Published on February 1st, 2021 by Nate Parsh

Every year, Sure Dividend reviews the Dividend Aristocrats, which we consider to be some of the best investments for investors seeking to build wealth. Companies who have attained Dividend Aristocrat status have met the following criteria:

- Are a member of the S&P 500 index.

- Have at least 25 consecutive years of dividend increases.

- Meet certain size and liquidity requirements.

Membership in this group is very exclusive, as there are just 65 stocks on the Dividend Aristocrats list.

We have compiled a list of all 65 Dividend Aristocrats, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can download the full list by clicking on the link below:

There are several new entries following dividend increases in 2020, one of which is utility giant NextEra Energy, Inc. (NEE).

This article will discuss NextEra Energy’s business model, growth prospects, and valuation to determine whether it is an attractive stock for income investors right now.

Business Overview

With a market capitalization of $158 billion, NextEra Energy has grown into one of the largest utility companies in the world since its founding in 1925. While the company does have nuclear power plants in Iowa, New Hampshire and Wisconsin, it is in Florida where NextEra Energy has the vast majority of its business.

The company consists of three operating segments, including: Florida Power & Light, NextEra Energy Resources and Gulf Power. NextEra Energy’s Florida Power & Light and Gulf Power segments are rate-regulated electric utilities that serves more than 5.6 million customer accounts in Florida.

NextEra Energy also owns 83% of NextEra Energy Partners LP (NEP), a Master Limited Partnership that owns, operates, and acquires contracted clean energy projects. You can see NEP featured in our top MLP list here.

NextEra Energy is the largest generator of wind and solar energy in the world. The company receives around two-thirds of adjusted earnings from its electric utility business, with the renewable energy business providing the remainder.

On January 26, 2021, the company recently reported earning results for the period ending December 31, 2020.

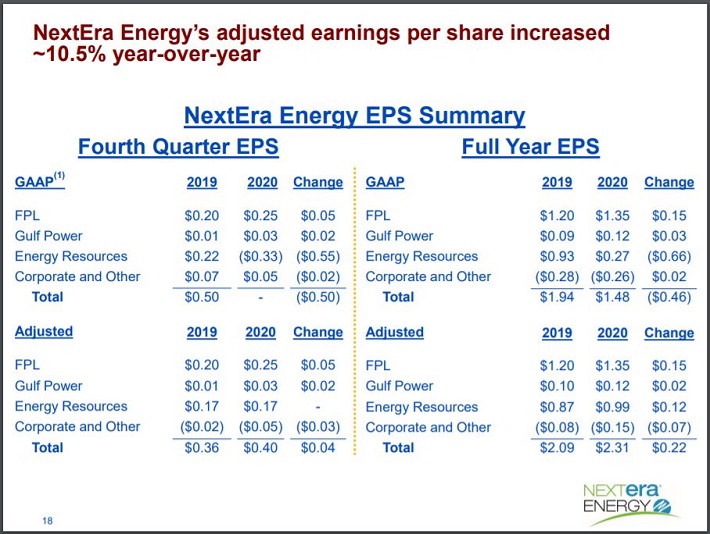

Source: Investor Presentation

For the quarter, revenue declined 4.2% to $4.39 billion, which was $1.32 billion less than expected. The company had a net earnings loss of $5 million which compared unfavorably to $975 million of earnings in the previous year. Adjusting for a $1.2 billion impairment charge on investments in the Mountain Valley Natural gas pipeline, earnings for the fourth quarter totaled $785 million, or $0.40. per share. This was an 11.1% increase in earnings-per-share from the prior year.

For the full year, adjusted earnings-per-share increased 10.5%.

NextEra has proven very successful at growing earnings-per-share over the long-term. From 2011 through 2019, adjusted earnings-per-share have increased with a compound annual growth rate of 6.7%.

Growth Prospects

NextEra benefits from several key factors that should enable the company to continue to grow. The company’s utility business is well-positioned to capture new customers as it resides in one of the largest states in the country. Florida’s population also continues to grow, which should provide the company the potential for additional customers.

NextEra is also located in state that is very constructive in its regulation of utilities. This allows the company to recover much of its investments in new projects. For example, Florida Power & Light, along with Gulf Power, notified regulators earlier in the year that it would seek annual base rate increases of $1.1 billion in 2022, $615 million in 2023 and $140 million in 2024 as it seeks to invest in projects.

Despite the massive annual base rate increases, rates for the average customers are only expected to grow 3.7% over the next four years. The company’s enormous customer base allows it make massive investments without resulting in extremely high base rate increases.

What really sets NextEra apart from its peers is the company’s renewable energy business. This business is growing at a much faster pace.

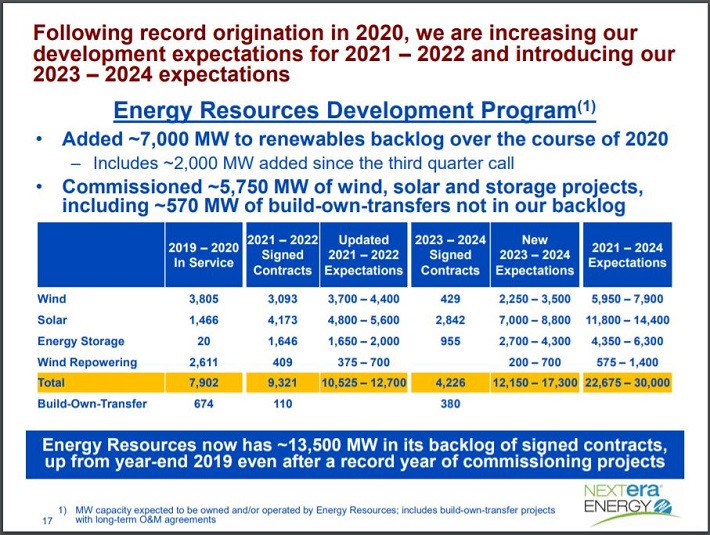

Source: Investor Presentation

NextEra Energy Resources added almost 7,000 megawatts to its backlog last year, with 2,000 MW of this occurring the fourth quarter alone. In total, the company has approximately 13,500 MW in its backlog. For context, NextEra has placed into service just 7,902 megawatts of projects over the last two years. The company expects to bring online 22,657 to 30,000 megawatts between 2021 and 2024. This includes expected growth in battery, which comprises very little of the company’s current renewable energy portfolio, but should play a significant role in the future.

It’s not just the NextEra Energy Resource segment that is focused on clean energy. Florida Power & Light has a stated goal of building 10 gigawatts of solar by 2030. The goal for this business is to have nearly 20% of its energy mix be solar.

Demand for clean energy continues to grow and, as the largest name in this space, it is likely that NextEra Energy will be able to take advantage of this over time.

Competitive Advantages & Recession Performance

Size and scale are NextEra’s chief competitive advantages. As stated previously, no other company in the world can claim a larger renewable energy business. Also bolstering the company’s business is a very large customer base that appears to show no signs of slowing.

To these we can add NextEra’s penchant for making strategic acquisitions. The company purchased Florida City Gas from Southern Company (SO) in 2018 for $530 million in cash. This transaction was completed in July of 2018 and added 110,000 residential and commercial natural-gas customers and 3,700 miles of natural gas pipelines to NextEra Energy.

The company followed that up with its 2019 purchase of Gulf Power, also from Southern Company, for $6.475 billion. This purchase price also includes the assumption of $1.5 billion of Gulf Power debt. Gulf Power added $0.12 to adjusted earnings-per-share in 2020 and both acquisitions are expected to add $0.20 to 2021 adjusted earnings-per-share. Considering analysts expect that NextEra Energy will produce adjusted earnings-per-share of $2.51 in 2021, this is no small contribution.

Utility companies are often viewed as reliable investments given the steadiness of their revenues and earnings. This makes these stocks especially attractive to investors in uncertain times. NextEra Energy is no different and performed very well during the last recession. Listed below are the company’s earnings-per-share before during and after the last recession:

- 2006 earnings-per-share: $0.81

- 2007 earnings-per-share: $0.82 (1.2% increase)

- 2008 earnings-per-share: $1.02 (24.4% increase)

- 2009 earnings-per-share: $0.99 (2.9% decrease)

- 2010 earnings-per-share: $1.19 (20.2% increase)

NextEra did suffer a slight drop in earnings-per-share in 2009, but overall saw its bottom-line grow almost 21% during one of the most adverse economic periods in recent memory.

At the same time, the company’s dividend continued to grow. Listed below are NextEra Energy’s dividend-per-share for the same period:

- 2006 dividends-per-share: $0.38

- 2007 dividends-per-share: $0.41 (7.9% increase)

- 2008 dividends-per-share: $0.45 (9.8% increase)

- 2009 dividends-per-share: $0.47 (4.4% increase)

- 2010 dividends-per-share: $0.50 (6.4% increase)

Dividend growth did slow in 2009 compared to the prior years, but ramped up the very next year. NextEra’s dividend has compound at rate of 9.8% over the last decade.

The company announced a 12% increase for the March 16, 2020 payment date, giving NextEra the 25 consecutive years of dividend growth needed to join the Dividend Aristocrat index. Shares currently yield 1.7%.

Valuation & Expected Returns

Shares of NextEra Energy closed the January 29, 2021 trading session at $80.87. Based on expected adjusted earnings-per-share, the stock has a price-to-earnings ratio of 32.2. NextEra Energy has a 10-year average price-to-earnings ratio of 18.1, though the average multiple has expanded to more than 22 times earnings-per-share over the last five years.

We feel that a five-year target multiple of 20 times earnings-per-share more properly values the company, as this is still a premium to most peers in the sector and accounts for NextEra’s leadership position in renewable energy.

Our target multiple implies that multiple reversion could be significant in the coming years. Shareholders could see valuation reduce expected total returns by 9.1% through 2026 if the stock were to trade with our target price-earnings ratio.

Fortunately, earnings growth and dividend yield will also contribute to total returns. We believe that the company’s extensive renewable portfolio, in addition to its growth prospects and competitive advantages, will allow NextEra to grow at a rate of 7% per year over the next five years.

Annual returns will consist of the following:

- 7% earnings-per-share growth

- 1.7% dividend yield

- 9.1% multiple reversion

In total, we expect that NextEra Energy will offer a total annual return loss of 0.4% through 2026.

Final Thoughts

There are a high number of positives that investors should find in NextEra Energy. The company’s size, ability to thrive in recessionary times, and dividend history are just three items we find very attractive about the company.

NextEra Energy is also located in a state that we believe to be very constructive for approving rate base increases. Florida’s population also continues to grow, which should provide for additional customers.

The company also is very adapt at making solid additions to its core business through acquisitions. We expect that this will be the case in future years as NextEra augments its organic growth with strategic additions.

Lastly, NextEra’s leadership position in the renewable energy space cannot be overstated. The company is blessed with an extremely large backlog that dwarfs projects put into service over the last two years. Expected deals will only increase the backlog. The renewable energy business is what separates the company from all others.

Unfortunately, the market has bid up shares of NextEra Energy to a valuation that is higher than even the stock’s own elevated average. Therefore, NextEra Energy receives a sell recommendation from Sure Dividend due to negative projected returns over the next five years. At a lower price, we would find the stock a much more attractive investment.