Published on August 2nd, 2022 by Josh Arnold

Agricultural and commodity stocks tend to be extremely cyclical. Not only is demand at least somewhat dependent upon economic growth, but prices tend to fluctuate wildly for most commodities. That makes it more challenging for companies in the sector to grow their dividend over time, as earnings make outsized moves, particularly in recessions.

That makes the 47-year dividend streak of Archer Daniels Midland (ADM) even more impressive. The company has paid dividends to shareholders for an incredible 90 consecutive years, and we see no end in sight for either of those streaks. The company has proven willing and able to return ever-higher amounts of capital to shareholders, even during tough recessions.

That puts Archer firmly in the camp of Blue Chip stocks, which is a group of more than 350 companies with at least 10 consecutive years of dividend increases.

We see these stocks as among the better dividend stock buys in the market today, simply because of their willingness and ability to return more and more capital to shareholders each year.

We’ve created a full list of the 350+ Blue Chips available today, which you can download below:

In addition to the spreadsheet above, we are individually reviewing the top 50 Blue Chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article in the 2022 Blue Chip Stocks In Focus series will analyze Archer Daniels Midland, including recent earnings, growth prospects, and total returns.

Business Overview

Archer is a highly diversified commodities company that is focused in the agricultural space. The company has a fully integrated model where it sources, transports, stores, processes, and distributes commodities, products, and ingredients across the globe. The three segments it operates are Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition.

Source: Investor presentation, page 7

Through these segments, it procures, processes, and distributes products including raw commodities, animal feed, ingredients for human consumption, and related products. Archer also offers futures commission merchant services, commodity brokerage services, cash margins and securities pledged, and other related financial services.

Archer was founded in 1902, and has paid consecutive dividends to shareholders since 1932. Today, it produces about $97 billion in annual revenue, and trades with a market cap of $47 billion.

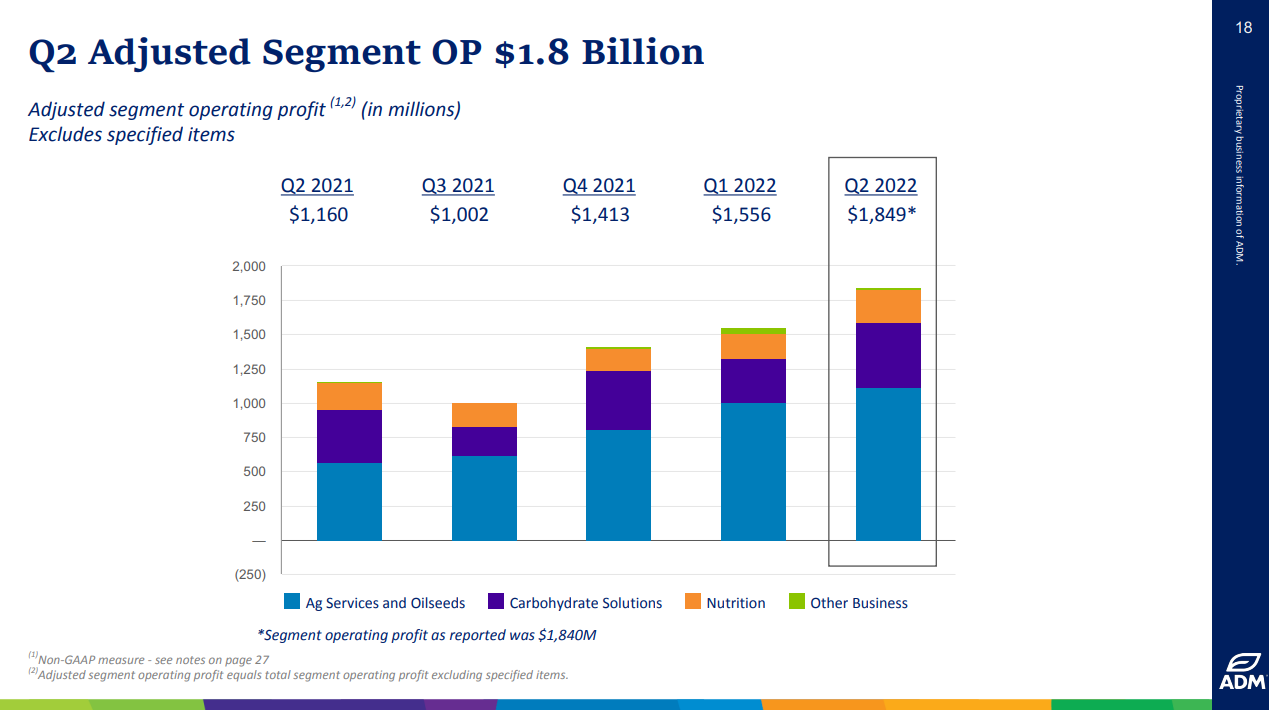

Archer reported second quarter earnings on July 26th, 2022, and the company’s results handily beat estimates on both the top and bottom lines.

Archer’s earnings-per-share came to $2.15 on an adjusted basis, which was 43 cents ahead of estimates. Revenue soared 19% year-over-year to $27.3 billion, blowing past estimates by more than $2.4 billion.

Ag Services & Oilseeds was a major driver of the earnings beat, with the company seeing operating profit in this segment more than double year-over-year. Archer cited strong volumes and margins as producing a confluence of positive factors that drove profits in Q2. Management cited good global demand for export volumes, in particular, grain. Soybean meal and soybean oil demand was very strong as well.

Carbohydrate Solutions were also much higher than the year-ago period. Starches and Sweeteners were much better as strong demand from food services was close to pre-pandemic levels. Corn products also saw high demand, and effective operating controls improved margins.

Nutrition saw 16% revenue growth and 19% higher operating profit, which actually made it a relative laggard for Archer in Q2; such was the strength demonstrated.

The company saw strong demand across the portfolio, including flavors, proteins, and texturants. Animal nutrition products saw strong volumes and margins as well.

Source: Investor presentation, page 18

Following Q2 results, we now see $6.73 in earnings-per-share for this year, which, if achieved, would easily be a record for the commodities company.

Growth Prospects

Archer has managed an extremely impressive average earnings growth rate of almost 12% in the past decade. Part of that growth was normalization out of the recession that accompanied the financial crisis, but to its credit, the company has continued to grow strongly in the years since.

We see 5% as more reasonable given the very high base of earnings in place for 2022, however.

Margin expansion through productivity efforts and rising volumes, organic growth from strong global demand, and periodic acquisitions should all help Archer grow in the years to come. We note that growth is unlikely to be linear given the inherent volatility in commodities, but over time, we expect the company will deliver.

Dividend growth has averaged about 9% annually in the past decade, but we’re expecting more like 3% growth in the years to come. The company has proven it wants to spend extra capital on investing in the business, either organically or through acquisitions. It has been buying back shares as well, so we don’t see meaningful expansion of the dividend in the years to come.

Competitive Advantages & Recession Performance

Given that commodities companies are inherently like competitors, Archer has created a strong niche for itself. It offers additional value to customers given its massive scale as a one-stop-shop for all things food commodity related. That gives it staying power among competitors, and helps it drive lower pricing while maintaining margins over time.

Recessions are somewhat unkind to Archer, not necessarily because of plummeting demand, but because it lacks pricing power on some of its products. Still, the company has managed to weather recessions for the past 90 years while continuing to pay dividends to shareholders, and we don’t see any cause for concern. Indeed, the payout ratio for this year is just 24%, so Archer’s dividend is ultra-safe in our view.

Valuation & Expected Returns

We see respectable 9% total returns for Archer over the coming years, driven by the 1.9% dividend yield, 5% growth, and a 2%+ tailwind from the valuation. Shares trade today at 12.5 times this year’s earnings, but we assess fair value at 14 times earnings. That implies a tailwind from a rising valuation over time, and we note that 14 times earnings is a conservative estimate. Archer has traded in the upper-teens multiple times in the past decade. With these factors in mind, Archer is rated a hold.

Final Thoughts

Archer is dividend royalty given its streak of 90 years of consecutive dividends, as well as its nearly-half-century streak of dividend raises. There are few companies in the world with streaks that can match.

We like the stock for its reasonable valuation, above-market yield, and future growth prospects, but it just misses the cut for a buy rating.

There are many other ways to screen for great dividend stocks besides the Blue Chips.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.