Updated on December 11th, 2019 by Bob Ciura

In 2019, California Water Service Group (CWT) raised its dividend for the 52nd year in a row. Therefore, it is one of the extremely few companies that have become Dividend Kings, i.e., companies that have grown their dividends for at least 50 years. You can see all 27 Dividend Kings here.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index, among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

There are currently 27 Dividend Kings, including California Water Service Group.

CWT stock flies under the radar of most investors. It has a fairly low current yield of 1.5%, which might make the stock unappealing for income investors, relative to the broader utility sector. Many of CWT’s utility peers have significantly higher yields.

The company makes up for a lower current yield with higher dividend growth than many other utilities, including its 5% raise in 2019. And, CWT has a very long history of steady dividends. In fact, its next dividend payment will be its 300th consecutive quarterly dividend, which amounts to 75 straight years of uninterrupted payouts.

Shares of CWT have also registered impressive price returns in recent years. Over the past five years, CWT generated total annual returns of 18.2% per year, compared with 9.9% for the Utilities Select Sector SPDR ETF (XLU).

However, the downside of CWT’s rising share price is that the stock appears very overvalued today. Even with solid dividend increases each year, in our view dividends are not likely to make up for the negative impact from overvaluation.

Business Overview

CWT is one of the largest publicly-owned water utilities in the United States, with a market capitalization of $2.5 billion. It has six subsidiaries, which provide water to about two million people in California, Washington, New Mexico, and Hawaii. California Water Service was founded in 1926. Last year, the company generated operating revenue of nearly $700 million.

California Water Service reported its third quarter earnings results on November 1. The company reported that its revenues totaled $233 million during the quarter, which was 5.1% more than the revenues that California Water Service generated during the previous year’s quarter. California Water Service beat the analyst consensus estimate for its revenues by $8 million, or close to 4%.

Source: Earnings Slides

California Water Service generated earnings-per-share of $0.88 during the third quarter, which missed the analyst consensus by $0.09 per share. Still, California Water Service’s earnings-per-share during the third quarter of fiscal 2019 were 17.1% higher than its earnings-per-share during the previous year’s quarter, which is a quite attractive growth rate.

Growth was fueled by revenue growth that were up year-over-year, while operating leverage allowed for some additional earnings growth. Specifically, rate increases were the major driver of the company’s profit growth last quarter. California Water Service’s net income increased by $6.2 million last quarter. Rate increases accounted for $6.1 million of net income growth last quarter. An unbilled revenue accrual boosted profits by $5.5 million. Offsetting profit growth were higher interest expense, depreciation, wage expenses, and property taxes.

Growth Prospects

Utilities are typically slow-growth companies. Due to the enormous amounts they spend on infrastructure, most utilities carry excessive amounts of debt and thus bear high interest expenses every year. Therefore, they rely heavily on the regulatory authorities to approve gradual rate hikes year after year.

These rate hikes secure the servicing of the debt but they tend to result only in single-digit growth of the revenues and the earnings per share in the long run.

Source: Earnings Slides

Regulatory authorities always try to secure rate hikes in order to encourage utilities to spend large amounts on capital expenses, which are required for the maintenance and the expansion of the utility network. On the other hand, authorities also do their best to satisfy consumers and thus tend to limit the magnitude of the rate hikes.

If the settlement agreement is approved, the company’s Cal Water subsidiary would be authorized to include in rates $609 million to $628 million of new projects in 2019 to 2021, along with roughly $200 million for completion of additional projects from recent years.

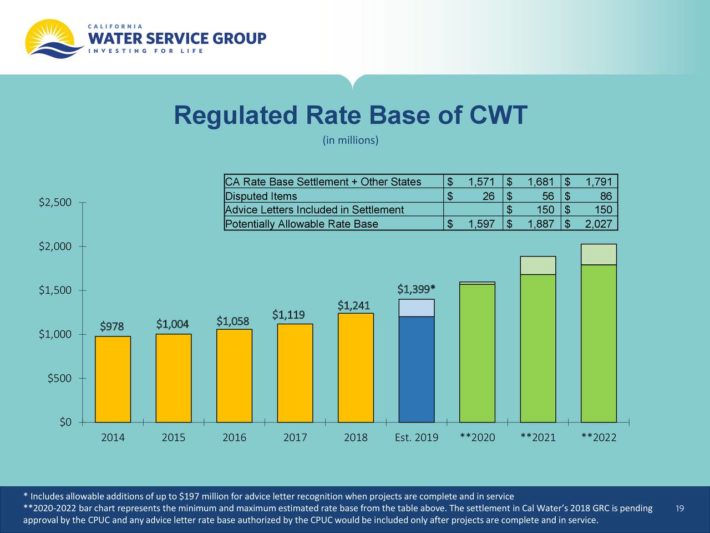

Nevertheless, despite the above negative factors, CWT still expects to see its regulated rate base rise this and next year.

Source: Earnings Slides

Continued increases in the rate base will provide a high likelihood of positive earnings-per-share growth for CWT. As a result, analysts expect the company to grow its earnings per share by 13.6% for 2019, and by 7.5% next year. We typically prefer to be more cautious with earnings growth expectations than the consensus analyst estimates, so we are projecting 4% annual EPS growth for the company over the next five years.

Competitive Advantages & Recession Performance

As mentioned above, utilities invest enormous amounts on the maintenance and the expansion of their network. As a result, it is almost impossible for a competitor to enter the market and make a meaningful profit. Therefore, like most utilities, CWT enjoys a wide moat in its business.

In addition, as recessions do not affect the amount of water that people consume, CWT is completely unaffected by recessions. To be sure, during the Great Recession, when most companies saw their earnings collapse, CWT exhibited resilient performance. Its earnings per share during the Great Recession were as follows:

- 2007 earnings-per-share of $0.75

- 2008 earnings-per-share of $0.95 (27% increase)

- 2009 earnings-per-share of $0.97 (2.1% increase)

- 2010 earnings-per-share of $0.90 (7.2% decline)

Therefore, not only did the company not see its earnings per share decline in 2008 or 2009, it also increased EPS by 27% in 2008 and 2% in 2009. Earnings fell in 2010, but the company resumed earnings growth thereafter. As a result, it can be concluded that CWT is a highly recession-resistant company.

This should not be surprising, as resilience during economic downturns is one of the most attractive qualities for utility stocks. The simple fact that water is necessary to sustain human life provides a relatively high level of certainty to CWT’s profit generation. Everyone needs water, during good economies and bad, which means the company should see a high level of profits, even in a recession. CWT’s resilience to recessions has been a key factor in its extremely long history of dividend increases.

Valuation & Expected Returns

Utilities are slow-growth stocks and as a result, typically do not hold high stock valuations. But this is not the case when it comes to the smaller group of water utilities. Many, including CWT, trade at elevated valuations. One explanation for their high multiples could be their outsized growth potential, relative to the broader utility sector.

Nevertheless, CWT’s high valuation is a significant concern. If investors overpay for a stock, it may take them several years only to breakeven. Therefore, while investors may make compromises in the premium they pay for high-growth stocks and in some cases might still enjoy great returns, they should pay particular attention to the valuation of utility stocks before buying.

CWT is no exception in this rule. We expect the company to generate earnings-per-share of $1.38 in 2019. As a result, CWT stock is currently trading for a 2019 price-to-earnings ratio of 37, which is excessive for a utility stock. Our fair value estimate is a price-to-earnings ratio of 20, which is much closer to the historical average valuation. Therefore, a declining valuation multiple could be a significant reduction in total shareholder returns going forward.

Thanks in part to the low prevailing interest rates, the stock has performed extremely well for an extended period. Shares of CWT have more than doubled in price in the past five years. But CWT’s diluted earnings-per-share of $1.36 in 2018 were only 14% higher than EPS of $1.19 in 2014. Consequently, it is evident that the outperformance of the stock was due mostly to an expanding valuation multiple rather than underlying EPS growth.

Moreover, after years of record-low interest rates, CWT’s stock price increase has resulted in a bloated valuation, and a reduced dividend yield. Stock prices and dividend yields move in opposite directions. As CWT’s stock price soared in recent years, its dividend yield has fallen to 1.5%, well below the dividend yields available from many other utility stocks.

At the same time, CWT has taken on significantly higher amounts of debt. The company ended 2018 with a long-term debt ratio of 52.7%, up from 44.5% in 2015.

We believe fair value for CWT is a price-to-earnings ratio of 20. Using 2019 earnings guidance, this would represent a share price of $28. This price is significantly below CWT’s current share price above $51, which implies significant downside risk. If it took five years for the P/E ratio to decline to our estimate of fair value, the contracting valuation would reduce annual returns by approximately 11.6% each year. As a result, even assuming 4% earnings growth, and a 1.5% dividend yield, total annual returns would be negative, to the tune of 6.1% per year. A negative expected return gives the stock a sell recommendation from Sure Dividend.

The dividend payout ratio remains very healthy, at 57% expected in 2019. This is a healthy payout ratio. Therefore, the company has ample room to continue to raise its dividend for years. Nevertheless, while utility stocks usually offer remarkable dividend yields, the lofty valuation of CWT has resulted in a current dividend yield of just 1.5%, which is certainly lackluster for a utility.

Investors interested in learning more about the company’s dividend safety can watch the following video for a detailed analysis:

As utilities are characterized by moderate growth, they tend to raise their dividend at a modest pace. CWT has raised its dividend at an average annual rate of 4% per year during the last five years. Therefore, while CWT has an exceptional dividend growth streak, the combination of its current dividend yield and its dividend growth rate are not appealing right now.

Final Thoughts

Thanks to its reliable free cash flows, which are secured by the rate hikes that are approved by regulators, CWT has an exceptional dividend growth record. It has paid nearly 300 quarterly dividends without interruption, and has raised its dividend for over 50 years in a row. In addition, thanks to its healthy payout ratio, it is likely to continue to raise its dividend for years.

Nevertheless, CWT’s underlying earnings growth has not kept pace with its soaring stock price over the past several years. The result is that today, the stock appears to be significantly overvalued. We believe shareholders buying at the current price are likely to lose money over the next five years. We recommend investors to wait for a sustained decline in CWT’s share price to obtain a much better entry point.