China’s $440 Billion Bet on Nuclear Energy

Key Points

- China will commit $440 billion to nuclear energy

- The country will build 150 nuclear plants in the next 15 years, and aims to be carbon neutral by 2060

In the wake of the Russo-Ukrainian conflict, nuclear energy has been revitalised as a key pathway for taping off fossil fuels. China in particular has doubled down, entrusting its energy plan for 2025 to its nuclear technology and committing to building at least 150 nuclear plants in the next 15 years. That is more than what the rest of the world has managed in the past 35 years.

1. Background

The country is expected to overtake the United States and France to become the largest operator of nuclear power in the world by 2030. This is off the back of massive support from the central government, as they singled out atomic power as the only energy form with specific interim targets in its official five-year plan. China’s energy plan highlights the need for energy supply chain security and the role of nuclear in China’s green, low-carbon energy transition, which aims to hit peak carbon emissions by 2030 and become carbon neutral by 2060.

In the shorter term, China aims to have 70 gigawatts (GW) of installed nuclear capacity by 2025, up from 51GW at the end of 2020, after failing to meet its previous target of having 58GW installed capacity by 2020. In addition, the chairman of the state-backed China General Nuclear Power Corporation projected the longer-term goal: 200GW by 2035, enough to power more than a dozen cities the size of Beijing.

This move comes in spite of many other countries turning to alternate sources of renewable energy. With the US only planning construction for 2 nuclear reactors compared to China’s 46. Some countries have even chosen to move away from nuclear energy. e.g. Belgium will shutting down all seven of its nuclear reactors by 2025 and Spain will start a nuclear power phase-out in 2027.

2. Why?

Coal has been the dominant source for China over the past decades, and while the Russo-Ukrainian Invasion exacerbated the reliance of raw materials from that region, the government’s emphasis to wean off this dependence came long before this year.

China is by far the world’s largest contributor of carbon dioxide emissions. Gas consumption in 2020 is expected to exceed 300 billion cubic metres according to China National Petroleum Corp, and cutting down China’s pollution while continuing to grow the economy is a difficult balance to maintain. This is why nuclear energy makes sense in this transitory period.

Coal has been shown to be a large logistical challenge. Most of China’s reserves are in the north or northwest and require nearly half the country’s rail capacity is used in transporting coal. Hence generating electricity continues to be a significant contributor to air pollution.

Desalination is an important part of China’s long-term water strategy – the country currently produces about 7 million m3 per day of desalinated water, about 7.5% of the world’s total. The country lacks fresh water and continuing to devote vast amounts of underground water resources to improve coal-fired power plants efficiency, as well as producing increased amounts of saline waste, would be unwise. It’s easy to see the reasoning behind China’s massive push for nuclear energy.

3. Development

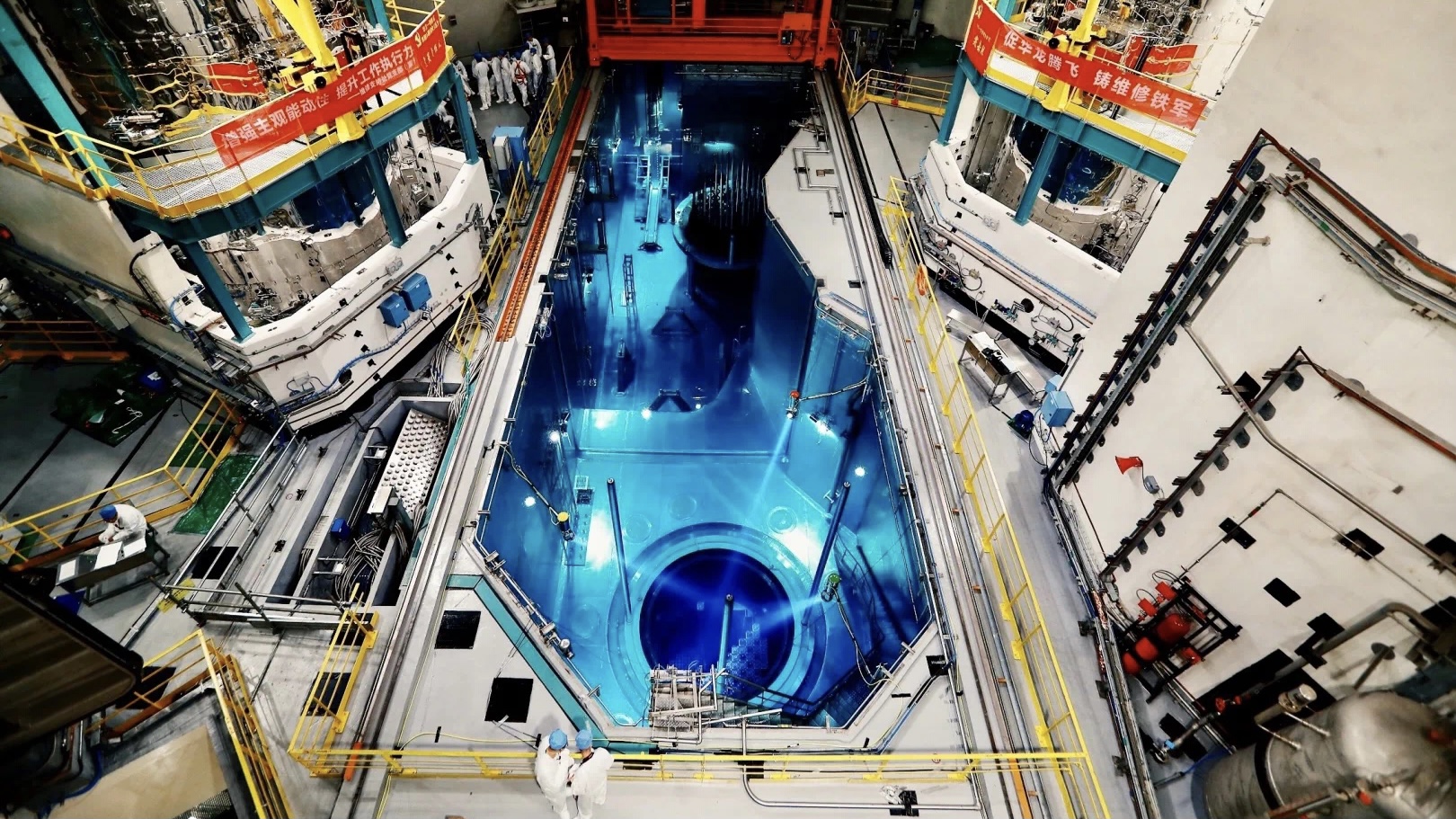

China has had a reputable positive record with regards to nuclear technologies, which were kicked off in the mid-70s. Its third-generation Hualong One water nuclear reactor design has already been well implemented. Crucially, this means that the cost of nuclear power in coastal China is competitive with coal power, and about half the cost of building new nuclear units in the US, UK or France, according to energy data company Wood Mackenzie.

The two main challenges are keeping the temperature over 100 million degrees Celsius and operating at a stable level for a long time; and there seems to be emerging success in this field.

The Experimental Advanced Superconducting Tokamak (EAST), a nuclear fusion reactor research facility, ran at 70 million degrees Celsius for as long as 1,056 seconds, after EAST achieved another milestone in May, running at a plasma – or hot gas – temperature of 120 million degrees Celsius for 101 seconds.

4. International Recognition

China’s confidence in their technology comes internationally as well. In February 2022, UK regulators signed off on the design of the UKHRP1000 nuclear power for use. Bradwell B, the proposed newest nuclear plant, is based primarily on the Hualong One power plant mentioned before.

This comes despite significant attempts by UK politicians to push back Chinese involvement in the country’s infrastructure. Last year, the UK government introduced a new funding programme designed to attract private investors in Britain and elsewhere to invest in nuclear projects in Britain and discourage Chinese investment in those projects.

5. Conclusion

In conclusion, nuclear energy is an industry with no ceiling in China. It continues to gain the unwavering support of the central government as its world-leading technologies continue to pave the path towards the ultimate prize – sustainable, unlimited clean energy.

Disclaimer: Our content is intended to be used solely for informational and educational purposes, and not as investment advice. Always do your research and consider your personal circumstances before making investment decisions. ChineseAlpha is not liable for any losses that may arise from relying on information provided.

Source chinesealpha