Published on August 8th, 2022 by Nikolaos Sismanis

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession. As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With a track record featuring 28 consecutive years of annual dividend hikes, Matthews International Corporation has certainly proven it can withstand various unfavorable trading periods while continuing to reward its shareholders sufficiently.

With all this in mind, we created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Matthews International Corporation (MATW).

Business Overview

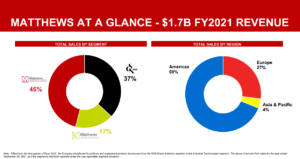

Matthews International Corporation provides brand solutions, memorialization products, and industrial technologies internationally. The company’s three business segments are diversified.

The SGK Brand Solutions division is their top sales generator. It supplies brand development services, printing equipment, creative design services, and embossing tools to the consumer-packaged goods and packaging industries.

The Memorialization segment sells memorialization products, caskets, and cremation equipment to funeral home industries.

The Industrial technologies segment is smaller than the other two businesses and designs, manufactures, and distributes marking, coding, and industrial automation technologies and solutions.

Source: Investor Presentation

Source: Investor Presentation

Matthews International was incorporated in 1850, and it has been trading in the public markets since 1994. The Pittsburgh-based company has a market cap of $784 million and generates roughly $1.7 billion in annual sales

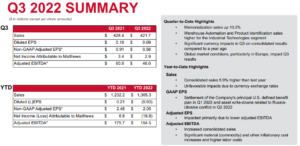

On July 28th, 2022, Matthews International reported its Q3 results for the period ending June 30th, 2022. The company posted sales of $422 million, a 6.7% decline compared to the same prior year period. The decline was in part due to changes in foreign currency exchange rates as a result of a stronger dollar.

Adjusted earnings came in at $0.58 per share, a decline of 36% from $0.91 a year ago. The company’s net debt leverage ratio rose from the year-ago period, from 3.1 to 3.5, despite management’s near-term objective of 3.0 times. The corporation maintains its focus on debt reduction moving forward as a result.

Management lowered its fiscal 2022 outlook. Growth in consolidated sales is now anticipated in fiscal 2022, but increased costs remain a headwind. Thus, adjusted EBITDA is now projected to land close to $205 million (down from $220 million).

Source: Investor Presentation

Source: Investor Presentation

Growth Prospects

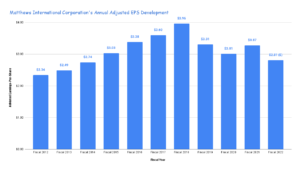

Matthews International utilizes adjusted earnings per share to measure its performance, which is earnings excluding intangible amortization and the non-service cost portion of pension/post-retirement expense. The company has not produced much growth, but it has steadily climbed by around 3.8%, compounded annually from 2012 to 2021.

Source: SEC filings, Author

Source: SEC filings, Author

The company is searching for complementary acquisition opportunities which can extend its capabilities in existing businesses or expand the corporation even further geographically. Matthews is targeting to achieve a long-term annual return on invested capital of at least 12% on these acquisitions. Continued debt reductions will reduce interest expenses, and Matthews International is working on cost structure improvements.

The company is also committed to repurchasing shares opportunistically with excess cash flow. The Memorialization segment has boomed as a result of COVID-19, as increased deaths and rising cremation rates add to the top line.

The Industrial Technologies division has also grown strongly, largely as a result of growing sales in its energy storage solutions at its Saueressig subsidiary, which develops equipment used in the manufacturing of lithium-ion batteries and embossing plates used in fuel cells.

Its third segment, SGK Branding, has been lagging in terms of significant growth and is focusing on redesigning, rebranding, and bundling its products and services. We are forecasting intermediate-term earnings growth of 3% annually.

In terms of its dividend-per-share, it has grown every year over the past 28 years, with no exception. While the dividend-per-share 10-year CAGR stands just over 10%, dividend growth has significantly slowed down over the past few years. The most recent dividend increase was by a humble rate of just 2.3%. Still, the overall track record is quite impressive.

Source: SEC filings, Author

Source: SEC filings, Author

It’s worth noting that Matthews International is not a Dividend Aristocrat as, due to its rather small size, it is not a member of the S&P500.

Competitive Advantages & Recession Performance

The dividend payout ratio for Matthews International has been very conservative and is nearing a decade peak at 31%. This conservative payout ratio allows for Matthews to continue raising the dividend as it has for the last 28 years. We do not see any hurdles in terms of dividend payments or increases.

The company has a small competitive advantage in that it is uniquely diversified across its businesses, which allows it to weather different storms on a consolidated basis. However, this also leaves the corporation open to more focused competition.

The company also differentiates itself by offering a broad range of services on a global scale where it can gain market share in a fragmented industry. The Great Recession saw Matthews’ earnings drop around -25%, but the company nearly recuperated this loss by the following year.

You can see a rundown of Matthews International’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $2.05

- 2008 earnings-per-share of $2.57

- 2009 earnings-per-share of $1.89

- 2010 earnings-per-share of $2.29

- 2011 earnings-per-share of $2.47

During the COVID-19 pandemic, earnings did not drop significantly.

Valuation & Expected Returns

Over the past ten and five years, Matthews International has traded at an average P/E ratio of 14.5 and 11.1, respectively. We are using 11.5 times earnings as a fair value starting point given ongoing uncertainties in the global economic landscape. The stock’s P/E stands at 9.7 based on the expected fiscal 2022 adjusted EPS of $2.81

If the price-to-earnings multiple expands from 9.7 to 11.5, future returns would be boosted by 3.5% per year over the next five years. Combined with our EPS & DPS growth rates, as well as the current dividend yield, we project annualized returns could amount to 9.3% through 2027.

Accordingly, we rate Matthews International a hold.

Final Thoughts

Matthews International has proven itself as a reliable blue chip stock, with an impressive dividend growth track record that spans over 28 years. The payout ratio remains quite healthy, and it should support further dividend hikes for years to come. That said, dividend increases should be expected to remain rather humble.

We forecast total annual returns of 9.3% for the next five years consisting of the current 3.2% yield, 3% earnings growth, and a 3.5% gain from the valuation expansion.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.