Updated on March 8th, 2021 by Nikolaos Sismanis

The Baupost Group is a long-only hedge fund founded in 1982 by Harvard Professor William Poorvu and his partners.

Among Mr. Poorvu’s founding partners was Seth Klarman, who built his billion-dollar fortune at the helm of the fund over these years, remaining the key executive today.

The fund has over $30 billion in assets under management (AUM), $10.8 billion of which is allocated to the firm’s public equity portfolio. The Baupost Group is headquartered in Boston, Massachusetts.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of -4.3%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of the Baupost Group’s current 13F equity holdings below:

Keep reading this article to learn more about The Baupost Group.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Baupost Group’s Fund Manager, Seth Klarman

- Baupost Group’s Investment Philosophy & Strategy

- Baupost Group’s Noteworthy Portfolio Changes

- Baupost Group’s Portfolio & 10 Largest Public Equity Investments

- Final Thoughts

Baupost Group’s Fund Manager, Seth Klarman

Upon founding Baupost, Poorvu asked Klarman and his associates to handle some funds he had raised from the selling of his stake in a local TV station, and the fund was commenced with US$27 million in start-up capital. Amongst Baupost’s founders, Mr. Klarman was considered relatively inexperienced. Thus the fund was taking a big risk with his involvement.

In 2008 Klarman managed to raise $4 billion in crisis-liquidated capital from large foundations and Ivy League endowments. He would allocate $100 million of these funds in stocks and other assets per day, including distressed securities and bonds, resulting in multi-bagger returns post-2008.

Klarman wrote the book Margin Of Safety which details his risk-adverse and value-driven investment philosophy. The book is an investing classic that is out of print. Copies on ebay sell from hundreds to thousands of dollars.

Baupost Group’s Investment Philosophy & Strategy

The Baupost Group’s investment philosophy revolves heavily around Mr. Klarman’s investing principles, which can be summed into the following key piints:

- Risk evaluation: While this may sound like a well-known and trivial principle, in reality, sophisticated risk-aversion is far from commonly practiced in the investing world. This is especially true in times of low volatility, such as the current incredible bull market, in which market participants tend to ignore the systemic risks that arise in the underlying economy. Therefore, Mr. Klarman and his team will make sure that their risk is well-mitigated, usually by holding put options against a market index.

- Capitalizing on “Motivated sellers”: A motivated seller is someone who, as Klarman puts it, is letting go of their shares for a non-economic reason. One such reason, for instance, can be the exclusion of stock from a major index. This can cause a stock to trade lower without anything changing in regards to its everyday operations, which can create very completing buying opportunities.

- Capitalizing on “Missing buyers”: One of Warren Buffett’s more famous proverbs is that if you have been in a poker game for 30 minutes and still don’t know who the patsy is, you can be fairly certain it’s you. Mr. Klarman’s version is that he never wants to appear at an auction (i.e., stock buying) to discover that all the other bidders (Mr. Market) are more knowledgeable and have a lower entry cost than he does. Therefore, Baupost is likely to be buying unpopular assets if it sees value in them in an attempt to be ahead of the overall market, despite the “missing buyers.”

The Baupost Group’s Noteworthy Portfolio Changes

During its latest 13F filing, The Baupost Group executed the following notable portfolio adjustments:

New Stakes:

Intel Corp. (INTC): The fund initiated a position in INTC, quickly becoming its second-largest holding, weighing 11.8% of its portfolio. The fund bought shares at prices between ~$44 and ~$55, having already benefited from shares currently trading at around $60.

Marathon Petroleum (MPC): The fund initiated a position in MPC, which currently occupies around 4% of the portfolio. The fund must have purchased shares during Q4 at prices between ~$27.50 and ~$44. The position already seems quite successful, with shares trading above $57.

Stake Disposals:

Applied Materials (AMAT): Baupost’s previously ~ 1.48% AMAT stake was established last quarter at prices between ~$55 and ~$68. It was disposed as of this quarter at prices between ~$57 and ~$90.

Howmet Aerospace (HWM): The previously tiny ~0.83% HWM stake was established last quarter at prices between $14.75 and $18.80 and eliminated this quarter at prices between $16.50 and $28.50.

HD Supply Holdings (HDS): HDS was previously a ~3% stake in Baupost’s portfolio. The position was purchased in Q1 of last year at prices between ~$23 and ~$43. Home Depot (HD) acquired HD Supply Holdings for $56 per share cash, and the transaction closed in December. Hence, the stake was disposed of.

HP Inc. (HPQ): HPQ was a <3% position in Baupost’s portfolio which was established in Q4-2019 anywhere between $16 and $21. The fund eliminated its poison completely this quarter at prices between ~$17.50 and ~$25.

McKesson Corp. (MCK): MCK was a ~ 2.7% portfolio stake built in late 2017 to early 2018 at prices between $123 and $177. The fund disposed of the remaining its position this quarter, after previously trimming its position, at prices between ~$144 and ~$184.

Baupost Group’s Portfolio & 10 Largest Public Equity Investments

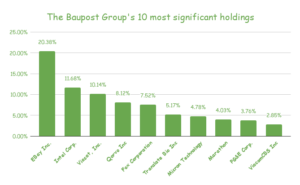

Baupost’s public-equity portfolio is not heavily diversified. Instead, its holdings are concentrated, featuring high-conviction ideas. The portfolio numbers only 24 equities, the 10 most significant of which account for 78.4% of its total composition. The fund’s largest holding, by far, is eBay (EBAY), occupying more than 1/5 of the total portfolio.

Source: 13F filing, Author

eBay Inc. (EBAY):

eBay is distinctly Baupost’s largest holding, currently accounting for more than 20% of its portfolio. The company’s revenues have remained mostly stagnant for nearly a decade, generating around $11 billion in sales per annum. However, the company has excelled in maximizing its profitability, consistently expanding its net income margins over the years. eBay is currently enjoying net income margins of around 50% and is essentially a cash cow that can remain wildly profitable under any economic environment.

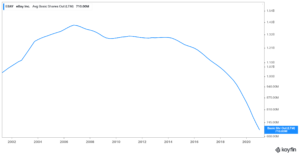

During the ongoing pandemic, for example, the company’s financials have remained very stable, as people have been flipping their old items, have been buying second-hand home decorations, etc., causing eBay’s results to remain consistent, without any disruptions. Because eBay has struggled with growing its revenues, management has been returning massive amounts of cash to its shareholders, primarily in the form of stock buybacks.

As you can see in the graph below, since 2006, the company has retired half its shares outstanding, which is utterly staggering. That is in addition to paying a modest dividend.

Those who are looking to start a position in eBay may be happy to hear that the stock is only trading at 13 times its forward net income. Investors are not willing to pay a premium for the stock due to its lack of growth. However, the company presents a fantastic value proposition, trading at a reasonable multiple and offering hefty capital returns. The stock is a clear example of Klarman’s preference for underappreciated companies with a wide margin of safety. Baupost holds around 4.5% of the company’s total shares outstanding.

Intel Corp. (INTC):

Intel is Baupost’s second-largest holding, despite the fund initiating its equity stake as recently as Q4-2020. The semiconductor giant performed well over the past year, delivering revenues of $77.8 billion, 8.2% higher YoY. The company enjoys massive margins, with $20.9 billion making it to the bottom line. Despite its resilient performance, investors have been lately worrying about competition catching up, especially from Advanced Mirco Devices (AMD). As a result, shares are currently trading at around 12 times their forward net income.

Intel counts 18 years of consecutive annual dividend increases, with its most recent one being of a decent 4.76%. The stock currently yields around 2.3%, while the dividend itself is well-covered, as Intel is currently featuring a payout ratio of around 30%.

Viasat, Inc. (VSAT), Fox Corporation (FOX), ViacomCBS Inc. (VIAC):

These three media conglomerates comprise Baupost’s 3rd, 5th, and 10th most significant holdings, collectively accounting for nearly 1/4 of its portfolio. In the current landscape, the legacy media conglomerates have been in trouble, as content creation is becoming increasingly decentralized. Companies such as Netflix (NFLX), Amazon (AMZN), and even Apple (AAPL) have started producing their own content, while the news outlets have moved mostly online, generating sales through ads or a subscription fee.

As a result, Fox’s, Viasat’s, and Viacom’s stock prices have underperformed the market over the past few years, currently trading at depressed valuations. In our view, Baupost holds these three equities as an activist investor. The fund holds 24%, 6.5%, and 1.0% of their total shares outstanding, respectively, indicating the possibility that Baupost wants to have active influence in how the companies are run, potentially aiming towards modernizing.

For retail investors, these positions could be risky long-term bets, though admittedly attractively priced ones.

Qorvo, Inc. (QRVO):

Qorvo develops and markets technologies and products for wireless and wired connectivity worldwide. It is the fund’s 4th largest holding. If the forecasts regarding 5G are to be true, then the semiconductor industry, along with Qorvo, is likely to enjoy massive growth over the next few years. At the same time, the company’s current revenues are quite stable, and the company has recently started delivering robust profits as well. Still, shares are currently trading at around 16 times the company’s forward net income, which, while an extended valuation for such a cyclical industry, is most likely justified given Qorvo’s medium-term growth catalysts.

Translate Bio, Inc. (TBIO):

Translate Bio is amongst the numerous companies that develop RNA-based therapeutics which could possibly reconstruct the entire biopharma space. As with most of the small-cap companies in the biopharma industry, the stock could potentially deliver massive returns should its own product succeed, or none if it fails. Investors who are not industry-insiders at the least should probably avoid such equities.

Translate Bio is Baupost’s only healthcare-related holding, accounting for around 5.2% of its portfolio. The fund holds nearly 1/4 of its shares outstanding.

Micron Technology, Inc. (MU):

Baupost’s seventh-largest holding is Micron, which accounts for around 4.8% of its holdings. The stock has skyrocketed over the past few years, currently trading 8 times higher than its 2016 levels. The fund is a bit late to the party, initiating the position in Q3-2020. While this means that Baupost believes the stock has more room to run, at a forward P/E of around 14.6, the stock could be quite expensive due to semiconductors’ cyclical nature, thus making for a risky bet at its current price levels.

Marathon Petroleum (MPC):

The energy sector had a rough 2020, as the pandemic caused massive challenges in the aviation and transportation industries. While most companies in the sector cut their distributions due to deteriorating financials, Marathon Petroleum sustained its DPS, as its higher exposure in midstream services helped maintain a borderline profitable bottom line.

The stock has recovered significantly since last year’s lows, with shares currently yielding around 4.1%. While the dividend is not covered from a net income standpoint, it is covered from cash flow generated from operations. Still, investors need to be wary of its future coverage, as it is likely to be slashed if earnings remain challenged.

PG&E Corporation (PCG):

PG&E is a risky company. In 2017 and 2018, wildfires ignited by its grid infrastructure caused the death of more than 100 people. The Campfire also destroyed the town of Paradise. The company barely dodged bankruptcy with $38 billion in debt. We have found the stock in many funds focusing on distressed equities, which are hoping for PG&E to gradually recover from its prolonged challenges. In any case, the company is a rather risky bet, and shareholders are not likely to see any tangible capital returns any time soon. It is Baupost’s ninth-largest holding.

Final Thoughts

The Baupost Group’s holdings provide several interesting positions for investors to consider. Based on our calculations, the fund’s public equity portfolio has been underperforming the overall market. However, this could be due to clients joining/leaving Baupost, as well as the fund’s various hedging instruments, distorting our return results. In any case, investors are likely to find several appealing investing ideas inside its holdings.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].