Published on August 8th, 2022 by Josh Arnold

The financial services sector is littered with great dividend stocks. With capital expenditures quite minimal for banks in particular, it comes as no surprise that companies in banking feature strong track records of cash shareholder returns. In fact, out of the roughly 350 Blue Chip companies we have compiled, which feature at least 10 successive years of dividend hikes, 91 operate in the financial services sector, and many of those are banks.

With 27 years of consecutive dividend increases, Northeast Indiana Bancorp is one of those companies. We see the Blue Chips as some of the safest dividend stocks around, given their proven longevity when it comes to boosting capital returns to shareholders. Northeast Indiana Bancorp also has one of the strongest dividend increase streaks among banks in the market today, which is particularly impressive given its diminutive size.

With all this in mind, we created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This edition of the 2022 Blue Chip Stocks In Focus series will analyze Northeast Indiana Bancorp’s (NIDB) prospects for shareholders.

Business Overview

Northeast Indiana Bancorp is a bank holding company for First Federal Savings Bank, based in Huntington, Indiana. The bank offers various traditional services and products such as checking accounts, savings accounts, retirement accounts, health savings accounts, direct deposits, and certificates of deposits. It also offers loan products including mortgage loans, construction loans, RV and ATV loans, equipment financing, and related products. The bank also offers business services such as treasury and cash management, insurance, and pension products.

The company operates five full-service offices in Indiana, and was formed in 1995. Today, it produces about $19 million in annual revenue, and trades with a market cap of $55 million.

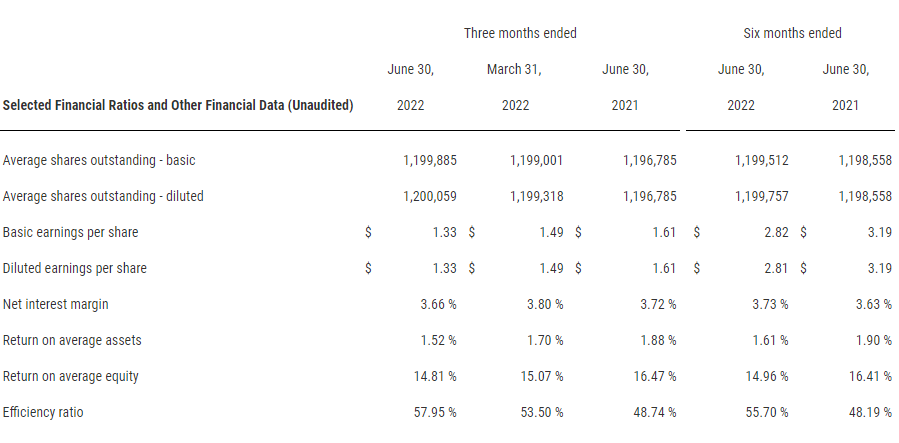

The bank reported second quarter earnings on July 18th, 2022, and results were off from the year-ago period. Net income came to $1.6 million, or $1.33 per share, which were down from $1.9 million, or $1.61 per share, in the year-ago period, respectively.

Declines in net income were primarily attributable to a reduction in the gain on sale of mortgage loans of $414,000. Mortgage production slowed as interest rates increased quickly during the period. Partially offsetting this was an increase in net interest income of $233,000.

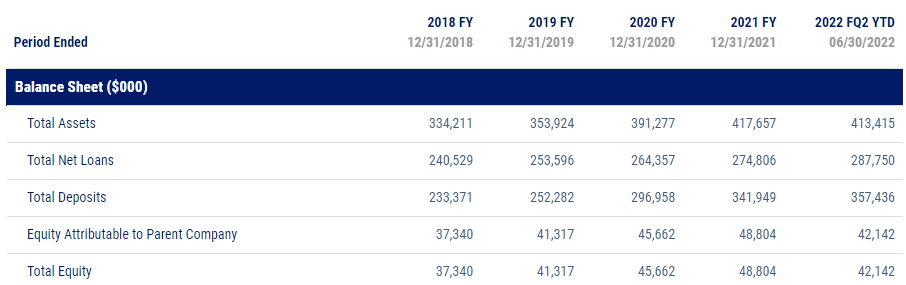

Total assets fell $4.2 million to $413 million. This was due to a decline in $12.1 million in the market value of the bank’s investment portfolio, while net loans rose more than $13 million. Total deposits were up $15.5 million, or 9.1% on an annualized basis from the end of 2021. Book value ended the quarter at $34.88 per share.

Following second quarter results, we see $5.00 in earnings-per-share for this year.

Growth Prospects

Northeast Indiana Bancorp’s average growth rate in the past decade has been quite impressive at 8%. It’s also been fairly consistent throughout the decade, even more impressive considering the COVID recession struck during that time, as well as sizable interest rate movements. We also note that some of that growth was attributable to the bank lending out more than 100% of its deposits for part of the past decade, some of which has unwound recently.

Going forward, we think the bank can do 3% from current earnings levels, as last year was a record for the company. Having a very high base of earnings makes it more difficult to grow from, but we do think the bank has some catalysts for future growth.

Source: Q2 2022 earnings release

We can see here that the bank’s net interest margin has been fairly stable in recent quarters, but is also very high. Many banks have struggled with declining lending margins in recent quarters, but Northeast Indiana Bancorp remains at ~3.7%. However, from a growth perspective, a very high base makes further expansion more difficult.

Source: Company website

We can see also that the bank has done a nice job of growing loans over time, which we expect to continue. Indeed, we believe this is likely the primary growth source going forward given lending margins are already high, and that management doesn’t buy back stock.

The past ten years have seen the bank grow its dividend by 5% annually, but we’re looking for 3% going forward. We think the management team will look to slow dividend raises somewhat on lower earnings growth potential.

Competitive Advantages & Recession Performance

Competitive advantages are difficult to achieve in commoditized industries, which banking certainly is. However, Northeast Indiana Bancorp has proven its ability to operate very successfully in its niche in part of Indiana, and we don’t see any reason its ability to collect deposits and profitably lend them out will deteriorate.

The company has withstood some tough recessions in its operating history, and managed to grow the dividend through all of it due to strong, consistent earnings. While banks are certainly susceptible to recessions, we don’t see the dividend being cut as a realistic threat. Indeed, the payout ratio is also just one-quarter of earnings, so even a massive decline in earnings could see the dividend continue to be paid and raised.

Valuation & Expected Returns

We see expected returns of just over 5% annually in the years ahead, as the combination of the yield, the valuation, and forecasted growth look decent.

Shares trade for 9.1 times this year’s earnings estimate, which is almost exactly the same as our estimate of fair value at 9.0 times earnings. We therefore find the stock to be fairly valued, and expect essentially no impact from the valuation in the years to come.

We already noted expectations for 3% growth, and the current dividend yield is strong at 2.7%. With all of this in mind, we see 5.4% total annual returns in the coming years.

Final Thoughts

We see Northeast Indiana Bancorp as an extremely prudent operator in the community banking space. We note the stock is very illiquid given its small size, with some trading days seeing no volume at all.

Total annual returns are okay at 5.4%, but the yield is the star here at 2.7%. We expect modest growth, and given the stock is already fairly valued, we rate Northeast Indiana Bancorp a hold.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.