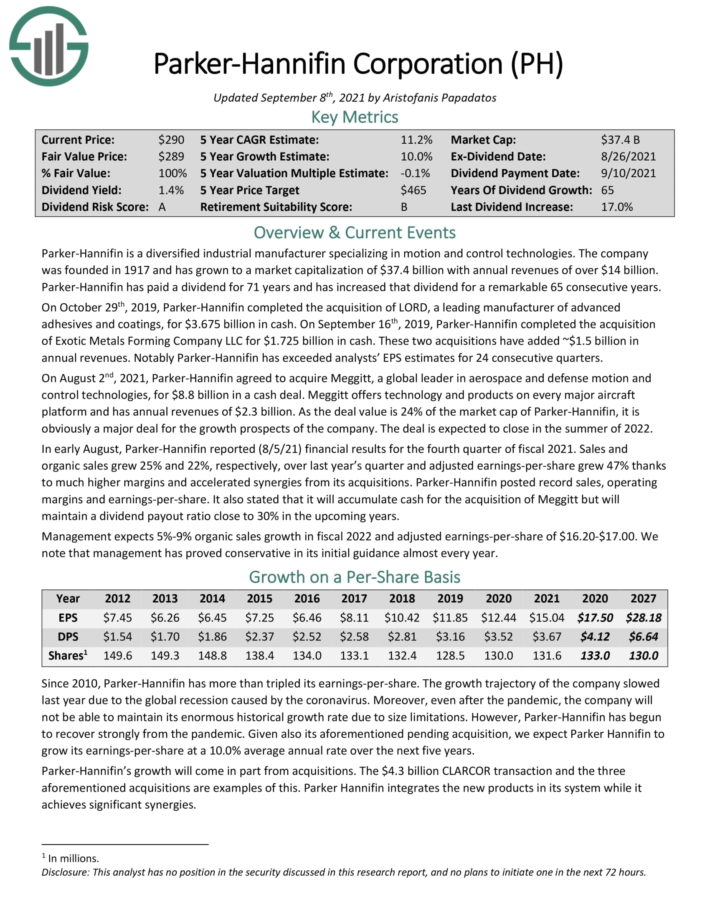

Industrial Stock #6: Parker-Hannifin (PH)

- 5-year expected annual returns: 11.6%

Parker–Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company was founded in 1917 and has grown to a market capitalization of $37.4 billion with annual revenues of over $14 billion. Parker–Hannifin has paid a dividend for 71 years and has increased that dividend for a remarkable 65 consecutive years. The company is also a member of the Dividend Kings.

PH stock offers investors a dividend that yields 1.4%, and we expect 10% annual EPS growth over the next five years. Combined with a very small boost from an expanding P/E multiple, total returns are estimated at 11.6% per year.

Click here to download our most recent Sure Analysis report on PH (preview of page 1 of 3 shown below):

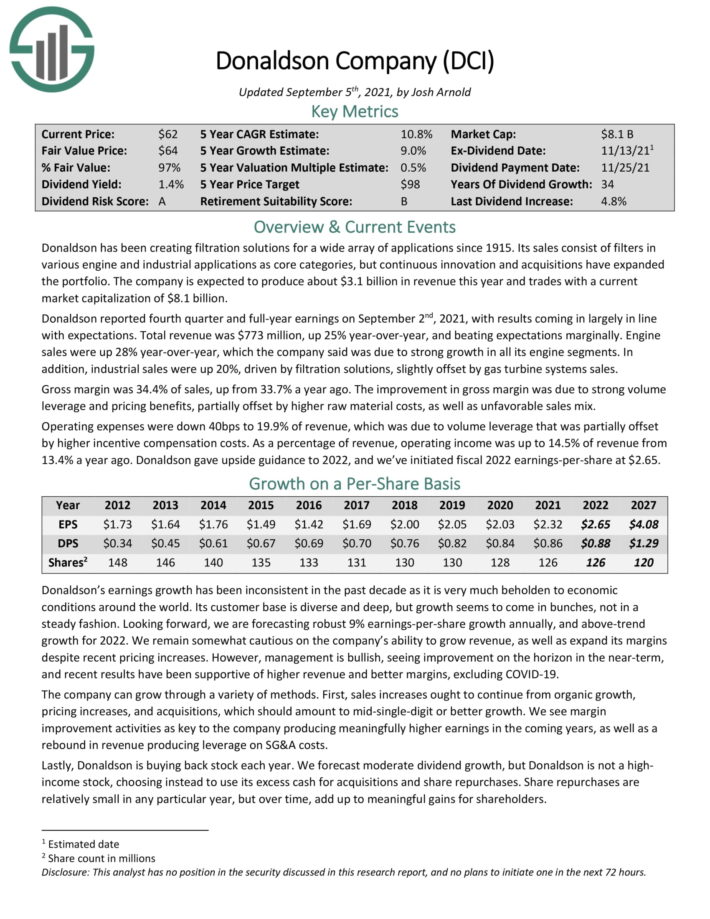

Industrial Stock #5: Donaldson Company (DCI)

- 5-year expected annual returns: 11.8%

Donaldson has been creating filtration solutions for a wide array of applications since 1915. Its sales consist of filters in various engine and industrial applications as core categories, but continuous innovation and acquisitions have expanded the portfolio. The company is expected to produce about $3.1 billion in revenue this year.

We expect 9% annual EPS growth for Donaldson going forward, while the stock also has a 1.5% dividend yield. With a very small boost from P/E multiple expansion, we expect 11.8% annual returns over the next five years for Donaldson stock.

Click here to download our most recent Sure Analysis report on DCI (preview of page 1 of 3 shown below):

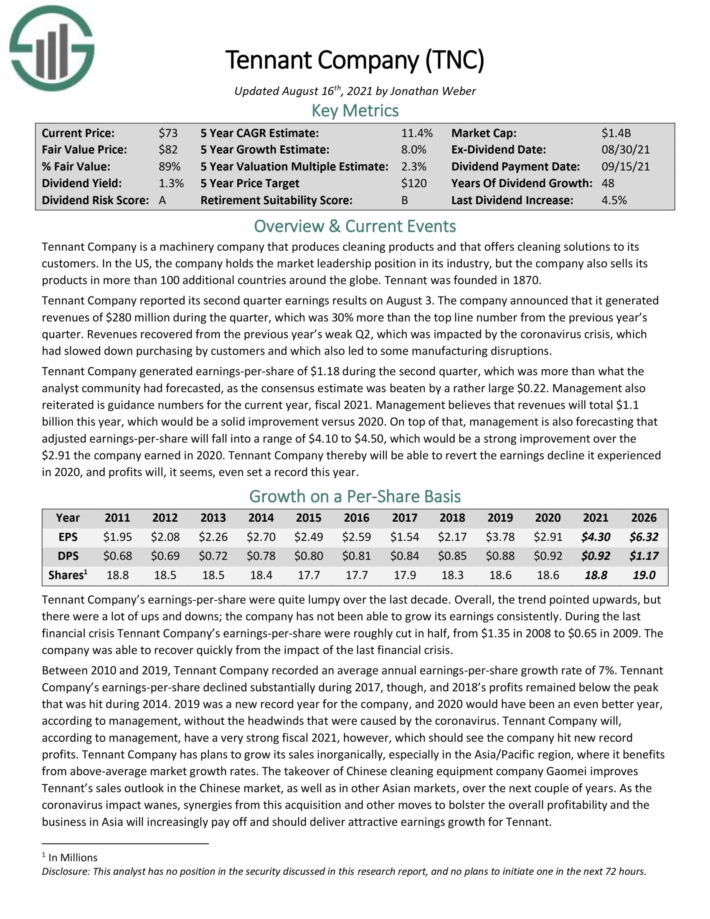

Industrial Stock #4: Tennant Company (TNC)

- 5-year expected annual returns: 12.1%

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its

customers. In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe. Tennant was founded in 1870. The company has increased its dividend for 48 consecutive years.

Source: Investor Presentation

We expect 8% annual EPS growth over the next five years. In addition to the 1.3% dividend yield and multiple expansion of ~3% per year, Tennant Company is well-positioned to deliver total returns just above 12% annually going forward.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

Industrial Stock #3: ABM Industries (ABM)

- 5-year expected annual returns: 13.0%

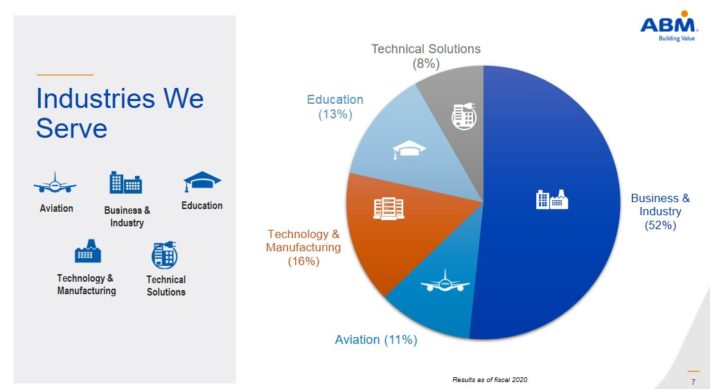

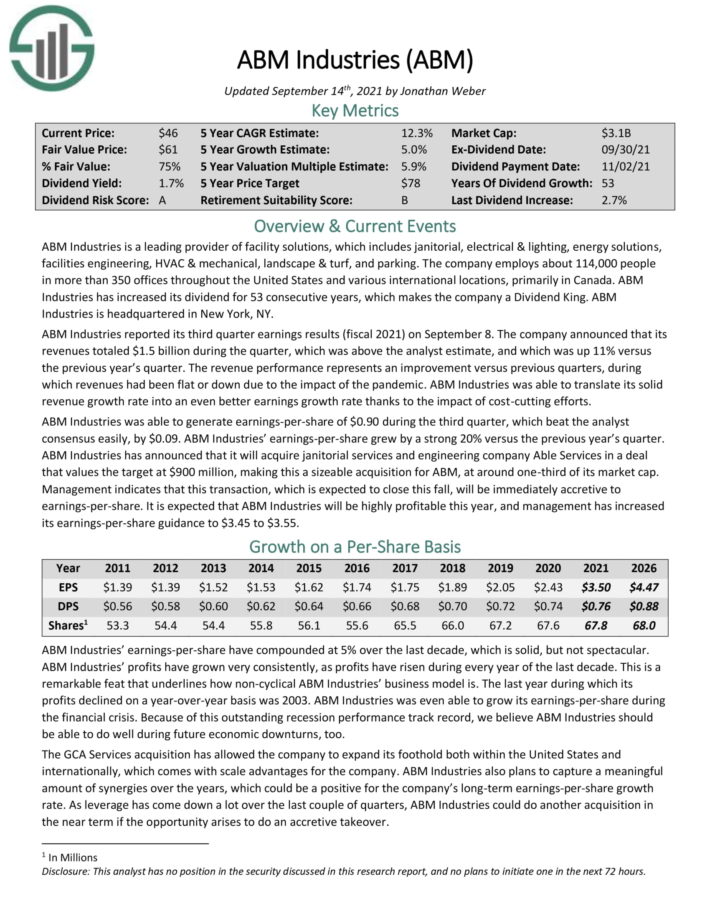

ABM Industries has increased its dividend for 53 consecutive years. ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking.

Source: Investor Presentation

ABM could produce total returns of 13% annually going forward, consisting of earnings-per-share growth (5%), dividends (1.7%), and multiple expansion (6.3%), which we deem to be a highly attractive total return estimate.

Click here to download our most recent Sure Analysis report on ABM (preview of page 1 of 3 shown below):

Industrial Stock #2: Lockheed Martin (LMT)

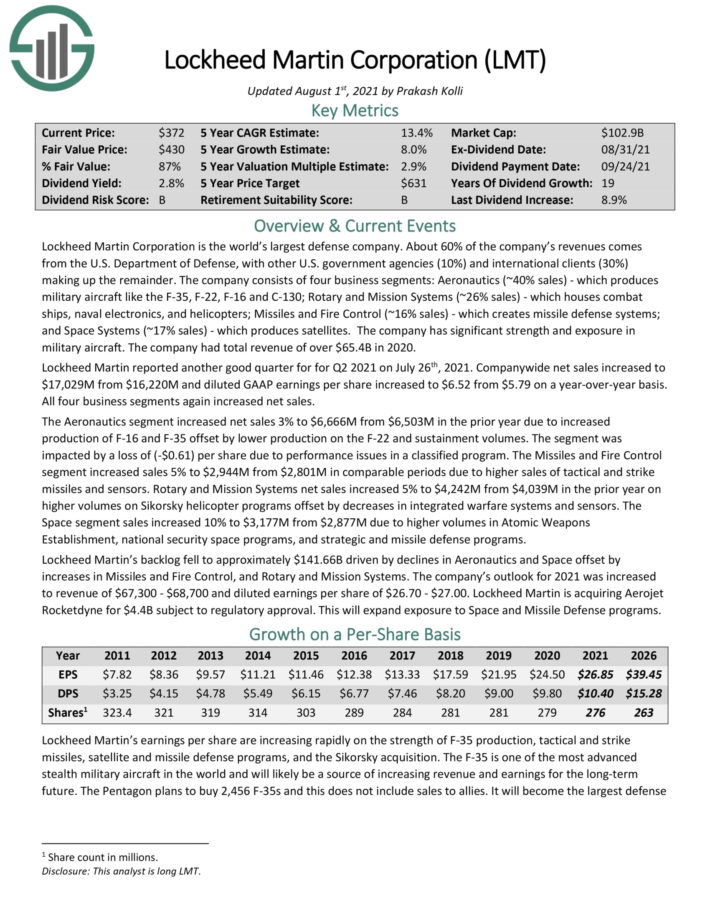

- 5-year expected annual returns: 15.6%

Lockheed Martin is the world’s largest defense company. About 60% of the company’s revenues comes from the U.S. Department of Defense, with other U.S. government agencies (10%) and international clients (30%) making up the remainder.

Lockheed Martin reported another good quarter for for Q2 2021 on July 26th, 2021. Companywide net sales increased to $17,029M from $16,220M and diluted GAAP earnings per share increased to $6.52 from $5.79 on a year–over–year basis. All four business segments again increased net sales.

Source: Investor Presentation

We expect Lockheed Martin to generate earnings-per-share of $26.85 in 2021. Based on this, the stock is currently trading at a price-to-earnings ratio (P/E) of 12.8. Our fair value estimate is a P/E of 16.0, which means expansion of the P/E multiple could increase returns.

When combined with the 8% anticipated EPS growth rate and 3% dividend yield, total return potential comes to 15.6% per year over the next half-decade.

Click here to download our most recent Sure Analysis report on Lockheed Martin (preview of page 1 of 3 shown below):

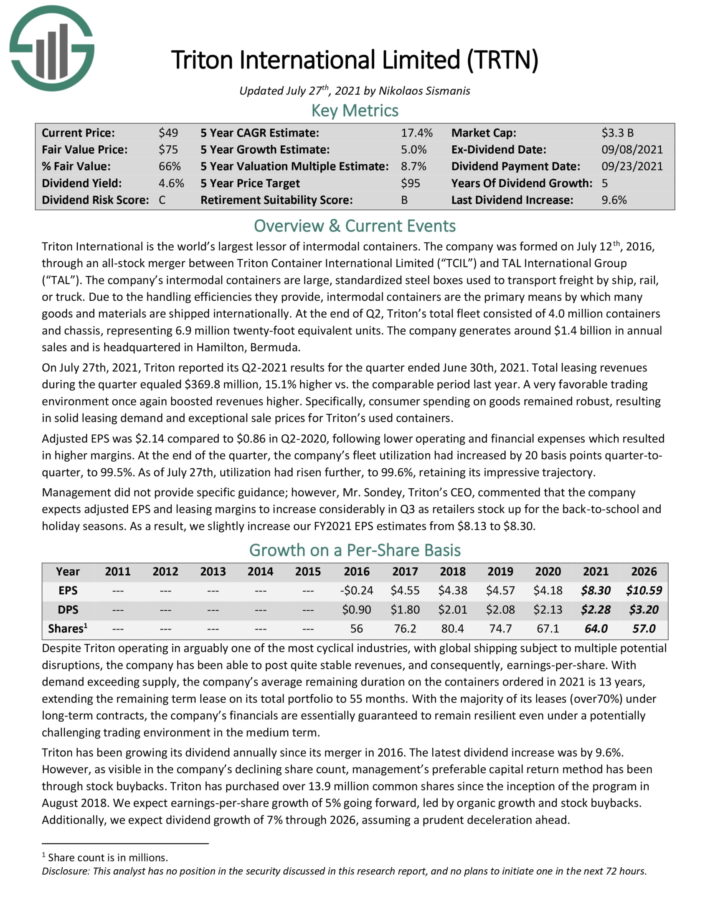

Industrial Stock #1: Triton International Limited (TRTN)

- 5-year expected annual returns: 17.5%

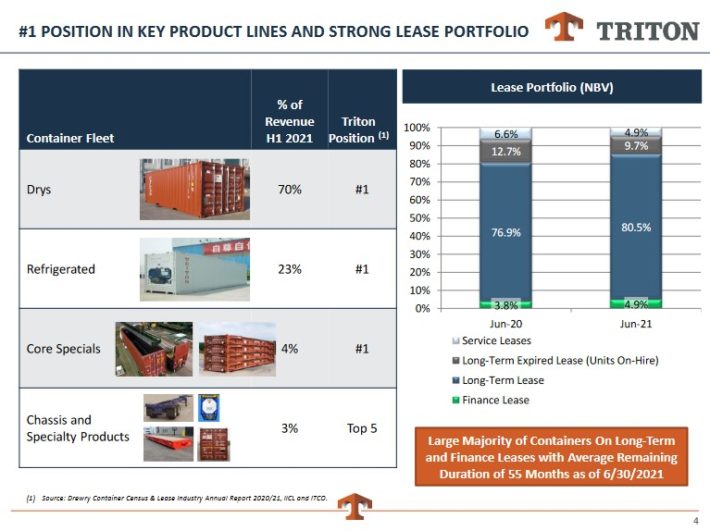

Triton International is the world’s largest lessor of intermodal containers. The company was formed on July 12th, 2016, through an all–stock merger between Triton Container International Limited (“TCIL”) and TAL International Group (“TAL”).

Source: Investor Presentation

The company’s intermodal containers are large, standardized steel boxes used to transport freight by ship, rail, or truck. Due to the handling efficiencies they provide, intermodal containers are the primary means by which many goods and materials are shipped internationally.

At the end of Q2, Triton’s total fleet consisted of 4.0 million containers and chassis, representing 6.9 million twenty–foot equivalent units. The company generates around $1.4 billion in annual sales.

This makes Triton our top industrial stock with the highest total return outlook over the next five years.

Click here to download our most recent Sure Analysis report on TRTN (preview of page 1 of 3 shown below):

Final Thoughts

Investors may not immediately think of industrial stocks when it comes to selecting high-quality dividend payers, but this is a mistake. In fact, the industrial sector represents the largest constituent in the Dividend Aristocrats list. Approximately 20% of the Dividend Aristocrats list is comprised of stocks from the industrial sector.

We rate the 7 industrial stocks in this article as buys, due to their 10%+ expected returns, in addition to their strong dividends and consistent growth.