Updated on September 16th, 2021 by Bob Ciura

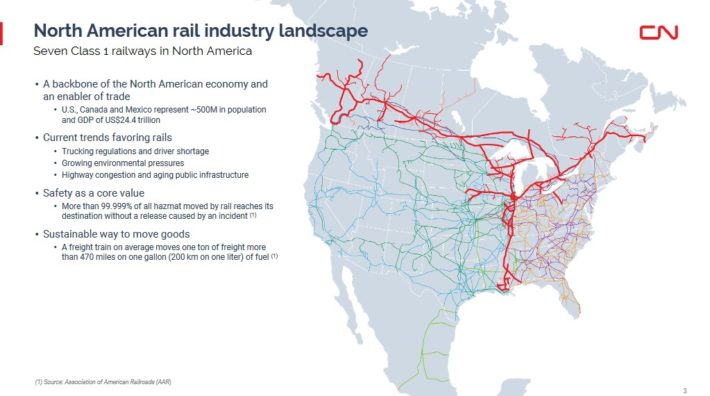

Last year was a very difficult one for cyclical industries such as railroads. The major railroad stocks are closely tied to the condition of the broader economy. As a result, the largest railroad stocks in North America struggled in 2020 due to the coronavirus pandemic.

That said, conditions have improved significantly to start 2021. Unemployment continues to fall and wages are growing. These factors benefit railroads, because as more people are employed, they have more disposable income. This means more goods can be purchased, many of which are shipped from ports to the consumer.

As a cheap, effective way of transporting goods, railroads often see higher volumes and revenues when economic conditions are strong.

Railroads are a huge component of the industrial sector. With this in mind, we have compiled a list of over 600 industrial stocks (along with important investing metrics such as P/E ratios and dividend yields) that you can download below:

We will calculate their expected returns by summing their expected earnings-per-share growth, their dividend and their expected annualized expansion or contraction of their price-to-earnings ratio. This data is from the Sure Analysis Research Database.

Table of Contents

The 6 major dividend-paying railroad stocks in North America are ranked below, according to their 5-year expected total annual returns, in order of lowest to highest.

You can jump to any specific section of the article by clicking on the links below:

- Railroad Stock #6: Kansas City Southern (KSU)

- Railroad Stock #5: Canadian National Railway (CNI)

- Railroad Stock #4: Union Pacific (UNP)

- Railroad Stock #3: Norfolk Southern (NSC)

- Railroad Stock #2: CSX Corporation (CSX)

- Railroad Stock #1: Canadian Pacific (CP)

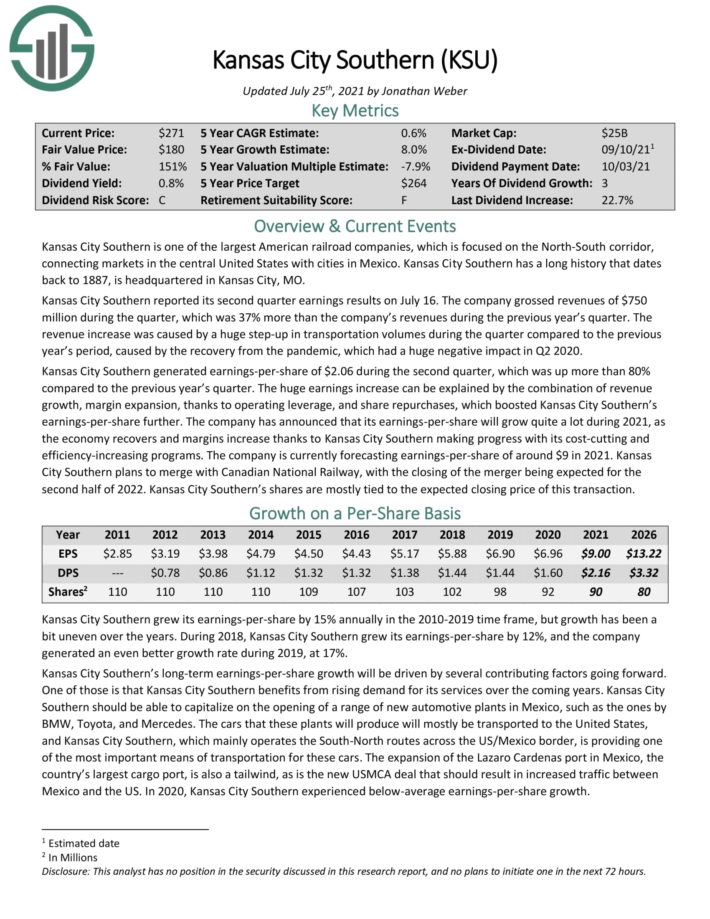

Top Railroad Stock #6: Kansas City Southern (KSU)

- 5-year expected annual returns: -0.2%

Kansas City Southern is one of the largest American railroad companies, which is focused on the North–South corridor, connecting markets in the central United States with cities in Mexico. Kansas City Southern has a long history that dates back to 1887, is headquartered in Kansas City, MO.

Kansas City Southern plans to merge with Canadian National Railway, with the closing of the merger being expected for the second half of 2022.

Source: Investor Presentation

Until then, the company continues to post strong results. Kansas City Southern reported its second quarter earnings results on July 16. The company grossed revenues of $750 million during the quarter, which was 37% more than the company’s revenues during the previous year’s quarter.

Kansas City Southern generated earnings–per–share of $2.06 during the second quarter, which was up more than 80% compared to the previous year’s quarter.

With the share price trading near the acquisition price, we do not foresee significant shareholder returns from here. We expect -0.2% annual returns, meaning shareholders should sell to lock in gains.

Click here to download our most recent Sure Analysis report on Kansas City Southern (preview of page 1 of 3 shown below):

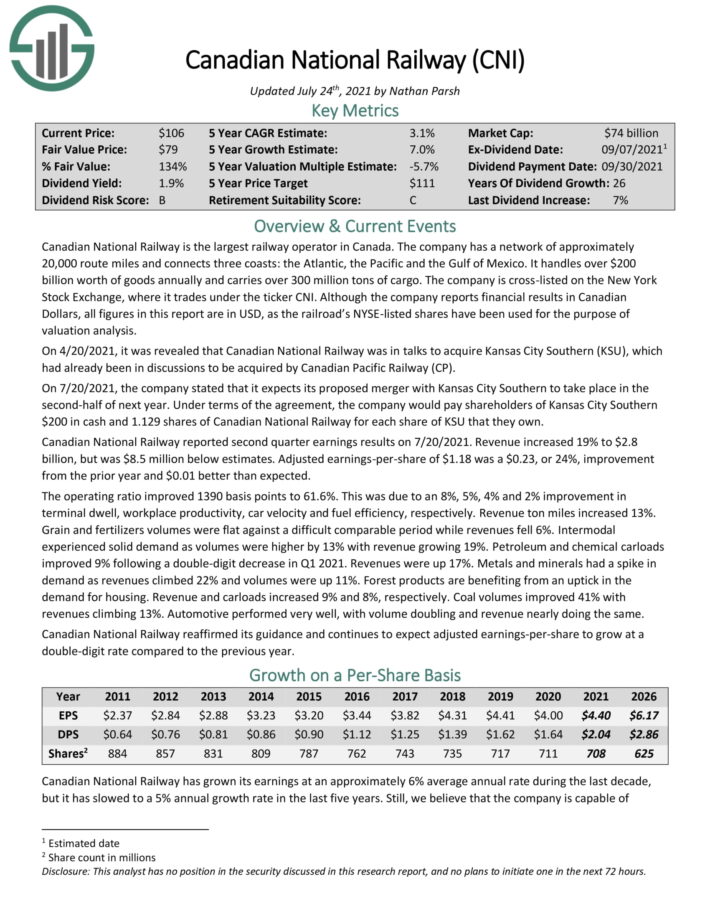

Top Railroad Stock #5: Canadian National Railway (CNI)

- 5-year expected annual returns: 1.0%

Canadian National Railway is the largest railway operator in Canada. The company has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

Canadian National Railway reported second quarter earnings results on 7/20/2021. Revenue increased 19% to $2.8 billion, but was $8.5 million below estimates. Adjusted earnings–per–share of $1.18 was a $0.23, or 24%, improvement from the prior year and $0.01 better than expected.

We expect 7% annual EPS growth for Canadian National Railway, and the stock has a ~2% dividend yield. However, shares appear overvalued, leading to total expected returns of 1% per year over the next five years.

Click here to download our most recent Sure Analysis report on Canadian National Railway (preview of page 1 of 3 shown below):

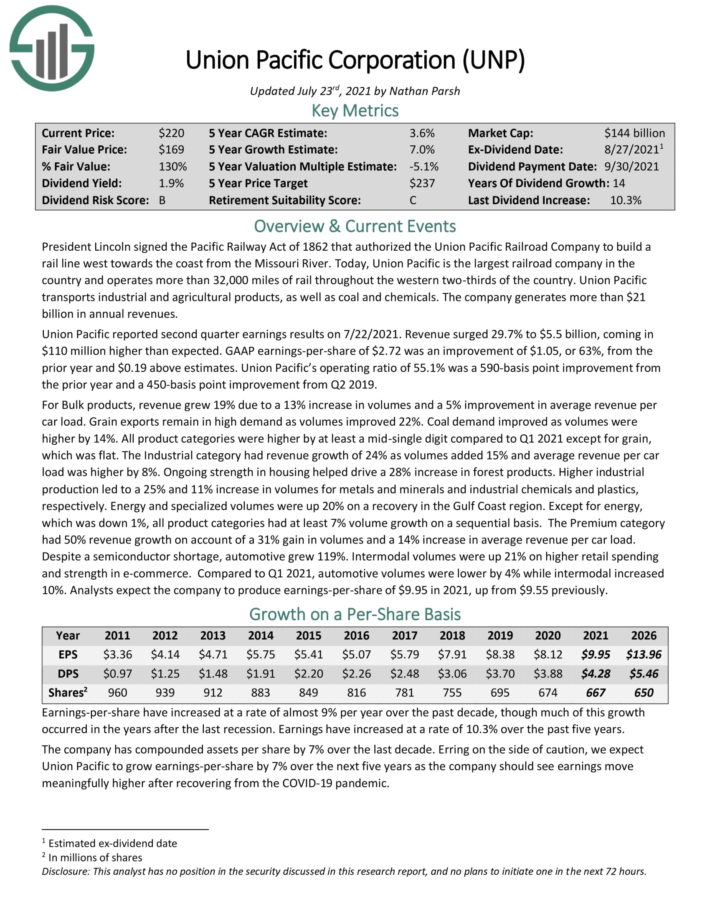

Top Railroad Stock #4: Union Pacific (UNP)

- 5-year expected annual returns: 5.1%

President Lincoln signed the Pacific Railway Act of 1862 that authorized the Union Pacific Railroad Company to build a rail line west towards the coast from the Missouri River. Today, Union Pacific is the largest railroad company in the country and operates more than 32,000 miles of rail throughout the western two–thirds of the country.

Union Pacific transports industrial and agricultural products, as well as coal and chemicals. The company generates more than $21 billion in annual revenues.

Union Pacific released strong second-quarter results:

Source: Investor Presentation

The company earned $2.15 per share, which was $0.06 higher than the average analysts’ estimate and a 43% increase from the previous year. Revenue grew 9.6% to $5.9 billion.

We expect 7% annual EPS growth for Union Pacific. Shares also currently yield 2%. Slight overvaluation could reduce shareholder returns through a declining P/E multiple, but we still expect solid total returns above 5% per year over the next five years.

Click here to download our most recent Sure Analysis report on Union Pacific (preview of page 1 of 3 shown below):

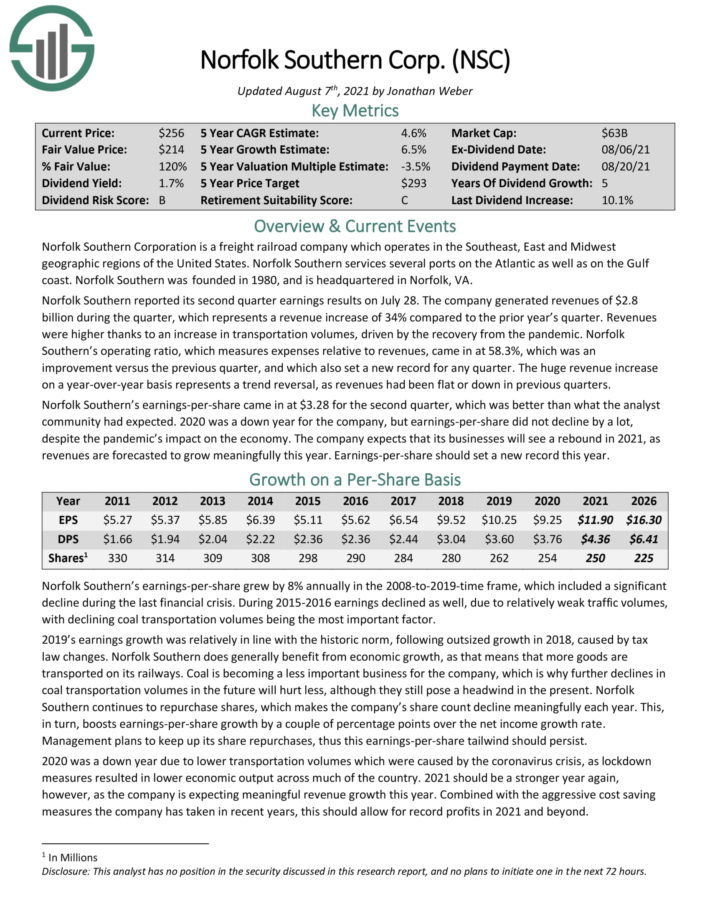

Top Railroad Stock #3: Norfolk Southern (NSC)

- 5-year expected annual returns: 5.2%

Norfolk Southern Corporation is a freight railroad company which operates in the Southeast, East and Midwest geographic regions of the United States. Norfolk Southern services several ports on the Atlantic as well as on the Gulf

coast. Norfolk Southern was founded in 1980, and is headquartered in Norfolk, VA.

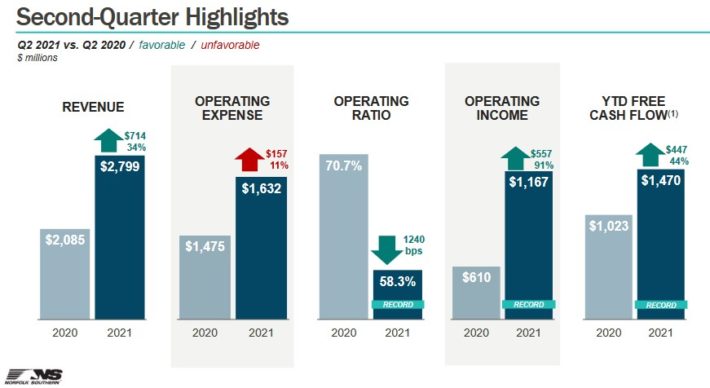

Norfolk Southern reported its second quarter earnings results on July 28. The company generated revenues of $2.8 billion during the quarter, which represents a revenue increase of 34% compared to the prior year’s quarter.

Source: Investor Presentation

Revenues were higher thanks to an increase in transportation volumes, driven by the recovery from the pandemic. Norfolk Southern’s operating ratio, which measures expenses relative to revenues, came in at 58.3%, which was an

improvement versus the previous quarter, and which also set a new record for any quarter.

We expect 5.2% annual returns over the next five years. Returns will be driven by expected EPS growth of 6.5% per year, along with a 1.8% dividend yield, partially offset by a declining valuation multiple.

Click here to download our most recent Sure Analysis report on Norfolk Southern (preview of page 1 of 3 shown below):

Top Railroad Stock #2: CSX Corporation (CSX)

- 5-year expected annual returns: 5.7%

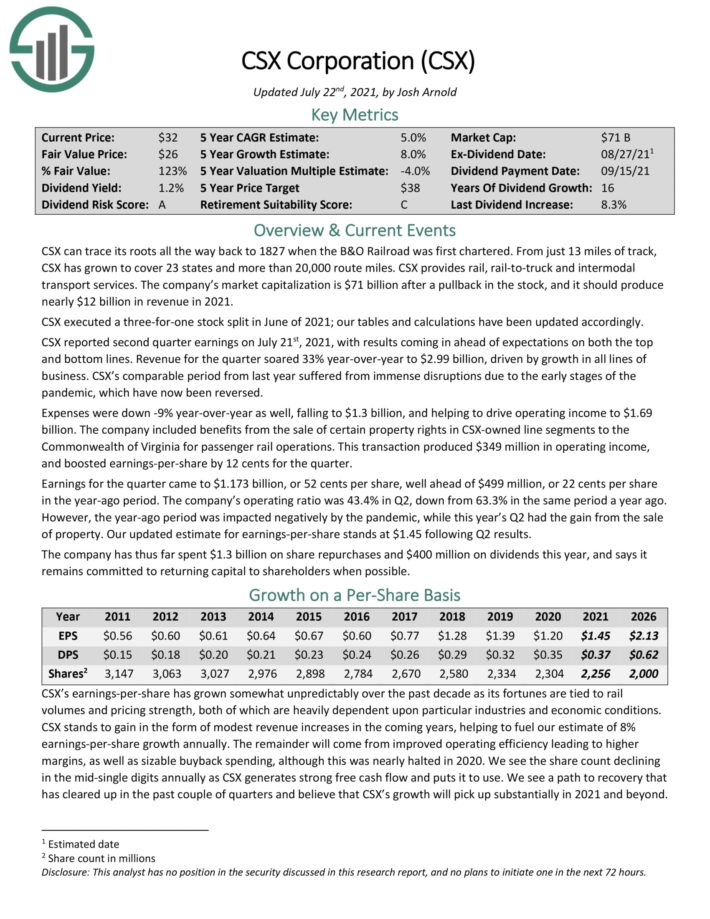

CSX can trace its roots all the way back to 1827 when the B&O Railroad was first chartered. From just 13 miles of track, CSX has grown to cover 23 states and more than 20,000 route miles. CSX provides rail, rail–to–truck and intermodal transport services.

CSX reported second quarter earnings on July 21st, 2021, with results coming in ahead of expectations on both the top and bottom lines.

Source: Investor Presentation

Revenue for the quarter soared 33% year–over–year to $2.99 billion, driven by growth in all lines of business. CSX’s comparable period from last year suffered from immense disruptions due to the early stages of the pandemic, which have now been reversed.

Earnings for the quarter came to $1.173 billion, or $0.52 per share, well ahead of $499 million, or $0.22 per share in the year–ago period.

We expect 8% annual EPS growth for CSX. In addition, shares currently yield 1.2%. However, the stock appears overvalued, leading to total expected returns of 5.7% per year over the next five years.

Click here to download our most recent Sure Analysis report on CSX (preview of page 1 of 3 shown below):

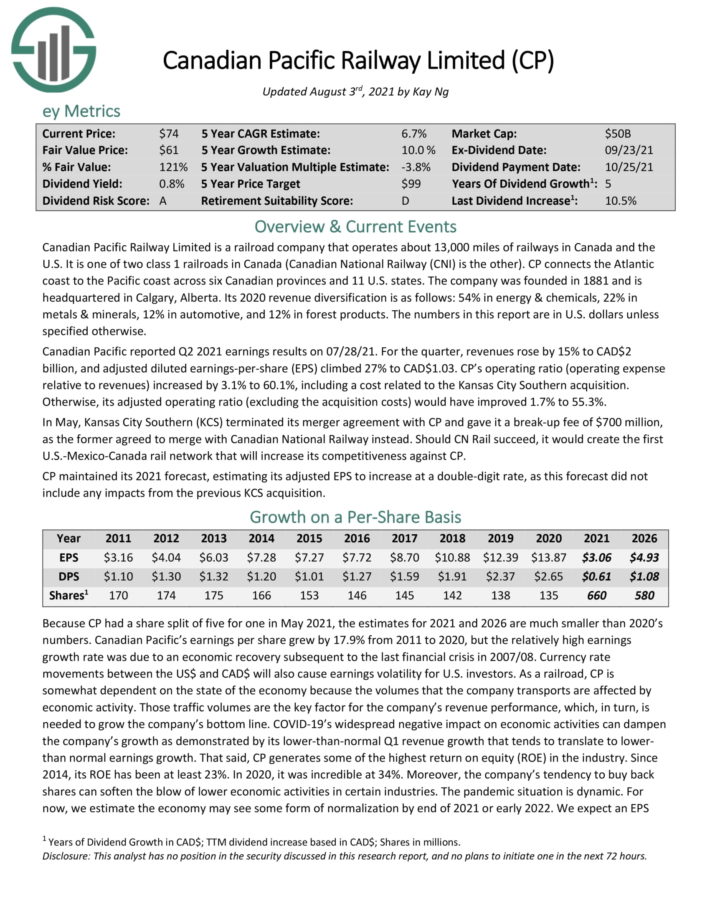

Top Railroad Stock #1: Canadian Pacific (CP)

- 5-year expected annual returns: 8.3%

Canadian Pacific Railway Limited is a railroad company that operates about 13,000 miles of railways in Canada and the U.S. It is one of two class 1 railroads in Canada. CP connects the Atlantic coast to the Pacific coast across six Canadian provinces and 11 U.S. states. The company was founded in 1881 and is headquartered in Calgary, Alberta.

Its 2020 revenue diversification is as follows: 54% in energy & chemicals, 22% in metals & minerals, 12% in automotive, and 12% in forest products.

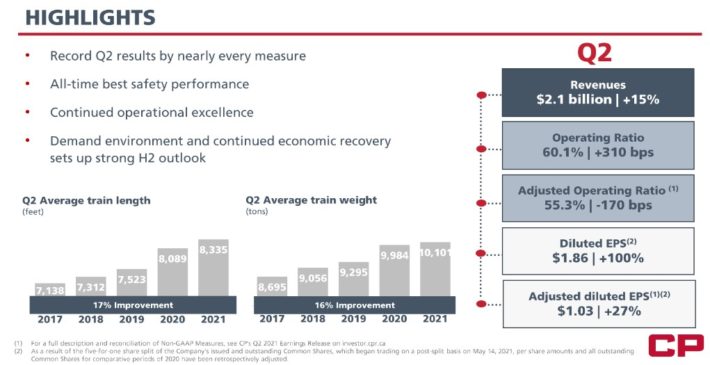

You can see a snapshot of Canadian Pacific’s second-quarter results in the image below:

Source: Investor Presentation

We expect 10% annual EPS growth going forward, while the stock has a 0.9% dividend yield. However, we also view the stock as slightly overvalued. Still, we expect total annual returns above 8% for Canadian Pacific over the next five years.

Click here to download our most recent Sure Analysis report on Canadian Pacific (preview of page 1 of 3 shown below):

Final Thoughts

Railroad stocks are a large component of the broader industrial sector. The major North American railroads perform a vital function for the economy, providing them with resilient cash flow each year. While the major railroad stocks are vulnerable to economic downturns, many of them listed here have maintained long histories of annual dividend increases.

Of the major railroad stocks, we view Canadian Pacific as the top railroad stock today, due to its highest expected annual returns over the next five years.