Published on November 6th, 2019 as a guest post by RIA Advisors

“I think we would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” – Jerome Powell, 10/30/2019

The recent quote from Federal Reserve Chairman Jerome Powell is powerful, to say the least. We cannot remember a time in the last 30 years when a Fed Chairman has so clearly articulated such a strong desire for more inflation.

In particular, let’s dissect the bolded words in the quote for further clarification.

- “really significant”– Powell is not only saying that the Fed will allow a substantial boost to inflation but does one better by adding the word “really.”

- “persistent”– Unlike the prior few Fed Chairman who claimed to be vigilant towards inflation, Powell is clearly telling us that he will not react to inflation that is not only a “really significant” leap from current levels, but a rate that lasts for a while.

- “even consider”– The language he uses here conveys the seriousness of the Fed’s commitment. The rise in inflation must not only be “really significant” but also “persistent.” Powell is saying both conditions must be met before they will even discuss rate hikes. A significant rise in inflation but one they do not deem to be persistent will not suffice. Nor would a persistent move in inflation but one they do not measure as significant. Both conditions must be present together based on his language.

We are stunned by the choice of words Powell used to describe the Fed’s view on inflation. We are even more shocked that the markets and the media are ignoring it. Maybe they are failing to focus on the three bolded sections.

This article presents Treasury Inflation-Protected Securities (TIPS) as a way to help hedge a portfolio of dividend stocks against Jerome Powell and the Fed getting what they want.

TIPS Mechanics

Few investors truly understand the mechanics of TIPS, so let’s review the basics.

TIPS are debt securities issued by the U.S. government. Like most U.S. Treasury securities, TIPS have a stated maturity and coupon. Unlike other securities, the principal value of TIPS adjust based on changes in the rate of inflation. The principal value can increase or decrease but will never fall below the bond’s initial par value. The semi-annual coupon on TIPS are a function of the yield of a like-maturity Treasury bond less the expected inflation rate over the life of the security, known as the break-even inflation rate.

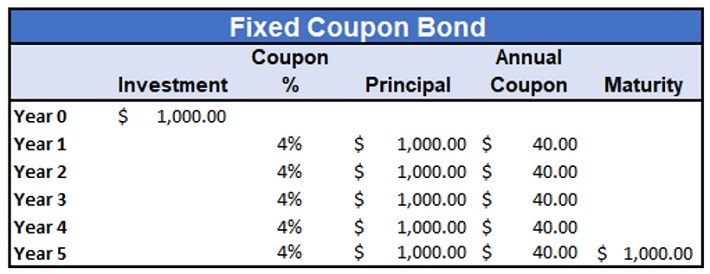

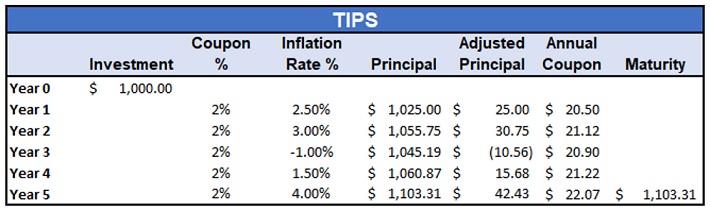

The tables below compare the cash flows of a typical fixed coupon Treasury bond, referred to as a nominal coupon bond, and a TIPS bond to help further clarify.

The table above shows the cash flows that an investor pays and receives when purchasing a five-year bond with a fixed coupon of 4% a year. The investor initially invests $1,000 in the bond and in return receives $40 or 4% a year plus a return of the original investment ($1,000) at maturity. In our example, the annual return to the bondholder is 4%. While the price and yield of the security will change during the life of the bond, an investor holding the bond to maturity will be guaranteed the cash flows, as shown.

TIPS are a bet or a hedge on the breakeven inflation rate. If realized inflation over the life of a TIPS is less than the breakeven rate the investor earns a lower return than on a nominal Treasury bond with the same coupon rate. As shown in our example, if inflation is greater than the breakeven rate, then the TIPS investor earns a higher return than a nominal Treasury bond with the same coupon.

The following chart shows the coupons under various inflation scenarios, for the fixed coupon and TIPS examples used in the tables above.

At any point in a TIPS life, investors may incur mark to market losses, and if the bonds are sold before maturity, this can result in a permanent loss. Any TIPS bond held from issuance to maturity will have a real positive gain (after inflation) assuming the coupon is above zero, the same is not true for a fixed rate bond.

Inflation and Dividends

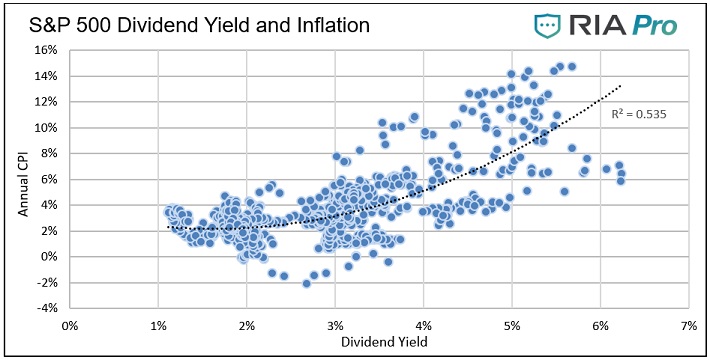

Equity investors, especially those focused on higher dividend stocks, tend to require a dividend yield greater than the rate of inflation. Because of this dynamic, dividend yields tend to rise and fall with the rate of inflation.

Each dot on the following graph represents a monthly instance of the dividend yield on the S&P 500 and the Consumer Price Index (CPI) going back to 1960. As shown, when the annual rate of CPI increases (left axis) dividend yields follow suit with meaningful statistical significance.

Data Courtesy- Shiller/Yale

At first blush, dividend investors may be thinking that inflation should be good for my portfolio as I can earn higher dividend yields. Unfortunately, the increase in yield is not always the result of larger dividend payments but also a decline in share prices.

For example, the last time inflation surged from a relatively low rate was in the early 1970’s. From 1973 through 1974, CPI rose from 3.65% to 12.34%. During that two year period, the S&P 500 dividend yield rose from 2.67% to 5.37%. The sharp increase in yield was a function of dividends rising 14% but more impactful, the S&P 500 falling 41%. On an inflation adjusted basis investors lost 49%. A second inflation scare in the later 1970’s (1977-1979) resulted in a total real return loss of 11% over three years.

The case for TIPS

While most market forecasts are based on the past and therefore do not predict meaningful inflation, we must remain cognizant that since the Great Financial Crisis in 2008/09, the Federal Reserve (FED) and many other central banks have taken extraordinary monetary policy actions. The Fed lowered their targeted interest rates to zero while central banks in Japan and Europe have gone even further and introduced negative interest rates. Additionally, banks have sharply increased their balance sheets. These actions are being employed to incentivize additional borrowing to foster economic growth and boost inflation.

Investors must be careful with the market’s assumption that the Fed’s efforts to stimulate inflation will lead to the same inflation rates of the past decade. Further, if “warranted”, a central bank can literally print money and hand it out to its citizens or directly fund the government. These alternative methods of monetary policy, deemed “helicopter money” by Ben Bernanke, would most likely cause prices to rise significantly.

“Too much” inflation would be a detriment to the equity markets.

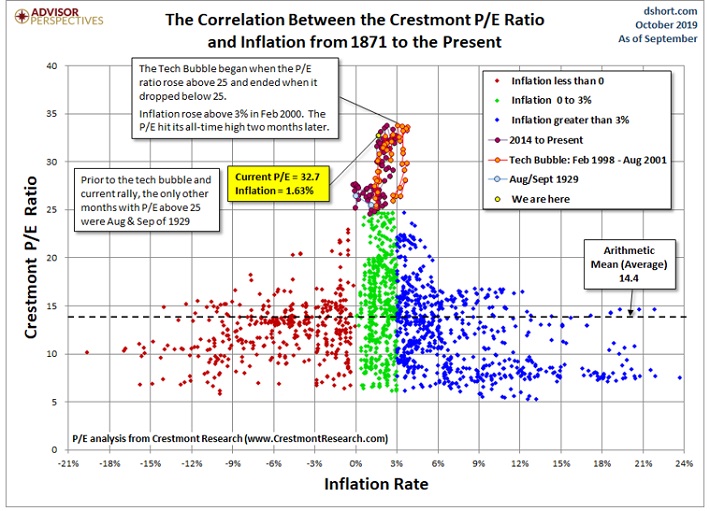

The graph below, courtesy Doug Short and Advisor Perspectives, shows that equity valuations tend to be at their highest when inflation ranges between zero and two percent. Outside of that band, valuations are lower. Currently, the market is making a big bet that valuations can remain near historical highs and inflation will remain in its recent range.

Given that equity valuations are historically high, in part based on stable inflation outlooks, we believe there an underappreciated risk that the Fed gets what they want- inflation.

We do not put high odds on inflation at this point, but we think it makes a lot of sense to explore adding TIPS to a portfolio of dividend stocks to help cushion the potential losses that inflation might cause.

Summary

Monetary policy around the world is managed by aggressive central bankers with strong and misplaced beliefs about the benefits of inflation. At some point, there is a greater than zero likelihood central bankers will be pushed to take actions that are truly inflationary. While the markets may initially cheer, the inevitable consequences may be dire for anyone not focused on preserving their purchasing power.

We urge you to focus on the forgotten leg of wealth, purchasing power. The opportunity costs of owning TIPS are minimal and the potential hedge value of TIPS is tremendous. Change can happen in a hurry, and the only way to protect and or profit from it is to anticipate it. As has been said, you cannot predict the future, but you can prepare for it.