Published on October 12th, 2019

This is a guest contribution by Lance Roberts and Michael Lebowitz with Real Investment Advice and Premium service RIA Pro. RIA Pro helps individual and professional investors grow capital and manage investment risks over all investment landscapes.

What is the yield curve, and what does it mean for the economy and the markets?

Over the last few months, the financial media has obsessed with those questions. Given the yield curve’s importance, especially considering the large amount of debt being carried by individuals, corporations, and the government, we do not blame them. We have given our two cents quite a few times on what a flattening and inversion of various yield curves may be signaling. Taking our analysis a step further, we now look at two high dividend stocks designed to take advantage of expected changes in the yield curve.

An inversion of the 2yr/10yr Treasury yield curve, where yields on 10-year Treasury notes are lower than those of 2-year notes, has accurately predicted the last five recessions. This makes yield curve signaling significant, especially now. It is important to note that in the five prior instances of yield curve inversions, the recession started when, or shortly after, the yield curve started to steepen to a more normal positive slope following the inversion. In our opinion, the steepening after inversion, and not the flattening or inversion of the curve, is the recession indicator.

In late August, the yield curve inverted for the first time in over a decade and has since begun to steepen. While the curve may yet invert once again, we believe that over the next 6-12 months, the curve will steepen significantly. If the economy enters a recession, the Fed will aggressively lower short term rates, which will more than likely result in a steeper yield curve. Conversely, a rebound in the economy should push longer-term rates higher, which would also steepen the curve.

The focus of this article is on REITs (real-estate investment trusts). Within this sector lies an opportunity to earn high dividends and price gains, if we are correct and the yield curve steepens.

What is an Agency Mortgage REIT?

Real Estate Investment Trusts are companies that own income-producing real estate and/or the debt backing real estate. REITs tend to pay higher than normal dividends as they are legally required to pay out at least 90% of their taxable profits to shareholders annually. Therefore, ownership of REIT common equity requires that investors analyze the underlying assets and liabilities of the REIT to assess the potential flow of income, and thus dividends, in the future.

The most popular types of REITs are called equity REITs. These REITs own equity in apartments and office buildings, shopping centers, hotels, and a host of other property types. There is a smaller class of REITs, known as mortgage REITs (mREITs), which own the debt (mortgages) on real-estate properties. Within this sector is a small subset known as Agency mREITs (AmREITs) that predominately own securitized residential mortgages guaranteed against default by Fannie Mae, Freddie Mac, Ginnie Mae and ultimately the U.S. government.

From an investor’s point of view, a key distinguishing characteristic between equity REITs and mREITs is their risk profiles. The shareholders of equity REITs are chiefly concerned with vacancy rates, rental rates, and property values. Most mREIT shareholders, on the other hand, worry about credit risk and interest rate risk. Interest risk is the yield spread between borrowing rates and the return on assets.

AmREITS that solely own agency guaranteed mortgages assume no credit risk as the timely payment of principal and interest is advanced by the security issuer (again either Fannie Mae, Freddie Mac, or Ginnie Mae, all of whom are essentially government guaranteed). Therefore, returns on AmREITs are heavily influenced by interest rate risk. Almost all REITs employ leverage, which enhances returns but adds another layer of risk.

Agency mREITs

Earnings for AmREITs are primarily the product of two sources: net income (yield on mortgages they hold less the cost of debt and hedging) and the degree of leverage.

A typical AmREIT is funded with equity financing and debt. The capital is used to purchase government-guaranteed mortgages. Debt funding allows them to leverage equity. For example, if a REIT bought $5 of assets with $1 of equity capital and $4 of debt, they would be considered 5x leveraged (5/1). Leverage is one way REITs enhance returns.

The second common way they enhance returns is to run a duration gap. A duration gap means the REIT is borrowing in shorter maturities and investing in long maturities. A 2-year duration gap implies the REIT has an average duration of their liabilities that is two years less than the duration of their assets. To better manage the duration gap and the associated risks, REIT portfolio managers hedge their portfolios.

The Fed’s Next Move and AmREITs

With that bit of knowledge, now consider the Fed’s quickly-changing policy stance, how the yield curve might perform going forward, and the potential impact on REITs.

Recent speeches from various Fed members including Chairman Powell and Vice Chairman Clarida are leading us (and most market participants) to believe the Fed will lower rates for a third time at the October 30th FOMC meeting. Most often, yield curves steepen when, or shortly before, the Fed starts lowering rates. While still too early to declare that the yield curve has troughed for this cycle, it is 20 basis points steeper from recent lows.

If we are correct that the Fed reduces the Fed Funds rate further and the yield curve steepens, AmREITs should benefit as their borrowing costs fall more than the yields of their assets. Further, if convinced of a steepening event, portfolio managers might reduce their hedging activity to boost income. The book values of AmREITs tend to have a strong positive correlation with the yield curve, and as a result, the book value per share of AmREITs should increase as the curve steepens.

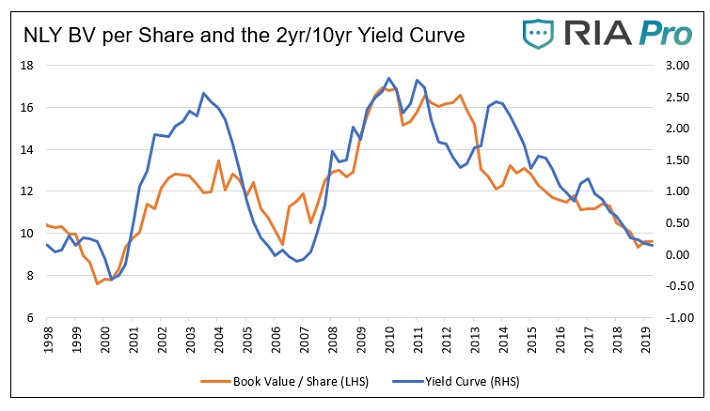

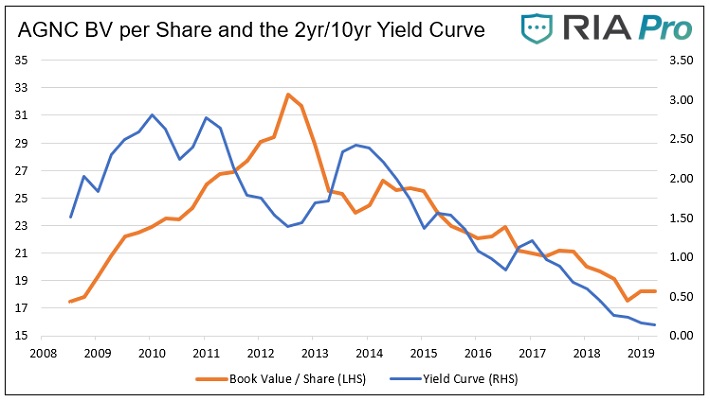

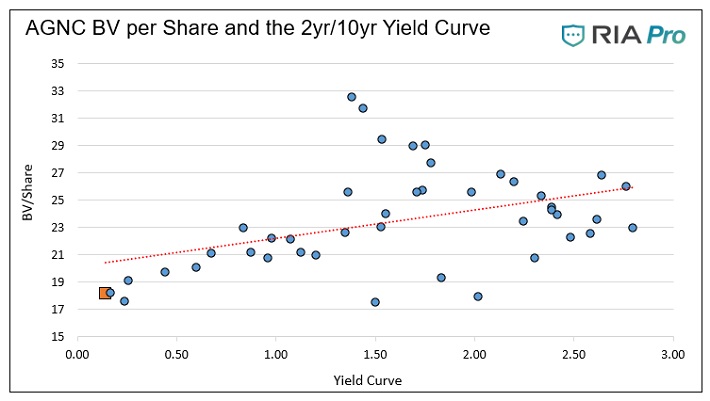

The following two graphs compare the shape of the 2yr/10yr yield curve versus the book value per share for the two largest AmREITs, Annaly Capital Management (NLY) and AGNC Investment Corporation (AGNC). The third and fourth graphs below show the same data in scatter plots to appreciate the correlation better. The current level of book value per share and yield curve is represented by the orange blocks in each scatter plot. Statistically speaking, a one percent steepening of the yield curve should increase the book value per share by approximately $2 for both stocks. Given both stocks have dividend yields in the low double-digits, any book value appreciation that results in price appreciation would make a good return, great.

Data Courtesy Bloomberg

While a steepening yield curve will likely create more spread income and thus a higher book value for these REITs, we must also consider the role of leverage and the premium or discount to book value that investors are currently paying.

- NLY is employing 8.2x leverage, which is slightly higher than their average of 7.6x since 2010, but less than their 20+ year average of 9.94x.

- AGNC uses more leverage at 10.2x, which is higher than its average of 8.8x since 2010. The REIT was formed in late 2008, therefore we do not have as much data as NLY.

- NLY trades at a discounted price to book value of .94, slightly below their historical average

- AGNC also trades at a discounted level of .92 and below their historical average.

The risks of buying AGNC or NLY are numerous.

- We may be wrong about the timing or amount of rate cuts and the curve may continue to invert, which would decrease book value. In such a case, we may see the book value decline, and potentially even more damaging, the discount to book value decreases further, harming shareholders.

- Even if we are right and the yield curve steepens and the REITs asset/liability spreads widen, we run the risk that investors are nervous about real-estate going into a recession and REITs trade to deeper discounts to book value and effectively offset any price appreciation due to the increase in book value.

- Leverage is easy to maintain when markets are liquid; however, as we saw a decade ago, REITs were forced to sell assets and reduce leverage, which can also negatively affect earnings and dividends. It is worth noting that NLY had an average of 12.90x leverage in 2007, which is significantly larger than their current 8.20x.

Summary

Despite double-digit dividend yields and the cushion such high dividends provide, buying NLY or AGNC is not a guaranteed home run. The two REITs introduce numerous risks as mentioned. That said, these firms and other smaller AmREITs, offer investors a way to take advantage of a steepening yield curve while avoiding an earnings slowdown that may hamper many stocks in an economic downturn.

While NLY and AGNC are in the same industry, they use different portfolio tactics. As such, if you are interested in the sector, we recommend diversifying among these two companies and others to help reduce idiosyncratic portfolio risks. We also recommend investors assess the iShares Mortgage Real ETF (REM). Its two largest holdings, accounting for over 25% of the ETF, are NLY and AGNC. It is worth noting this ETF introduces risks not found in the AmREITs. The ETF holds the shares of mortgage REITs that contain non-guaranteed mortgages as well as mortgages on commercial properties.