"Here's how to know if you have the makeup to be an investor. How would you handle the following situation? Let's say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do y

MAMA BEAR (August 9, 2022): Throughout 2021 some analysts compared the U.S. stock market with Goldilocks and her porridge: not too hot, not too cold, but just right. Unfortunately many of them played hooky in kindergarten so they never learned that Goldilocks is always followed by the three bears. This truancy has come home to haunt analysts and investors in 2022 which featured the appearance of Baby Bear throughout the first half of this year.

Far too many analysts have recently rushed to declare that "the bear market is over" but, alas, we haven't seen either Mama or Papa so far. Mama Bear is about to surprise many with her dramatic entrance. Unlike Baby Bear, Mama needs a lot to keep her well fed, so she's going to be around for a year or two. Once she's had her fill, Papa Bear will bring the proceedings to a thunderous grand finale.

The U.S. equity bear market has a long way to go, with QQQ facing additional losses of 75% or 80%.

On November 22, 2021 at 10:16:19 a.m., just after Jerome Powell was reappointed as Fed chair, QQQ completed its all-time record zenith at 408.71. After making lower highs through January 4, 2022, it didn't take long for QQQ to lose one-third of its value by June 15, 2022. Since then it has been generally rebounding for several weeks which has encouraged a surprising number of people, especially those who haven't studied market history, to conclude loudly that "the bear market is over." Often they'll mention something about inflation receding or a recession not being imminent or something equally irrelevant as justification for their outlook.

Quite a few of these folks declared in both late March and more recently that "the bear market is over," probably on the way to doing so several more times.

The bear market of 2021-2025 has almost nothing to do with inflation, recession, Ukraine, or energy. It has everything to do with all-time record overvaluations, insider selling, net inflows, and public participation in 2021.

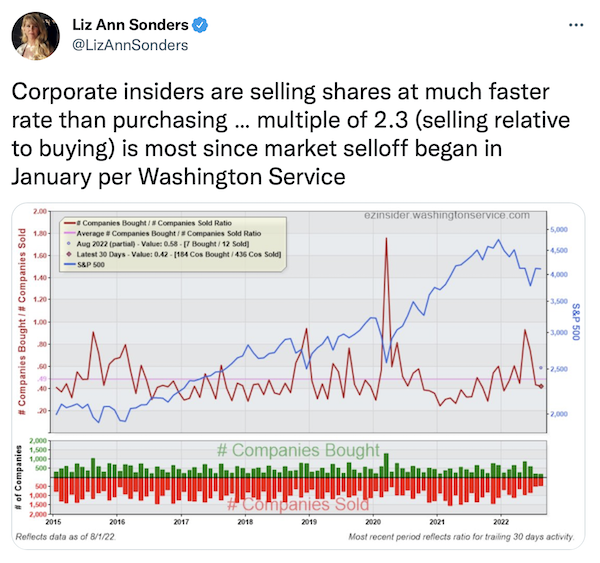

The media have been completely clueless about why we're in a bear market and why it must continue for at least two more years. We had the highest overpricings in history last year combined with by far the most intense insider selling and greater total net inflows for 2021 than we had for 2001 through 2020 combined. The market has to reward insiders for bailing out and punish the average investor in a way which will be unforgettable, at least until the next bear market comes along and no one respects it either.

The two previous longest bull markets in history were followed by bear markets of 34 and 31 months respectively.

Some analysts would have you believe that the bull market from March 2000 through January 2022, almost 13 years altogether and by far the longest in U.S. history, ended with a 5-1/2-month mild bear market. If we look at the second- and third-longest bull markets then this is what we find: the powerful uptrend from August 1921 through September 1929 was followed by the most severe bear market ever recorded which terminated in July 1932, 34 months later. The bull market from October 1990 through March 2000 was followed by a bear market which ended in the U.S. in October 2002 after 31 months and in most of Europe in March 2003 which was three years (36 months) altogether.

If this pattern repeats itself then the current bear market won't end until either the second half of 2024 or sometime in 2025.

Bear markets aren't "healthy corrections." They destroy an average of one decade's worth of investors' total accumulation.

In any bear market a major index like the S&P 500 will return to its top from the bull market prior to the previous one. In this case that means going back to its October 11, 2007 top of 1576.09 which had been the previous all-time intraday record prior to the 2007-2009 collapse. Since the S&P 500 on January 4, 2022 had reached 4,818.62 this means a loss of more than two-thirds from top to bottom and it could be significantly higher than that.

From its top of March 10, 2000 through its bottom of October 10, 2022, QQQ dropped 83.6%. Not many investors have prepared their portfolios for a repeat performance.

U.S. government bonds are irrationally underappreciated.

As I have discussed in previous essays, the best deal you can get is to put up to 65K each calendar year into I Bonds per couple or 35K if you are single. These are currently paying 9.62% free of state and local income taxes, and possibly free of federal income taxes if the money is eventually used for someone's college education. Once you have maxed out your I Bonds you can still get the highest guaranteed yields since October 2007 by purchasing U.S. Treasuries at each auction at TreasuryDirect.gov. The 52-week, 1-year, 2-year, and 3-year Treasuries are auctioned once per month, while the 26-week Treasuries are issued each week. I have recently been buying all of the above including the auctions on August 8 and August 9, 2022. Recent yields include 3.325% on today's 52-week auction and 3.202% for the 3-year U.S. Treasuries. Yesterday's 26-week auction yielded 3.130% which is much higher than you will get from any bank, plus the interest is free of state and local income taxes.

Bogleheads would do much better getting 3.2% guaranteed by the U.S. government than continuing to pile into U.S. equity index funds which are near double or triple fair value and which could still be behind after adjusting for inflation a half century from now.

Here is the official U.S. government link for the results of recent U.S. Treasury auctions:

Sell short in any bear market whenever VIX drops below 20.

Huge insider selling combined with massive net fund inflows are two clear signals that U.S. equities are headed much lower regardless of what they do in the short run. If you're uncertain about when to sell short, a useful guideline in a bear market is to track VIX. Whenever this measure of the average implied volatility of a basket of options on the S&P 500 Index goes below 20 it is safe to add to your short positions. The lower VIX goes below 20, the more aggressively you can add to your shorts, although always continue to do so gradually into extended equity strength.

Partially balance your short positions with long positions.

While funds including QQQ and XLK remain near triple fair value, other sectors tend to perform strongly during bear markets which follow growth-stock bubble tops. Gold mining shares consistently rally strongly following Nasdaq-style bubble peaks after an eight-month delay as we saw after September 1929, January 1973, and March 2000. For example, QQQ completed a key zenith on March 10, 2000; $HUI which is a long-running index of gold mining shares began a huge uptrend starting on November 15, 2000. In the current cycle QQQ peaked on November 22, 2021, so it is possible that the recent lows for gold mining shares eight months later may be following a similar pattern.

GDXJ is an ideal fund to hold during the current U.S. equity bear market. Other funds will likely become compelling over the next several months if they retreat irrationally during the next major downward phase for QQQ and SPY.

Not counting TLT and other funds of U.S. Treasuries, my equity short-to-long ratio is currently about 9:8. In other words, my combined short equity positions are modestly greater than my combined long equity positions, constantly adjusting both sides by buying into extended weakness and selling into extended strength.

Probably we will soon retest the upside a few more times for QQQ and SPY before we suffer their severe plunges.

It's somewhat unlikely that August will be the month where the U.S. equity bear market accelerates. Looking back at similar bear-market years including 1929, 1937, 1973, 2000, and 2008, it is probable that equity indices will periodically try to rally on "good news," especially near the opening bell, before we experience a more sustained decline after Labor Day to what will likely be the lowest points this autumn since April-May 2020.

A likely downside target for QQQ in the next phase of the bear market will be 215. We could bottom slightly higher and potentially much lower. Right now I expect this to occur before the end of 2022 although there exists a smaller chance of a slower descent into early 2023. If VIX suddenly spikes above 60 then expect this intermediate-term bottom to occur sooner rather than later.

Here are three useful charts.

Top corporate executives set new all-time records of insider selling to insider buying in 2021 and have recently been selling at their most intense pace since the beginning of 2022:

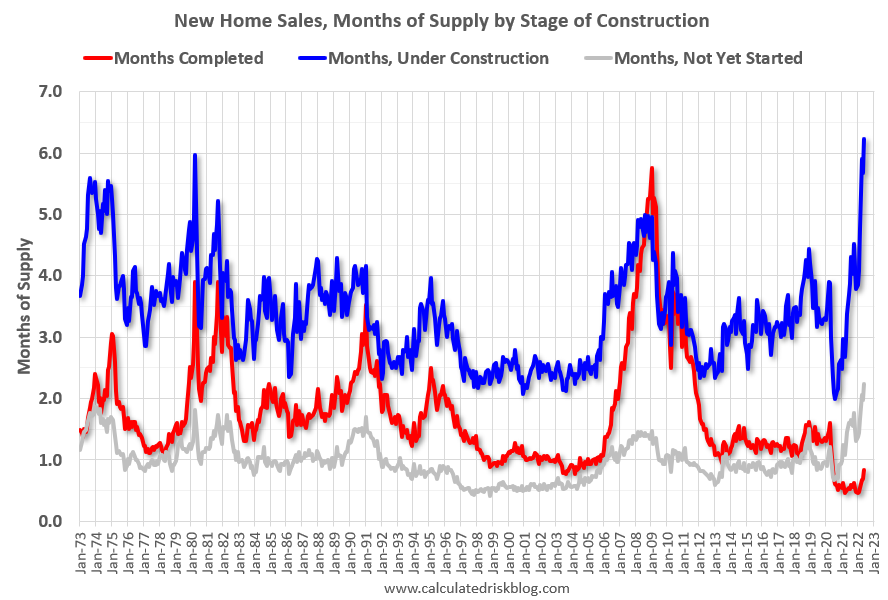

It's not just stocks which are overpriced; new homes under construction set a new all-time record as housing inventory is being transformed from a record shortage to a record surplus:

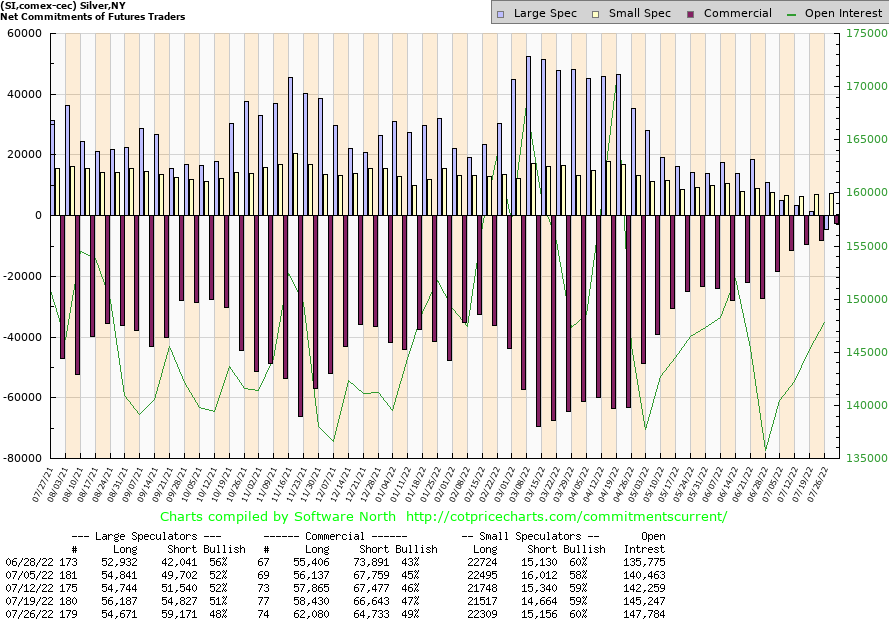

Among the few undervalued assets are precious metals, with silver's traders' commitments demonstrating the 99th percentile of its historic range. When commercials aren't hedging it's because they expect a substantial price increase in coming years:

The bottom line: the bear market is far from over as Mama Bear is about to make her appearance. An ideal way to ride out the current bear market is to keep a substantial percentage of your money in U.S. Treasury bills averaging 3.2% guaranteed which is free of state and local income taxes.

Disclosure of current holdings:

Here is my asset allocation in order from largest to smallest position: U.S. I Bonds along with 26-week, 52-week, 1-year, 2-year, and 3-year Treasuries, VMFXX, and similar cash reserves; short XLK; short QQQ; long TLT; long GDXJ (some bought in July); long GDX (some bought in July); short TSLA; long ASA (many bought in July); long GEO; long KWEB; long EWZ; long XBI; long TEI (many bought in July); long INTC (many bought recently including today); long TKC (many bought in July); long EPOL (some bought in July); long LEMB (many bought in July); long PCY (many bought in July); long TUR; short AAPL; long T; long ECH; short XLU; short XLE; long VZ (many bought in July); long FXF (some bought in July); long FXY (many bought in July); long FXB (many bought in July); short IWF; short SMH; long WBD; long VMBS; long EGPT (many bought in July); long PAK (many bought in July); long UGP; long ITUB; long BBD; long TIMB.

Steven Jon Kaplan runs True Contrarian where this article appeared first.

Source truecontrarian-sjk