Published on August 4th, 2022 by Nathan Parsh

The utility sector is often among the most recession-resistant because the products and services these companies provide, which includes gas, electricity, and water, are items people need for everyday life.

This often provides for fairly stable and reliable results, which in turn allow for companies to return capital to shareholders in the form of dividends.

Many utility companies count their dividend growth streaks in decades. This includes Black Hills Corporation (BKH), which has raised its dividend for 50 consecutive years.

A dividend growth streak of this magnitude places Black Hills Corporation among the Blue Chip stocks, which is a group of more than 350 companies with at least 10 consecutive years of dividend raises.

We’ve created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article in the 2022 Blue Chip Stocks in Focus series will examine Black Hills Corporation’s recent earnings results, growth prospects, competitive advantages, and total return potential.

Business Overview

Black Hills Corporation is a holding company for Black Hills Energy, which provides electricity to nearly 220,000 customers in Colorado, Montana, South Dakota, and Wyoming. In addition, the company has more than 1 million gas customers in six U.S. states, including Arkansas, Colorado, Iowa, Kansas, Nebraska, and Wyoming. Black Hills Corporation was founded in 1941, has a market capitalization of just under $5 billion, and generated revenue of close to $2 billion in 2021.

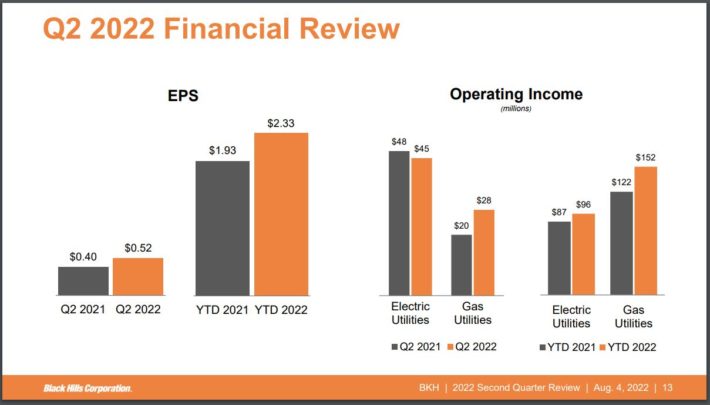

Black Hills Corporation reported second quarter results on August 3rd, 2022.

Source: Investor Presentation

Revenue for the quarter grew more than 27% to $474.2 million. Net income of $35.8 million, or $0.52 per share, compared favorably to net income of $28.3 million, or $0.40 per share, in the prior year.

Black Hills Corporation reaffirmed its guidance for 2022 as well, with the company expecting earnings-per-share of $3.95 to $4.15 for the year. If achieved this would be an 8.3% improvement from the prior year.

Growth Prospects

Most of Black Hills Corporation assets, like most utility companies, are regulated. These businesses depend on rate reviews to grow.

In fact, more than 90% of the company’s assets are regulated, which provides for slow, but stable profit growth as Black Hills Corporation has to have rate increases approved before implemented. For example, the company benefited from higher rates in several of its businesses in the most recent quarter, which aided results. Black Hills Corporation has submitted applications for rate increases in additional states, including Arkansas and Wyoming, that should provide for future returns as well.

Utility companies are generally allowed to recover investments made in their infrastructure. Black Hills Corporation has a capital investment plan of at least $3.2 billion for the 2022 to 2026 time period. Management has pointed towards additional projects as likely being added over time as the company looks for more growth opportunities.

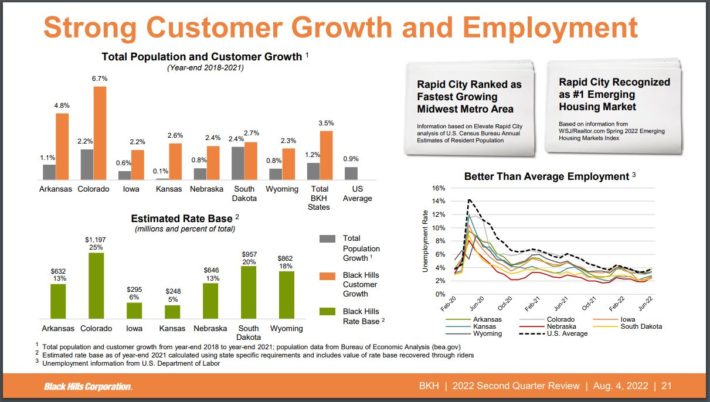

Another way to grow the business is to attract new customers.

Source: Investor Presentation

All of Black Hills Corporation’s territories have seen an increase in population growth over the last four years, with most states’ growth rates topping that of the country as a while. This growth is led by a 2.2% increase in Colorado.

What stands out is that the company’s customer growth has outpaced total population growth in every state, often by a factor of two or three.

It is likely that Black Hills Corporation will continue to see outsized customer growth as these states continue to see an increase in population, which, when combined with rate increases, should provide the company the ability to grow earnings-per-share at a rate of 4% annually through 2027. This is below the long-term growth rate of more than 7% for the 2012 to2021 period, but more in-line with the typical utility company.

Competitive Advantages & Recession Performance

Given their near monopoly-like status, utility companies have limited competition. It is one reason why Black Hills Corporation has been able to see such strong customer growth from modest population increases.

This provides some stability and should help smooth out earnings results over long periods of time.

Investors often hold utility stocks for this reason, as electricity and gas demand depends more on the weather than the state of the economy.

Below are the company earnings-per-share totals before, during, and after the last recession.

- 2006 earnings-per-share: $2.21

- 2007 earnings-per-share: $2.68 (21% increase)

- 2008 earnings-per-share: $0.18 (93% decrease)

- 2009 earnings-per-share: $2.32 (1,189% increase)

- 2010 earnings-per-share: $1.66 (28% decrease)

- 2011 earnings-per-share: $1.01 (39% decrease)

- 2012 earnings-per-share: $1.97 (95% increase)

Black Hills Corporation’s has a more erratic earnings growth history than many of its peers. The company experienced a substantial decline in earnings-per-share in 2008, before experiencing a nearly as dramatic improvement the very next year. Black Hills Corporation also suffered several more years following the Great Recession and didn’t establish a new high for earnings-per-share until 2014.

Some of this volatility was due to the company’s oil and gas business, which was more sensitive to the change in commodity prices. Black Hills Corporation exited this business in 2018, allowing the company to focus almost entirely on its regulated businesses. Not surprisingly, the company has seen earnings-per-share grow every year since 2016.

Despite these weak periods, Black Hills Corporation managed to raise its dividend every year for the last five decades, which qualifies the company as a Dividend King.

Shareholders received a total dividend increase of 3.6% for the 2007 to 2009 period. The dividend has a compound annual growth rate of 5% over the last decade. Black Hills Corporation yields 3.1% today, nearly twice the average yield of the S&P 500 Index. And with an expected payout ratio of 59%, Black Hills Corporation is likely to continue to raise its dividend in the coming years.

Valuation & Expected Returns

Black Hills Corporation trades close to $76, implying a price-to-earnings ratio of 18.8 using the midpoint of company guidance.

This is within striking distance of our 2027 target price-to-earnings ratio of 18. Reverting to our target valuation would mean a 0.8% reduction in annual returns due to multiple reversion over the next five years.

In total, we expect that Black Hills Corporation will provide total annual returns of 6.2% through 2027. This projection stems from a 4% earnings growth rate and a starting yield of 3.1%, offset by a small headwind from multiple contraction.

Final Thoughts

Black Hills Corporation has several factors working in its favor, including potential rate increases, a sizeable capital allocation plan, and good customer growth. The company is also much more focused on the regulated utility aspect of its business then it was during the last recession, which should allow for a better performance in the next economic downturn.

Black Hills Corporation’s dividend growth streak is one of the longest in the utility sector and the yield is solid.

That said, the stock is only expected to provide mid-single-digit total returns over the next five years, which earns Black Hills Corporation a hold recommendation.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.