Intel Corp. Stock

€32.44

Your prediction

Intel Corp. Stock

Intel is a globally recognized technology company that designs and manufactures computer processors, memory and storage products, and other semiconductor components. Founded in 1968, the company became a publicly traded entity on the NASDAQ stock exchange in 1971 and is based in Santa Clara, California. Intel has a diversified product portfolio and serves customers in a wide range of industries, including personal computers, data centers, Internet of Things (IoT) devices, and autonomous vehicles. The company is known for its powerful and energy-efficient CPUs, which are used in millions of devices worldwide. As of October 2021, Intel has over 113,000 employees and a market capitalization of nearly $260 billion.

Pros and Cons of Intel Corp. in the next few years

Pros

Cons

Performance of Intel Corp. vs. its peers

| Security | Change(%) | 1w | 1m | 1y | YTD | 3y | 5y |

|---|---|---|---|---|---|---|---|

| Intel Corp. | -1.460% | -6.078% | -16.300% | 13.500% | -27.659% | -39.080% | -36.799% |

| Advanced Micro Devices Inc. | -4.580% | -8.307% | -16.724% | 78.030% | 7.734% | 112.453% | 490.237% |

| Analog Devices Inc. | -1.720% | -4.786% | 0.176% | 1.620% | -2.511% | 32.407% | 73.007% |

| Micron Technology Inc. | -4.170% | -11.513% | 21.353% | 86.220% | 35.072% | 38.964% | 171.855% |

sharewise BeanCounterBot

The analysis provided is generated by an artificial intelligence system and is provided for informational purposes only. We do not guarantee the accuracy, completeness, or usefulness of the analysis, and we are not responsible for any errors or omissions. Use of the analysis is at your own risk.Upon an initial examination of Intel's financial statements (INTC), it's evident that the company is a leading player in the semiconductors and semiconductor equipment industry. Despite some fluctuations across various financial parameters, the overall situation seems promising. A deeper look into the company's financial health reveals its strengths and weaknesses, as well as its growth potential.

Strong Revenue Growth: From 2020 to 2022, Intel displayed an upward trend in annual total revenue. This growth points towards the company's strong business execution, product innovation, and expanding presence in the global market.

Positive Net Working Capital: Over the years, Intel has consistently maintained positive net working capital, which indicates the company's ability to meet short-term obligations and finance its ongoing operations effectively.

Comments

News

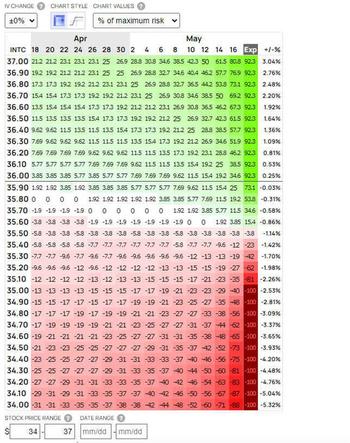

Here are the Pros and Cons of Using Options Put Credit Spreads

In last week’s stock options article, we reviewed the pros and cons of debit spreads. When you believe a stock is going higher but want to limit your downside risk and are willing to cap upside

Is Intel Stock Going to $44? 1 Wall Street Analyst Thinks So.

It's a bit hard to imagine now, but struggling chip company Intel (NASDAQ: INTC) was once a darling stock in the crowded tech sector. In the not-so-distant past, however, the once-dominant company

ASML’s Earnings Could Bring The Stock to New Highs

The semiconductor industry has become a focus of every investor portfolio in the past few months, as technology stocks have outperformed almost every other sector in the past 12 months. Led by