This is a guest contribution by Taylor Krystkowiak, Vice President of Product Management at Cboe Vest. Cboe Vest is the creator of Target Outcome Investments, which strive to buffer losses, amplify gains, or provide consistent income to a diverse spectrum of investors. The first of these leading-edge investments, Cboe Vest’s flagship Buffer Protect Strategy, was introduced in 2013.

Difficult Dynamics for Dividends

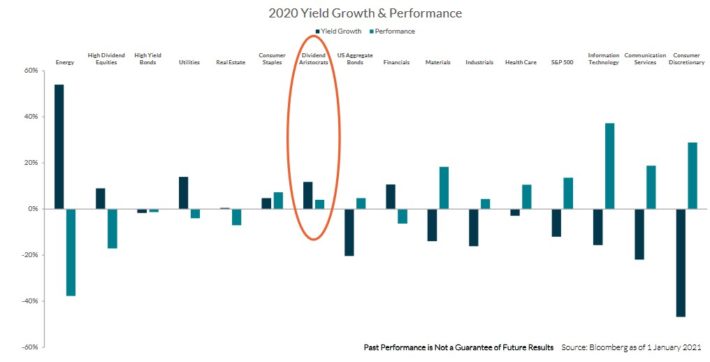

2020 proved to be a difficult year for dividends. Buckling under the unprecedented pressures of the pandemic, traditional dividend-oriented sectors struggled over the past year; Energy, Financials, Real Estate, and Utilities all logged negative annual returns. Energy suffered significantly as oil prices crashed, Real Estate revenues were strained by declining demand for office/retail space, and Financials/Utilities were sapped by historic unemployment spikes/business disruptions and ongoing economic uncertainty.

On the other hand, the valuation of the S&P 500 Index as a whole (as well as the vast majority of its individual sectors) rose significantly as price-to-earnings (P/E) multiples expanded to historic highs relative to long-term averages. Meanwhile, interest rates/bond yields fell to all-time lows in the wake of accommodative monetary policy, a major factor underpinning this expansion in equity valuations.

These dual dynamics have driven dividend yields to historic lows and present a unique challenge to income-oriented investors. The current dividend yield on the S&P 500 (1.58%) is at its lowest point in over 15 years, while the yield on the benchmark 10-Year Treasury (1.08%) is near the all-time low it reached just a few months ago (see chart).

Navigating the New Normal

In this new market environment, dividend-oriented investors are seemingly faced with a difficult decision: preserve yield at the expense of performance, or preserve performance at the expense of yield. Yet, a certain class of equities (aptly named the Dividend Aristocrats) has defied this prevailing dynamic.

In order to be considered a Dividend Aristocrat, a company must have increased its dividend every year for the last 25 consecutive years, a designation earned by only 65 companies in the S&P 500. Given that these companies have survived many other major storms that have swept the stock market over the past quarter century or more, it is unsurprising that this tried and true class of “aristocrats” proved to be uniquely resilient to the pressures posed by the pandemic.

Simply put, they were the best suited to navigate this new normal, a reality reflected by both their performance and dividend growth. Over the course of 2020, the Dividend Aristocrats Index was one of the only major indices that both increased its yield and posted positive price performance (see chart).

Driving Dividends with Derivatives

Yet, the current yield from the Dividend Aristocrats alone may be insufficient for some income-oriented investors. Traditionally, investors seeking the highest incomes have had to sacrifice quality or assume more risk in order to obtain higher yields. Currently, the only major indices that provide yields exceeding 4% are Energy, high dividend equities, and high yield bonds (i.e., sub-investment grade), all of which logged negative returns in 2020 and require investors to assume additional risk relative to higher quality assets (see charts).

However, an alternative (and often under-utilized) option to increase income without necessarily sacrificing quality is leveraging the potential benefits of derivatives. Writing (i.e., selling) call options on a percentage of portfolio assets can be an effective way to boost income without compromising asset quality.

A covered call is an options strategy whereby an investor holds a long position in a stock and sells (also referred to as “writes”) call options on that same stock in an attempt to generate increased income from the stock. A covered call is also known as a “buy-write.”

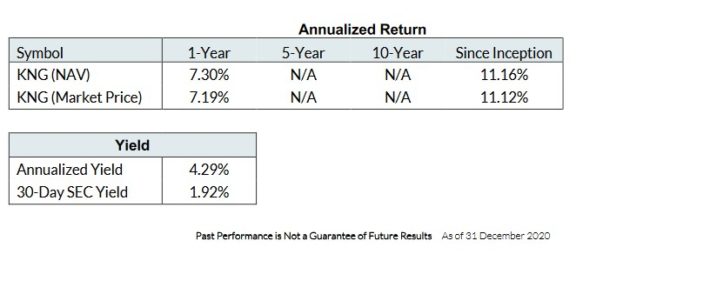

Cboe Vest has utilized this strategy in its S&P 500 Dividend Aristocrats Target Income ETF (Ticker: KNG), one of the few ETFs that allow investors access to the Dividend Aristocrats Index. The strategy seeks to obtain a total income target that is 3% above the annual dividend yield of the S&P 500 Index. The fund achieves this goal by not only holding stocks from the Dividend Aristocrats Index and collecting their dividends, but also writing call options on a percentage of the portfolio (currently 4.42%).

The net effect is a higher annualized yield than can be obtained purely through the Dividend Aristocrats Index; the current annualized yield of KNG is 4.29%, which is 1.66% higher than the current 2.63% yield of the Dividend Aristocrats Index (see chart). As a result, KNG offers investors a yield that rivals even the highest yields provided by Energy (5.84%), high dividend equities (4.90%), and high yield bonds (4.89%), while maintaining exposure to the higher-quality and positively-performing stocks that comprise the Dividend Aristocrats Index.

In short, the strategy offers an often elusive synergy between yield, quality, and performance.

A Strategic Solution for the Income Investor

As shown by its performance and yield, the Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF has not only persevered but prevailed over the pressures posed by the pandemic. The fund continues to offer investors the opportunity to gain exposure to both high-quality equity growth as well as a highly competitive yield, and the diversified nature of its underlying Dividend Aristocrats Index mitigates single-stock and/or sector risk.

In short, the strategy has proven to be a sound solution that has succeeded in both stormy and steady conditions alike, which may make it a worthwhile addition to the portfolio of any income-oriented investor.

About the Investment Advisor

Cboe Vest Financial LLC is a wholly owned subsidiary of Cboe Vest Group Inc. Cboe Vest offers institutional-quality Target Outcome InvestmentsTM built on the backbone of its unique investment philosophy—that strive to buffer losses, amplify gains or provide consistent income—to a diverse spectrum of investors.