Updated on February 25th, 2020 by Josh Arnold

AGNC Investment Corp (AGNC) has a sky-high dividend yield of 10.1%, which is something this stock is certainly known for. In terms of dividend yield, AGNC is near the top of our list of high-yield dividend stocks. And, this is following a massive rally in the stock in the past few months.

It is one of a select few stocks with a 10%+ dividend yield. In addition, AGNC pays its dividend each month, rather than on a quarterly or semi-annual basis, as is the case with most dividend stocks.

Monthly dividends give investors the ability to compound dividends even faster. There are not many monthly dividend stocks, as the administrative burden on the companies paying the dividends is higher than paying quarterly, for example.

Indeed, there are only 58 stocks that pay dividends monthly. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

That said, it is also important for investors to assess the sustainability of such a high dividend yield, as yields in excess of 10% are generally for good reason. This article will discuss AGNC’s business model, and whether the stock is appealing to income investors.

Business Overview

AGNC was founded in 2008, and is an internally-managed REIT. Whereas most REITs own physical properties that are leased to tenants, AGNC has a different business model. It operates in a niche of the REIT market: mortgage securities.

AGNC invests in agency mortgage-backed securities. It generates income by collecting interest on its invested assets, minus borrowing costs. It also records gains or losses from its investments and hedging practices.

The trust employs significant amounts of leverage to invest in these securities in order to boost its ability to generate interest income. AGNC borrows primarily on a collateralized basis through securities structured as repurchase agreements.

The trust’s stated goal is to build value via a combination of monthly dividends and net asset value accretion. AGNC has done well with its dividends over time, but net asset value creation has sometimes proven elusive.

Indeed, the trust has paid $41.32 of total dividends per share since its IPO; the share price today is just over $19. That sort of track record is extraordinary, and is why some investors are drawn to the stock. Net asset value, unlike in 2018, rose nicely in 2019, adding $1.10 over the year-end 2018 value of $16.56.

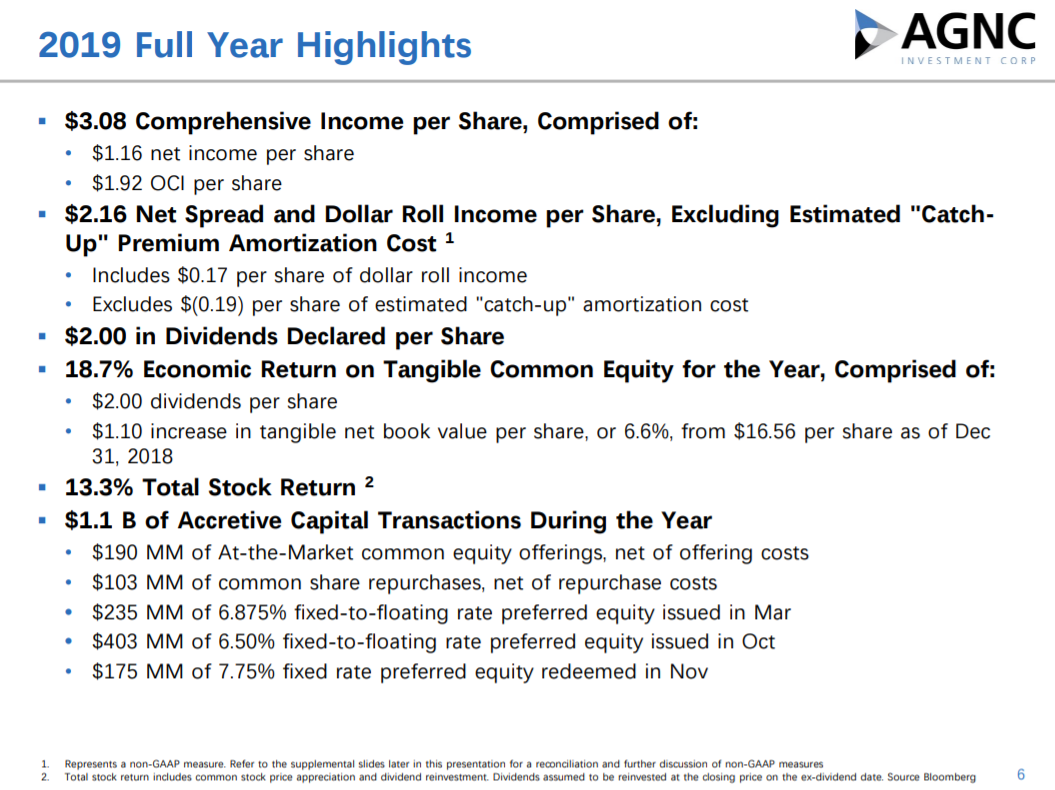

Source: Q4 Investor Presentation, page 6

AGNC’s 2018 was a tough period, as it was for the mortgage REIT industry as a whole. Rising interest rates are highly inversely correlated to a mortgage REIT’s ability to generate higher spreads on its portfolio, so in general, earnings capacity falls. However, 2019 was a rebound year and AGNC’s results improved materially.

For the full-year 2019, AGNC posted a total of $3.08 per share in comprehensive income, resulting from $1.16 in net income per share, as well as $1.92 in other comprehensive income per share. The trust also declared $2.00 per share in dividends for the year. The monthly dividend is currently at $0.16 per share.

The trust’s economic return, which is the sum of dividends and change in tangible book value, was 18.7%, which was a vast improvement from -4.9% in 2018. The gain was made from the nearly-7% increase in book value, as well as the $2.00 in dividends per share.

The trust also continued its long tradition of raising funds via preferred and common equity offerings in order to fund portfolio growth, pay the dividend, and for corporate uses.

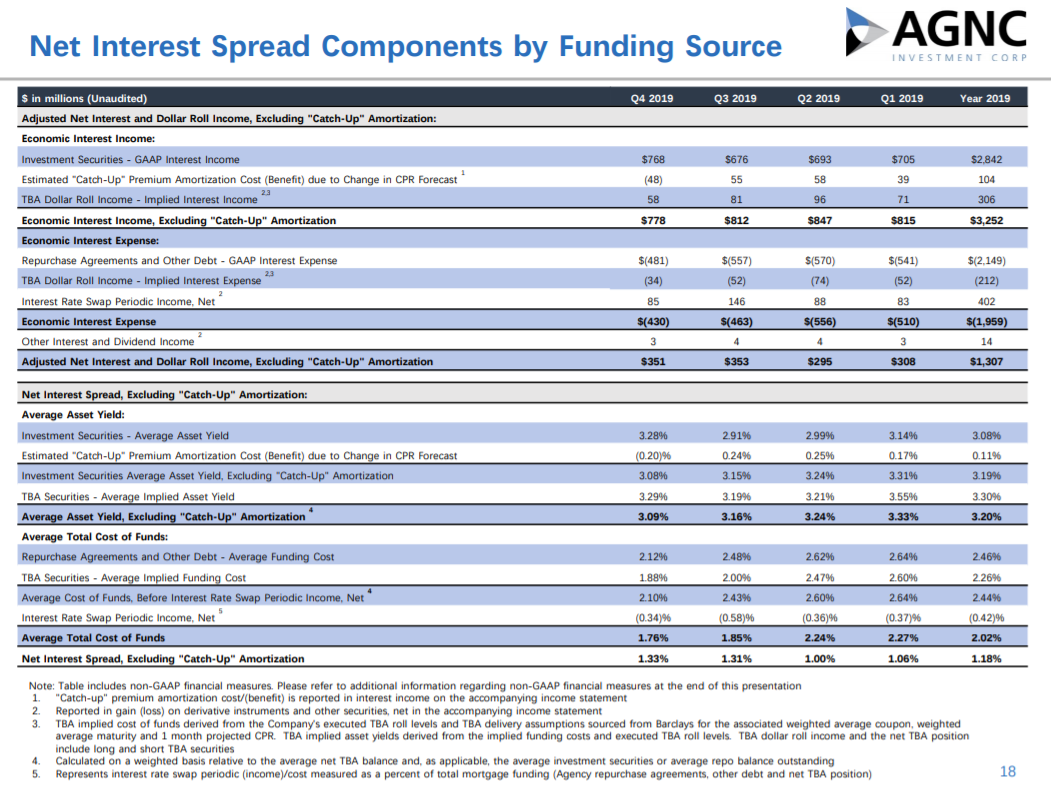

Source: Q4 Investor Presentation, page 18

AGNC’s net interest spread, which is the manner in which it generates revenue, was basically flat year-over-year in 2019 at 1.18%. This was due to the spreads the trust earned on its cost of funds staying roughly even during the year.

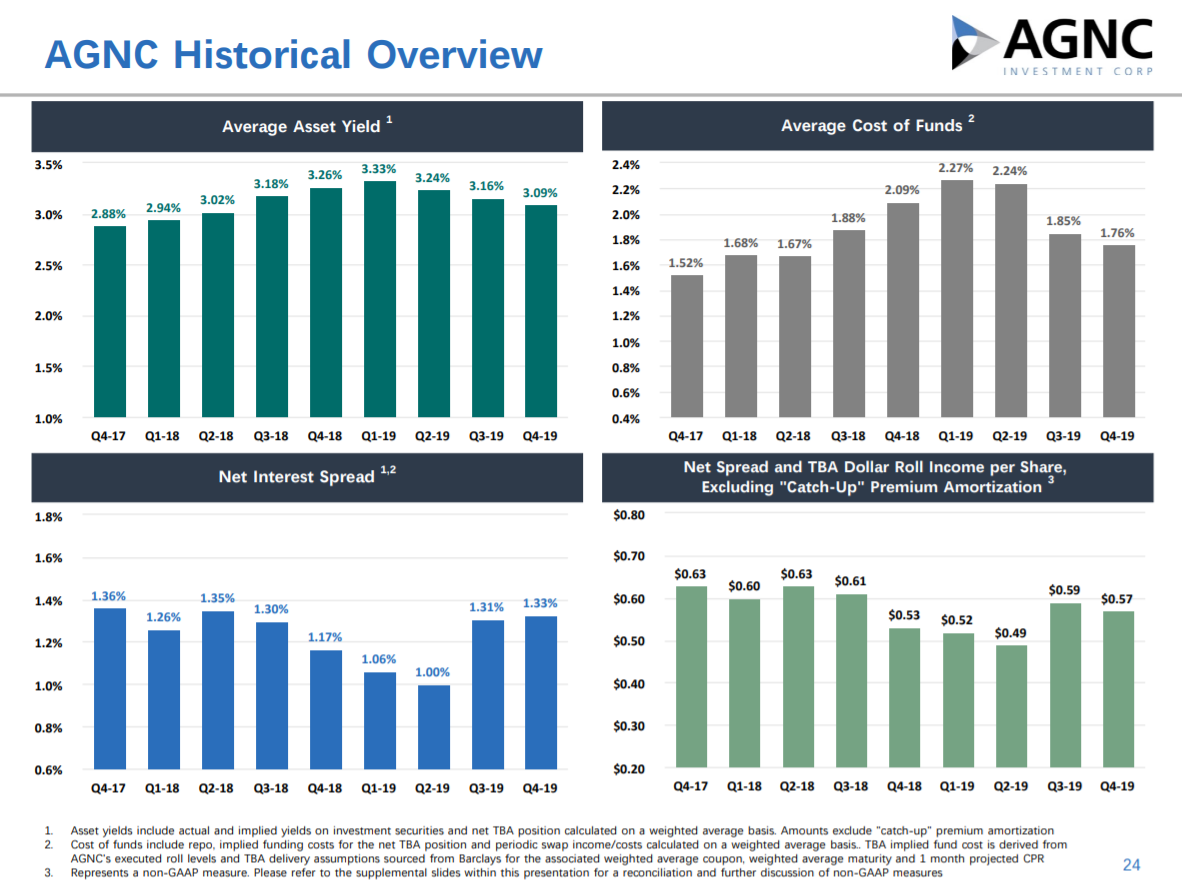

Source: Q4 Investor Presentation, page 24

This slide shows that declining spreads aren’t a new problem for AGNC, as rising interest rates have taken their toll on the trust’s ability to generate income, as well as its book value, for several quarters.

So long as AGNC’s cost of funds is rising at rates in excess of its asset yields, it will continue to have a difficult time growing earnings.

As interest rates continue to normalize around the world, mortgage REITs like AGNC will likely continue to face headwinds to interest spreads and book value. Average cost of funds has declined of late as short-term interest rates have fallen, but rates on earning assets for AGNC haven’t improved, so yields have drifted lower over time.

Growth Prospects

The major drawback to mortgage REITs is that the business model is negatively impacted by rising interest rates. AGNC makes money by borrowing at short-term rates, lending at long-term rates, and pocketing the difference. To amplify returns, mortgage REITs are also highly leveraged.

In a rising interest rate environment, mortgage REITs typically see the value of their investments reduced. And, higher rates usually cause their interest margins to contract. This double-impact is what investors experienced in 2018 as spreads contracted and book value fell.

However, as interest rates stabilized and fell during 2019, AGNC saw the benefit as its spreads stabilized as well, allowing it to produce economic earnings. To offset some of the inherent volatility in the way interest rates behave, AGNC has employed hedges to mitigate this interest rate risk.

AGNC had 102% of its portfolio hedged as of the end of 2019, which is quite high compared to historical norms, and is up from 94% at the end of 2018. The company recognizes that interest rates likely aren’t done rising, and it has therefore attempted to hedge against that upside risk, which is a negative for its portfolio value. But recent moves lower in interest rates would have benefited AGNC, so it is possible the trust has removed some hedges since the end of the year.

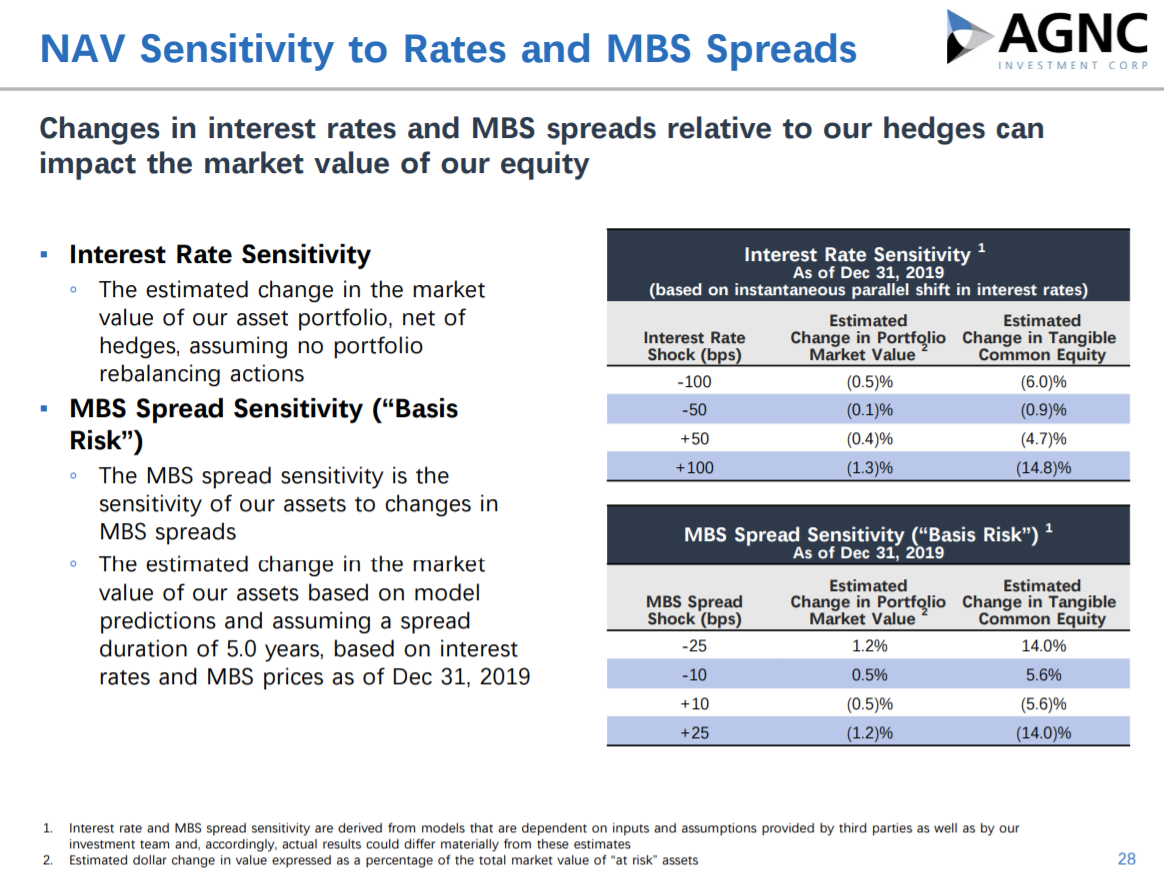

AGNC is highly sensitive to fluctuations in interest rates. For every 100-basis point increase in interest rates, AGNC will see a 1.3% change in portfolio market value. The reason this number isn’t higher is because of hedging activity.

Source: Q4 Investor Presentation, page 28

A parallel 100bps shift upwards in interest rates would cause a small decline in the value of the portfolio but thanks to high leverage, tangible book value would fall nearly 15%. More specifically, if mortgage-backed securities spreads rose just 25bps, AGNC’s tangible book value would fall by 14%. This speaks to the tremendous leverage the trust has and its reliance upon a favorable rate environment to reach its stated goal of higher net asset value.

AGNC has paid a monthly dividend of $0.16 since May of 2019 after cutting it from the prior level of $0.18. We were somewhat surprised by the move to cut the dividend, but at this point, the payout seems much better covered, with expected earnings of $2.30 per share for this year, and an expected annual dividend rate of $1.92.

That said, dividend increases are likely a long way away. Therefore, AGNC should be thought of more as a high-risk income stock than a dividend growth stock.

Dividend Analysis

AGNC has declared monthly dividends of $0.16 per share since May 2019. This means AGNC has a 10.1% dividend yield with the share price currently under $19. While this is much lower than it was last year – with much of the year seeing a yield in excess of 12% – it is still a tremendously high yield.

A double-digit dividend yield is often a sign of elevated risk. And, AGNC’s dividend does carry significant risk. AGNC has reduced its dividend several times over the past decade, and less than a year ago.

We do not see a dividend cut as an imminent risk at this point given that the payout was fairly recently cut to account for unfavorable interest rate movements, and that AGNC’s net asset value appears to have stabilized. Management has taken the necessary steps to protect its interest income, so we don’t see another dividend cut in the near term.

However, with any mortgage REIT, there is always significant risk to the payout, and that is something investors should keep in mind, particularly given the volatile behavior of interest rates in recent years.

Final Thoughts

High-yield stocks are extremely attractive for income investors, at least on the surface. This is particularly true in an environment of low interest rates. AGNC pays a heft yield of 10% right now, which is very high, even for AGNC and mortgage REITs in general.

We believe the yield to be safe for the foreseeable future, but this is hardly a low-risk situation given the company’s business model and interest rate sensitivity. While AGNC should continue to pay a dividend yield many times higher than the S&P 500 Index average, it is not an attractive option for risk-averse income investors.