Bank Turmoil: 65% Surge In SMBs Using Local Credit Unions

Given the banking turmoil over the past couple of weeks, Alignable polled 2,711 randomly selected small business owners from 3/17/23 to 3/30/23 to see where they’re moving their money to protect their businesses. What we found was eye-opening:

Q4 2022 hedge fund letters, conferences and more

Surge In SMBs Using Local Credit Unions

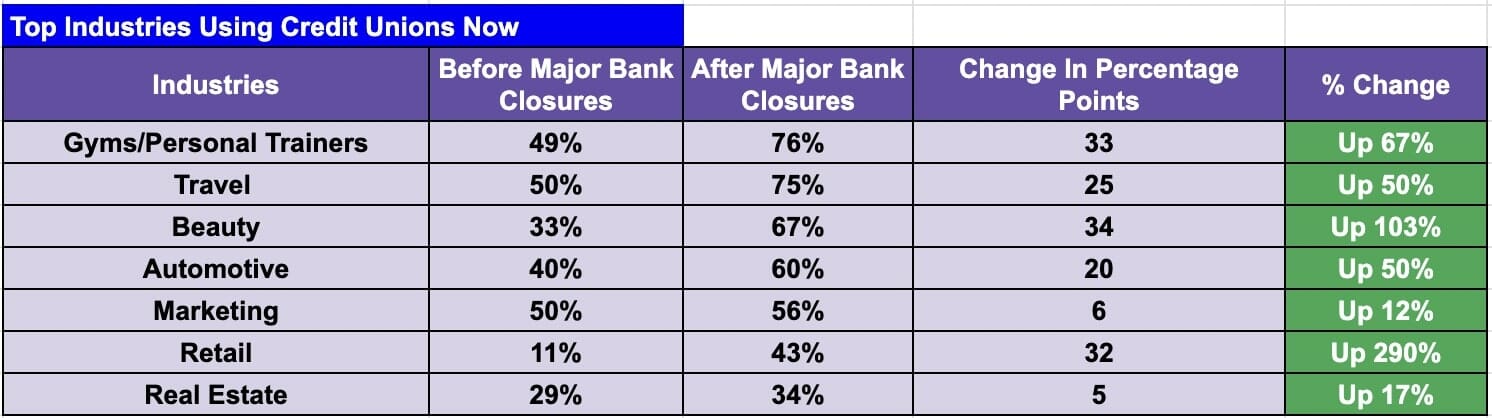

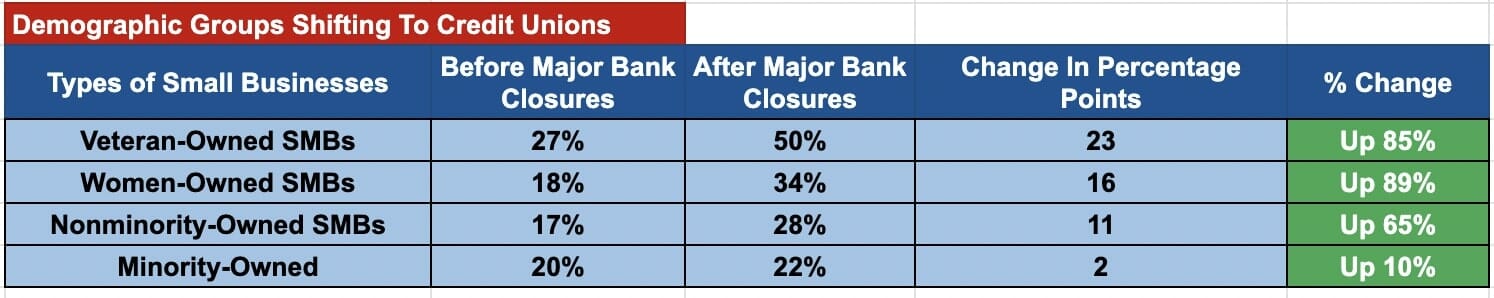

- So far, 17% of SMBs already have shifted their funds with many more still considering their next move. SMBs affected most by banking instability are leaving major national banks behind, and going hyper-local by moving funds into their hometown credit unions.

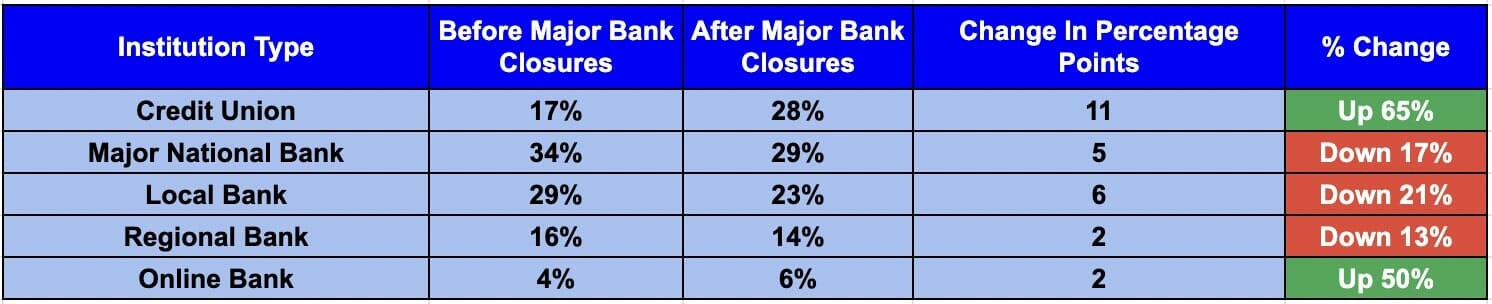

- In fact, comparing where their money was prior to the banking upheaval to where it is now, there was a massive 65% surge in credit union use among SMBs, while there was a 17% downward shift in SMBs banking with big, national money center banks, and a 13% reduction of those using regional banks.

- Reasons include that credit unions are member-owned and have a close link to their communities, while offering more personalized service than national banks. Several small business owners said they don’t trust the banks, but do trust the local nature of the credit unions, their members, and their connections to their towns.

- Amid this economic climate, we also have noted that financial anxiety has reached a new high for 2023 among small business owners. There are a few indicators:

- 60% now feel a recession is imminent (and 33% say it’s already here). That’s a jump of five percentage points from Feb., when 55% said a recession is near (and 27% said it has already started).

- 74% of SMBs say ever-rising interest rates are either already hurting their business or will be soon (up five percentage points over 69% in Feb.).

- Small business revenues are down. 47% of SMBs are earning 50% or less of the monthly revenues they generated prior to COVID (up 3% from Feb.). Unfortunately, that percentage has increased each month this year showing ongoing losses.

- Rent problems have skyrocketed again among SMBs, with 38% unable to pay their full rent in March, up by six percentage points over February’s figure of 32%. This is the biggest jump in rent delinquency over the past five months.

Source valuewalk