Updated on January 14th, 2020 by Samuel Smith

High-quality dividend growth stocks have the potential to deliver outsized returns to investors over the long-term. And, for retirees, dividend growth stocks can help replace lost income from no longer receiving a paycheck.

A good place to look for the best dividend growth stocks is the list of Dividend Aristocrats. This is a select group of 57 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

You can see a full downloadable spreadsheet of all 57 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

We review all 57 Dividend Aristocrats each year. Next up is pharmacy giant Walgreens Boots Alliance (WBA). Walgreens has increased its dividend for 44 years in a row. However, the past year was not a good one for the company.

Shares of Walgreens declined 24% in the past one year, and it was the worst-performing Dividend Aristocrat of 2019.

Still, Walgreens has a strong brand, and it remains an industry leader. It still has room for growth moving forward, and has a long history of annual dividend increases.

Plus, due to the share price decline over the past year, Walgreens stock yields 3.4% today. As a result, we believe Walgreens stock is an attractive buy for 2020.

Business Overview

Walgreens was founded all the way back in 1901. In its current form, the company was created when Walgreens merged with Alliance Boots in 2014. The merger created the largest retail pharmacy in the U.S. and Europe. Today, together with its equity method investments, Walgreens Boots has more than 18,750 stores in 11 countries around the world.

Source: Investor Presentation

Investor sentiment has been subdued in recent years, due to fears of rising competition from online retail giants like Amazon (AMZN).

This is a challenging time for all of retail. The rapid growth of e-commerce has put pressure on brick-and-mortar retailers. However, Walgreens continues to find ways to grow its top line.

The company recently concluded fiscal 2020 Q1, and the results were mixed. Walgreens reported a 6% decline in adjusted earnings-per-share for the quarter while sales increased 1.6% (up 2.3% on a constant currency basis), thanks to continued growth in the Retail Pharmacy USA segment and a 5.2% increase in the Pharmaceutical Wholesale segment.

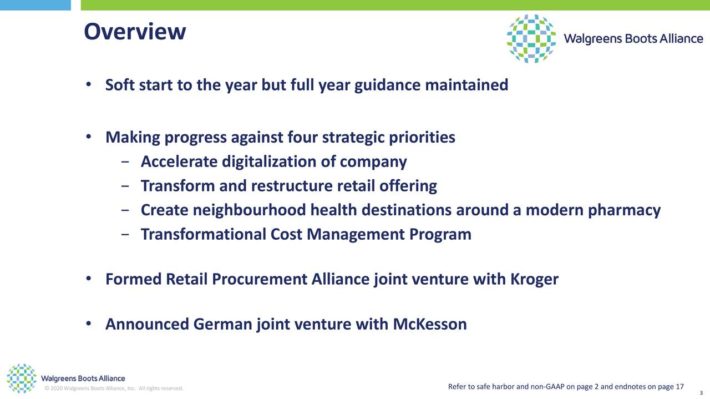

Walgreens made progress on a number of strategic initiatives last quarter. It created a German wholesale joint venture with McKesson (MCK) and formed a group purchasing organization with Kroger (KR) as it believes these strategic partnerships will help it grow its market share and improve its long-term growth outlook. In the short term, it fiscal 2020 outlook expects relatively little change in its earnings-per-share from fiscal 2019.

The most recent quarter showed that the company continues to struggle with earnings-per-share growth, but also is taking steps to secure its long term growth prospects through strategic investment. It is aiming to accomplish this by accelerating its digitization, restructuring its retail business and transforming its stores into neighborhood health centers, and significantly improving cost efficiencies.

Source: Investor Presentation

Pharmacy sales were up 2.9% last quarter, while prescriptions grew 1.4%. This shows that Walgreens continues to be the go-to retailer for pharmacy products and services.

Excluding acquisitions, pharmacy sales and prescriptions still grew 2.5% and 2.8%, respectively. One negative point from the quarter was that Walgreens lost market share by 55 basis points, to 20.9%. In addition, its international segment saw a 2.7% decline in sales due to ongoing soft market conditions in the U.K.

While the company continues to be plagued by sluggishness and growing competition in the space, there should be plenty of room for growth next year and beyond, thanks to sales growth, strategic initiatives, and the continued integration of the Rite Aid acquisition.

Growth Prospects

Walgreens’ most important catalyst in the U.S. is to grow through new stores and customers. It has accomplished this through acquisitions. For example, Walgreens acquired over 1,900 Rite Aid (RAD) stores, three distribution centers, and related inventory, for $4.375 billion. Hundreds of Rite Aid stores were optimized in 2018 and 2019.

As discussed above, the Rite Aid transaction has already helped Walgreens grow earnings. Walgreens assumed the real estate obligation, but did not assume any debt from Rite Aid. Furthermore, there are significant cost synergies to accelerate earnings growth from the acquisition.

Since Walgreens and Rite Aid have nearly identical operations, Walgreens can eliminate duplicated functions across the business. Walgreens expects to realize more than $300 million in annual cost savings by 2021.

Share buybacks will also help fuel Walgreens’ future earnings growth. In 2018, Walgreens approved an additional $10 billion to the company’s share repurchase authorization. This represents nearly 15% of the current market capitalization of the stock, meaning the buyback could be a significant boost to EPS.

This is a benefit of a profitable company with a discounted share price–it can use excess cash flow to repurchase its own shares at a significantly lower price. We expect it to continue allocating billions of dollars into share repurchases when the current authorization expires.

For fiscal 2020, Walgreens expects adjusted earnings-per-share of $6.00 at the midpoint, with flattish earnings-per-share growth expected year-over-year. Looking out further, Walgreens should continue to grow earnings for the long-term, due to very favorable macro-economic conditions.

Specifically, the U.S. is an aging population. As they age, consumers will have higher demand for healthcare products and prescriptions. Judging by Walgreens’ recent financial results and future outlook, it is clear the highly pessimistic sentiment is misguided. Walgreens still has a strong market position and balance sheet.

Competitive Advantages & Recession Performance

The first competitive advantage for Walgreens is its scale. Walgreens has one of the world’s largest global wholesale and distribution networks, with roughly 400 distribution centers that supply more than 230,000 pharmacies, doctors, health centers, and hospitals.

With such a massive global footprint, it is very challenging for a competitor to compete on the same scale as Walgreens. Despite the difficulties facing retail, there is still an operational advantage of physical stores. Most of the U.S. lives within a short distance of a Walgreens store. As a result, it is very difficult for competitors to take market share.

Separately, Walgreens benefits from a strong brand, and operates in a stable industry. Consumers cannot go without prescriptions and health care products. This helps earnings stay afloat, even during recessions. For example, Walgreens suffered only a slight decline in earnings-per-share during the Great Recession:

- 2007 earnings-per-share of $2.03

- 2008 earnings-per-share of $2.17 (6.9% increase)

- 2009 earnings-per-share of $2.02 (7.2% decline)

- 2010 earnings-per-share of $2.16 (6.9% increase)

Walgreens grew earnings-per-share from 2007 to 2010. It followed up this performance with over 20% earnings growth in 2011. Earnings-per-share have nearly tripled from fiscal year 2009 to fiscal year 2019, which equates to a CAGR of more than 24% during this time period. Erring on the side of caution and taking into account recent challenges, we anticipate an annual earnings growth rate of 5% through 2025.

It is clear that Walgreens has a recession-resistant business model, which helps it raise its dividend each year.

Valuation & Expected Returns

Walgreens has a current share price of ~$54 and a midpoint for adjusted earnings-per-share of $6.00 for fiscal 2020. As a result, the stock trades for a price-to-earnings ratio of 9.0. This is a low valuation for a highly-profitable company, especially one with a strong brand and leadership position in its industry.

The S&P 500 Index has an average price-to-earnings ratio of over 21 right now. Over the past 10 years, Walgreens held an average price-to-earnings ratio of 16.2.

As a result, Walgreens stock appears to be undervalued, relative to both the broader market as well as its own historical averages. But due to Walgreens’ slower growth and current headwinds, we have a 2025 price-to-earnings ratio target of 12 for the stock.

If shares were to expand to meet our target valuation, investors would see an additional 5.9% added to annual returns over the next five years. Plus, Walgreens will generate returns from earnings growth and dividends. Expected returns could be as follows:

- 5% earnings-per-share growth

- 3.4% dividend yield

- 5.9% multiple expansion

In this forecast, total annualized returns could exceed 14% over the next five years. This is an excellent projected rate of return, and indicates that Walgreens stock offers a mix of all attractive qualities. The company has compelling growth potential, is undervalued, and offers a solid dividend yield. The combination of these three major catalysts results in a buy recommendation for value and income investors.

Final Thoughts

When it comes to retail stocks, there is a great deal of fear in the market. This is apparent, even with strong retailers like Walgreens. Not only are investors worried about a sluggish environment for brick-and-mortar retailers, but the threat of Amazon entering the healthcare industry is a constant overhang.

Walgreens remains a strong company, with a great brand and positive growth prospects moving forward. The addition of Rite Aid has allowed the company to grow its prescription drug market share.

In addition, Walgreens offers an above market dividend yield. Given the business fundamental, the company should have no trouble raising the dividend every year. We view the stock as significantly undervalued and rate the stock a buy.