The strategy behind Global Water’s asset base makes sense; areas with population growth and relatively scarce water supplies should see ever-rising demand for water. Global Water is positioned to do that, but the expense of doing so has proven too much.

In addition, it is present essentially in one metropolitan area in the southwest US, so geographic diversification is as poor as it can be. Even if Phoenix continues to see demand for water move higher, Global Water has proven that the expense of operating its utilities has generally kept pace with revenue growth, which has led to lackluster earnings.

The company has seen its total connections grow over time, but that growth has been fairly slow. Indeed, while connections have grown from 32k to 46k, that growth took 13 years, so we don’t believe organic growth will be a meaningful contributor to the top line moving forward. Global Water continues to see low-single-digit expansion in connections, but the expense required to build out the network and maintain it has proven quite costly.

Source: Investor relations

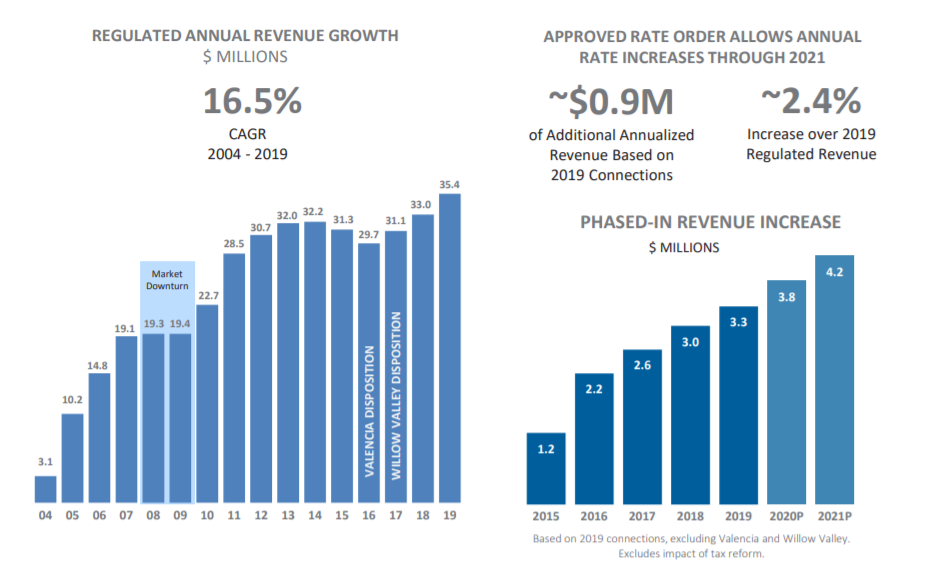

From 2004 to 2019, Global Water achieved a 16.5% compound annual growth rate in revenue, but that is somewhat deceiving. Most of that growth took place in the earliest years of this period, as illustrated by the fact that 2019 revenue was just $3.2 million higher than 2014’s revenue.

There were two dispositions in that period, but the total growth rate in revenue is unreasonable to expect moving forward, as the company is much larger now and will have a more difficult time coming close to that sort of revenue growth.

On the right side of the graphic, we can see organic growth contributions from rate increases, which amounts to another low-single-digit gain annually, on average. Like other utilities, Global Water is able to pass through approved pricing increases to its customers, which is a steady, long-term tailwind to revenue.

Putting all of this together, we see a path to mid-single-digit revenue growth, but with much of that offset by rising operating and maintenance costs, as well as the prodigious interest expense the company must pay to service its debt.

Dividend Analysis

Global Water has paid a monthly dividend since May of 2016, with a handful of raises in that time from the initial two cents per share monthly. The current payout is $0.0241 per share monthly, or $0.2892 per share annually, and is continuing to be paid through the current COVID-19 impacted environment.

This results in a current yield of 2.8%, which is respectable for a utility. However, we are concerned about dividend safety because Global Water’s earnings haven’t covered the dividend in recent years, or even gotten close.

Earnings for 2018 and 2019 came in at just $0.15 and $0.10, respectively, or about half and one-third, respectively, of what the company paid out in dividends for those years. In other words, depending upon the year, Global Water is paying out two or three times its net income in dividends. That means it has a significant shortfall and must fund the payout through other means, including debt and share issuances.

We expect about $0.10 in earnings-per-share for Global Water, and with the dividend still set at about three times that level, we are quite concerned about the company’s ability to continue to pay the current dividend for the long-term. It simply doesn’t make enough money to pay this level of dividend at the current level of earnings. If the company does not grow its earnings-per-share above the dividend, the payout will either need to be cut, or it will continue to fund the dividend with expensive sources of capital.

Final Thoughts

We think Global Water has a relatively tough road in front of it when it comes to earnings growth. We believe revenue growth is all but assured given the sources of organic growth the company possesses. However, we also see rising interest expense and maintenance costs as keeping a lid on margins, as it has for years.

With the dividend at nearly 300% of earnings, and the yield at 2.8%, we see the risk of owning the stock as far outweighing the reward. Despite its attractive monthly payouts, we do not recommend Global Water Resources stock.