Updated on January 19th, 2022 by Nikolaos Sismanis

Founded by Paul Singer in 1977, Elliott Management is one of the oldest fund managers with uninterrupted operations. As of its latest filing, the fund had around $73.5 billion of assets under management (AUM). While most of these assets comprise of financial derivatives, nearly $13.9 billion is allocated to U.S. public equities.

Elliott Management is legendary within the investing community, not only for its long history of continuous success but also for its humble beginnings, including launching with just $1.3 million from friends and family. The company is based in New York but it also has operations in London, Hong Kong, and Tokyo.

Investors following the company’s 13F filings over the last 3 years (from mid-November 2018 through mid-November 2021) would have generated annualized total returns of 18.03%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 18.51% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Elliott Management’s current 13F equity holdings below:

Keep reading this article to learn more about Elliott Management.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Elliott Management’s Culture And Investment Strategy

- Elliott Management’s 10 Largest Public-Equity Investments

- Final Thoughts

Elliott Management’s Culture And Investment Strategy

Elliott believes that to achieve its goal of generating consistent returns for its investors, there are several elements for the fund’s investment and risk-management activities that are vital.

These elements include:

- An opportunistic trading approach

- Identification and creation of value

- Effective liquidity management, and

- Managing operational and counter-party risk

The fund applies a multi-strategy trading approach that incorporates a broad spectrum of strategies, including but not limited to:

- Distressed securities

- Traditional equity opportunities

- Arbitrage and commodities trading

- Various debt structures

- Portfolio volatility protection

- Private equity and credit, and

- Real-estate-related securities

Elliott will regularly take a leading role in event-driven situations to generate value or manage risk. For example, in May 2018, Elliott Management won a legal battle to control 2/3 of Telecom Italia’s board seats.

Elliott Management’s 10 Largest Public-Equity Investments

While the fund’s past-three-year performance may seem a bit underwhelming compared to the returns of the overall market, it’s important to remember that the fund utilizes a number of strategies as named above. As a result, its public-equity performance is not accurate to the performance of the fund itself.

Still, the company’s largest stakes in public equities are noteworthy, as these companies represent investable opportunities in which Elliott has identified profitable opportunities.

Source: Company filings, Author

Howmet Aerospace Inc. (HWM)

Howmet Aerospace provides superior engineered solutions for the aerospace and transportation industries. The company manufactures jet engine components, aerospace fastening systems, and mission-critical applications to be used both in defense and commercial aircraft.

While the company’s defense operations have remained robust, powered by multi-year contracts with governmental entities, its commercial segments have suffered significantly due to COVID-19. The stock is Elliott’s largest single-stock investment, occupying just over 23% of its public equity portfolio.

Thankfully, the company has remained profitable through the pandemic due to its defense backlog, though management cut the dividend a little over a year ago to preserve liquidity. It has now been reinstated but at a quarterly rate of just $0.02 the stock yields a tiny 0.23% at its current levels.

At its current stock price of around $34.32, the company trades at around 21 times its forward earnings, which indicates that shares are trading at relatively fair levels. Still, COVID-19 remains active, and the aviation industry’s resumption to normality remains unclear. Therefore, new investors must be aware of such risks.

Elliott holds approximately $1.3 billion worth of shares, owning around 9.6% of the company, which displays the fund’s active involvement goals. The position remained unchained as of Elliott’s latest 13F filing, signaling that the fund remains positive on the company’s long-term story, despite the recent challenges.

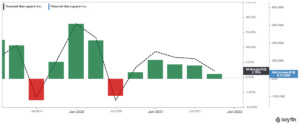

Marathon Petroleum (MPC)

The energy sector has had a rough past few years, as the pandemic caused a massive decline in the aviation and transportation industries. While most companies in the sector cut their distributions due to deteriorating financials, Marathon Petroleum has sustained last year’s increased dividend, as its higher exposure in midstream services has helped maintain a profitable bottom line.

Shares currently yield 3.1%, following the stock’s surge over the past year amid the energy sector’s recovery. Elliott kept its position steady during the quarter, which displays confidence for the company’s future. Considering Elliott’s position in Marathon and Howmet aerospace, the fund possibly expects further upside following the post-pandemic era.

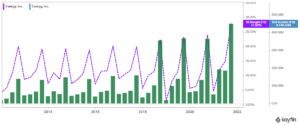

Evergy, Inc. (EVRG)

Evergy is an electric utility holding company incorporated in 2017 and headquartered in Kansas City, Missouri. Through its subsidiaries Evergy Kansas, Evergy Metro, and Evergy Missouri West, the company serves approximately 1.4 million residential customers, nearly 200,000 commercial customers, and 6,900 industrial customers and municipalities in Kansas and Missouri.

Evergy has a market capitalization of $14.7 billion and is significantly impacted by seasonality, as about one-third of its retail revenues is recorded in the third quarter.

Evergy has grown its earnings-per-share at a 5.4% average annual rate over the last decade. This mid-single-digit growth rate is typical in the utility sector. However, Evergy has enhanced its investments in growth projects lately and hence it is likely to accelerate its growth pattern in the upcoming years.

The company expects to spend $9.2 billion on capital expenses through 2025 while it will also reduce its operational and maintenance expenses. It reduced these expenses by 10% in 2020 and expects to reduce them by another 8% until 2024. Given also expected regulatory approval of 5%-6% annual growth in rates, Evergy expects to grow its earnings-per-share by 6%-8% per year until at least 2025, as a result.

Every is Elliot’s third-largest holding, accounting for around 11.8% of its portfolio. The fund holds around 4.6% of the company’s total shares, while the position remained unchanged as of its latest quarter.

Twitter (TWTR)

Unlike the energy sector mentioned earlier, the social media giants have been posting record sales, attracting huge traffic levels due to people spending more time inside as a result of the pandemic.

Twitter has had more challenges than its competitor Meta Platforms (FB) in effectively monetizing its user base. However, with revenues steadily growing lately, it’s likely that the company’s net income margins will soon follow higher.

Elliott kept its stake in Twitter constant last quarter, sharing such bright expectations for its future as well. It’s worth noting that the fund sold the entirety of its Meta Platforms position last year, which was previously included in its top 10 holdings.

Santander Consumer USA Holdings Inc. (SC)

Santander Consumer USA Holdings is a full-service specialized consumer finance company concentrated on vehicle finance and third-party servicing based in Dallas, Texas.

The company’s main business is the indirect origination and servicing of retail installment contracts and leases, primarily via manufacturer-franchised dealers in connection with their sale of new and used vehicles to retail consumers. Santander Auto Finance (SAF) is the company’s primary vehicle brand, which is well-known as a finance option for automotive dealers across the United States.

The company’s financials have remained robust and even hit new record highs through the pandemic despite concerns over the ongoing retail consumer financing risks.

Elliot initiated its position in the company as recently as last quarter, quickly accumulating just over 4% of the company’s total shares outstanding, indicating high confidence towards its newest holding.

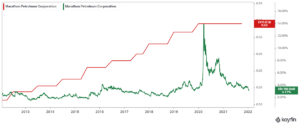

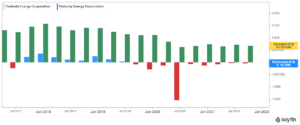

Peabody Energy Corporation (BTU)

Peabody Energy Corporation is a leading coal producer. The company owns interests in 17 active coal mining operations located in the United States (U.S.) and Australia. While regulatory pressures have challenged global coal production, coal prices have surged amid reduced supply.

While the stock has recovered over the past couple of years, it’s worth noting that the company remains unprofitable on a GAAP basis. The dividend has also remained suspended since 2019.

The stock likely comprises another activist position for Elliot, whose equity stake represents just over 20% of the company’s total shares.

Uniti Group Inc. (UNIT)

Uniti Group is a Real Estate Investment Trust (i.e., REIT) that focuses on acquiring, constructing, and leasing out communications infrastructure in the United States. In particular, it owns millions of miles of fiber strand along with other communications real estate.

In its recent past, it has faced challenges due to its largest tenant filing for bankruptcy and renegotiating its lease with Uniti. However, the REIT is now on firmer footing and is pursuing growth opportunities.

You can see our full REIT list here.

The company is one of Elliott’s few meaningful real estate positions, and its stake is relatively new, initiated in Q3-2020.

Uniti is Elliott’s second-most significant stock in terms of its dividend yield as well, which currently stands at around 4.72%.

The dividends should provide ample cash flows for Elliott to allocate to its other investments, or towards more shares of Uniti.

Arconic Corporation (ARNC)

Arconic Corporation produces and sells aluminum sheets, plates, extrusions, and architectural products globally. As industrial output and construction activities have been lagging during the pandemic, the company’s revenues were hit hard. While recovery signs are visible, the company has struggled to record meaningful profitability levels. The ongoing supply chain crisis further pressures the company as well.

Elliott’s purchase of around 10.3 million shares was initiated in Q2 of 2020, as shown in the fund’s 13F filing, and is likely one of the “distressed-equity” situations that the fund specializes in. Arconic shares have been rallying higher over the past few months because the company’s IPO in the midst of pandemic had already priced shares at an incredibly depressed valuation.

Elliott is now holding around 7.8% of the company’s outstanding shares after the fund trimmed its position by around 19% likely to secure some profits.

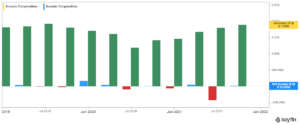

Public Storage (PSA)

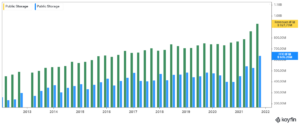

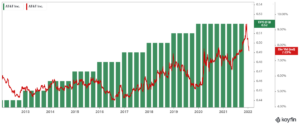

Public Storage is a REIT that was formed in 1980. The trust owns an interest in about 2,400 properties that lease storage space, typically on a month-to-month basis, making it the largest such entity in the United States. The trust produces about $3.5 billion in annual revenue and has a market capitalization of $63 billion.

Public Storage has grown FFO nicely in the past decade, even if that growth has come in a non-linear fashion. FFO-per-share has roughly doubled since 2008, producing an average growth rate in the mid-single-digits.

However, while we recognize that Public Storage has important scale advantages over its competitors, overcrowding in the building of storage space has us forecasting just 4% annual FFO-per-share growth for the foreseeable future, up from 3.7% previously.

Public Storage has been able to grow revenue at an average rate of 6.7% in the past decade, but given how large the trust already is and the fact that saturation is becoming a problem, we see that growth slowing to a low-single-digit rate.

Public Storage is Elliot’s ninth-largest holding, with the fund holdings its position steady during the last quarter.

AT&T Inc. (T)

Last year in May, AT&T announced an agreement to combine WarnerMedia with Discovery, Inc. to create a new global entertainment company. Under the terms of the transaction, AT&T will receive $43 billion in a combination of cash, securities, and retention of debt.

In addition, AT&T shareholders receive stock representing 71% of the new company, with Discovery shareholders owning 29%. The company will combine HBO Max and Dsicovery+ to compete in the direct-to-consumer business, bringing together names like HBO, Warner Bros., Discovery, CNN, HGTV, Food Network, TNT, TBS, and more. The new company expects $52 billion in 2023 revenue and the transaction is expected to close in mid-2022.

In September AT&T declared a $0.52 quarterly dividend, marking the 8th payment at this rate and the same yearly total for 2020. This would mark an end to the company’s dividend growth streak and Dividend Aristocrat status amid the changing business.

AT&T is Elliot’s tenth-largest holding. The fund held its position steady as of its latest filings.

Final Thoughts

Elliott Management has had an outstanding run. From humble beginnings, the fund has grown into one of the world’s biggest, all while led by the same manager since its inception, Paul Singer.

Considering that the fund utilized multiple strategies at once, a relatively small part of its AUM is allocated towards individual public equities. However, the relatively small sample of stocks is enough to showcase the company’s strategy of investing in distressed equities and taking relatively sizeable stakes in companies to have some sort of active control on their board.

Some of their holdings are quite risky, while others may require a combination with the fund’s various derivatives to pay off. Still, investors can get a decent look at which companies the fund is fond of and potentially consider replicating as well.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers:

- Bridgewater Associates’ Stock Portfolio: Top 10 Holdings Analyzed

- 2022 Kevin O’Leary Stock Portfolio | His Top 10 Dividend Picks Now

- Athanor Capital’s Stock Portfolio: Top 10 Holdings Analyzed

- 2022 Bill Gates Portfolio List | All 24 Stock Investments Now

- Pershing Square: Bill Ackman’s Stock Market-Beating Portfolio