Updated on March 2nd, 2021 by Nikolaos Sismanis

Co-founded by Jeffrey Keswin and Andrew Wellington, Lyrical Asset Management was born out of their 25-year friendship, aiming to provide investors with a value-investing proposition based on quality research and analysis.

Lyrical has more than 770 clients collectively totaling more than $7.4 billion of discretionary assets under management (AUM), more than half of which are allocated in public-equity holdings. The company was founded in the midst of the 2008 global financial crisis and is based in New York.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 6.6%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Lyrical Asset Management’s current 13F equity holdings below:

Keep reading this article to learn more about Lyrical Asset Management.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Lyrical Asset Management’s Philosophy & Discipline

- Lyrical Asset Management’s Portfolio & 10 Largest Holdings

- Final Thoughts

Lyrical Asset Management’s Philosophy & Discipline

Lyrical’s primary goal is to maximize the long-term investment returns of its clients through what the company claims as a “repeatable process to identify undervalued securities.” While the fund’s returns based on its 13F securities show mediorce returns, it is important to remember that funds hold various securities throughout each quarter, which causes returns to deviate away from their pure, public-equity holdings. Therefore, investors can still find value in diving into Lyrical’s holdings, as they can potentially showcase compelling standalone investment cases after Lyrical’s own search for undervalued securities.

The fund’s philosophy and discipline are summarized in three distinct hallmarks:

- Value: Lyrical strives to own shares of companies that are trading at significant discounts to their intrinsic value. Management believes that owning securities at discounts to intrinsic value is likely to create a margin of safety and allow for extraordinary return generation. Lyrical believes that the larger the discount, the more all-embracing the potential for its investment return.

- Quality: Although the company focuses on buying undervalued companies, it does care about each individual investment to be of high quality. includes robust businesses with manageable debt levels, rapid growth, fruitful margins, and skilled management teams. Being able to deliver resilient results through various economic cycles is another crucial factor that Lyrical seeks.

- “Analyzability”: Lyrical makes sure that it can deeply understand and comprehend the business model and operations of each of its holdings. The company will bypass businesses that display complex accounting practices and complicated operations such as biotech and high-tech companies. The simpler and more understandable a company is, the better Lyrical can analyze it and identify the potential for superior returns.

Lyrical Asset Management’s Portfolio & 10 Largest Holdings

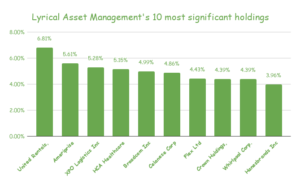

Lyrical’s public-equity portfolio is quite diversified. While it consists of only 32 individual holdings, no stock accounts for more than 6.8% of its total weight.

Source: F13 filings, Author

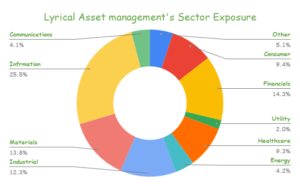

Additionally, the company is also exposed to several sectors, emphasizing Technology, Financials, Industrials, and Consumer Discretionary, which collectively account for over 50% of its total holdings.

Source: F13 filings, Author

Lyrical’s 10 most significant holdings are the following:

United Rentals, Inc. (URI):

Staying true to its business-model-simplicity philosophy, Lyrical’s most significant holding is its $487M stake in United Rentals. The company operates as an equipment rental company, which is a fairly straightforward business model. The company has been growing its financials rapidly, while both its top and the bottom line have remained resilient during the ongoing pandemic, fitting Lyrical’s key criteria.

The fund has been holdings shares since early 2019. Shares have more than doubled since marking United Rentals as one of Lyrical’s most successful picks. The fund’s position accounts for 2.4% of United Rental’s total shares outstanding.

The company’s Q4 report revealed that its rental volumes continued struggling as a result of COVID-19, causing revenues to decline by 7.2% to $2.28 billion. However, United Rentals was able to maintain robust profitability levels, posting net income margins of 13%, or EPS of $4.09. With a quicker than expected recovery, shares are currently trading at all-time high levels, crossing the $300/share level, but still at a reasonable valuation of around 25 times their net income. Lyrical retained United Rental as its top holding, trimming its position only by 2% despite the stock’s prolonged rally.

Ameriprise Financial, Inc. (AMP):

Ameriprise Financial provides advice & wealth management, asset management, annuities, protection, and various other financial products. The company has delivered 15 years of consecutive dividend increases to its investors, growing its financials consistently since its IPO. Shares are also trading at a relatively attractive valuation compared to the overall market, at a P/E ratio of around 18.

Ameriprise is one of Lyrical’s oldest holdings, initially buying its first shares in 2011. Over the years, the fund has accumulated more stock whenever it sees fit, featuring an average purchasing price of around $118. With shares currently trading beyond $200, Ameriprise is another successful pick of Lyrical.

The company’s Q4 was quite strong, with revenues of $3.14 billion compared to $3.05 in the year-ago period. Assets under management hit a record high of $1.1 trillion, boosting the company’s adjusted operating earnings to $201 million, an increase of 13%. Lyrical increased its position slightly during the quarter, by around 9000 shares.

XPO Logistics, Inc. (XPO)

XPO Logistics is Lyrica’s third-largest holding, with the fund initially buying shares in Q2-2019. Since then, it has accumulated shares through various periods, currently holding around 3.4% of the company’s total shares outstanding.

XPO’s latest quarter displayed very impressive results, with the company achieving all-time high quarterly revenues of 12.8% to $4.67 billion, beating analyst estimates by $420 million. Management also surprised investors with very optimistic guidance for FY2021, expecting adjusted EBITDA growth of 24%-29% to $1.725-$1.8 billion.

HCA Healthcare, Inc. (HCA):

Medical and surgical services giant HCA is a major health care services provider, generating more than $50 billion in annual revenues. The Nashville-based company is Lyrical’s fourth-largest holding.

The company has mostly been using its spare cash to retire the shares it repurchases. Further, HCA started paying out dividends in 2018 but had suspended them in the midst of the pandemic to retain liquidity. Amid Q4’s great results, posting revenue growth of 5.7% to $14.29, and strong guidance of FY2021 EPS of $12.10-$13.10, management reinstated its quarterly dividend program, declaring a $0.48/share dividend, implying a forward yield of 1.12%.

Lyrical has been holdings HCA for a couple of years now, featuring an average purchasing price of around $90. The fund increased its position marginally as of its latest 13F filing by less than 1%. Investors should expect returns in the form of capital gains, as the stock’s dividend yield is rather humble.

Broadcom Inc. (AVGO):

Broadcom may be a rapidly growing semiconductor company, but it is also a solid dividend payer, currently yielding an industry-leading 2.94%, despite its prolonged stock rally.

The company is a cash-cow, growing its dividend for 9 years now, featuring a DPS growth 5-year CAGR of 52.1%. All catalysts point toward Broadcom continuing to deliver increasingly more chips, indicating plenty of room to continue growing the dividend. The company’s Q4 was the company’s greatest quarter to date, delivering all-time high revenues of $6.47 billion, a growth of 11.1% YoY, and a massive FCF of $3.25 billion.

Lyrical allocated capital in Broadcom in 2013 for the first and has since built its position over time. It currently is the fund’s 5th-largest holding.

Celanese Corporation (CE):

Celanese Corporation manufactures and sells high-performance engineered polymers. As you can see, Lyrical’s stays true to its philosophy of buying an easy-to-understand business model which offers products and services its analysts can comprehend and dive deeply into.

Celanese has managed to grow over the years, backed by increasing demand for its chemicals. The company is paying a fairly decent dividend, currently yielding around 1.9%, but with plenty of room to grow amid robust EPS (earnings-per-share) generation. Celanese generated EPS of $16.75 during the quarter, comfortably covering its annual DPS of $2.72.

Lyrical has been invested in Celanese since 2012, currently being its sixth-largest holding.

Flex Ltd. (FLEX):

Flex offers design, engineering, manufacturing, and supply chain services and solutions to original equipment manufacturers all over the world. The company’s revenues have been incredibly volatile and on a slightly downward trajectory over the past decade, having reached its peak back in 2008.

Flex’s business model, while simple, is subject to the macro-economic landscape and how it affects global manufacturers. As a result, revenues will continue being unstable, and Flex’s bottom line will likely continue to be razor-thin.

Since the company cannot sustain a dividend due to its cyclical operations, it has been buying back stock whenever it is free cash flow positive as a way to reward its shareholders. The company has retired nearly 40% of all its share since 2010.

Lyrical has owned the stock since 2017, increasing its stake by 1% during the past quarter. It’s the fund’s seventh-largest holding, owning 3.3% of the company’s shares outstanding.

Crown Holdings, Inc. (CCK):

Crown Holdings provides products for the consumer goods sector, such as steel and aluminum cans for food, beverage, and other household essentials.

While the company is not rapidly growing, operating in a very mature industry, Crown has rewarded its shareholders, despite its lagged financials.

Management has been able to reward shareholders nonetheless, buying back massive amounts of its own stock. Over the past 18 years, the company has retired around 22% of its total shares outstanding. Even though its bottom line has been stagnant, it is also very stable due to the defensive nature of its sector. With massive buybacks, its EPS has been growing regardless, helping shares appreciate over time.

Lyrical owns shares in Crown Holdings since early 2018, having enjoyed significant returns since. The fund owns around 2.5% of Crown Holdings.

Whirlpool Corporation (WHR):

Whirlpool produces and markets home appliances and related products such as refrigerators, freezers, ice makers, laundry appliances, and various such devices. You probably own one or more products of this iconic company, which has been around since 1911.

The company has been increasing its DPS only when it feels certain it can sustain it. This has resulted in Whirlpool having never cut its DPS, since paying its first one in 1983. The company’s business model is incredibly mature, which allows the company to deliver consistent profitability despite the cyclical nature of home appliances. Whirlpool has remained profitable in every single quarter during the ongoing pandemic. The stock currently yields a decent 2.78% and trades at a humble P/E ratio of around 11.58, which is below its historical average of around 20.

Whirlpool has been in Lyrical’s portfolio since late 2016. The fund currently owns around 2.5% of the company’s total shares.

Hanesbrands Inc. (HBI)

Hanesbrands Inc., a consumer goods company, offering a range of basic apparel for men, women, and children in the United States. The company’s performance has remained resilient during the pandemic, with its most recent quarter, Q4, posting revenue growth of 2.85%, to $1.81 billion.

The company has been paying an unchanged quarterly DPS of $0.15 since 2016, with the stock currently yielding 3.39%. The company is expected to deliver FY2021 EPS of $1.61, comfortably covering its underlying annual DPS while also implying an attractive valuation multiple of around 11.26 its forward earnings at the stock’s current price.

Final Thoughts

Lyrical Asset Management’s holdings provide several compelling stocks for investors to consider. On paper, the fund’s public equity portfolio has been under-performing the overall market, barely generating any positive returns. However, this could be the case due to clients joining/leaving Lyrical, as well as the fund’s various hedging instruments, distorting our calculations.

It turns out that the company’s individual current holdings have been doing well, delivering above-average returns. Staying true to its philosophy and growth-at-a-reasonable-price strategy, investors may want to consider following Lyrical for its current and future stock ideas and holdings.