Updated on December 23rd, 2019 by Samuel Smith

Put simply, investing in high-quality dividend growth stocks can lead to outstanding long-term returns. Of course, this might seem to be an overly simplistic view Investors looking for dividend income and sustainable growth should start with the Dividend Aristocrats, an exclusive group of companies that have raised their dividends for 25+ consecutive years.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by using the link below:

There are only 57 Dividend Aristocrats. This article will review diversified industrial company Stanley Black & Decker (SWK).

Stanley Black & Decker has an amazing track record of dividend growth. In 2019, Stanley Black & Decker increased its dividend for the 52nd year in a row. Today, the company’s dividend appears very safe relative to its underlying fundamentals:

Two years ago, it joined the ranks of an even more exclusive club than the Dividend Aristocrats. Stanley Black & Decker is now a member of the Dividend Kings, a group of just 27 companies with 50+ consecutive years of dividend increases.

Put simply, the Dividend Kings are the best of the best when it comes to dividend growth stocks. This article will discuss the qualities that have made Stanley Black & Decker a time-tested dividend growth stock.

Business Overview

Stanley Black & Decker is the result of Stanley Works’ $3.5 billion acquisition of Black & Decker in 2009. Stanley Works and Black & Decker were both named after their respective founders. Stanley Works was formed in 1843, when Frederick Stanley started a small shop in New Britain, Connecticut, where he manufactured bolts, hinges, and other hardware. His products developed a reputation for their quality.

Meanwhile, Black & Decker was started by Duncan Black and Alonzo Decker in 1910. Like Stanley, they opened a small hardware shop. In 1916, they obtained a patent to manufacture the world’s first portable power tool. Over the next 175 years, Stanley Black & Decker has steadily grown into one of the world’s largest industrial products manufacturers.

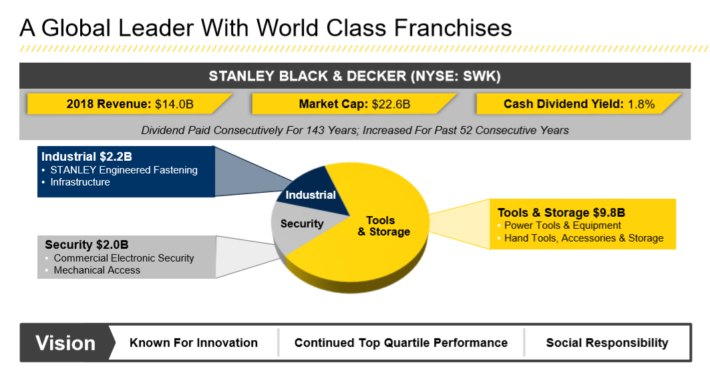

Source: Investor Presentation

Its main products include hand tools, power tools, and related accessories. It also produces electronic security solutions, healthcare solutions, engineered fastening systems, and more.

Revenue growth has accelerated over the past two decades. Today, Stanley Black & Decker has a market capitalization of $25 billion, and annual sales of more than $14 billion. It operates three business segments, which are Tools & Storage, Security, and Industrial products.

Late last year, Stanley Black & Decker announced that products from its hand tools and storage portfolio will be available exclusively at Home Depot (HD). The company has produced excellent growth rates in recent years, due in large part to an aggressive acquisition strategy.

Growth Prospects

Stanley Black & Decker’s growth prospects are promising. The company recently reported a solid third quarter. The company earned $2.13 per share, beating estimates and growing 2.4% from the prior year. Revenue improved 6% to $3.6 billion and was roughly in-line with estimates.

The Tools & Storage segment had a strong performance with 5% organic growth. Separately, Industrial organic sales declined 2% though revenue was higher by 13%, while organic sales for the Security division increased 1%, as a 3% improvement in North America was only partially offset by a 1% decline in Europe. Tariffs, currency and commodity costs were a $90 million headwind during the quarter and the adjusted operating margin of 14.5% was flat from the prior year. Adjusted SG&A expenses declined 120 bps to 19.8% and the company announced it will pursue a new cost reduction program expected to reduce costs by $200 million annually.

The main disappointment in the quarter was management’s announcement that it was lowering its full-year guidance and now expects adjusted earnings-per-share in a range of $8.35 to $8.45, down from $8.50 to $8.70 previously. Still, we believe the company has positive long-term growth potential, which will be boosted significantly by acquisitions.

Acquisitions have played a key role in the company’s growth in recent years, and remain a critical component of the company’s growth strategy going forward.

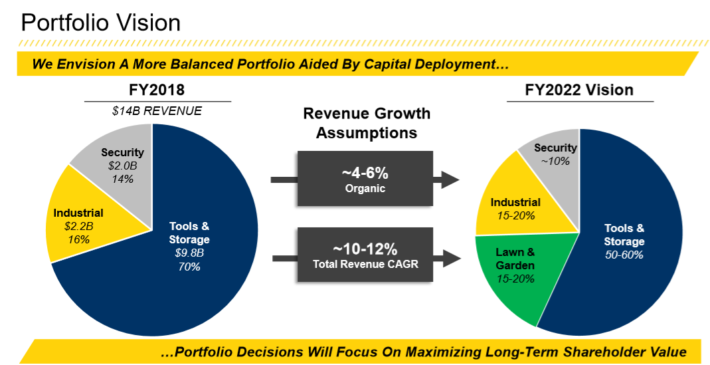

Source: Investor Presentation

Recent acquisitions have helped shape Stanley Black & Decker’s product portfolio. For example, in 2017 Stanley Black & Decker closed on the $1.95 billion acquisition of the Tools business of Newell Brands. This acquisition strengthened the company’s foothold in tools, and added the high-quality Irwin and Lenox brands to the product portfolio.

Not only that, but in 2017 Stanley Black & Decker also acquired the legendary Craftsman brand from Sears Holdings (SHLD) for $900 million. Both deals were immediately accretive to the company’s bottom line in 2017. The Craftsman brand is expected to add $1 billion in revenue by 2021.

Acquisitions continued in 2018. Last August (8/7/18) Stanley Black & Decker acquired International Equipment Solutions Attachments Group, or IES Attachments, for $690 million. This acquisition will add to Stanley Black & Decker’s presence in industrial markets. IES Attachments provides heavy equipment attachments tools for off highway applications. This division provides leading brands such as Paladin, Genesis and Pengo. Almost 60% of revenues for IES Attachments is related to aftermarket services.

Not yet done with acquisitions for the year, Stanley Black & Decker took a 20% stake in MTD Products for $234 million. MTD Products is a privately held manufacturer of outdoor power equipment. Stanley Black & Decker has the option to acquire the remaining 80% of MTD Products starting July 1st, 2021. The company expects that this investment could add as much as $0.10 to earnings-per-share in 2019.

For 2019, Stanley Black & Decker expects 4% organic revenue growth. Adjusted earnings-per-share are expected in a range of $8.35-$8.45. At the midpoint, this would represent 3.1% growth from the previous year.

The market has actually reacted positively despite the company’s reduced guidance, sending shares up by 7.8% since before the news broke. This reaction was likely due to a phase one deal in the ongoing U.S.-Chinese trade war as well as an improving economic outlook.

Stanley Black & Decker is also attempting to offset trade war headwinds with aggressive cost controls. The company is removing costs from its business, and with acquisition-related cost synergies, should see a positive benefit of $1.05 to earnings this year and hundreds of millions of dollars in total savings in the years to come.

Looking longer-term, management has a plan to continue growing into the next decade. By 2022, Stanley Black & Decker expects revenue to approach $20 billion, driven by a mix of organic growth, and growth from acquisitions. The company plans to invest more heavily in its Industrial segment, which is on track to generate 25% of total revenue by 2022.

Competitive Advantages & Recession Performance

Stanley Black & Decker’s main competitive advantages are its brand portfolio, and global scale. Innovation and scalability are at the core of the company’s growth strategy. It has a leadership position in each of its three product categories and its brand strength gives the company pricing power, which leads to high profit margins. Furthermore, it is relatively easy for the company to scale up its brands, thanks to distribution efficiencies.

To retain these competitive advantages, Stanley Black & Decker is constantly investing in product innovation. The company’s research & development expense is as follows:

- 2014 research-and-development expense of $174.6 million

- 2015 research-and-development expense of $188 million

- 2016 research-and-development expense of $204.4 million

- 2017 research-and-development expense of $252.3 million

- 2018 research-and-development expense of $275.8 million

That said, Stanley Black & Decker is not immune from recessions. Earnings declined significantly in 2008 and 2009. As an industrial manufacturer, Stanley Black & Decker is reliant on a strong economy and a financially-healthy consumer.

Stanley Black & Decker’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $4.00

- 2008 earnings-per-share of $3.41 (15% decline)

- 2009 earnings-per-share of $2.72 (20% decline)

- 2010 earnings-per-share of $3.96 (46% increase)

Despite the steep decline in earnings from 2007-2009, Stanley Black & Decker recovered just as quickly. Earnings-per-share increased another 32% in 2011, and reached a new high. Earnings have continued to grow in the years since.

Valuation & Expected Returns

Using the current share price of $166 and expected earnings-per-share for 2019 of $8.40, Stanley Black & Decker has a price-to-earnings ratio of 19.8. This is above the ten-year average valuation of 15.7 that the stock has held since 2008.

Stanley Black & Decker stock appears to be overvalued given that its price-to-earnings ratio is higher than its historical norm. If the stock’s valuation were to contract to met its historical average by 2024, investors would experience a meaningful 4.5% headwind to annualized total returns over this period of time.

Going forward, returns will therefore likely be comprised of earnings growth and dividends offsetting valuation multiple contraction. In the past 10 years, Stanley Black & Decker increased earnings-per-share by 8% compounded annually. Due to organic growth and acquisitions, we feel that this growth rate is sustainable.

The stock has a current forward dividend yield of 1.7%. Based on this, total returns would reach approximately 4.7% per year, consisting of earnings growth and dividends offsetting valuation multiple contraction. This is a fairly modest rate of return, meaning Stanley Black & Decker earns a hold recommendation.

Final Thoughts

Stanley Black & Decker is not a high-yield stock, but it has all of the qualities of a strong dividend growth stock. It has a top position in the industry, strong cash flow, and durable competitive advantages.

The company has a positive growth outlook, which bodes well for the dividend. The stock appears overvalued today, but at the same time it is very likely Stanley Black & Decker will continue to hike its dividend each year for the foreseeable future.

Since the stock is expected to produce mid single digit annualized total returns over the next five years, Stanley Black & Decker remains a hold–but not a buy at the current price–for long-term dividend growth investors.