Great Elm’s first quarter results showed a company that was bracing for the worst, given management was well aware of the COVID-19 crisis and its potential impacts on the portfolio. The company monetized $29 million of investments on its balance sheet, selling them for an average of just $0.82 on the dollar, with an average yield of nearly 14%.

Contrast that with new investments that were made at an average price of $0.99 on the dollar and an average yield of 7.1%, and you can see Great Elm was trying to de-risk. In other words, it appears Great Elm was selling riskier positions for unfavorable prices in order to reinvest the proceeds into lower-yielding positions that are likely much safer.

While this should help the company limit the damage in Q2 and Q3 in terms of credit losses, it will also produce lower expected returns in the coming years from a lower portfolio yield.

NII came in at $0.26 in Q1, which covered the distribution of $0.25. However, the company saw a realized loss of $1.12 per share during the quarter, and a further $2.47 per-share unrealized loss. Net asset value also plummeted from $8.63 at the end of 2019 to just $5.05 at the end of Q1.

We see Great Elm as struggling to maintain its current level of earnings, and therefore forecast a negative growth rate for the foreseeable future. Great Elm’s portfolio is moving down the credit risk ladder, but this also means average yields will fall, and operating leverage will dictate that earnings must fall as well. In short, we think Great Elm will struggle for the balance of 2020 and into 2021.

Dividend Analysis

Great Elm’s distribution hasn’t been cut yet, but given the way the company is paying the distribution today, as well as the negative factors mentioned above, we see the payout as being at high risk of being cut.

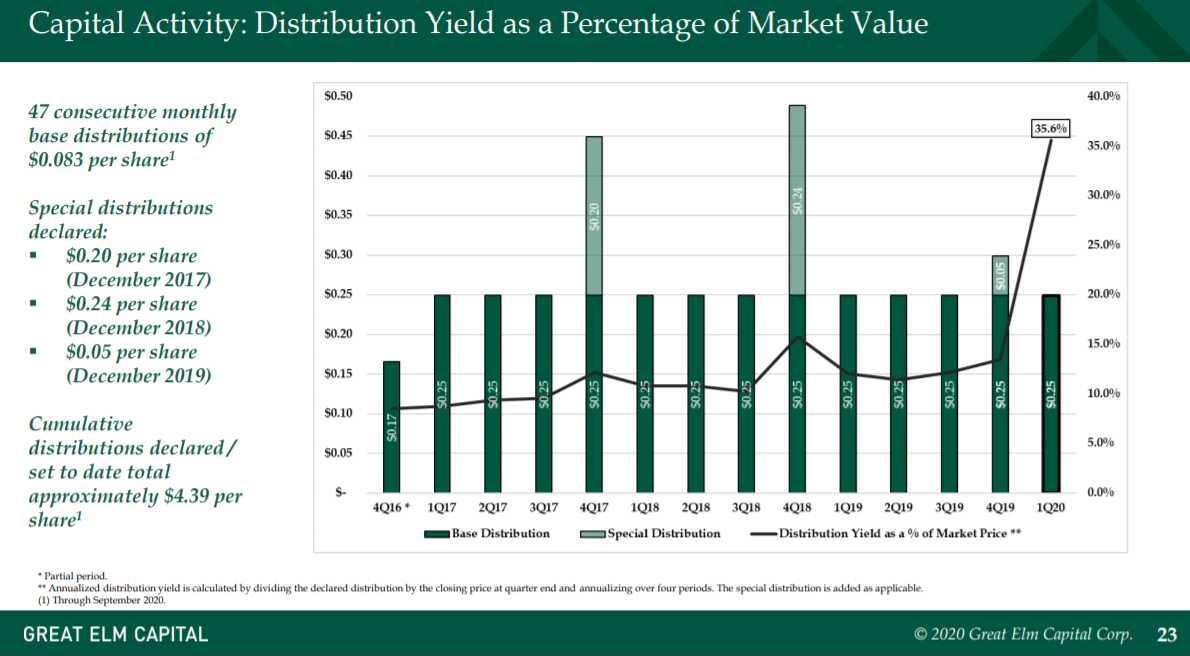

Source: Investor presentation, page 23

Great Elm has paid a monthly distribution of $0.083 per share since the first quarter of 2017, and continues to do so today. However, the current distribution is being paid almost entirely in new common shares, instead of cash, because the company simply cannot afford to pay cash distributions at this level.

This could continue for at least another quarter or two past the already-declared third quarter distribution, which is also almost entirely in common shares instead of cash. This can carry on for some time but the constant dilution is costly as well, so we believe a more prudent course of action would be to cut the payout.

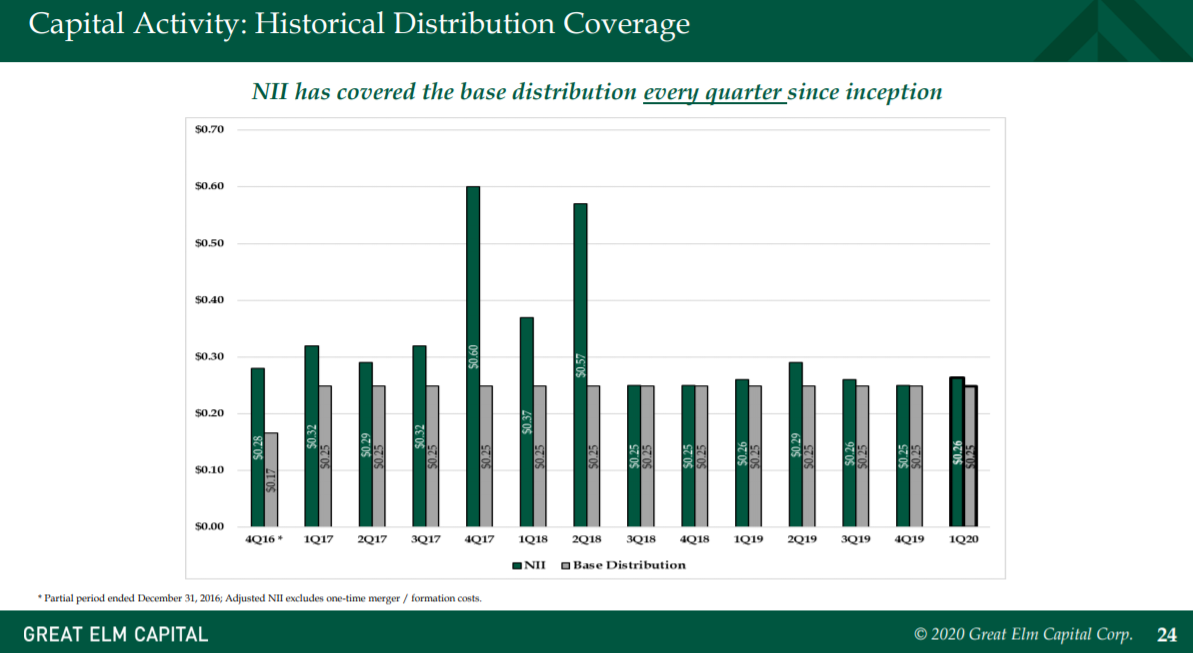

Source: Investor presentation, page 24

Great Elm points out NII continues to cover the dividend, but this streak will likely end when Q2 results are released. In addition, with portfolio losses the size of the market capitalization of the stock, we see NII coverage of the distribution as a moot point.

In total, we believe the distribution of Great Elm is at great risk, and this should not be relied upon by income investors.

Final Thoughts

Great Elm’s reliance on issuing common stock for the distribution is a huge red flag, and investors should be very cautious as a result. The current yield is obviously unsustainable and we believe it will be cut.

With the prospect for earnings growth quite bleak at this point, we rate Great Elm a sell. We see further erosion of NAV, a dividend cut, and sizable dilution from newly-issued shares to pay the distribution. There isn’t a lot to like here, and we recommend income investors look elsewhere for sustainable dividends.