Originally by Eli Inkrot

Updated by Josh Arnold on August 13th, 2019

When you’re talking about dividend paying companies (and specifically dividend growth), you’re likely to think about the normal host of characters – the Coca-Cola’s (KO), Johnson & Johnson’s (JNJ) and Procter & Gamble’s (PG) of the world.

You think about large firms that have not only paid but also increased their dividends for years. And then the other companies – the smaller firms or those that have much shorter dividend increase streaks – are easy to forget.

To be frank, this could be a perfectly reasonable focus for the dividend investor. If you only concentrate on companies that have increased their payouts for decades, you stand a solid chance of narrowing down your focus to only the highest quality businesses. This tactic doesn’t guarantee success, but it certainly leads you in the right direction.

Yet, we would contend that there are often other groups of stocks – outside of the typical Dividend Aristocrats or Dividend Kings – that can be equally as compelling.

The firm that we would like to highlight for this article is JPMorgan Chase & Co. (JPM).

Source: JPMorgan Investor Relations

JPMorgan had a long and impressive dividend increase streak for quite some time, right up until the financial crisis showed up.

What was once a $0.38 quarterly dividend was slashed to just $0.05. For an income investor relying on the cash dividends from this security, that’s terrible news. And from this fact alone, it’s easy to write off JPMorgan as a source of reliable income.

However, some caveats are needed to truly justify what occurred with JPMorgan during the crisis.

First, the dividend was effectively “forced” to be cut. This doesn’t give much solace to the retiree living off dividends, but it is nonetheless interesting to note that JPMorgan had the ability to keep making its payment, but the company faced regulators that were keen for the company to preserve and build its capital buffer.

Next, times of distress often turn out to be strong periods for investment. Indeed, JPMorgan bottomed under $16 in 2009 and today, trades north of $100.

And finally, the previous dividend has now been restored, and then some, as the quarterly dividend now sits at $0.90.

The point in all of this is to say that investors would do well to keep an open mind on stocks like JPMorgan, even if they don’t have the longest dividend increase streaks around.

Table Of Contents

- Banks Becoming Utilities: Industry Overview

- JPMorgan The Business

- It’s Hard To Go Bankrupt If You Keep Generating Profits

- Past Earnings Growth

- Future Earnings Growth

- The Dividend

- Share Repurchases

- Valuation

- Putting It All Together

Banks Becoming Utilities: Industry Overview

First, we’ll discuss the sector in general terms. A lot of people are concerned that large banking institutions are becoming more like utilities. As a result of increased regulation, including higher capital requirements, investors are expecting banks to grow at a slower rate than what we have been accustomed to seeing.

The specifics are a bit complex, but the logic is simple. Banks make money by lending out capital (among other services). They earn profits on the difference between the interest they collect (from mortgages and other lending) and the interest that they must pay out (deposits, long-term debt). In addition, banks are able to utilize leverage to increase the returns that they generate.

The higher the leverage, the riskier banks become in poor economic times. So, the updated regulations require that banks hold more capital and decrease their leverage. Thus, the returns that they are able to generate, as compared to decade ago, could certainly be lower moving forward. The goal of such regulation is to make it less likely that a large bank would need rescuing during the next recession, as was the case for many large banks during the financial crisis. These rules should make that much less likely, but also make it more difficult for banks to generate profits during good times.

This is a real possibility and should be thought about appropriately. However, that’s not to suggest that this fate has already been written in stone. For instance, while regulation could certainly act as a headwind, the possibility of higher interest rates in the future could be a tailwind. These items could net out, resulting in reasonable growth after all. Indeed, we’ve seen large banks, including JPMorgan, grow their profits at strong rates for years since the crisis, despite these tougher rules.

In short, for banking in general we’d expect two things. One, we’d generally anticipate that banks would be safer as a result of the new guideline, the result of much higher capital buffers compared to prior to the crisis. Second, we would expect the future growth rate of the firms to be in line with or even a bit below what it has been in the past.

Now, let’s take a more detailed look at JPMorgan.

JPMorgan The Business

JPMorgan CEO Jamie Dimon’s most recent shareholder letter summarizes the business very well. The level of communication in the shareholder letter is much higher than what most corporations give.

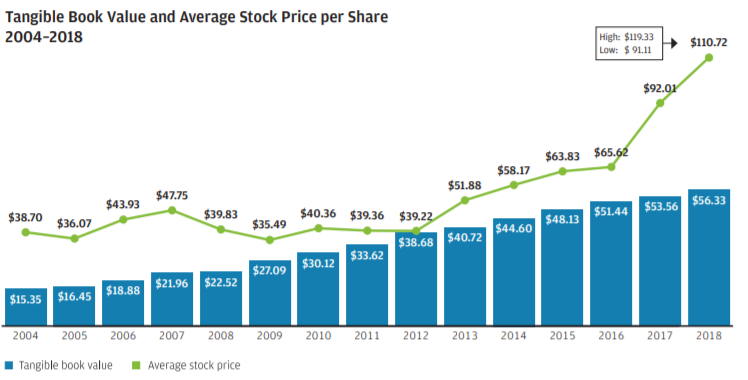

The image below shows how JPMorgan has continued to thrive over the last 15 years – despite the Great Recession:

Source: 2018 letter to shareholders

Remember that increased regulation results in the possibility for slower growth; that’s the negative. The positive is that large banks are forced to become stronger.

Here’s a particularly telling exchange framed as a Q&A in the letter:

Question: “You say you have a “fortress balance sheet.” What does that mean? Can you handle the extreme stress that seems to happen around the world from time to time?”

Answer: “Nearly every year since the Great Recession, we have improved virtually every measure of financial strength, including many new ones. It’s important to note as a starting point that in the worst years of 2008 and 2009, JPMorgan Chase did absolutely fine – we never lost money, we continued to serve our clients, and we had the wherewithal and capability to buy and integrate Bear Stearns and Washington Mutual.”

While this quote is a few years old, it is just as true today. JPMorgan famously references its fortress balance sheet in each and every quarterly earnings report because it is at the core of how the company operates. The reason JPMorgan was an acquirer during the crisis is because it remained profitable, largely attributable to its fortress balance sheet. This is the recipe for a great bank and JPMorgan has perfected it over time.

During the crisis, the dividend was slashed and the share price cratered, falling by more than three-quarters during the worst of it.

Yet during all of it, every quarter, JPMorgan was still turning out a profit. Granted, profits fell dramatically, but it was never as if the company was in jeopardy. Indeed, one cannot say this about the other large banks JPMorgan competes with nationally, with the exception of perhaps Wells Fargo (WFC).

It’s Hard To Go Bankrupt If You Keep Generating Profits

There was certainly a lot of fear during the crisis, but JPMorgan as an ongoing concern remained steady. And just as importantly, if the company can still generate profits in the worst of times, it gives investors an idea of what’s possible for better times.

Later on in the 2015 shareholder letter, Jamie Dimon added the following information related to the Comprehensive Capital Analysis and Review (CCAR) that is performed each year:

“The capital we have to bear losses is enormous. We have an extraordinary amount of capital to sustain us in the event of losses. It is instructive to compare assumed extreme losses against how much capital we have for this purpose.”

“JPMorgan Chase alone has enough loss absorbing resources to bear all the losses, assumed by CCAR, of the 31 largest banks in the United States. Because of regulations and higher capital, large banks in the United States are far stronger. And even if any one bank might fail, in my opinion, there is virtually no chance of a domino effect. Our shareholders should understand that while large banks do significant business with each other, they do not directly extend much credit to one other. And when they trade derivatives, they mark-to-market and post collateral to each other every day.”

In our view, and clearly in the view of Jamie Dimon, JPMorgan has emerged to be a much stronger company. It is quite easy to argue that JPMorgan was the strongest of the large banks heading into the crisis. But now, with much more stringent capital buffer regulations, it is even more so. Next, we’ll take a look at JPMorgan’s past earnings growth, as well as it outlook for the future.

Past Earnings Growth

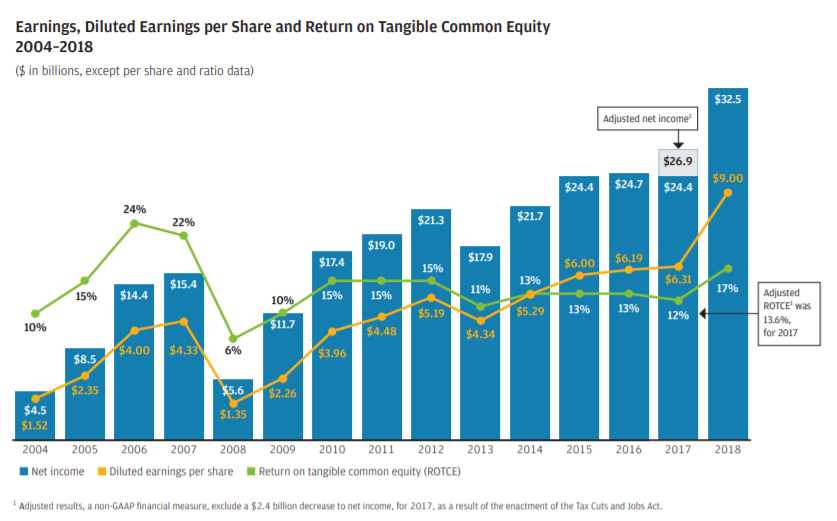

Here’s a look at JPMorgan’s earnings-per-share and tangible common equity growth from 2004 to 2018, a period that includes the Great Recession:

Source: 2018 letter to shareholders

JPMorgan’s tangible common equity, or TCE, which is a measure of equity that excludes preferred stock and intangible equity, has risen from $4.5 billion in 2004 to $32.5 billion as of the end of 2019. And while TCE fell markedly in 2008, it quickly rebounded as JPMorgan rebuilt its balance sheet following the damage of the Great Recession. Even including the Great Recession, JPMorgan has built its TCE at an annualized rate of 15% since 2004.

Due to the sizable uncertainty the Great Recession ushered in, as well as the intense regulatory scrutiny banks have faced in the years since, the valuation that investors were willing to pay for shares has oscillated significantly. The stock was valued at less than 8 times earnings in 2012, but more than 13 times earnings in 2017. We see current fair value around 11 times earnings.

The dividend still grew, but not quite as quickly as earnings for most of the past decade. However, recent years of rapid dividend growth have seen the payout ratio rise in excess of a third of earnings.

In total, JPMorgan has an outstanding track record of generating earnings and building its shareholders’ equity over time, irrespective of economic or regulatory conditions.

Future Earnings Growth

Estimating future growth is the most difficult part of analyzing any stock. However, given the information above, we see 5.5% annual earnings-per-share growth in the coming years.

We see this growth accruing from low single digit revenue growth as net interest income should continue to rise. In addition, JPMorgan buys back a lot of its own stock, which provides investors with a natural earnings-per-share tailwind each year. We see the bank as continuing to skillfully navigate whatever interest rate environment prevails in the coming years, but note that the bank’s exposure to credit cards could see its returns diminish if credit quality declines meaningfully over time.

The Dividend

JPMorgan’s payout ratio is in line with where it was prior to the crisis in the mid-30% area. However, the base of earnings-per-share is much larger, resulting in a dividend that is more than double the pre-crisis level at $0.90 quarterly.

We forecast $10 in earnings-per-share for 2019, meaning that even with the recently-raised payout of $3.60 annually, JPMorgan’s payout ratio is just 36%. At the very least, we anticipate future dividend growth to be in line with earnings-per-share growth. JPMorgan could certainly boost its dividend at a faster rate, but it also wants to spend billions of dollars on share repurchases.

Even so, we see the dividend at $4.80 in five years. Over time, shareholders can collect large sums of money, which can be used to increase their position in the stock. The dividend provides a 3%+ tailwind to total returns and we believe it will continue to do so for a long time to come.

Share Repurchases

JPMorgan pays out most of its earnings in the form of dividends and share repurchases. This is possible because of the company’s fortress balance sheet, which has seen its capital buffer built up over time. JPMorgan has been in the enviable position for the past few years of having more capital than it needs. This allows it to return effectively all of its earnings to shareholders.

If the company is paying out ~35% in dividends, that leaves at least as much to go toward share repurchases. Effectively, the company may use equal parts dividends and share buybacks for capital returned to shareholders in the coming years, as it has for some time.

This can have an important impact. JPMorgan has decreased its share count at an average rate of ~2% in the past decade, which provides a steady boost to earnings-per-share over time.

The business could grow overall earnings by just 3% or 4%, and still generate our target of 5.5% annual earnings-per-share growth. A share repurchase program, especially when used in large amounts and at lower share prices, can fuel some per share growth.

Valuation

The final piece of the puzzle, and an important one, is the valuation. We see fair value at 11 times earnings given that we are at or near the end of the current credit expansion cycle, and investors have made it clear they are willing to pay a bit less for bank stocks as a result. This estimate takes into account the stock’s historical multiples, as well as the fact that we see JPMorgan as the strongest and best-run large bank of the group.

Today, shares trade for 10.8 times earnings, meaning they are very slightly under fair value. Interest rates have started to decline meaningfully and bank stocks are suffering as a result. However, one thing we’ve learned about JPMorgan is that tough periods are the best times to buy. The bank has staying power unlike any of its competitors, and we see the current valuation as quite attractive.

Putting It All Together

Now, let’s put everything together. Should shares of JPMorgan earn $13.07 by 2024 and trade at 11 times earnings. This would indicate a future target share price of about $144. If the dividend grew at the same rate as earnings, 5.5% per year, investors will collect an average of just over $4 annually for the next five years in dividends as well.

We see our estimate of fair value, as well as our estimate of earnings growth as quite achievable. Given balance sheet growth, expense reductions, and share repurchases, we think JPMorgan has upside potential to our 5.5% growth forecast.

Combined with a compelling dividend yield, and a payout that will grow meaningfully over time, we don’t think it is difficult to make the case for owning JPMorgan shares today.

We think JPMorgan is the best-run, strongest bank among the large US banks. We also see the possibility for robust growth ahead for both earnings and the dividend. With total forecast returns in the high single digits, accruing from the 3%+ yield, 5.5% earnings growth, and essentially no impact from the valuation, JPMorgan’s totals returns look compelling for those wanting exposure to the banking industry.