Updated on May 6th, 2021 by Nikolaos Sismanis

Burgundy Asset Management was founded in 1990 and began investing for clients in 1991. The Burgundy region of France inspired the name “Burgundy”. This area of France is known for producing high-quality wines in the world. Burgundy currently has offices in Toronto, Montreal, and Vancouver, Canada.

Tony Arrell co-founded the firm. He recognized the firm’s focus on quality-value investing and long-term thinking. He joined Burgundy as Chairman and CEO in 1993.

Tony Arrell holds a Bachelor of Science degree from the University of Guelph. He also holds a Master’s degree in Business Administration from York University. Mr. Arrell has more than 50 years of professional experience, which includes Gardiner Watson Ltd, Wood Gundy, and Midland Walwyn.

The Fund currently administers over $22.3 billion in Assets Under Management (AUM).

Following the company’s 13F filings over the last three years (from mid-February, 2018, through mid-February 2021), investors would have generated a total return of around 11.70%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Burgundy Asset Management’s current 13F equity holdings below:

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Burgundy’s Investing Strategy

- Burgundy’s Portfolio & 10 Largest Equity Holdings

- Final Thoughts

Burgundy’s Investing Strategy

The fund’s goal is to preserve and grow its client’s capital over the long term. It focuses on buying undervalued high-quality companies to hold for the long term. Burgundy’s investment approach has three core components.

- Focus on research

- Remain patient

- Invest globally

Burgundy narrows down global investment options and only focuses on companies that fit its “circle of competence.” The Fund uses a qualitative and quantitative research methodology. Some of the qualitative research techniques include interviewing the management teams, site visits, and talking to customers and industry experts.

The fund analyzes financial statements, tests balance sheet strength, and identifies and forecasts key operating metrics for quantitative research.

Burgundy uses these same strategies and applies them globally. This helps the firm to obtain the necessary experience and insight to allow Burgundy’s team to create a global perspective.

Once both qualitative and quantitative analyses have been completed, the firm focuses on the valuation assessment and determines the investments’ intrinsic value. Burgundy prefers to have concentrated investment portfolios with approximately 25-40 holding per regional geography.

The firm has developed its skills progressively since its inception. It initially started with a Canadian equity strategy and finally built a policy in the emerging markets.

Burgundy’s Portfolio & 10 Largest Equity Holdings

As of February 2021’s 13F filing, Burgundy’s portfolio comprised 105 equities, with a total market value of $9.5 billion.

During the period covering Burgundy’s latest 13F filing, the fund initiated and exited the following stocks:

New Buys:

- Equifax Inc. (EFX)

- Synnex Corp (SNX)

- EMCOR Group, Inc. (EME)

- CRA International Inc. (CRAI)

- Points International Ltd (PCOM)

- Brookfield Infrastructure Partners L.P. Subordinate Shares (BIPC)

- Gartner, Inc. (IT)

- Thomson Reuters Corp. (TRI)

New Sells:

- Brookfield Property Partners L.P. (BPY)

- United Fire Group, Inc. (UFCS)

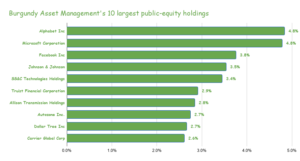

The firm’s top 10 holdings constitute the following stocks, with no single investment accounting for more than 4.8% of the total portfolio’s weight.

Source: 13F filings, Author

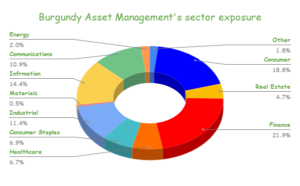

The portfolio is not only well-diversified in terms of the weight of each capital allocation, but also from a sector angle as well. No sector accounts for more than 22% of the total holdings, with the most capital allocated in companies operating in finance.

Source: 13F filings, Author

Source: 13F filings, Author

The company’s 10 largest individual holdings are the following:

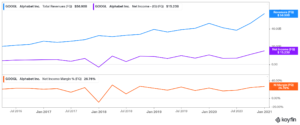

Alphabet Inc. (GOOGL) (GOOG):

Alphabet is Burgundy’s largest holding, accounting for around 4.8% of its portfolio. The parent company of Google is one of the more reasonably-priced growth equities. Alphabet has been expanding its top and bottom line with great consistency, yet only trades at around 30 times its next year’s net income.

Admittedly, Alphabet’s performance faltered temporarily in the very first months following the pandemic’s outbreak. However, the company returned quite rapidly back to its growth trajectory, with both revenues and net income hitting new all-time highs of $56.9 billion and $15.26 billion, respectively in its Q4 results. The company showcases net margins north of 20% consistently, which translates into a great margin of safety against short-term hurdles when it comes to retaining profitability.

Due to its robust profitability, Alphabet has amassed a cash and cash equivalents position of $136 billion. Therefore, the company can easily afford to burn up cash for its long-term bets, such as Waymo, and in the meantime reward its shareholders with strong capital returns. Alphabet has repurchased nearly $32 billion worth of stock over the past year, retiring shares at an all-time high rate.

Burgundy Capital has been holding shares since 2018, adding to its position occasionally. It trimmed its stake by 34% last quarter, likely for diversification reasons, being its largest holding.

Microsoft Corporation (MSFT)

Microsoft can be found among the top holdings of multiple funds we have covered over time. It is Burgundy’s second-largest position, accounting for 4.8% of its portfolio. The company has been proliferating across every direction of the tech sector, with leading internet infrastructure and its numerous office applications and various other SaaS.

Its latest quarter registered another profitability record, producing a net income of $15.46 billion. The fund has been holding shares from as early as 2004, which means that it has enjoyed the entirety of the stock’s prolonged rally.

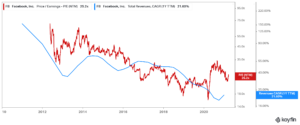

Facebook, Inc. (FB):

Facebook is Burgundy Capital’s third-largest holding, with its ~$354 million-worth position accounting for 3.8% of the total portfolio. While the company has been unique in its ability to draw an adversarial reputation, its financials are world-class, with lush margins and confident catalysts ahead. The company has no long-term debt on its balance sheet and $62 billion of cash to fuel its forthcoming ventures.

The pandemic has boosted Facebook’s engagement metrics, which has attracted more advertisers, expanding Facebook’s turnover. The company delivered an all-time high revenue and net income of $28.07 billion and $11.2 billion, respectively. Facebook remains one of the most cheaply valued growth stocks out there, still retaining 20%+ revenue growth, but trading at a forward P/E of just 25.

Facebook has been a part of Burgundy Capital’s portfolio since Q4-2018. The position was trimmed by 25% quarter-over-quarter, similar to most of Burgundy’s positions during this period.

Johnson & Johnson (JNJ):

The company’s largest, and only significant pure healthcare play, is the industry giant Johnson & Johnson, which the company also trimmed quite considerably, by around 32%, in order to rebalance its portfolio. Counting 58 years of consecutive dividend increases, the company is a Dividend Aristocrat and also a Dividend King.

J&J has displayed financial resilience throughout several decades and numerous recessions. As a result, the stock provides a magnificent combination of income and growth and is universally considered quite a solid investment in the sector.

The company recently posted its Q1-2021 results, reaching a new all-time high revenue of $22.48B. Despite the ongoing pandemic, the company once again displayed its capability to produce resilient (and growing) financials. The stock currently yields around 2.5%, slightly lower than its historical average.

SS&C Technologies Holdings (SSNC):

SS&C Technologies is not that well-known amongst investors, but its software-enabled solutions can be found integrated with various financial and healthcare institutions. The company has recently been rapidly expanding its revenues while also focusing on growing its distributions due to higher profitability levels.

Dividends have grown at a 5-year CAGR (compound annual growth rate) of 17.7%, while the payout ratio currently stands at a comfortable 14% of the company’s underlying net income generation.

The fund held its position in SS&C quite steady, only marginally adding 15.5K shares during the quarter.

Truist Financial Corp (TFC):

Truist Financial is Burgundy’s largest financial holding, making up around 3% of its total holdings. Despite the challenges of COVID-19, which slightly compressed the company’s EPS, Truist continued growing its dividend payouts. Dividends per share have grown by a 5-year CAGR of 10.76%. Considering the juicy yield of 3%, double-digit dividend growth, and its comfortable payout ratio of 43%, the stock offers qualities that dividend growth investors may find quite attractive.

The fund also trimmed its position by 27% on this one.

Allison Transmission Holdings (ALSN)

Allison Transmission mainly manufactures tactical U.S. defense vehicles worldwide. As a result, its revenues are relatively secured and predictable. The company managed to remain profitable throughout 2020, despite its capital-intensive business. The dividend was increased by 13.3% during 2020, while the company announced another 12% dividend increase in February to a quarterly dividend rate of $0.19 for this year. The stock currently yields around 1.8%.

Burgundy held its position steady throughout the quarter, selling just under 24K shares, or less than 1% of its total exposure.

AutoZone Inc. (AZO):

AutoZone is Burgundy’s eighth-largest holding, accounting for around 2.7% of its portfolio. The company distributes automotive replacement parts and accessories, which have seen increased demand amid the ongoing pandemic reducing consumers’ interest in purchasing new vehicles.

AutoZone has been expanding its retail network gradually, growing its revenues quite steadily over the years. Management applies a capital return policy consisting of massive stock buybacks, ignoring dividends completely.

To highlight the magnitude of its buybacks, AutoZone has repurchased and retired 85% of its shares outstanding over the past 2 decades, which is utterly impressive. Consequently, the company has delivered massive value to its shareholders over time.

Burgundy has been an AutoZone shareholder since 2015. The fund increased its stake by 11% during the previous quarter.

Dollar Tree (DLTR)

Dollar Tree operates more than 7800 discount variety retail stores, offering much of its merchandise at the established price of $1.00. Dollar Tree’s revenues have been growing steadily over time. They could also be considered recession-proof due to the company’s discount prices attracting more consumers during adverse economic times.

That being said, however, its margins are extremely thin in order to sustain this model. Dollar Tree chooses not to pay any dividends. Instead, like AutoZone, it repurchases shares in the open market when it finds itself with excess cash.

Burgundy held its position steady throughout the quarter, adding just under 14K shares, or less than 1% of its total exposure, in its existing position.

Burgundy held its position steady throughout the quarter, adding just under 14K shares, or less than 1% of its total exposure, in its existing position.

Carrier Global Corporation (CARR):

Carrier Global is Burgundy’s tenth-largest holding. The fund bought around 9.4 million shares during Q2-2020, just after the company completed its IPO. Since the company’s initial offering, the stock has more than tripled, currently trading near all-time highs. As a result, CARR is one of Burgundy’s most successful purchases as of recently.

The company is quite profitable in its refrigeration, fire, security, and building automation technologies, which is quite rare for an IPO during this period. The company has initiated a dividend as well, quickly returning cash back to shareholders. Carrier Global is expected to generate EPS of $1.92 next year, implying a forward P/E of around 22 at its current price levels. Hence, shares may still be quite reasonably valued despite their extended rally.

Burgundy trimmed its position by 27% during the previous quarter, likely to book some profits off of the stock’s prolonged rally.

Final Thoughts

Burgundy’s portfolio is well-diversified, holding 105 individual holdings. The past 3-year performance has been quite adequate, while its latest moves should reward its clients quite nicely in the future. The fact that the firm does not have one investment that is over 10% of the total portfolio displays satisfactory levels of diversification, with careful risk management.

Investors seeking capital preservation and high resilient quality companies, investing in or following Burgundy moves could be rewarding.

Additional Resources:

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed

Akre Capital’s 26 Stock Portfolio: Top 10 Holdings Analyzed

Appaloosa Management’s 35 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed