This is a guest contribution from Harvi at Hashtag Investing

Dividend investing is a great way to ensure that you create passive wealth during both bull and bear markets. Dividend stocks are companies that pay out a part of their profits to their shareholders. Dividend investing is favored by many investors because it gives them the benefit of passive income plus long-term capital gains as the value of the stock rises over time.

Investors who have a low-risk appetite generally purchase dividend stocks. Investors who want a part of their portfolio in ‘safe’ territory also opt to buy a certain amount of dividend stocks. However, as with every investment, one has to be wary about investing in the right companies.

Here are 5 Canadian dividend stocks that are undervalued, and will likely deliver long-term stock price appreciation as well.

Table of Contents

You can instantly jump to any individual stock analysis by clicking on the links below:

- Undervalued Canadian Dividend Stock #1: AltaGas (ATGFF)

- Undervalued Canadian Dividend Stock #2: Enbridge Inc. (ENB)

- Undervalued Canadian Dividend Stock #3: TELUS Corporation (TU)

- Undervalued Canadian Dividend Stock #4: Summit Industrial Income REIT (SMMCF)

- Undervalued Canadian Dividend Stock #5: Algonquin Power and Utilities (AQN)

Undervalued Canadian Dividend Stock #1: AltaGas (ATGFF)

AltGas operates one of the largest regulated natural gas distribution businesses in the US, and has an integrated midstream operation in Canada. Around 79% of its midstream business’ EBITDA for 2021 will come from rate regulated utilities and take or pay contracts. Around 70% of the Utilities segment is protected by fixed distribution charges. Out of the unprotected revenue, around 70% comes from residential customers.

For 2021, AltaGas increased guidance after its Q1 2021 numbers beat estimates. For Q1, it reported EBITDA of $674 million compared to $499 million in Q1 2020, representing a 35% year-over-year increase and reflected solid performance across platforms.

Its new EBITDA guidance for 2021 is $1.475 billion – $1.525 billion. This compares to the previous range of $1.4 billion – $1.50 billion, and the new guidance represents approximately 15% year-over-year growth using the midpoint. AltaGas has a dividend yield of 4.47%. It’s a great fit into the undervalued dividend list.

Undervalued Canadian Dividend Stock #2: Enbridge Inc. (ENB)

This midstream energy company has one of the biggest moats in the business. It is Canada’s largest natural gas distribution provider, and moves around 25% of the oil in Canada and 20% of natural gas in the US. It has 22 wind farms and multiple other renewable energy facilities. It counts the likes of Imperial Oil, BP and NextEra among its clients.

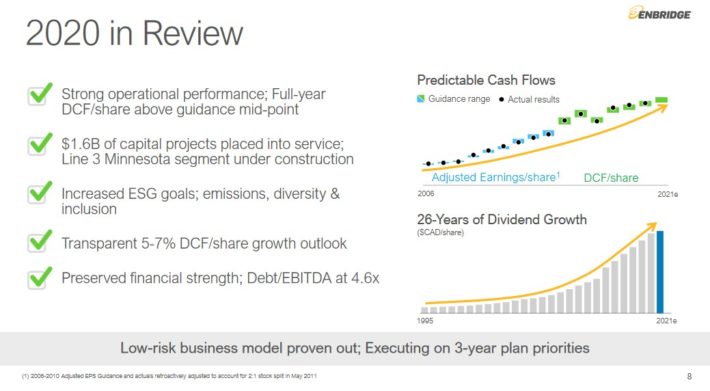

A breakdown of Enbridge’s performance in 2020 can be seen in the image below:

Source: Investor Presentation

The amount of capital required to build and maintain pipelines is in the billions and the regulations in this sector is a minefield. Enbridge will spend $16 billion on expansion projects through 2023.

Enbridge is currently trading at $47.41, 10% less than the target price of $51.83 according to analyst consensus. It has a dividend yield of 7.04%, making Enbridge an attractive high dividend stock.

Enbridge has increased its dividend for 26 straight years. The company is going to declare its Q1 2021 results on May 6. This is a great opportunity to add the stock to your portfolio.

Undervalued Canadian Dividend Stock #3: TELUS Corporation (TU)

Telus is one of the largest telecom companies in Canada. Telus has over 16 million subscribers out of which 9 million are mobile phone subscribers. It added around 900,000 subscribers in 2020. Despite the pandemic in 2020, it reported an increase of 5.5% in revenue to $15.5 billion from $14.7 billion in 2019. It also increased its dividend payout by 5.2% to $1.18 per share. Telus has a dividend yield of 4.8% right now.

The company’s big bet in 2021 is 5G assuming the pandemic doesn’t throw everything out of whack again. For 2021, Telus has given guidance of 8-10% increase in revenue, 6-8% increase in EBITDA, and cash flow of $1.5 billion. With the potential for growth set to come to fruition in the second half of 2021, and a dividend yield touching 5%, one can assume that Telus will deliver solid returns to its investors.

Undervalued Canadian Dividend Stock #4: Summit Industrial Income REIT (SMMCF)

Summit Industrial Income REIT is an open-ended Real Estate Investment Trust with a major focus on light industrial properties in Canada. You can see Sure Dividend’s complete REIT list here.

Approximately 80% of its portfolio is based in two regions: Ontario and Alberta. The stock is very resilient. It was trading at $12.70 in February 2020 just before the pandemic. It closed April 2021 at $15.61. It has grown at a CAGR of 22.42% from May 1, 2017 when it traded at $6.95. Its properties are single-storied buildings and are located close to major cities or transport hubs.

Revenue for 2020 increased by 34.3% while net income increased by 35.9%. It acquired interests in 23 industrial properties, including the remaining 50% interest in 11 Montreal properties and two Guelph properties from joint venture partners, totaling 1.7 million square feet for $345.1 million. The company is scheduled to report its numbers for Q1 2021 on May 11. It has dividend yield of 3.46% and when you add the CAGR, you can expect a total return in excess of 25%.

Undervalued Canadian Dividend Stock #5: Algonquin Power and Utilities (AQN)

Algonquin Power and Utilities is a steady stock, and it is not too flashy. The stock price has moved up 41% from May 1, 2017 when it was trading at $13.97 to $19.83 on April 30, 2021, a CAGR of 9.15%. This stock is a favorite of investors who want growth at a steady clip as well as decent passive income that Algonquin provides. It has a dividend yield of 3.92% which makes it a good harbor in stormy waters.

It has a $9.4 billion capex plan running from 2021 to 2025, of which $3.1 billion will be deployed in renewable energy. The last 10 years have seen it increase its dividends at a CAGR of 10%. The stock has proven to be a win in all seasons, and there is little reason to think that any of that will change in 2021. It has a very good track record, and should be a buy in any dividend portfolio.

The Final Takeaway

The ongoing pandemic has led to a sell-off in several sectors including REITs, energy and retail. This suggests several of the stocks mentioned in this list are trading at attractive valuations and should derive outsized gains in 2021 and beyond, making them a solid bet for income, value and contrarian investors.

Another bullish scenario is that value stocks could finally outperform growth stocks in the near future so these are stocks you definitely want to have on your radar.