Bull of the Day: Enova (ENVA)

Make no mistake, friends, this market is still playing favorites. Tech darlings hog the headlines, while other names quietly put up monster numbers in the shadows. That’s fine by me. The less crowded the trade, the more room there is for us to profit. Case in point, today’s Bull of the Day, Enova International (ENVA), a Zacks Rank #1 (Strong Buy) that’s been quietly stacking earnings beats like poker chips in a Vegas high-roller room.

Enova isn’t some fly-by-night fintech chasing the latest crypto meme. They’re a proven digital financial services company offering online lending and financing solutions to consumers and small businesses. Think personal loans, lines of credit, SMB working capital, all delivered through proprietary AI-driven underwriting models. Translation: they’ve built a tech moat around a very old and very profitable business, lending money at a spread.

Operating in the U.S. and abroad, Enova owns recognizable brands like NetCredit, CashNetUSA, and Headway Capital. That diverse portfolio means they can pivot between consumer and commercial lending depending on the credit environment. And with credit conditions tightening in the traditional banking sector, guess who’s been picking up the slack? Yep, our friends at ENVA.

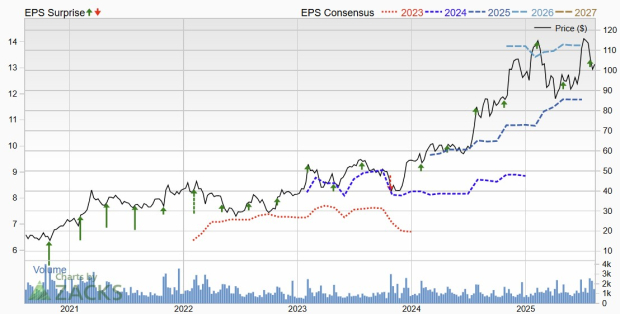

The Zacks Rank doesn’t hand out #1 slots for good behavior, it’s earned by positive earnings estimate revisions. Over the last 60 days, analysts have been busy ratcheting up expectations for both the current year and next. The Zacks Consensus Estimate for 2025 has climbed sharply, up from $11.83 to $12.11 over the last sixty days while next year’s number is following suit, up from $13.89 to $14.12. That’s on top of a track record that would make most CEOs blush as Enova has delivered ten straight earnings beats.

Image Source: Zacks Investment Research

Last quarter? EPS came in 8.75% ahead of expectations on revenues that also beat the Street. That’s the double-barrel beat-and-raise we love to see. The loan book is growing, net charge-offs remain well within historical norms, and net interest margins are holding strong, which is a testament to their risk modeling.

Current year revenue growth is projected to come in at 19.57% with next year up at 16.26%. EPS growth is outpacing that, at 32.35% this year and 16.27% next, thanks to operational efficiencies and smart underwriting. Next year, analysts see continued earnings expansion, even as the broader economy wobbles. That’s the beauty of ENVA’s model, they adjust credit criteria in real-time, protecting the bottom line when macro risks flare.

And while fintech peers are often priced like they’re curing cancer, Enova still trades at a very reasonable forward P/E of 8.51. That’s growth at a value price, a combination that doesn’t stay hidden for long.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enova International, Inc. (ENVA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com