Published 1/21/20

This is a guest contribution from Dividend Growth Investor, an independent investor who has been covering dividend growth stocks since 2008.

The goal of every investor is to generate enough in dividend income to pay for their retirement expenses. At the dividend crossover point, your dividend income exceeds your expenses, which means that you can retire if you want to.

In order to reach that coveted dividend crossover point however, we need to focus on things within our control. These are fairly common-sense, but somehow get lost in our culture for instant gratification.

The items within our control include:

- Your savings rate

- The investments you choose

- Keeping costs low

- Your holding period

A larger savings rate can help you put more money to work, which will result in reaching financial independence sooner. If you keep investment costs low, you will have more money working hard for you, rather than feeding a financial advisor charging you a 1% fee. The other points include focusing on quality dividend paying companies, who are relatively recession proof, and which generate ample cash flow from their operations. This excess cashflow is used to reward patient shareholders with a high and growing dividend. A dividend that grows over time can maintain the purchasing power of your income, which ensures that you can keep your standard of living in retirement. When you are paid a dividend that also grows over time, it is much easier to hold onto your stocks for the long-term, and let the power of compounding do the heavy lifting for you.

The process of creating a dividend portfolio is simple. It focuses on diversification, and making sure you hold different companies with different growth characteristics.

I have identified three major types of dividend growth stocks. A diversified portfolio should have exposure to all three types, even if its goal is for current income.

The first one includes companies with higher yields today, but slower dividend growth. A few examples include AT&T (T), Altria (MO) and W.P. Carey (WPC).

The second type includes companies in the sweet spot, which have median yields around 2.5% – 4%, and average dividend growth. A few examples include Johnson & Johnson (JNJ), 3M (MMM), Clorox (CLX), Walgreen’s (WBA).

The third type includes companies with lower dividend yields today, but rapid dividend growth. These are the companies that are ignored today because of their low yields. These companies can generate high dividend growth and high yields on cost over time.

In today’s article, I am going to review three of the type 1 companies for current income.

When reviewing companies, I look for a few things. Notably, I look for a company with a long dividend streak. I prefer companies that have increased dividends for at least ten years in a row, which helps me identify a lot of quality companies for further research.

Next, I review growth in fundamentals, whether it is earnings per share or funds from operations. I believe that rising earnings will provide the fuel behind future dividend increases.

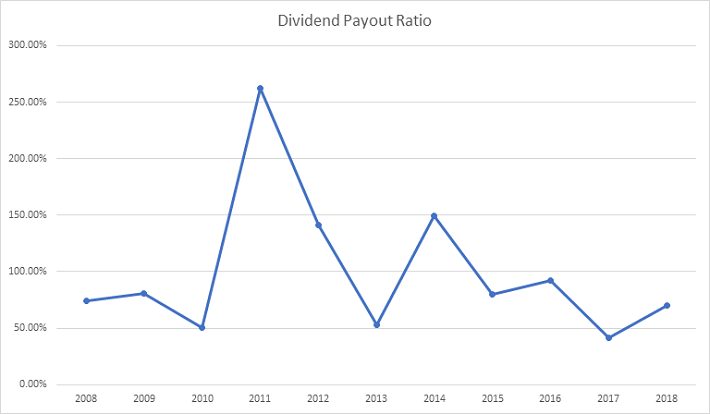

I also review the payout ratio, in order to evaluate the sustainability of the distribution. I usually require a payout ratio below 60%. However, I make exceptions for companies with defensive income streams, which also have managed to grow distributions while maintaining a higher payout ratios. In other words, I look at trending in this indicator. In addition, the evaluation of sustainability is enhanced by ensuring that income grows over time.

Dependable High Yield Dividend Stock #1: AT&T

AT&T Inc. (T) provides telecommunications services to consumers and businesses in the United States and internationally. This dividend champion and Dividend Aristocrat has paid dividends since 1984 and increased them for 35 years in a row. The most recent dividend increase was in December 2019, when the Board of Directors approved a 2.20% increase in the quarterly dividend to 46 cents/share.

The company’s competitors include Verizon (VZ), Sprint (S) and T-Mobile (TMUS).

Over the past decade this dividend growth stock has delivered an annualized total return of 9% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

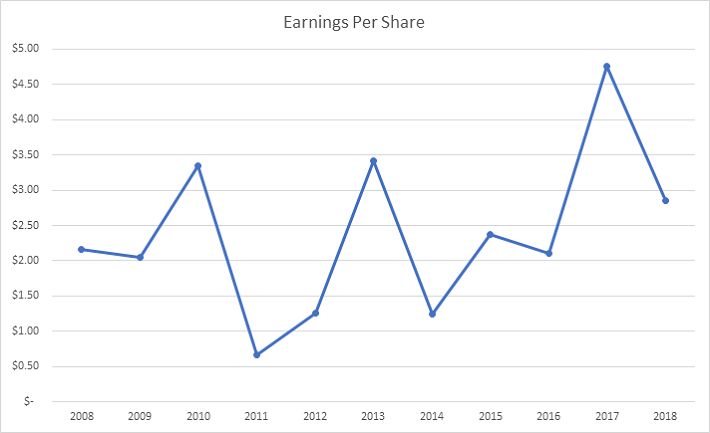

The company has managed to deliver a 2.90% average increase in annual EPS over the past decade. AT&T is expected to earn $3.54 per share in 2019 and $3.60 per share in 2020. In comparison, the company earned $2.85 per share in 2018, which is up from $2.16/share in 2008.

The competitive advantage for AT&T is the scale of its operations, as evidenced by the number of subscribers it has. In addition, the company owns valuable spectrum, which is of limited quantities and is a deterrent for entry into the telecom market. Both AT&T and Verizon have scale that is unmatched at present times from the next two competitors.

The wireless market in the US is close to a saturation point. However, a potential for growth includes data, and not just the type used by ordinary consumers, but machine-to-machine use. The drawback is the fact that telecom service is essentially a commodity, which is why differentiation from one carrier to another is difficult, if there was a price war. In addition, there is the need for constant capital expenditures to maintain the quality of the network and keep up with the times. Given the competitive nature of the telecom industry, and the constant need for technological upgrades merely to keep up with the next big wave, it is highly unlikely that companies like AT&T will provide outstanding stock performance. However, they should do okay for those who need a high dividend today and who do not mind having their income mostly keeping up with inflation.

The company could also grow through strategic acquisitions. It is an embodiment to acquisitions, since it was spun-out of the original AT&T in 1984 and named SBC. After a series of acquisitions, SBC acquired AT&T (ma-bell) in 2005, and then promptly changed its name to AT&T. The company has a track record of successfully integrating acquisitions, which is no small feat.

AT&T has been active on the acquisition front by acquiring DirecTV in 2015 and Time Warner in 2018. Although these were expected to diversify revenue and earnings, and generate synergies, they have also made the corporate structure more bloated and increased debt. I especially like that AT&T will be able to offer consumers a bundled service, which would be a differentiator in many key markets.In September 2019, Elliott Management published a letter outlining its proposal for a “value-creation opportunity” at AT&T. The activist investor announces that it owns $3.2 billion of AT&T stock (a 1.2% equity interest), and asserts that the company could increase its share value through divestiture of some of its assets.

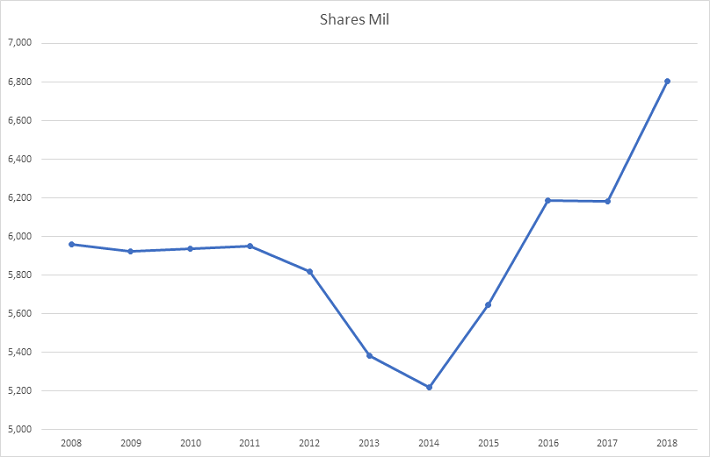

AT&T has consistent history of share repurchases. The company has been able to reduce the number of shares outstanding from 6.17 billion in 2007 to 5.220 billion in 2014. Due to acquisitions of DirecTV, Time Warner however, the number of shares outstanding increased to 6.806 billion by 2018.

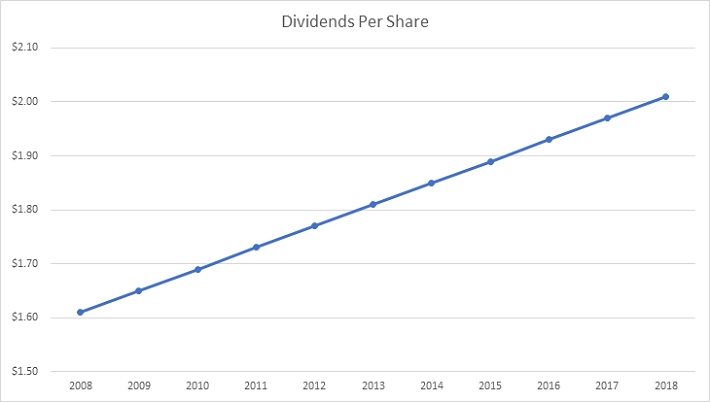

The annual dividend payment has increased by 2.20% per year over the past decade, which is lower than the growth in EPS. Since 2009, AT&T has managed to raise annual dividends by 4 cents/share, or about 2%/year. I would expect future dividend growth to be close or slightly exceed the rate of inflation over the next 10-15 years.

A 2% growth in distributions translates into the dividend payment doubling every 36 years on average. If we check the dividend history going as far back as 1984, we could see that AT&T has indeed managed to double dividends every fourteen and a half years on average.

In the past decade, the dividend payout ratio has been all over the place, ranging from 41% in 2017 to 260% in 2011. Of course, this was caused by the effect of one-time items on earnings per share. A lower payout is always a plus, since it leaves room for consistent dividend growth, minimizing the impact of short-term fluctuations in earnings.

Currently, AT&T is attractively valued at 10.8 times forward earnings, and has a dividend yield of 5.5%. Investors who purchase AT&T today should not expect much in terms of dividend growth over the lifetime of their investment. The most likely scenario is that dividend income merely keeps up with inflation over time, which is not too bad of an outcome for some. Thus, AT&T has mostly been purchased by income-hungry retirees, who need the current income today, and are fine even if the income mostly keeps purchasing power over time.

Dependable High Yield Dividend Stock #2: W.P. Carey Inc.

WP. Carey Inc. is an independent equity real estate investment trust. The firm also provides long-term sale-leaseback and build-to-suit financing for companies. It invests in the real estate markets across the globe. The firm primarily invests in commercial properties that are generally triple-net leased to single corporate tenants including office, warehouse, industrial, logistics, retail, hotel, R&D, and self-storage properties. Approximately 66% of revenues are derived from US, with Europe accounting for 30% of revenues. The rest is derived from properties in Australia, Japan, Canada and Mexico. I will analyze the REIT according to the checklist for reviewing REITs.

W.P. Carey is a dividend achiever, which has managed to boost dividends for 21 years in a row. The most recent dividend increase was in December, when the Board of Directors increased its quarterly cash dividend to $1.038 per share, equivalent to an annualized dividend rate of $4.15 per share.

In September 2012, this dividend achiever converted from a limited partnership into a real estate investment trust. After this transformation, as well as merger with one of its privately managed REIT, dividend growth has been spectacular initially. Subsequently, it slowed down to a rate of 2% – 3%/year, and I expect it to be slow for the foreseeable decade.

The company only invests in triple-net lease properties throughout the world and it also has historically managed a sizeable amount of privately held REITs for an annual fee. As a result, its sources of revenues were derived from the stable and recurring rents from those properties, which are usually leased to tenants under long-term leases. Those triple-net leases also allow for rent escalation over time. Under a triple-net lease, the tenant is required to pay all expenditures associated with maintaining and operating the property under lease.

The company is trying to simplify its structure by exiting the asset gathering business for non-traded real estate investment trusts. Instead, W.P. Carey is focusing on direct management of its own real estate. WP Carey has historically acquired its non-traded REITs under management as they reach their maturity targets. As a result of the structure simplification, a much higher portion of income is now derived from rents as opposed to asset management fees. The business simplification improves the quality of cash flows by significantly increasing earnings from long-term, real estate assets while reducing finite-life investment management income.

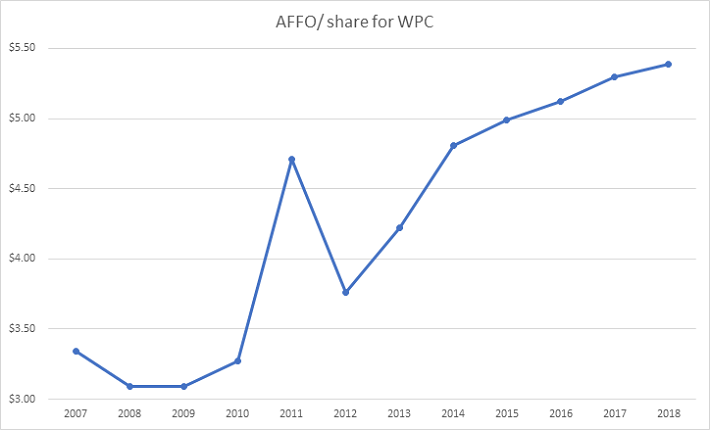

Since 2007, FFO/share has grown by 4.40%/year. Growth in FFO will be delivered through accretive acquisitions for its own portfolio of properties, increasing rents over time, and making strategic acquisitions for its remaining private REITs. Growth in FFO/share has decreased to 2% – 3%/year since 2014, which will limit future growth in distributions. The REIT has an AFFO guidance for 2019 to be at $4.95 – $5.01/share.

On the surface, it might not look like FFO/share has increased that much over the past decade. However, once you look at the composition, the data paints another picture. Up until 2007 – 2008, approximately 40% – 60% of FFO/share were derived from fees to manage non-traded REITs. The rest came from managing real estate holdings. As various of its CPA non-traded REIT programs came to their end, they ended up being acquired by W.P. Carey in a liquidity event, which boosted the share of rental real estate FFO/share. The portfolio management fees provide a source of income for the REIT, which is relatively stable, and allows it to spread costs over a larger asset base. In one of the company’s recent presentations however, I noticed the REIT’s intent to invest exclusively for WPC’s balance sheet. This will be achieved by exiting from non-traded retail fundraising, ultimately leading to a more simplified structure. In addition, the merger brings scale, as it spreads expenses over a larger base of assets as it increases the number of properties.

The nice thing is that almost all of the leases include either fixed or CPI-based rent increases or percentage rent. The REIT has virtually no exposure to operating expenses due to nature of net leases, and they come with built-in rent increases as mentioned in the previous sentence. The weighted average lease term is about 10 years. Approximately half of leases expire after 2025.

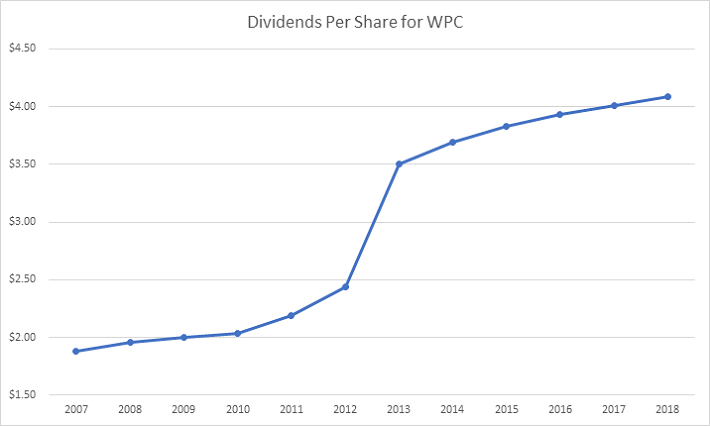

Since 2008, dividends per share have increased by 7.70%/year. I wanted to point out that W.P. Carey converted into a Real Estate Investment trust in 2012 from a Master Limited Partnership. As a result, dividends per share increased rapidly after 2012. Prior to 2012, dividends per share (or unit), grew very slowly over time. Unfortunately, it looks like dividends per share will likely continue to grow at an annual rate of 2% – 3%/year, which has been the case since 2014.

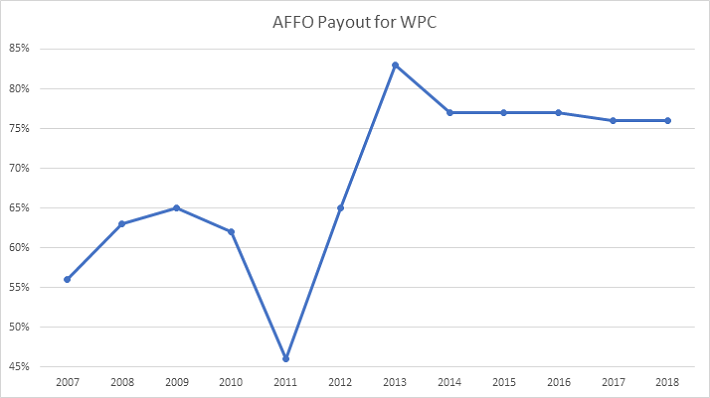

The FFO payout has been increasing from 56% in 2007 to 76% in 2018. This is still sustainable, but means that future growth in distributions will definitely have to come from growth in FFO, since this ratio cannot exceed 100%. I do view the dividend to be sustainable at the moment.

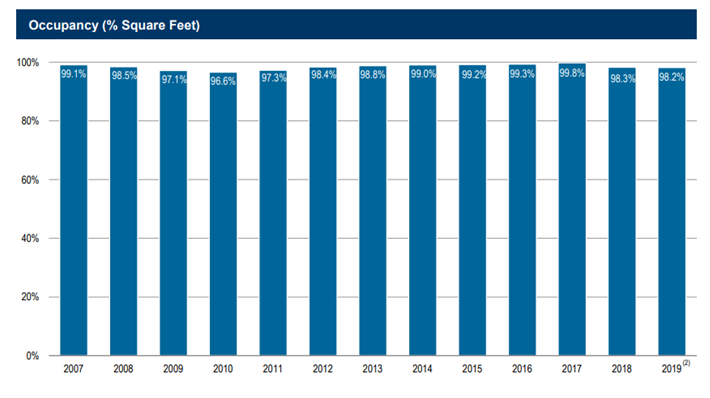

The portfolio occupancy has increased from 89% in 2004 to 97% in 2007, before stumbling again during the 2008 – 2009 recession and bottoming at 89% in 2010. It has been on the rebound and is approximately at 98% as we speak of. I am a little concerned about the fluctuations in occupancy/vacancy over the past decade, since it seems prone to high vacancy rates when times are tough and we are coming out of a recession. I have not seen declines of a similar nature with Realty Income (O), or National Retail Properties (NNN) for example.

The interesting part is that I obtained this information on portfolio occupancy by going through old press releases by W.P. Carey, going as far back as 2007. When I look at the investor presentations however, I never see portfolio occupancy below 96.60%. The reason for the difference is that the higher sounding occupancy amounts include both W.P. Carey owned and W.P. Carey managed properties. The lower sounding occupancy percentages include only W.P. Carey’s owned properties. This is an example as to why the equity analyst needs to dig around the data, and not just rely 100% on the presentations and work done by others.

The other metric I like to look at is tenant diversification. The nice thing about W.P. Carey is that it owns and manages triple-net properties in 17 countries. International accounts for approximately one third of revenues. The top 10 tenants account for 31% of revenues. If the proposed acquisition of CPA 17 goes through, the top ten tenants will account for 25% of revenues.

Rising interest rates are a risk, since they could increase the cost of capital It would make it more expensive to be rolling debt that is maturing, if interest rates go up. On the other hand, rising rates coupled with increased economic activity may be bullish for real estate, and offset the effect of increasing interest rates. In the case of W.P. Carey, there is also an additional risk with foreign revenues, whose exposure is hedged.

The current yield on W.P. Carey is 5%. I believe that the dividend is sustainable, due to the nature of long-term lease agreements, and that it will likely grow slowly over time due to acquisitions and rent increases. I also like the attractive valuation at 16.8 times FFO. I find the REIT to be attractively valued today. I believe it will be able to grow distributions to shareholders over time, albeit slowly. It is probably best for a hypothetical retiree who needs high current income today.

Dependable High Yield Dividend Stock #3: Altria Group, Inc.

Altria Group, through its subsidiaries, manufactures and sells cigarettes, smokeless products, and wine in the United States. It offers cigarettes primarily under the Marlboro brand; cigars principally under the Black & Mild brand; and moist smokeless tobacco products under the Copenhagen, Skoal, Red Seal, and Husky brands. The company also produces and sells varietal and blended table wines, and sparkling wines.

Altria is a dividend king, which has rewarded shareholders with a raise for the past 50 years in a row. Altria’s intention is to return a large amount of cash to shareholders in the form of dividends.

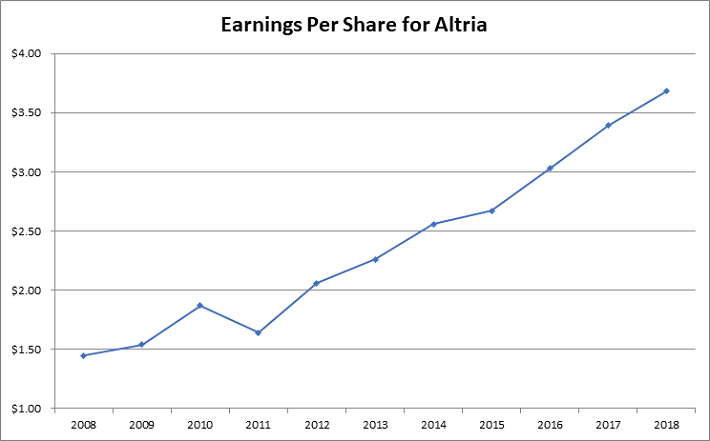

Between 2008 and 2018, Altria managed to boost its earnings per share from $1.45 to $3.68. The company expects to generate between $4.22/share in adjusted earnings per share in 2019. That’s before any one-time charges related to the disastrous investment in JUUL last year.

On a side note, the earnings per share for 2016 and 2017 have been adjusted to exclude one-time accounting items.

There are a lot of reasons to like Altria. The products are branded and addictive and the market for tobacco products so far is in the hands of a few major players with Altria holding a dominant position. There is some threat of future legislation banning the sale of tobacco products or making it uneconomical. However, local governments take in a ton of money by heavily taxing tobacco products. It is hard to find another scapegoat that can be taxed so heavily.

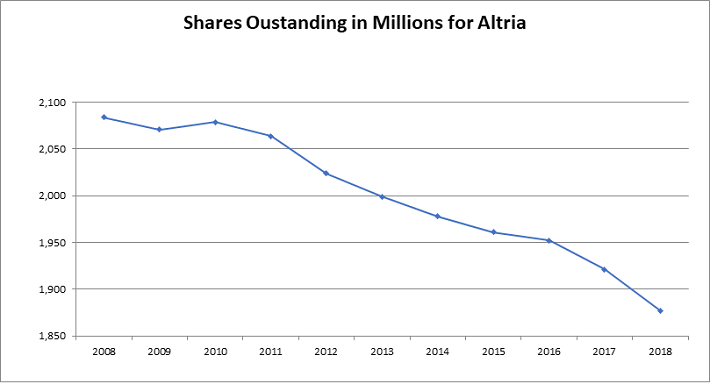

The other factor to consider is that while the number of smokers is expected to be decreasing over time, so far the increase in prices has more than offset the drop in consumers. At some point, this could reverse, but this has been the fear for several decades now. So far, price increases have more than offset volume declines, which results in growing net income year over time. Future growth in earnings will also be driven by productivity improvements, as well as strategic acquisitions and new product developments. Share buybacks are another tool that could increase earnings per share over time. As an owner of a 10% stake in Anheuser – Busch Inbev (BUD), Altria’s fortunes are also tied to the performance of this entity.

New regulations could potentially be bad for e-cigarettes, which compete with Altria’s products. However, there may be regulation against certain types of menthol cigarettes, which is one reason why tobacco stocks seems to have sold off as of recently. I am not sure if I would embrace marijuana’s legalization, or Altria’s deals to acquire stakes in cannabis companies. The cannabis market is still young, and may disrupt the market for tobacco products. The winners from legalization may not be known for years down the road however.

I am not a big fan of the company’s investment in JUUL. You can check the reasons here. While this deal shifts the risk profile, and increases debt, it could theoretically also increase earnings per share too. It is very likely that the future dividend growth may be less stellar than in the past.

I was thinking that this would be my last investment in Altria for this year. However, the stock is a very good value today. That being said, I am taking an increasingly concentrated bet, because I have the highest portion of my dividend income coming from Altria. If I am wrong, and the tobacco business is being disrupted at a faster pace than anticipated, my portfolio could take a hit in dividend income. If the stock goes further down, I would be unable to add further to the position from a risk management perspective (I have been saying that for one year however).

Growth in earnings per share is impressive, given the fact that the company has paid out 80% of earnings to shareholders annually. In addition, the company also managed to repurchase 10% of shares outstanding during that same time period.

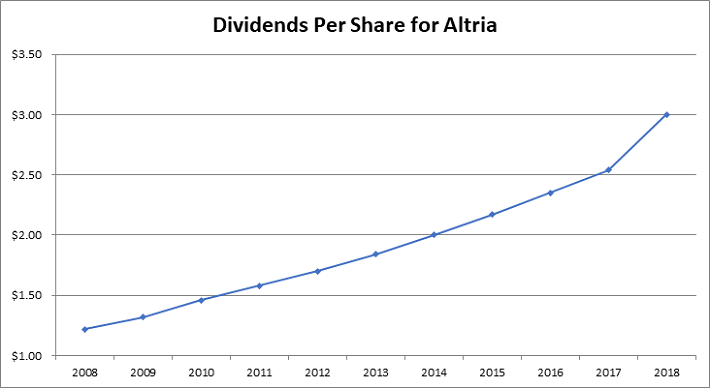

Over the past decade, Altria has managed to more than double its dividend. The company paid out $1.22/share in 2008, and it paid out $3/share in 2018. Altria raised its dividend in August 2019 by 5% to 84 cents/share.

The company’s dividend payout ratio has declined from 85% in 2008 to a little over 82% in 2018. Management has stated its target for Altria’s dividend payout ratio of approximately 80% of its adjusted diluted earnings per share. That hasn’t stopped it from more than doubling earnings per share over the past decade.

Currently, the stock is attractively valued at 12.1 times forward earnings and yields 6.6%. I believe that the dividend is defensible and can grow over time above the rate of inflation.