Published December 12th, 2019

This is a guest contribution from Sean O’Reilly, Co-Founder and CMO of KingsCrowd. The stock market has ratings agencies like Moody’s, Morningstar, and S&P — KingsCrowd is a ratings and research platform for private markets.

Investors have a greater choice today than ever before. And it’s also no exaggeration to say that the amount of information about potential investments far surpasses any other time in history.

But how many quality investments are out there for retirees? All of a sudden, the question becomes far more difficult. Historically, those at or near retirement have followed the tried-and-true method of investing in a mix of income-producing securities (stocks and bonds). Say, 60% dividend-paying stocks and 40% bonds. Such a blend gave the investor a solid mix of capital growth, stability, and current income. Unfortunately, with interest rates still at record lows and the stock market at record highs, that rule is quickly being thrown out the window.

Investors have no choice.

The simple fact of the matter is that at a time when we have more information about our investments than ever before, the number of investment options at our disposal to generate current income and long-term inflation-beating growth has never been lower.

Therefore, I’m here today to suggest something radical: Private markets.

By the time I’m through, you’ll see that while the 60-40 Rule might be about to go the way of the dodo bird your ability to put your money to work, providing for your financial future has never been more alive.

Dividends Are Valuable Because They Aren’t Tied to the Stock Market

Why do retirees invest in things like dividend stocks and income-producing bonds?

Because they pay money, of course.

But it’s more than that, isn’t it? After all, investing in top growth-names like Facebook (FB) or Apple (AAPL) in recent years would have “paid” you far more money than even the top dividend-names out there: You just have to sell the stock in question when you need to pay the electric bill or to take that cruise.

So really, we don’t invest in dividend stocks because they pay investors money. We invest in them because they provide a return independent of what the stock market does.

Obviously, for anyone trying to enjoy their golden years, this point is key. Dividend stocks represent the ultimate instance of “having your cake and eating it too.” You get current income that’s uncorrelated with the stock market’s gyrations and, as history has shown, stand to slowly see capital appreciation and dividend increases.

Not a bad deal.

This brings us the situation facing today’s retirees. Starting in 2011, 13,000 Baby Boomers started retiring every day. When all is said and done, 77 million Boomers will shift away from their working years and towards (hopefully) enjoying their retirement.

Yet, as I’ve already hinted, these 77 million Americans have a shortage of what we’ll call “ideal” investment options. A 30-Year U.S. Treasury Bill yields just 2.25% (Fun fact: As I write this a 30-Year German Bund yields just 0.21%, while the 2-Year Bunds have negative yields of 0.65% per year – incredible). You’re lucky to get 5% off a corporate bond. And the stock market has been on a tear, sitting at record highs as of December 2019:

Image Source: Bloomberg.

And the yield on the S&P 500? A paltry 1.8%. The stock market’s bull run has seen to it that even those retirees willing to accept stock market volatility won’t make much in the way of current income.

Of course, all is not lost.

There are many fine stock market sites that parse out higher-yield stocks worthy of your nest egg’s commitment (suredividend.com being one of them). But not all these stocks will grow forever — and for Boomers looking at a life expectancy that could easily stretch into the 90s, growth of capital is just as important as current income.

Don’t worry, I have the solution.

The US Economy is More Than Just the Stock Market

Ok, you’ve waited long enough to hear my radical solution: Investing in startups.

Wait, wait, don’t go anywhere. At least hear me out… I promise it will be worth it.

First, let’s review. Everyone’s goal is to have enough money to retire on and have enough money coming in from your investments, Social Security, etc..to enjoy our golden years. Assuming you’ve managed your money and saved reasonably well, I’m going to assume #2 is at least on track to be accomplished.

This leaves us with #1 to worry about: Growing your capital in the decades ahead.

I won’t bore you with statistics on inflation or speculate as to what the future holds. Back when inflation reached 13% per year in the 1970s I wasn’t even born yet. But I do know economic history, and I know that everyone still needs to make money off their money.

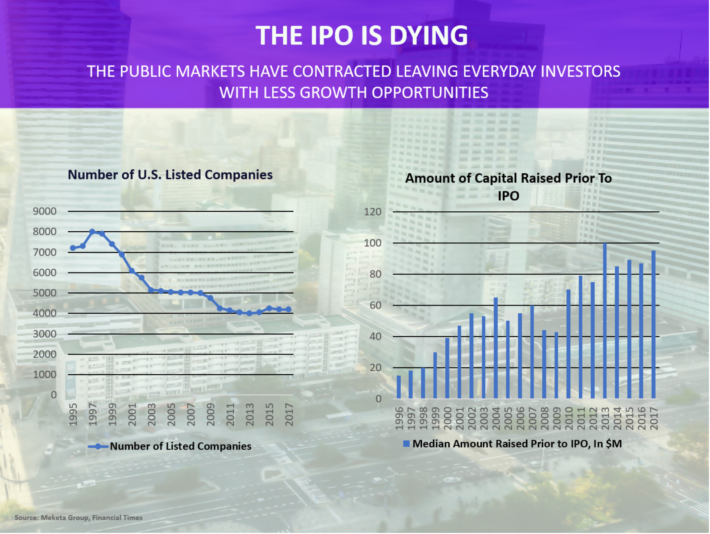

And this comes at a time (as previously discussed) when the stock market itself (as measured by the number of publicly traded companies) is literally shrinking:

Source: KingsCrowd.

What most traditional stock market investors don’t realize is that big things are happening in the private markets. And I’m not just talking private equity and venture capital. I’m referring to equity crowdfunding — a way for literally anyone to invest as little as $100 in fast-growing startups. The companies that could arguably be the dividend stocks of tomorrow.

Thanks to the Jobs Act of 2012 (which was fully enacted in 2016) everyone has the opportunity to invest like a venture capitalist in the highest growth asset class that exists: Startups.

And while many startups fail, others go on to become incredible successes. The equity crowdfunding market, despite its youth, has already seen multiple companies go on to astounding success.

- Early Equity Crowdfunding Investors in software startup Zenefits have seen their investment rise an incredible 20,600% since the company first raised from the crowd in May 2013.

- Delivery startup Rappi has delivered a 12X return to investors that first invested via “The Crowd.”

- Had you invested in 21st-Century background-check leader Checkr via its October 2015 crowdfunding raise you’d be up 3,000% today.

Am I suggesting that retirees and soon-to-be retirees bet their nest egg on the next hot startup? Absolutely not.

But do I think it’s worthwhile to contribute a small percentage of one’s ones investment portfolio to a few promising ventures as an addition to a stable, income-producing dividend portfolio? You bet.

Last month, almost $11 million was invested in dozens of exciting new startups. And since it was born, the equity crowdfunding market has garnered over $1 billion in investment.

Best of all, finding these promising startups worth investing growth-capital in is easier than ever with Kingscrowd’s ratings and research.