Published December 10th, 2019 by Rich Howe

This is a guest contribution by Rich Howe, CFA, who runs Stock Spinoff Investing. Rich originally recommended KTB in June 2019.

Shortly after it was spun off from VF Corporation (VFC) in July, Kontoor Brands’ (KTB) stock price sank like a rock.

Note: VFC is 1 of 57 Dividend Aristocrats; S&P 500 stocks with 25+ years of rising dividends.

Why?

It had nothing to do with KTB’s fundamentals.

In fact, they looked quite strong:

- KTB had historically generated over $300MM of free cash flow annually, a very high number relative to the company’s initial $1.8BN market cap.

- KTB was in the enviable position of having a defensive product (jeans). During the Great Recession, revenue only declined by 10%.

- KTB’s management team is seasoned and trained in VF Corp’s culture of excellence.

The reason that KTB sunk like a rock was because it is a mid cap company ($1.8BN market cap) and it’s parent company (VF Corp) is a large cap company (>$30BN market cap).

You see, many of VF’s investors’ investment mandates only allow them to invest in large cap companies. As a result, they sold their KTB shares indiscriminately.

Further, Kontoor Brands as a mid to small cap company would not be included in the S&P 500, unlike its parent VF Corp. As a result, index funds that owned VF Corp and tracked the S&P 500 were forced to sell their Kontoor Brands shares, regardless of price.

As a result, KTB’s stock price traded almost straight down during its first month of trading.

Anyone who researched the spin-off ahead of time knew that the sell off created a fantastic opportunity. KTB had already disclosed that it intended to pay a $2.24 annual dividend. As a result, patient investors were able to buy the stock with an implied dividend yield of 8.4%.

Once index fund forced selling subsided, the stock began a slow and steady march higher, and it currently trades at over $38 per share.

But the past is the past.

Is the stock still a BUY today?

Before we answer that question, let’s take a step back and review Kontoor Brands background.

Kontoor Brands Overview

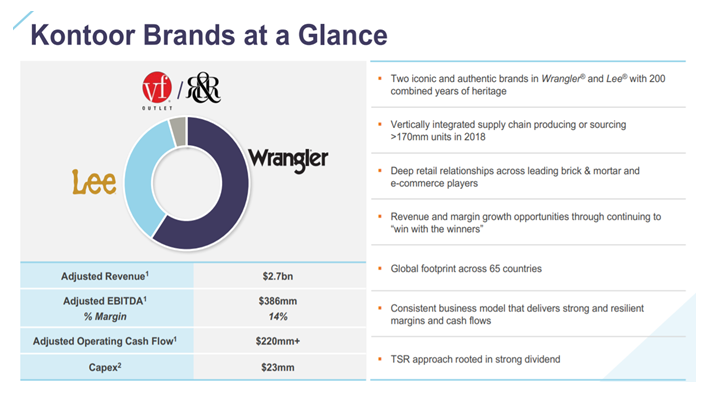

Kontoor Brands is an apparel/’fashion’ stock focused on the denim market, an attractive market that has historically grown at a 4% CAGR. The company’s key brands are Wrangler and Lee.

Growth Strategy

As is often the case with spin-offs, Kontoor Brands had been neglected when it was a part of VF Corporation because Wrangler and Lee were slower growing than VF Corp’s other brands such as Timberlands, North Face, and Vans.

Because Wrangler and Lee weren’t growing quickly, VF Corp did not invest in the brands, but merely harvested the cash flow that they generated to invest elsewhere.

As a result, there are numerous actions that management can take to accelerate revenue growth and improve margins.

Prior to the spin-off, Kontoor Brands revenue trended flat-to-down due to the VF Corp’s neglect. KTB’s management has undertaken initiatives to accelerate growth on both the top and bottom lines.

Growth Initiative #1: Geographic Expansion

KTB generates ~26% of sales outside of the US. Competing apparel companies generate a much higher percentage of sales outside the US. For instance, VF Corp generates over 40% of sales from outside the US.

Management is working hard to correct this. It’s first effort entails launching the Wrangler brand in China. Lee, Kontoor Brands other major denim brand, is a leading lifestyle brand in China. And yet, Wrangler hasn’t even been launched in the country. It just wasn’t a priority for VF Corp. Wrangler will launch in China in Q1 2020 and should immediately accelerate international growth.

Growth Initiative #2: Category Extension

A key part of Kontoor Brands strategy is to expand Wrangler and Lee brands into other categories. First, the company has made an effort to increase distribution of its Wrangler all terrain gear. This focus provides Wrangler with the ability to expand into other distribution channels such as specialty and sporting good stores. Second, Wrangler and Lee are both expanding their focus on tops which are selling well at specialty stores and online. Finally, the company is extremely under represented in its t-shirts business. For context, the company sells 500 pairs of jeans for every t-shirt. In contrast, some of its competitors sell five t-shirts for every pair of jeans.

Growth Initiative #3: Margin Expansion

KTB generated 13.9% earnings before interest and taxes (EBIT) margins in 2016. This year, the company is on pace to generate 10.2% EBIT margins. Margins are depressed primarily due to one time costs associated with the spin-off. However, the company has identified $50MM of additional cost savings that will enable it to increase EBIT margins significantly.

Cost saving opportunities include:

- Exiting certain unprofitable distribution channels in India, Chile, Russia, and Israel.

- Consolidating facilities. For instance, Lee’s Headquarter was moved from Kansas City to Greensboro.

- Examining unprofitable SKUs.

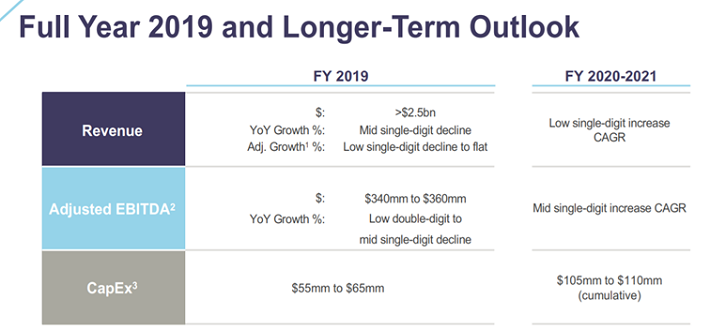

Based on revenue growth and margin expansion initiatives, management believes will result in low single digit revenue growth and mid single digit adjusted EBITDA growth in 2020 and beyond.

Valuation and Price Target

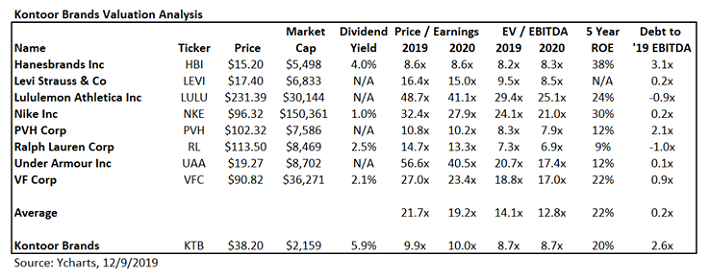

As shown in the chart below, Kontoor Brands is cheap on an absolute and relative basis trading at a price-to-earnings multiple of 10.0x (using expected fiscal 2020 earnings) and an enterprise value to EBITDA multiple of 8.7x (using expected fiscal 2020 EBITDA). It also pays a best in class dividend of $2.24 per share which translates to a 5.9% dividend yield.

While KTB does not deserve to trade inline with faster growing Lululemon and Nike, it’s current valuation is too cheap. Assuming revenue growth can accelerate to 2% per year by 2022 and EBIT margins eventually expand to 14.5%, KTB is worth $49, based on my discounted cash flow analysis, ~28% higher than current prices.

As a result of its undervaluation, reasonably recession resistant brands, and growth prospects, I rate KTB a buy at current prices.