Published on August 1st, 2022 by Josh Arnold

The industrial sector is littered with great dividend stocks. While the sector can be quite cyclical, there are niches where great companies have tremendous moats that afford them steady growth over time. That’s why so many of the 350+ Blue Chip stocks are industrials. We define Blue Chips as any stock with at least 10 consecutive years of dividend increases.

With 49 years of consecutive dividend increases, Gorman-Rupp (GRC) is among the best-of-the-best in terms of dividend longevity in the world. The company has stood the test of time from competitive threats, economic downturns, and technological changes to put it on the cusp of being a Dividend King.

Given this, we put Gorman-Rupp among the most elite dividend stocks available today.

For a complete list of Blue Chip stocks, you can click below:

In addition to the Excel spreadsheet above, we are individually reviewing the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Gorman-Rupp’s business, its prospects for growth, and total return estimates.

Business Overview

Gorman-Rupp is a designer, manufacturer and distributor of pumps and pump systems in the US, as well as internationally. The company’s family of brands include products such as centrifugal, submersible, high pressure, oscillating pumps, and more. Applications are numerous, including water and wastewater management, construction, industrial, petroleum, agriculture, and fire protection, among others.

The company was founded in 1933, generates about half a billion dollars of annual revenue, and trades with a market cap of $800 million.

Gorman-Rupp’s most recent earnings were second quarter results, released on July 29th, 2022. Revenue was up 28% year-over-year to $119 million, beating expectations by $14 million. Earnings, on the other hand, came to 27 cents per share on an adjusted basis, which missed by a nickel.

During the quarter, Gorman-Rupp completed its acquisition of Fill-Rite and Sotera, which it purchased from Tuthill Corporation for $526 million. The company reckons it will see $80 million in tax benefits, netting a total transaction value of $446 million. Given the timing of the acquisition, second quarter earnings were impacted.

Total revenue for the second quarter was up from $93 million to $119 million year-over-year. Domestic sales were up 32%, or $21 million, while international sales were up 18%, or $5 million. Fill-Rite added $13.6 million to the top line.

Excluding Fill-Rite, sales in water markets rose 17%, while non-water market sales were up 6% excluding the acquisition. The company continues to see strong end-market demand in a variety of places, further bolstered by the addition of Fill-Rite.

Gross profit was $28 million in Q2, or 23.7% of revenue. That was down from 26.5% of revenue the in year-ago period, but on a dollar basis, was up from $25 million due to higher revenue. The decline in gross margins was driven by a 500bps increase in the cost of material, as well as inventory-related adjustments for Fill-Rite and existing Gorman-Rupp products. On the plus side, labor and overhead costs were leveraged down 220bps due to higher revenue, helping to limit the overall damage.

Operating income came to $11.4 million on an adjusted basis, or 9.6% of revenue. That was off from 11.4% a year ago, but up from $10.6 million on a dollar basis.

Following Q2 results, we now expect to see $1.30 in earnings-per-share for Gorman-Rupp this year.

Growth Prospects

Gorman-Rupp’s historical rates of growth haven’t been particularly impressive. Indeed, the past decade has seen just 2% average annual earnings growth accrue, as the company has posted four years of earnings declines in ten. The company’s primary products related to water management tend to see fairly stable demand, while more cyclical products that serve the petroleum industry, for instance, can see earnings oscillate more.

Despite this, we see the company’s focus on margins, as well as what appear to be prudent acquisitions as fueling 6% earnings-per-share growth in the coming years.

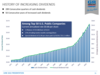

Source: Investor presentation, page 38

The company sees a variety of growth drivers in the years to come, over and above any acquisitions it may do. As water becomes more and more scarce across the globe, managing what is available becomes more and more critical. Gorman-Rupp finds itself at the center of that effort, be it for agriculture, wastewater removal, water quality, and flood control. This should keep demand for its products rising steadily over time.

Source: Investor presentation, page 31

Gorman-Rupp is one of the best dividend stocks in the market when it comes to longevity. It has paid quarterly dividends to shareholders for more than 70 consecutive years, in addition to the very impressive dividend growth streak.

The dividend growth rate in the past decade has averaged more than 8%, which also puts the stock firmly into the category of dividend growth. We see 5% growth going forward given the company’s focus on acquisitions, but note that even this conservative forecast means Gorman-Rupp will remain a strong dividend growth stock.

Competitive Advantages & Recession Performance

Gorman-Rupp has a decades-long history of providing highly customized solutions to niche problems for its users. The market where Gorman-Rupp operates isn’t particularly large, but it has a firm grasp on the needs of its customers, and delivers well engineered solutions.

Recessions can take a toll on its earnings, however, given oil and gas demand tends to fall sharply during recessions, and municipalities tend to curtail capital spending during recessions. Still, the company has managed seven consecutive decades of quarterly dividends, so its recession resistance is fairly good.

The dividend is about half of earnings for this year, which is right in line with historical averages. We don’t expect the company to boost its dividend meaningfully over half of earnings, to protect the payout, as well as to provide capital for acquisitions. We see the dividend as extremely safe today.

Valuation & Expected Returns

Gorman-Rupp’s shares have been very weak thus far in 2022, but even so, we see them as trading slightly above fair value. Shares trade for 23.8 times our estimate of $1.30 in earnings-per-share, somewhat ahead of our estimate of fair value at 22 times earnings. That could introduce a minor headwind to total returns in the coming years.

The dividend yield is 2.2% today, and we expect 6% earnings growth. All told, that puts expected total returns at just over 6% for the years to come, as the yield and valuation reset largely offset each other. That’s good enough for a solid hold rating on the stock.

Final Thoughts

While Gorman-Rupp faces some inherent cyclicality, its exemplary dividend longevity puts it in elite company. We see meaningful growth ahead for the pump company, and many more years of dividend growth. While the stock is slightly expensive, we still see solid mid-single digit returns for shareholders.

The list of Blue Chips is not the only way to find great dividend stocks.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.