Published on September 28th, 2020 by Nate Parsh

While there are many dividend paying stocks in the market, there are only 30 stocks that have offered a rising dividend for at least fifty consecutive years. This exclusive group of stocks are referred to as the Dividend Kings.

You can see the full downloadable spreadsheet of all Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

This year, the Dividend Kings gained a new member when Universal Corporation raised its dividend for the 50th year in a row. This article will review the company to determine if the stock earns a buy recommendation today.

Business Overview

Universal Corporation is the largest exporter and importer of tobacco leaf in the world. The company is a wholesale purchaser and processor of tobacco and operates as a go between for farms and the companies that manufacture cigarettes, pipe tobacco and cigars. Universal Corporation has been in business since 1886 and is headquartered in Richmond, VA. The company is valued at $1 billion today.

Universal Corporation has extensive reach around the world.

Source: Universal Corporation’s Fiscal Year 2020 Investor Presentation, slide 24

Universal Corporation has a presence in more than 30 countries and employs in excess of 20,000 permanent and seasonal employees.

Universal Corporation has had a difficult couple of years as earnings-per-share have actually declined 4% annually since 2010. There have been years of sporadic growth, but profitability has been an issue.

Still, there are some bright spots to the company’s business that could lead to future returns, not to mention a very appealing dividend yield.

Growth Prospects

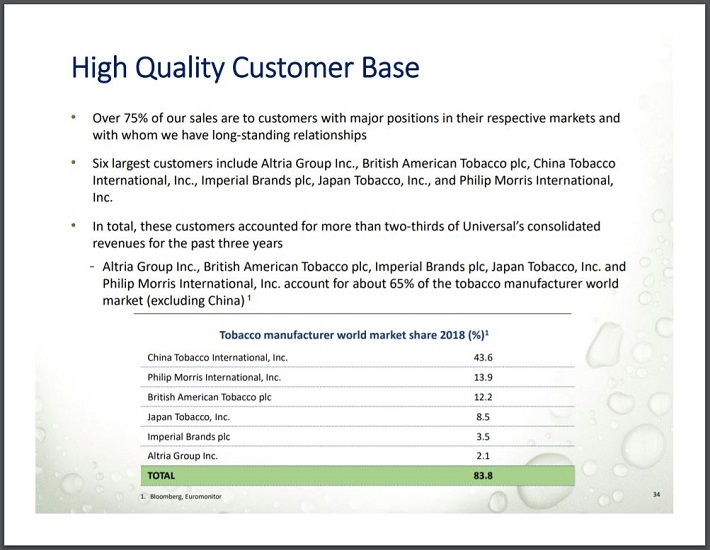

As the largest exporter and importer of leaf tobacco in the world, Universal Corporation offers a size and scale that competitors cannot match.

This means that the company can count the largest tobacco product manufactures in the world among its customers.

Source: Universal Corporation’s Fiscal Year 2020 Investor Presentation, slide 34

Six of Universal Corporation’s top customers are among the largest tobacco manufactures in the world. These companies control more than four-fifths of the global tobacco market.

Three-quarters of Universal Corporation’s annual revenue usually comes from these customers. Counting the largest names in the sector as customers likely means that the vast majority of revenues can be counted on each year. This provides the company some stability and can reassure shareholders that the business can be sustainable.

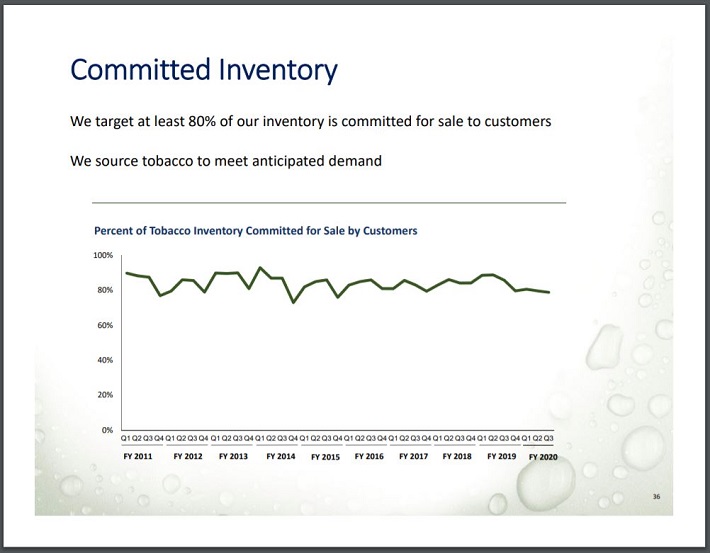

Universal Corporation also strives to source the majority of its sales to meet anticipated demand.

Source: Universal Corporation’s Fiscal Year 2020 Investor Presentation, slide 36

This means that the company targets at least 80% of its inventory to customers with committed sales orders. This allows Universal Corporation to not be stuck holding product or being forced to sell at a lower price in order to reduce inventory.

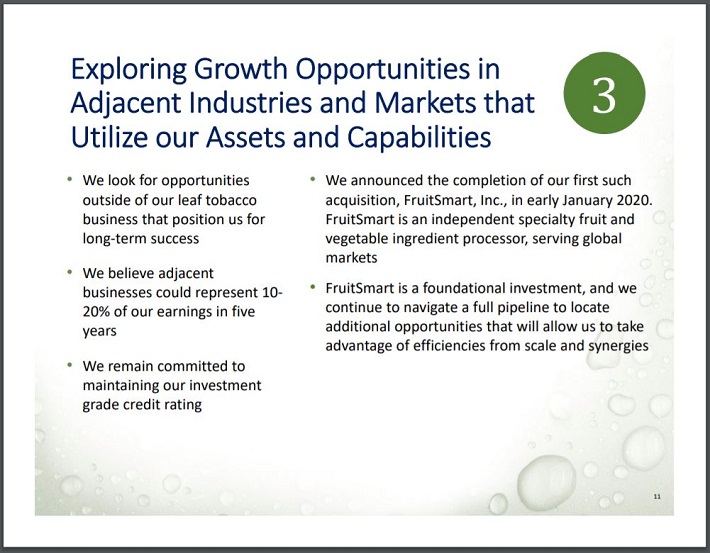

Finally, as smoking rates have declined in the U.S. and elsewhere, companies in the tobacco sector have to figure out other ways to grow revenues.

Source: Universal Corporation’s Fiscal Year 2020 Investor Presentation, slide 11

Universal Corporation is attempting to do just that. The company made its first such acquisition earlier in 2020 when it added FruitSmart, Inc to its portfolio. FruitSmart processes fruit and vegetable ingredients and markets them to customers around the world. Universal Corporation has targeted 10% to 20% of earnings to come from sources outside of leaf tobacco within the next five years.

Diversifying the business is a very prudent move in our opinion as the number of smokers is lower year after year.

Competitive Advantages & Recession Performance

Universal Corporation’s chief business tends to see a reliable consumer, even if tobacco usage has declined. Consumers who do smoke are likely to seek out tobacco products regardless of the state of the economy. This makes business reliable even in an unreliable time.

While earnings growth has been weak in recent years, Universal Corporation navigated the last recession very well. The company’s earnings per-share before, during and after the Great Recession are listed below:

- 2006 adjusted earnings-per-share: $3.48

- 2007 adjusted earnings-per-share: $4.02 (15.5% increase)

- 2008 adjusted earnings-per-share: $4.32 (7.5% increase)

- 2009 adjusted earnings-per-share: $5.68 (31.5% increase)

- 2010 adjusted earnings-per-share: $5.30 (6.7% decrease)

- 2011 adjusted earnings-per-share: $3.25 (38.7% decrease)

- 2012 adjusted earnings-per-share: $4.66 (43.4% increase)

Universal Corporation’s earnings-per-share actually improved more than 41% from 2007 through 2009 during what was a very difficult environment for many companies in the market.

Earnings-per-share didn’t start to suffer their steep decline until after the worst part of the recession had taken place. It should be noted that the company still has not taken out its 2009 high.

Valuation & Expected Returns

Like all common equities, Universal Corporation total returns will consist of dividend payments, earnings growth and valuation changes. Using the annualized dividend of $3.08, shares of Universal Corporation yield 7.4%. This yield level would be the highest figure in at least 15 years were this to be the year-long average.

The dividend payout ratio has climbed steadily in recent years. The payout ratio is expected to be more than 96% for this year. We don’t believe a dividend cut is imminent, but do preach caution with regards to the yield. At the very least, it is likely dividend growth will be muted until earnings growth materializes.

Due to the company’s rather weak performance for profitability over the last 10 years, we anticipate a modest improvement for earnings growth of just 1.5% annually through fiscal 2026.

Finally, the valuation will likely be a headwind for the stock over the next few years. With earnings-per-share estimates of $3.20 for the current fiscal year, Universal Corporation’s stock has a price-to-earnings ratio of 12.9.

Shares have traded with an average valuation of more than 13.1 over the last decade, but we feel a fiscal 2026 target multiple of 11 times earnings takes into account the company’s difficulty in growing earnings. Reverting to this target valuation would reduce annual returns by 3.2% over this period of time.

Therefore, expected total returns would consist of the following:

- 1.5% earnings growth

- 7.4% dividend yield

- 3.2% multiple reversion

In total, we expect annual returns of 5.7% over the next five years. This is a decent expected rate of return, but is not high enough to earn a buy recommendation right now. The stock has a certain level of appeal for income investors due to the very high yield, but total returns are likely to be lackluster.

Final Thoughts

Universal Corporation is one of the newest Dividend Kings. This is a rare feat as there are only 30 companies that have the required 50+ years of dividend growth to gain membership into the exclusive Dividend Kings.

That said, investors shouldn’t purchase shares of a company simply because of the dividend. While Universal Corporation offers a very high yield, it also has a very high payout ratio.

In addition, the company hasn’t been able to sustain the growth it experienced in the last recession. It’s been nearly a decade since a new high for earnings-per-share has been established. The company’s dividend growth has not been accompanied by earnings growth, which has resulted in a higher dividend payout ratio.

Universal Corporation receives a hold recommendation from Sure Dividend due to lack of earnings growth, valuation reversion and mediocre projected returns.